Hi I am new here.. I want to ask about unit trust. Is Philip mutual very good company? Because I have been approached by someone to join as an agent.

Fund Investment Corner v3, Funds101

Fund Investment Corner v3, Funds101

|

|

Aug 16 2017, 04:07 PM Aug 16 2017, 04:07 PM

|

Newbie

1 posts Joined: Aug 2017 From: Setia Alam |

Hi I am new here.. I want to ask about unit trust. Is Philip mutual very good company? Because I have been approached by someone to join as an agent.

|

|

|

|

|

|

Aug 16 2017, 05:02 PM Aug 16 2017, 05:02 PM

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(xilem89 @ Aug 16 2017, 04:07 PM) Hi I am new here.. I want to ask about unit trust. Is Philip mutual very good company? Because I have been approached by someone to join as an agent. Phillip mutual or Public mutual?Phillip mutual is https://www.eunittrust.com.my/ More info can be found here https://forum.lowyat.net/topic/4268975/all Is one of the place to buy unit trust at zero percent service charge |

|

|

Aug 18 2017, 08:49 AM Aug 18 2017, 08:49 AM

|

Senior Member

2,114 posts Joined: Jul 2013 |

QUOTE(Ramjade @ Aug 16 2017, 05:02 PM) Phillip mutual or Public mutual? Philips mutual vs fsm, which place to buy unit trust better and why?Phillip mutual is https://www.eunittrust.com.my/ More info can be found here https://forum.lowyat.net/topic/4268975/all Is one of the place to buy unit trust at zero percent service charge |

|

|

Aug 18 2017, 09:46 AM Aug 18 2017, 09:46 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

deleted.....oops...wrong understanding

This post has been edited by T231H: Aug 18 2017, 09:50 AM |

|

|

Aug 18 2017, 09:48 AM Aug 18 2017, 09:48 AM

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(leo_kiatez @ Aug 18 2017, 08:49 AM) Different platform for different situationPhillip - If you have RM5k to topup (during promo only), you can get funds from Phillip at 0% service charge - A good platform to buy bond fund because if you can topup/buy RM5k worth of bond fund during promo, you won't get charge the 1% (for bond fund). and there's no quarterly platform fees. - Less user friendly interface FSM - Good for those who topup in small amount (<RM5k/topup) - Nice looking interface - Charges you 0.05% platforms fees per quarter for bond funds which will increase over time as the value of your bond fund grow (so you are losing money every quarter) just by buying bond funds from FSM. |

|

|

Aug 18 2017, 10:02 AM Aug 18 2017, 10:02 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

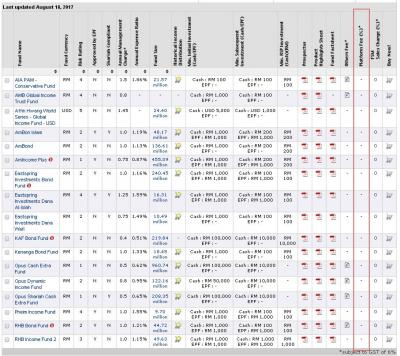

QUOTE(Ramjade @ Aug 18 2017, 09:48 AM) Different platform for different situation Phillip - If you have RM5k to topup (during promo only), you can get funds from Phillip at 0% service charge - A good platform to buy bond fund because if you can topup/buy RM5k worth of bond fund during promo, you won't get charge the 1% (for bond fund). and there's no quarterly platform fees. - Less user friendly interface FSM - Good for those who topup in small amount (<RM5k/topup) - Nice looking interface - Charges you 0.05% platforms fees per quarter for bond funds which will increase over time as the value of your bond fund grow (so you are losing money every quarter) just by buying bond funds from FSM. btw,..these 0.05% per quarter will be 0.2% per year...thus 2% per 10 years.....kind of "cheaper" than buying funds with 1.75% initial sales charges Attached thumbnail(s)

|

|

|

|

|

|

Aug 18 2017, 10:09 AM Aug 18 2017, 10:09 AM

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(T231H @ Aug 18 2017, 10:02 AM) btw,..these 0.05% per quarter will be 0.2% per year...thus 2% per 10 years.....kind of "cheaper" than buying funds with 1.75% initial sales charges |

|

|

Aug 18 2017, 10:16 AM Aug 18 2017, 10:16 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Ramjade @ Aug 18 2017, 10:09 AM) Er you are forgetting that as your bond fund value increases, your quarterly payment also increase even if you didn't topup. the quantum of ROI one gets with the RR it gives in a fixed income fund outweights the 0.2% pa or platform feesRM10000 is RM20. if your funds grow to RM20000 will be RM40 anyway, one can select those that has no platform fees don't focus on the minute things in life that is insignificants to the overall good of life This post has been edited by T231H: Aug 18 2017, 10:17 AM |

|

|

Aug 18 2017, 10:22 AM Aug 18 2017, 10:22 AM

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(T231H @ Aug 18 2017, 10:16 AM) the quantum of ROI one gets with the RR it gives in a fixed income fund outweights the 0.2% pa or platform fees 1. Why pay for something when you can get the same thing for free? It's small but it's still money Too much money to "donate to FSM"? RM10000 is RM20. if your funds grow to RM20000 will be RM40 anyway, one can select those that has no platform fees don't focus on the minute things in life that is insignificants to the overall good of life RM20 enough for my one week groceries already Well it's up to a person. I already listed down the pros and cons of FSM vs Phillip. Those who feel like "donating free money" to FSM, be my guest. Those who don't feel like "donating free money" can use the alternative. Btw, better I donate that RM20 to charity than give FSM. At least the RM20 for charity will be put to good use rather than masuk pocket of iFAST shareholders. |

|

|

Aug 18 2017, 10:31 AM Aug 18 2017, 10:31 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Ramjade @ Aug 18 2017, 10:22 AM) 1. Why pay for something when you can get the same thing for free? It's small but it's still money Too much money to "donate to FSM"? RM20 enough for my one week groceries already Well it's up to a person. I already listed down the pros and cons of FSM vs Phillip. Those who feel like "donating free money" to FSM, be my guest. Those who don't feel like "donating free money" can use the alternative. Btw, better I donate that RM20 to charity than give FSM. At least the RM20 for charity will be put to good use rather than masuk pocket of iFAST shareholders. that is how a person will gets what he seeked in life... a perudoa car is still a car compare to a toyota car why pay for so much more for a transport? you want a better interface you pay more lor you want a faster CS responses you pay more lor well,. one choose what he/she wants in life |

|

|

Aug 18 2017, 11:06 AM Aug 18 2017, 11:06 AM

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(T231H @ Aug 18 2017, 10:31 AM) that is how a person will gets what he seeked in life... a perudoa car is still a car compare to a toyota car why pay for so much more for a transport? you want a better interface you pay more lor you want a faster CS responses you pay more lor well,. one choose what he/she wants in life |

|

|

Aug 18 2017, 11:09 AM Aug 18 2017, 11:09 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Aug 18 2017, 11:12 AM Aug 18 2017, 11:12 AM

|

Senior Member

1,498 posts Joined: Nov 2012 |

|

|

|

|

|

|

Aug 20 2017, 02:16 AM Aug 20 2017, 02:16 AM

|

Junior Member

82 posts Joined: Aug 2017 From: Garden City, Jakarta |

I've been reading up lately.. Investing in ETFs or Mutual Funds?

Naturally, the clear advice I'd get from senior members and experienced friends tend to be ETF as it has advantages in the form of Fees & Expenses, Liquidity and lower entry amount. On the other hand, I am quite keen towards Mutual Fund as it is professionally managed and often they offer unique strategies which can outperform some of the ETFs. This leaves me with a big dilemma. In fact, I might do a split test on both investment channels and see it for myself. :/ Any advice from fellow members will be well appreciated. |

|

|

Aug 20 2017, 10:28 AM Aug 20 2017, 10:28 AM

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(Hetna Ligiv @ Aug 20 2017, 02:16 AM) I've been reading up lately.. Investing in ETFs or Mutual Funds? You need to think about how to buy as a malaysian and the cost associated with it. Even if you go with say Interactive Broker,Naturally, the clear advice I'd get from senior members and experienced friends tend to be ETF as it has advantages in the form of Fees & Expenses, Liquidity and lower entry amount. On the other hand, I am quite keen towards Mutual Fund as it is professionally managed and often they offer unique strategies which can outperform some of the ETFs. This leaves me with a big dilemma. In fact, I might do a split test on both investment channels and see it for myself. :/ Any advice from fellow members will be well appreciated. - can you cough up USD10k as initial deposit? - can you withstand their inactivity fees of USD10/month - do you think about the with holding taxes Even if you don't choose Interactive Broker and use a Malaysian broker, they will charge you high er brokerage charges (this is confirm) and either maintenance fees or/and dividend fees + 30% with holding tax with forex losses (everytime you make payment, payment will be at bank's rate) - Now that really adds up doesn't it? There's a forum post on ETFs https://forum.lowyat.net/topic/3396549/all This is just my personal opinion. ETFs only work for western market. That's it. For asia region, ETF is still not the way to go. Why? There are many funds which still can beat the benchmark index for asian region (after plus management fees). If they beat the benchmark index, they indirectly beat the ETF which track the benchmark index as most ETF are design to just "track the benchmark". It won't surpass the benchmark, it won't underperform the benchmark. It will just give you benchmark performance. Some other valid reason ETF investing is not for everyone 1) http://fifthperson.com/passive-index-inves...ation-of-value/ 2) ETF just "track the biggest company" and being big doesn't make you profitable. » Click to show Spoiler - click again to hide... « This post has been edited by Ramjade: Aug 20 2017, 10:33 AM |

|

|

Aug 20 2017, 11:11 AM Aug 20 2017, 11:11 AM

|

All Stars

11,954 posts Joined: May 2007 |

QUOTE(Ramjade @ Aug 20 2017, 10:28 AM) You need to think about how to buy as a malaysian and the cost associated with it. Even if you go with say Interactive Broker, Why u want to go with IB?- can you cough up USD10k as initial deposit? - can you withstand their inactivity fees of USD10/month - do you think about the with holding taxes Even if you don't choose Interactive Broker and use a Malaysian broker, they will charge you high er brokerage charges (this is confirm) and either maintenance fees or/and dividend fees + 30% with holding tax with forex losses (everytime you make payment, payment will be at bank's rate) - Now that really adds up doesn't it? There's a forum post on ETFs https://forum.lowyat.net/topic/3396549/all This is just my personal opinion. ETFs only work for western market. That's it. For asia region, ETF is still not the way to go. Why? There are many funds which still can beat the benchmark index for asian region (after plus management fees). If they beat the benchmark index, they indirectly beat the ETF which track the benchmark index as most ETF are design to just "track the benchmark". It won't surpass the benchmark, it won't underperform the benchmark. It will just give you benchmark performance. Some other valid reason ETF investing is not for everyone 1) http://fifthperson.com/passive-index-inves...ation-of-value/ 2) ETF just "track the biggest company" and being big doesn't make you profitable. » Click to show Spoiler - click again to hide... « There are a lot more US broker with low entrance barrier. https://www.scottrade.com/online-brokerage/...comparison.html |

|

|

Aug 20 2017, 11:12 AM Aug 20 2017, 11:12 AM

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(MNet @ Aug 20 2017, 11:11 AM) Why u want to go with IB? Because it let you have access to UK markets wtih 15% with holding tax vs 30%?There are a lot more US broker with low entrance barrier. https://www.scottrade.com/online-brokerage/...comparison.html This post has been edited by Ramjade: Aug 20 2017, 11:13 AM |

|

|

Aug 20 2017, 11:14 AM Aug 20 2017, 11:14 AM

|

All Stars

11,954 posts Joined: May 2007 |

when u talk about ETF we talk about US ETF not UK.

|

|

|

Aug 20 2017, 11:15 AM Aug 20 2017, 11:15 AM

|

Junior Member

82 posts Joined: Aug 2017 From: Garden City, Jakarta |

QUOTE(Ramjade @ Aug 20 2017, 05:28 AM) You need to think about how to buy as a malaysian and the cost associated with it. Even if you go with say Interactive Broker, - can you cough up USD10k as initial deposit? - can you withstand their inactivity fees of USD10/month - do you think about the with holding taxes Even if you don't choose Interactive Broker and use a Malaysian broker, they will charge you higher brokerage charges (this is confirm) and either maintenance fees or/and dividend fees + 30% with holding tax with forex losses (everytime you make payment, payment will be at bank's rate) - Now that really adds up doesn't it? There's a forum post on ETFs https://forum.lowyat.net/topic/3396549/all This is just my personal opinion. ETFs only work for western market. That's it. For asia region, ETF is still not the way to go. Why? There are many funds which still can beat the benchmark index for asian region (after plus management fees). If they beat the benchmark index, they indirectly beat the ETF which track the benchmark index as most ETF are design to just \"track the benchmark\". It won't surpass the benchmark, it won't underperform the benchmark. It will just give you benchmark performance. Some other valid reason ETF investing is not for everyone 1) http://fifthperson.com/passive-index-inves...ation-of-value/ 2) ETF just \"track the biggest company\" and being big doesn't make you profitable. » Click to show Spoiler - click again to hide... «

Thank you so much for the clear explanation! 1.One of the biggest brokerage firms in US and they're regulated by US SEC and CFTC 2. Has options and futures on their platform (Something that is hardly being offered in Asia brokerage firms. Even if there is, higher barrier of entry) 3. Reputation for honoring orders Coming back to the ETF topic, I like the fact that we can buy and sell ETFs like stocks. That's 1 of the more attractive reasons for me to try. But as the saying go, people often have the syndrome known as the "Shining Object Syndrome" where everything looks attractive and interesting that we want to try them all but never really get to master 1 of them. I have told myself not to buy into the high-fees laden Mutual Funds and now I might not even want to try ETFs as well. Better focus on FX spot, lol. Anymore input will be well appreciated though! |

|

|

Aug 20 2017, 11:18 AM Aug 20 2017, 11:18 AM

|

All Stars

24,388 posts Joined: Feb 2011 |

QUOTE(MNet @ Aug 20 2017, 11:14 AM) Why not UK? People who want to go for ETF want to reduce cost. And if a ETF which says tracks the S&P500 is available in the UK, the with holding fees is only 15% vs another ETF which also track the S&P500 in the US which will charge you 30% with holding tax on dividend.Also, Malaysians are "blacklisted" overseas and not many brokers want to take in Malaysian customer. |

| Change to: |  0.0175sec 0.0175sec

0.57 0.57

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 10:46 AM |