QUOTE(familyfirst @ Aug 14 2015, 01:57 PM)

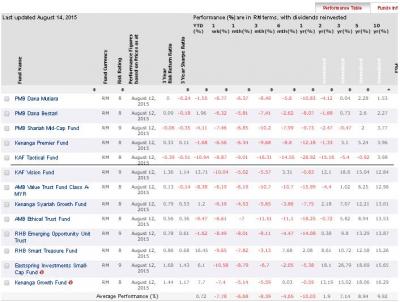

Just want to know how long generally people invest in unit trust funds? 1 yr, 3 yrs, 5 yrs or longer? Anyone still keeping it after 10 yrs? Does keeping it longer really bring more value?

Attached thumbnail(s)

Aug 14 2015, 02:08 PM

Aug 14 2015, 02:08 PM

Quote

Quote 0.0209sec

0.0209sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled