QUOTE(ZeneticX @ Apr 6 2025, 05:55 PM)

Allianceonline is really not the best online banking out there huh...

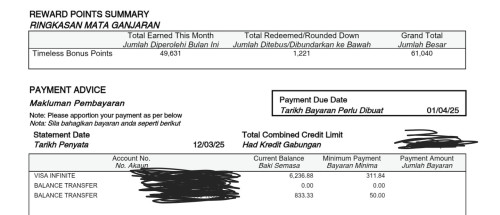

logged in just now and noticed like 40k of my tbp is suddenly gone... I hope its just a temporary glitch

ok now I am getting really concerned.... decided to give a call to CS to check on the missing pointslogged in just now and noticed like 40k of my tbp is suddenly gone... I hope its just a temporary glitch

the CS claim the reason was due to me converting a 4k+ purchase (4.7k to be exact) on my virtual cc to instalment plan so this is eligible only for 1x points instead of 8x.... but the thing is the points are already there before I even make the transaction

even if this is the reason, the limit for 8x tbp is only for 3k = 24k points, it doesn't make sense for me to lose 40k+ points

and I have proof from my March statement that I earned 40k+ tbp during that month alone

they say will check and update me within 3 working days

anyone encountered this before?

have to be honest here I haven't had the most pleasant experience with Alliance so far since becoming their customer on Feb... first the balance transfer interest screw up and now this. the CS are good but I just wonder what's going on in the backend....

im actually surprised they are able to pull off the whole virtual credit card thing

This post has been edited by ZeneticX: Apr 7 2025, 01:06 PM

Apr 7 2025, 12:53 PM

Apr 7 2025, 12:53 PM

Quote

Quote

0.1047sec

0.1047sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled