Outline ·

[ Standard ] ·

Linear+

Savings Account in Malaysia

|

GrumpyNooby

|

Jul 10 2020, 10:27 AM Jul 10 2020, 10:27 AM

|

|

Would you still put your money in the bank?KUALA LUMPUR (July 10): With the overnight policy rate (OPR) at a record low now, it may not be a wise idea to put your money in the bank if a high return is what you are looking for. Bank Negara Malaysia slashed the OPR by another 25 basis points (bps) to a record low of 1.75% on Tuesday. With this, the rate has been cut by 125bps this year. https://www.theedgemarkets.com/article/woul...your-money-bank

|

|

|

|

|

|

GrumpyNooby

|

Jul 10 2020, 05:35 PM Jul 10 2020, 05:35 PM

|

|

Revision of Deposits Rates Effective 14 July 202010 July 2020 We wish to inform that effective 14 July 2020, the revised deposits rates are as follows: Revision of Deposits Rates Effective 14 July 2020 https://www.affinonline.com/AFFINONLINE/med...ate14072020.pdfFor more information, contact our Call Centre at 03-8230 2222, visit your nearest AFFINBANK branch.

|

|

|

|

|

|

KCY3701

|

Jul 15 2020, 05:15 PM Jul 15 2020, 05:15 PM

|

|

I know we already have a thread for Conditional High Yield Savings Account. How about Unconditional High Yield Savings Account? Is there any good ones that exist?

Means those account that doesn't need any credit/debit card spend, salary deposit, buy insurance/mutual fund nonsense etc. Of course the rate will be lower a bit la.

|

|

|

|

|

|

!@#$%^

|

Jul 15 2020, 05:48 PM Jul 15 2020, 05:48 PM

|

|

QUOTE(KCY3701 @ Jul 15 2020, 05:15 PM) I know we already have a thread for Conditional High Yield Savings Account. How about Unconditional High Yield Savings Account? Is there any good ones that exist? Means those account that doesn't need any credit/debit card spend, salary deposit, buy insurance/mutual fund nonsense etc. Of course the rate will be lower a bit la. not lower a bit, but a lot |

|

|

|

|

|

GrumpyNooby

|

Jul 15 2020, 06:01 PM Jul 15 2020, 06:01 PM

|

|

QUOTE(KCY3701 @ Jul 15 2020, 05:15 PM) I know we already have a thread for Conditional High Yield Savings Account. How about Unconditional High Yield Savings Account? Is there any good ones that exist? Means those account that doesn't need any credit/debit card spend, salary deposit, buy insurance/mutual fund nonsense etc. Of course the rate will be lower a bit la. There're tier/band based high yield saving account. These saving accounts rate could be high but may not on par with Conditional High Yield Savings Account that comes with various conditions to fulfill. |

|

|

|

|

|

KCY3701

|

Jul 15 2020, 07:27 PM Jul 15 2020, 07:27 PM

|

|

QUOTE(GrumpyNooby @ Jul 15 2020, 06:01 PM) There're tier/band based high yield saving account. These saving accounts rate could be high but may not on par with Conditional High Yield Savings Account that comes with various conditions to fulfill. Any good example? |

|

|

|

|

|

GrumpyNooby

|

Jul 15 2020, 07:36 PM Jul 15 2020, 07:36 PM

|

|

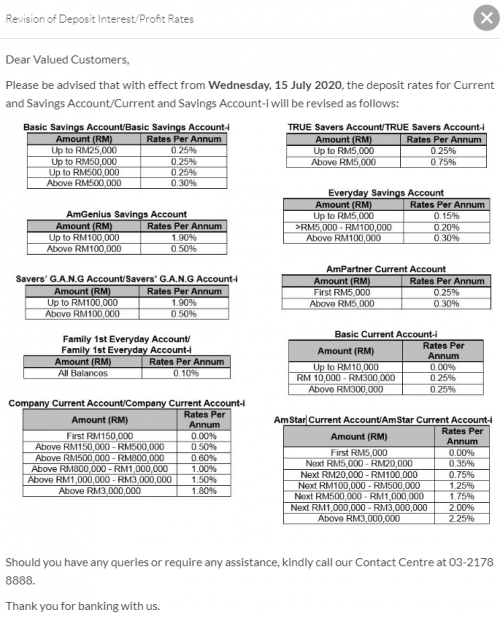

|

|

|

|

|

|

GrumpyNooby

|

Jul 23 2020, 02:25 PM Jul 23 2020, 02:25 PM

|

|

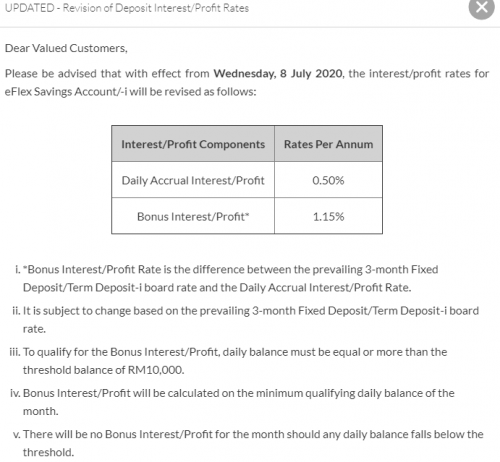

|

|

|

|

|

|

GrumpyNooby

|

Jul 27 2020, 04:33 PM Jul 27 2020, 04:33 PM

|

|

|

|

|

|

|

|

Eurobeater

|

Jul 30 2020, 05:42 PM Jul 30 2020, 05:42 PM

|

|

I wish these banks can communicate changes in the interest rates to us via email. My HLB PnS interest rate fell from 2% to 1.75% and I had no idea until I looked at their website.

|

|

|

|

|

|

cybpsych

|

Aug 1 2020, 09:14 AM Aug 1 2020, 09:14 AM

|

|

Get RM20 worth of KFC dining voucher when you apply for a Hong Leong GSC Visa Credit Card today [ HLB | T&Cs ] 01 AUGUST 2020-31 OCTOBER 2020 *Limited to the first 1,000 customers every month during the Campaign Period. Terms & Conditions apply. *Limited to the first 1,000 customers every month during the Campaign Period. Terms & Conditions apply.

|

|

|

|

|

|

GrumpyNooby

|

Aug 4 2020, 06:17 PM Aug 4 2020, 06:17 PM

|

|

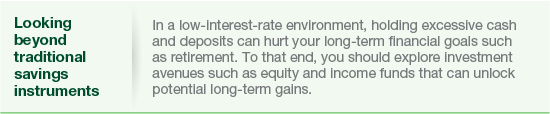

Key takeaways from H2'20 Global Market Outlook WebinarAccording to Standard Chartered Wealth Expectancy Report 2019, 70% of Malaysians primarily use Savings Accounts for wealth generation. This fact is concerning given that interest rates are at a decade low and investors are finding it increasingly difficult to reinvest their savings at returns offered previously. In times like these, inaction can make you vulnerable to market movements. Here is how we can help you navigate through the uncertainties:

|

|

|

|

|

|

GrumpyNooby

|

Aug 11 2020, 07:38 PM Aug 11 2020, 07:38 PM

|

|

QUOTE(JohnLo @ Aug 11 2020, 07:36 PM) what purpose of saving in saving acc? interest rate is not high also For doing transactions; online bill payment with extension JomPay network, DuitNow QR (replicating e-wallet) and using debit card. This post has been edited by GrumpyNooby: Aug 11 2020, 07:39 PM |

|

|

|

|

|

GrumpyNooby

|

Aug 11 2020, 08:20 PM Aug 11 2020, 08:20 PM

|

|

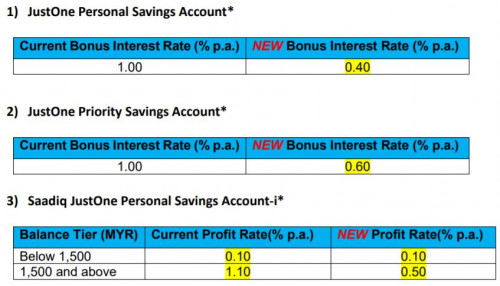

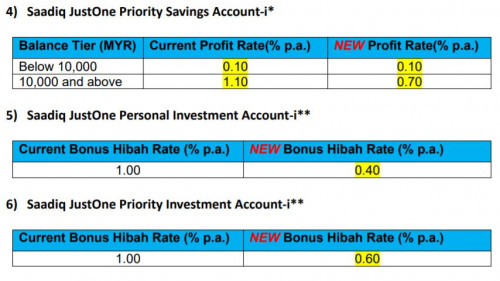

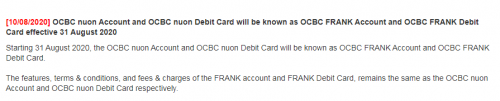

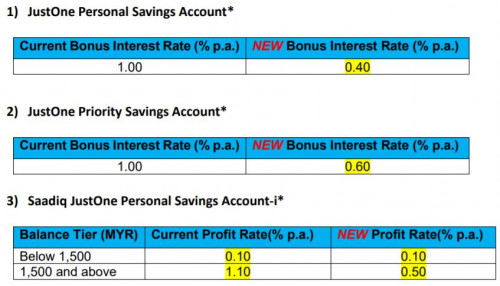

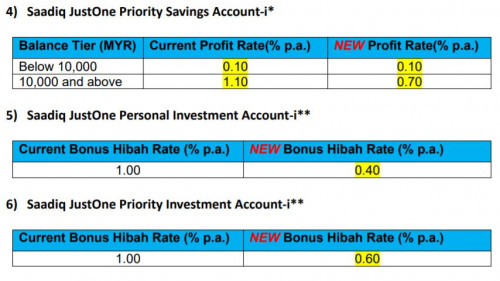

JUSTONE PRODUCT STREAMLINING AND REVISION OF BONUS INTEREST/BONUS HIBAH/PROFIT RATEKindly be informed that to simplify our product offerings, we are streamlining some of our products. Therefore, effective 1 September 2020, the accounts as mentioned in Table 1, Section A below will be known as the accounts named in Table 1, Section B. All other product features, account numbers, fees and charges will remain unchanged. | Table 1 | | | Section A | Section B | | Current Product Name | Now Known As | | JustOne Preferred Current Account | JustOne Personal Current Account | | JustOne Preferred Savings Account | JustOne Personal Savings Account | | Saadiq JustOne Preferred Account-i | Saadiq JustOne Personal Account-i | | Saadiq JustOne Preferred Investment Account-i | Saadiq JustOne Personal Investment Account-i |

Please take note that effective 1 September 2020, the bonus interest/bonus hibah/profit rate for JustOne Accounts will be revised as follows.   https://av.sc.com/my/content/docs/Announcem...-Sept-20-v3.pdf https://av.sc.com/my/content/docs/Announcem...-Sept-20-v3.pdf

|

|

|

|

|

|

GrumpyNooby

|

Aug 12 2020, 06:21 PM Aug 12 2020, 06:21 PM

|

|

QUOTE(JohnLo @ Aug 12 2020, 06:20 PM) current acc can do these types of transaction? I don't know as I don't have current account. And current account usually got maintenance fee if balance cannot be maintain or no activity. I'm a salary man; current account is not needed for me. |

|

|

|

|

|

MUM

|

Aug 12 2020, 06:57 PM Aug 12 2020, 06:57 PM

|

|

QUOTE(donnysen @ Aug 12 2020, 06:51 PM) which bank service is good? as a depositor or loan borrower? company a/c or individual a/c? normal account holder or priority banking account holder? wow, i would like to know that too.... for to be able to judge that, must really have actual experiences at those banks in Malaysia and judge them on the same situation too. good question |

|

|

|

|

|

GrumpyNooby

|

Aug 13 2020, 07:07 PM Aug 13 2020, 07:07 PM

|

|

QUOTE(donnysen @ Aug 13 2020, 06:21 PM) bank depositor, individual acc You want good service; join into the privileged banking level. Normal banking service is comparable among each other. |

|

|

|

|

|

David_Yang

|

Aug 13 2020, 08:34 PM Aug 13 2020, 08:34 PM

|

|

QUOTE(JohnLo @ Aug 12 2020, 07:20 PM) current acc can do these types of transaction? Yes, there is zero difference, Current Acc just have higher interest sometimes. But not at SC and OCBC. |

|

|

|

|

Jul 10 2020, 10:27 AM

Jul 10 2020, 10:27 AM

Quote

Quote

0.0199sec

0.0199sec

0.44

0.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled