Savings Account in Malaysia

Savings Account in Malaysia

|

|

Jan 29 2020, 04:20 PM Jan 29 2020, 04:20 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

196 posts Joined: Aug 2017 |

|

|

|

|

|

|

May 14 2020, 01:18 PM May 14 2020, 01:18 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

196 posts Joined: Aug 2017 |

|

|

|

Jul 15 2020, 05:01 PM Jul 15 2020, 05:01 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

196 posts Joined: Aug 2017 |

|

|

|

Aug 11 2020, 06:43 PM Aug 11 2020, 06:43 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

196 posts Joined: Aug 2017 |

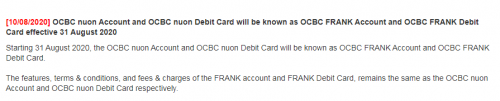

OCBC NoticesOCBC nuon Account and OCBC nuon Debit Card will be known as OCBC FRANK Account and OCBC FRANK Debit Card effective 31 August 2020

https://www.ocbc.com.my/personal-banking/notices.html FAQ-Renaming  Attached File(s)  FAQ_or_More__Info_on_Renaming_Exercise.pdf ( 227.36k )

Number of downloads: 14

FAQ_or_More__Info_on_Renaming_Exercise.pdf ( 227.36k )

Number of downloads: 14 |

|

|

Aug 21 2020, 09:30 AM Aug 21 2020, 09:30 AM

Return to original view | IPv6 | Post

#5

|

Junior Member

196 posts Joined: Aug 2017 |

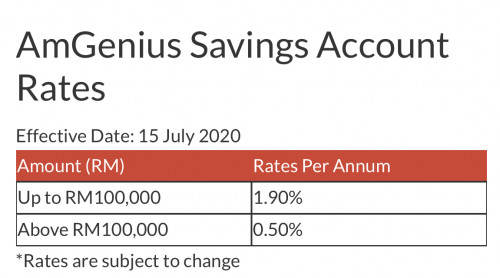

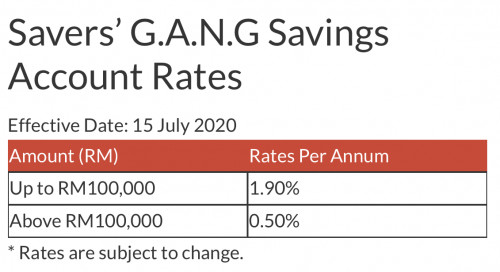

QUOTE(yklooi @ Aug 20 2020, 11:39 AM) AmBank saving account for kids offers comparably higher interest than Hong Leong Junior Saving.  yklooi liked this post

|

|

|

Oct 5 2020, 07:15 PM Oct 5 2020, 07:15 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

196 posts Joined: Aug 2017 |

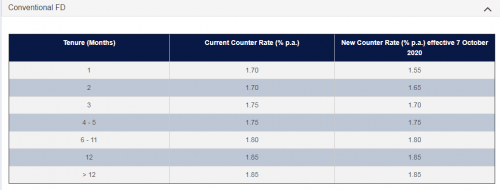

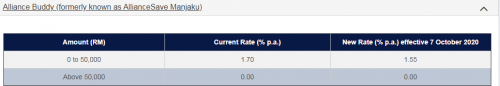

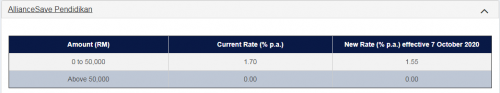

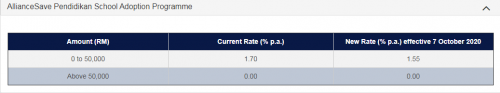

REVISION OF ALLIANCE BANK DEPOSIT RATES (Alliance Bank - Revision of Deposit Rates)

With effect from 7 October 2020, the Deposits interest rates will be revised as follows:     This post has been edited by a.lifehacks: Oct 5 2020, 07:16 PM |

|

|

|

|

|

Sep 13 2021, 10:17 PM Sep 13 2021, 10:17 PM

Return to original view | Post

#7

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(ScrappyCoCo @ Sep 13 2021, 09:40 PM) Can somebody advise which bank should i open a new savings account? Only considering between CIMB or Public Bank. CIMB imposes a high annual fee for Debit Card, on the point of issuance, you will get charged for RM15 issuance fee, and there will be RM15 charged annually from second year onwards. Refer here: Which are safer and offer good interest? Public Bank is way more accessible in my area but i feel their online banking n app seems very outdated, while CIMB constantly up their game to be on par with Maybank. Currently only has Maybank and thought of putting my eggs in different basket, will mostly just use for savings n create eFD with no intention of transfer out. https://www.cimb.com.my/en/personal/help-su...ebit-mastercard The above charges, however, do not apply if you opt for:- BASIC SAVING ACCOUNT (OPTION 1) NO ANNUAL FEE Link: https://www.cimb.com.my/en/personal/day-to-...gs-account.html The downside, would be, the free option comes with a monthly threshold of how many time(s) user can use the - counter service (known as Over-The-Counter transaction): Free 6 over-the-counter visits. Above threshold - RM5.00 per visit - ATM cash withdrawal: Free 8 ATM cash withdrawal. Above threshold - RM0.50 per transaction Reference: https://www.cimb.com.my/en/personal/help-su....html?#basic-sa In case you require unlimited option, you may opt for:- BASIC SAVING ACCOUNT (OPTION 2) WITH ANNUAL FEE- that offers the unlimited monthly OTC (Counter) & ATM cash withdrawal usage. Reference: https://www.cimb.com.my/en/personal/day-to-...gs-account.html This post has been edited by a.lifehacks: Sep 13 2021, 10:18 PM |

|

|

Sep 13 2021, 10:20 PM Sep 13 2021, 10:20 PM

Return to original view | Post

#8

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(jonoave @ Sep 13 2021, 09:54 PM) What's your main purpose of opening an account in another bank? I know CIMB AirAsia Savers Account has the RM5 cash back, would you mind to share which is the other CIMB Bank Account product that offers the same feature?Diversify your money holdings? Do you plan to use FD of that bank? I can't say too much about PB, just had an account briefly with them. But I know they're damn stingy with they interest on savings account. CIMB has decent savings account, there are 2 accounts where if you keep a monthly balance of RM5k, you get RM5 bonus. However, I strongly disagree that CIMB online banking is great Yes they have made improvements but I still find them to be the worst one I've experienced: 1. "Daily" maintenance between 11.55 pm to 6.00, where some services are not available 2. Random downtimes that can last for hours or days, though admittedly they have gotten better. But it was pretty frustrating when it happens and you can see their Facebook pages flooded with complains 3. Random "maintenance" over weekends etc. 4. CIMB clicks app still doesn't implement fingerprint security/access. You can "superficially" login using fingerprint or allow transfer of favourite accounts. But do anything more like view transactions etc, you need to key in your CIMB clicks password. I've never seen any online banking portal that requires "daily maintenance". CIMB AirAsia Savers Account: https://www.cimb.com.my/en/personal/day-to-...rs-account.html |

|

|

Sep 13 2021, 10:30 PM Sep 13 2021, 10:30 PM

Return to original view | Post

#9

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(jonoave @ Sep 13 2021, 09:54 PM) What's your main purpose of opening an account in another bank? For Public bank, I would recommend this product:-Diversify your money holdings? Do you plan to use FD of that bank? I can't say too much about PB, just had an account briefly with them. But I know they're damn stingy with they interest on savings account. CIMB has decent savings account, there are 2 accounts where if you keep a monthly balance of RM5k, you get RM5 bonus. However, I strongly disagree that CIMB online banking is great Yes they have made improvements but I still find them to be the worst one I've experienced: 1. "Daily" maintenance between 11.55 pm to 6.00, where some services are not available 2. Random downtimes that can last for hours or days, though admittedly they have gotten better. But it was pretty frustrating when it happens and you can see their Facebook pages flooded with complains 3. Random "maintenance" over weekends etc. 4. CIMB clicks app still doesn't implement fingerprint security/access. You can "superficially" login using fingerprint or allow transfer of favourite accounts. But do anything more like view transactions etc, you need to key in your CIMB clicks password. I've never seen any online banking portal that requires "daily maintenance". PB UnionPay Savings Account https://www.pbebank.com/Personal-Banking/Ba...gs-Account.aspx Reason being, there are constantly promo campaign for cash back with their UnionPay debit card which are much more widely accepted- on par with VISA/ MasterCard (when compared with AMEX) in Malaysia. Annual Fee for the debit card is RM8 (just like other banks with fee options- unlimited Counter/ atm cash withdrawal usage) https://www.pbebank.com/Personal-Banking/Ra...ebit-Cards.aspx For the list of promo:- https://www.pbebank.com/Personal-Banking/Pr...your-share.aspx Other promo for Public Bank Debit Card (other than the UnionPay debit card) https://www.pbebank.com/Personal-Banking/Pr...Debit-Card.aspx https://www.pbebank.com/Personal-Banking/Pr...ron-Visa-C.aspx https://www.pbebank.com/Personal-Banking/Pr...government.aspx. [GOVERNMENT TRANSACTIONS, usually banks don't give cashback for government transaction, but public bank is famous for giving out promo for govt transactions) Hope the above helps. This post has been edited by a.lifehacks: Sep 13 2021, 10:35 PM |

|

|

Sep 14 2021, 12:57 AM Sep 14 2021, 12:57 AM

Return to original view | Post

#10

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(ScrappyCoCo @ Sep 13 2021, 11:21 PM) @a.lifehacks, thanks. I will surely opt for no annual fee debit card as i have no intention of doing withrawal or spending using the card. So cashback or not doesn't matter for my purpose of this account. cklimm is right, CIMB OctoSavers Account-i is able to be opened via online.But since it's an islamic account type, you need to be aware that you won't be able to use the debit card that's issued (linked to the account) in a non-shariah complaint merchant. So, if you plan to use it in a non-shariah complaint merchant, always opt for a CONVENTIONAL account type. You do need to mention specifically to the banker who will be assisting you for the account opening just to make sure your desired account type is opened. This post has been edited by a.lifehacks: Sep 14 2021, 12:58 AM |

|

|

Sep 26 2021, 02:01 AM Sep 26 2021, 02:01 AM

Return to original view | Post

#11

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(MilesAndMore @ Aug 9 2021, 10:52 PM) I am compiling a list of banks that now allow remote bank account opening along with the requirements. Currently i know the followings : Bank of China (Malaysia) now offers account opening via app without the hassle of visiting their branch.- Hong Leong Bank - CIMB Bank - AmBank - Alliance Bank - UOB Bank - HSBC Any other banks ? P/S: Only available for New-to-Bank Customers (don’t hold any existing product with Bank of China) It’s called the e-pocket account that offers virtual debit card via app that’s free for life (no annual fee). There is a promo campaign for signing up this account from now until 31/12/2021. https://www.bankofchina.com.my/m/en-my/serv...d-Campaign.html Details of the product can be found on this link below:- https://www.bankofchina.com.my/m/en-my/segm...et-Account.html https://www.bankofchina.com.my/dam/en-my/se...article-eng.pdf https://www.bankofchina.com.my/dam/en-my/se...-Procedures.pdf https://www.bankofchina.com.my/dam/en-my/se...ePocket-PDS.pdf https://www.bankofchina.com.my/dam/en-my/se...Pocket-FAQs.pdf https://www.bankofchina.com.my/dam/en-my/se...ePocket-TnC.pdf https://m.facebook.com/BOCMalaysia/videos/t...120196204/?_rdr This post has been edited by a.lifehacks: Sep 26 2021, 02:39 PM id28 liked this post

|

|

|

Sep 26 2021, 02:30 PM Sep 26 2021, 02:30 PM

Return to original view | Post

#12

|

Junior Member

196 posts Joined: Aug 2017 |

QUOTE(!@#$%^ @ Sep 26 2021, 02:03 AM) Nothing. Except that the accountholder will have access to its UnionPay QR function for scan-qr-to-Pay on all merchant that accepts UnionPay QR (much more prevalent in China Mainland/ HK SAR/ Taiwan Region)And it’s a free account with no annual fee. Other than that, can’t think of any. And this, "customers can easily make code-sweeping payments at unionpay merchants in china, hong kong, china, and other international or regional locations for a convenient, digital cross-border transaction experience." "客户可在中国境内、中国香港及其他国际或地区的银联商户轻松进行扫码支付,畅享便捷、数码化跨境交易体验。" (Source: Translated from Oriental Daily, https://www.orientaldaily.com.my/news/centr...1/09/23/439728) This post has been edited by a.lifehacks: Sep 26 2021, 02:44 PM |

|

|

Dec 23 2022, 01:38 PM Dec 23 2022, 01:38 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

196 posts Joined: Aug 2017 |

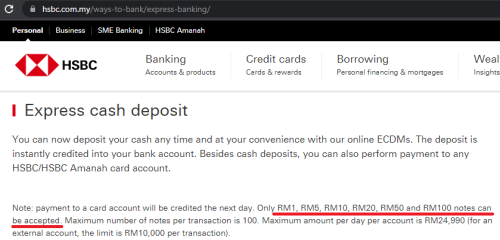

QUOTE(xperiaDROID @ Dec 22 2022, 10:05 PM) Just curious, are there any banks with cash deposit machines that accept RM 1 and RM 5 notes? HSBC Bank Express Banking CDM Machine accepts all kinds of MYR denomination except coins.So far I only know Hong Leong has it, but other than that are there any alternatives? Source: https://www.hsbc.com.my/ways-to-bank/express-banking/  |

| Change to: |  0.0225sec 0.0225sec

0.46 0.46

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 12:39 AM |