Man, my UT in CIMB CWA and Dali had dropped like water for past few weeks

Should I withdraw the current capital? Reinvest when the price go lower?

Fund Investment Corner v3, Funds101

Fund Investment Corner v3, Funds101

|

|

Feb 17 2016, 12:18 AM Feb 17 2016, 12:18 AM

|

Senior Member

2,650 posts Joined: Feb 2009 |

Man, my UT in CIMB CWA and Dali had dropped like water for past few weeks

Should I withdraw the current capital? Reinvest when the price go lower? |

|

|

|

|

|

Feb 17 2016, 08:30 AM Feb 17 2016, 08:30 AM

|

Senior Member

1,590 posts Joined: Nov 2006 |

hi guys,

this is my scenario: i have biz that requires me to use my capital for only 1 or 2 weeks per month the rest of the days i just put the money into my company's current account do i have better option on where to place the fund while i'm not using it? your opinion is highly appreciated ty |

|

|

Feb 17 2016, 01:37 PM Feb 17 2016, 01:37 PM

|

Senior Member

1,338 posts Joined: Sep 2012 |

|

|

|

Feb 17 2016, 04:16 PM Feb 17 2016, 04:16 PM

|

Senior Member

2,650 posts Joined: Feb 2009 |

|

|

|

Feb 17 2016, 04:17 PM Feb 17 2016, 04:17 PM

|

Senior Member

2,650 posts Joined: Feb 2009 |

QUOTE(epie @ Feb 17 2016, 08:30 AM) hi guys, business is always about liquiditythis is my scenario: i have biz that requires me to use my capital for only 1 or 2 weeks per month the rest of the days i just put the money into my company's current account do i have better option on where to place the fund while i'm not using it? your opinion is highly appreciated ty better put it in short term fixed deposit |

|

|

Feb 17 2016, 10:42 PM Feb 17 2016, 10:42 PM

|

Senior Member

1,590 posts Joined: Nov 2006 |

|

|

|

|

|

|

Feb 17 2016, 11:20 PM Feb 17 2016, 11:20 PM

Show posts by this member only | IPv6 | Post

#2127

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(epie @ Feb 17 2016, 08:30 AM) hi guys, U may consider Cash Mgt Fund offer by UTMCthis is my scenario: i have biz that requires me to use my capital for only 1 or 2 weeks per month the rest of the days i just put the money into my company's current account do i have better option on where to place the fund while i'm not using it? your opinion is highly appreciated ty |

|

|

Feb 18 2016, 07:57 AM Feb 18 2016, 07:57 AM

|

Senior Member

3,491 posts Joined: Jan 2013 |

|

|

|

Feb 18 2016, 08:01 AM Feb 18 2016, 08:01 AM

|

Senior Member

3,491 posts Joined: Jan 2013 |

Hi guys, I currently have Manulife India equity fund- worth it to maintain it? NAV going down

|

|

|

Feb 18 2016, 10:41 AM Feb 18 2016, 10:41 AM

|

Senior Member

1,338 posts Joined: Sep 2012 |

QUOTE(ZZMsia @ Feb 18 2016, 08:01 AM) What do you think the prospect is for the Indian economy? If you have a positive outlook for them and you think they'll bounce back within your investment horizon, then you should probably keep them. |

|

|

Feb 20 2016, 08:10 PM Feb 20 2016, 08:10 PM

|

Junior Member

230 posts Joined: Aug 2011 |

Hi guys, have anyone ever invest in PMB shariah aggresive fund?

http://www.fundsupermart.com.my/main/fundi...e-Fund-MYASM006 |

|

|

Feb 20 2016, 09:28 PM Feb 20 2016, 09:28 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

Hi guys

What do you think about AIA fund performance for investment ? |

|

|

Feb 21 2016, 01:58 PM Feb 21 2016, 01:58 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

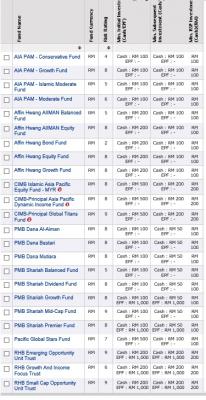

QUOTE(Manada @ Feb 21 2016, 01:35 PM) Guys I want to invest in some Unit Trust Funds from Fundsupermart but I only have RM1k. Not sure what I can do with RM1k since the minimum investment for most UTs is RM1k using FUNDS SELECTION tool in FSM MY Website....a quick search found this.....MANY funds with initial investment of RM 100, RM 200 and RM 500 see attached.... This post has been edited by T231H: Feb 21 2016, 02:00 PM Attached thumbnail(s)

|

|

|

|

|

|

Feb 21 2016, 02:28 PM Feb 21 2016, 02:28 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Manada @ Feb 21 2016, 02:01 PM) ...you asked "Not sure what I can do with RM1k since the minimum investment for most UTs is RM1k"my post is to show to you that there are still some "good" funds that can starts with less than RM 1000 and to response to your question above...YES....you are right. |

|

|

Feb 22 2016, 10:35 PM Feb 22 2016, 10:35 PM

|

All Stars

48,445 posts Joined: Sep 2014 From: REality |

Eastspring Investments Bhd has launched the Eastspring Investments Target Income Fund 5, the fifth in a series of closed-ended global bond fund.

The Fund is a 5-year close-ended bond fund which aims to provide potential regular income distribution of 5.75% per annum on investment amount less Goods and Services Tax (“GST”) with relatively lower volatility compared to equities. The targeted payout is derived from coupon income from bonds. http://mrem.bernama.com/viewsm.php?idm=26240 |

|

|

Feb 24 2016, 09:47 PM Feb 24 2016, 09:47 PM

|

Junior Member

266 posts Joined: Nov 2009 From: Kuala Lumpur |

With equity funds are not doing well this year (bad economy, generally equity funds becomes high risk low returns?), thinking of switching to balanced or fixed income funds. Would like to seeks experts' opinions from this forum. Of course this is a broad question, it is always depends on which equity fund and which balanced/fixed income funds.

EDIT: it is always good to diversify, im investing from epf, and already have equity fund, planning to invest in equity fund again, but thinking twice, maybe it is better to put in balanced/fixed income funds. This post has been edited by jtleon: Feb 24 2016, 09:48 PM |

|

|

Feb 24 2016, 09:51 PM Feb 24 2016, 09:51 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(jtleon @ Feb 24 2016, 09:47 PM) With equity funds are not doing well this year (bad economy, generally equity funds becomes high risk low returns?), thinking of switching to balanced or fixed income funds. Would like to seeks experts' opinions from this forum. Of course this is a broad question, it is always depends on which equity fund and which balanced/fixed income funds. EDIT: it is always good to diversify, im investing from epf, and already have equity fund, planning to invest in equity fund again, but thinking twice, maybe it is better to put in balanced/fixed income funds. Balanced Funds Worth Looking At During Volatile Periods [15 Jan 2016] http://www.fundsupermart.com.my/main/resea...-Jan-2016--6710 while others may liked to invest more into EQ during this volatile period Five Charts You Need to Know in the Year of the Monkey! http://www.fundsupermart.com.hk/hk/main/re...articleNo=11292 thus it all depends on individual risk appetite..... This post has been edited by T231H: Feb 24 2016, 10:00 PM |

|

|

Feb 26 2016, 04:11 PM Feb 26 2016, 04:11 PM

|

Junior Member

78 posts Joined: Jul 2013 |

QUOTE(fykk64 @ Nov 23 2015, 09:51 PM) Hi all. Dear,I am new here and would like to ask for some advice. I have been working for 2 years plus already and so far only put my money in FD and ASX FP. I do not have much financial knowledge but would like to try out UT. I have created a FSM account for myself for its lower sales charge. So I plan to just contribute a bit to it every month (my spare cash). I was told by friend to start of with KGF first if I want. Is there a suitable time to buy or I can just buy it now and park my money there? Thank you, sorry for this stupid question. You have better return in other sectors of investment but risk is always there. At a certain point you may even lose all your capital! Thats why for small amount it is more stable to invest in trust fund because there is a professional manager to manage the fund. |

|

|

Mar 2 2016, 03:29 PM Mar 2 2016, 03:29 PM

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

Mar 2 2016, 10:37 PM Mar 2 2016, 10:37 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(kenteoh94 @ Mar 2 2016, 02:44 PM) I am certified financial planner holder and now proceeding to get license under bnm and sc as financial advisor. Anyway there is a fixed income fund and duration 5 years and only can invest from 1-15march 2016, the return is 10%p.a, if interested or anyone else have any question can contact this number yea. 011 1894 0271 ken FI for 10%pa... |

| Change to: |  0.0506sec 0.0506sec

0.07 0.07

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 03:36 AM |