To read my brief comments on HSBC CNY Promo, go to my blog (towards the end just before summary).

Fixed Deposit Rates in Malaysia V2, Read 1st post to find highest rate.

|

|

Jan 9 2012, 08:51 AM Jan 9 2012, 08:51 AM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

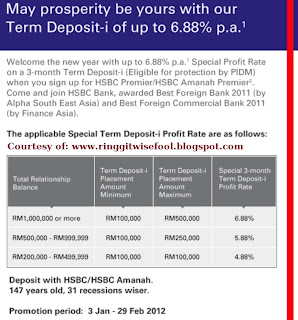

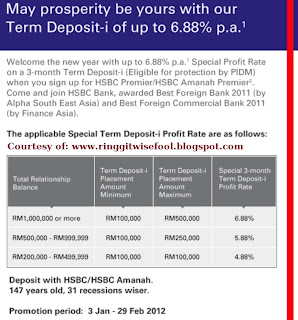

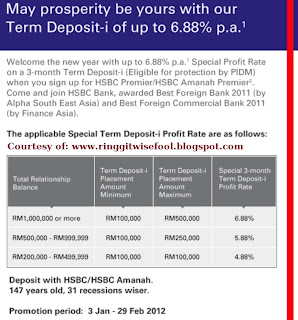

Got a Million Ringgit in cash? If yes you get to enjoy 6.88% for 3 months with HSBC NEW Premier Account, but for only half of it.

To read my brief comments on HSBC CNY Promo, go to my blog (towards the end just before summary). |

|

|

|

|

|

Jan 9 2012, 02:49 PM Jan 9 2012, 02:49 PM

|

Senior Member

5,644 posts Joined: Feb 2008 From: Heaven to HELL |

|

|

|

Jan 9 2012, 03:40 PM Jan 9 2012, 03:40 PM

|

Junior Member

130 posts Joined: Nov 2010 |

QUOTE(Gen-X @ Jan 9 2012, 08:51 AM) Got a Million Ringgit in cash? If yes you get to enjoy 6.88% for 3 months with HSBC NEW Premier Account, but for only half of it. if i read this right, this hsbc u have to leave the total funds (the part which is not in FD) with the bank for 3 months, to enjoy up to 6.88%. To read my brief comments on HSBC CNY Promo, go to my blog (towards the end just before summary). whereas for ocbc, u can enjoy 5% but the funds not in FD u can take it out and use it elsewhere. |

|

|

Jan 9 2012, 06:01 PM Jan 9 2012, 06:01 PM

|

Junior Member

6 posts Joined: Sep 2011 |

hello all, i am a bit confuse about the current FD package, I dont find those good rates you guys mentioned from bank websites, most of their website still showing annual rate of 3.1% - 3.15%, I dont see any FD rate at 4%, 5% etc.

I am asking on behalf of my mother, she lost quite a bit from public mutual and now she wants to put all her money into FD. But I don't know which one is a best package. From this topic I see OCBC 5%, HSBC 5%, UOB and stanchart etc, but when I go to their website, all 3.1%-3.15% only. So, if you have a cash of around RM1,300,000, which bank and which FD package? hosrt term 3 months also can, so that it wont get locked in, in case here are some better package, my mother can change to other bank. I try to search this topic but still a bit confuse. So, all tai kor and tai jie, please lend me your hand, advise me which one is a best package on the market now. thank you very much!!!! |

|

|

Jan 9 2012, 06:34 PM Jan 9 2012, 06:34 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(ultraman29 @ Jan 9 2012, 03:40 PM) if i read this right, this hsbc u have to leave the total funds (the part which is not in FD) with the bank for 3 months, to enjoy up to 6.88%. yes, for HSBC case, your other half of the funds have to remain with HSBC for 3 months.whereas for ocbc, u can enjoy 5% but the funds not in FD u can take it out and use it elsewhere. QUOTE(taitai29 @ Jan 9 2012, 06:01 PM) hello all, i am a bit confuse about the current FD package, I dont find those good rates you guys mentioned from bank websites, most of their website still showing annual rate of 3.1% - 3.15%, I dont see any FD rate at 4%, 5% etc. Another guy to be spoon fed I am asking on behalf of my mother, she lost quite a bit from public mutual and now she wants to put all her money into FD. But I don't know which one is a best package. From this topic I see OCBC 5%, HSBC 5%, UOB and stanchart etc, but when I go to their website, all 3.1%-3.15% only. So, if you have a cash of around RM1,300,000, which bank and which FD package? hosrt term 3 months also can, so that it wont get locked in, in case here are some better package, my mother can change to other bank. I try to search this topic but still a bit confuse. So, all tai kor and tai jie, please lend me your hand, advise me which one is a best package on the market now. thank you very much!!!! and with you posting you have RM1.3M cash, either you love to be receiving PM by the many con men and maybe one or two overly eager insurance agents lurking around this forum or you just want to let us know you're freaking rich And welcome to the FDMCG club **Edited** For your case, it is best you go talk directly to a Premier/Priority/Privelige Banking Relationship Manager directly instead of just anyone in the banking hall to avoid what sylille gone thru. click below link and read Post#404 http://forum.lowyat.net/topic/2070535/+400 And if your place got no Premier Banking, with RM1.3M, the Bank Manager himself/herself would be more than happy to attend to you and your mother. With your amount and for 3 months tenure, look into HSBC promo above. But after that, you can close the account because they usually don't have good promotions for existing Premier Account holders. This post has been edited by Gen-X: Jan 9 2012, 08:03 PM |

|

|

Jan 9 2012, 08:32 PM Jan 9 2012, 08:32 PM

|

Senior Member

1,332 posts Joined: Oct 2005 |

QUOTE(BoomChaCha @ Jan 7 2012, 04:35 AM) MBSB's board rates are negotiable too, and it depends on the FD amount and the business relationship history with them. But MBSB's 4.7% rate for 5 years tenure is strictly not negotiable, they claims that 4.7% is the best rate in the market... the rate is pretty good. 1% more than Bank Rakyat's 5 year 4.6% QUOTE I think the same way... MilesAndMore also said that Bank Rakyat is a profitable company loh... Can go for OCBC 4% promo and Bank Rakyat simultaneously, but the only different thing is: put large sum into OCBC, and put a very small sum into Bank Rakyat for testing purpose... And at the same time, study Bank Rakyat business model, background and etc...I think MilesAndMore knows pretty well about Bank Rakyat... According to the teller, Bank Raykat's 'FD' profit is paid monthly. I have just signed up for OCBC 12mth 4% tenure. Staff told me the rate is fixed and does not fluctuates. Also to add on, if u withdraw after 90days, u will be compensated half of the interest. QUOTE For example : if you sign up for their 60mth tenure (4.6%), you will receive 4.6% profit monthly. If u withdraw the principal before maturity at the 12th mth (4.01%), the extra profit given to u will be deducted from your principal based on 4.01%. ---- from turion64 So, this means that the principal money will not be lost if premature withdrawal? They just took back the given interest but depositor can still make a small amount of interest? (4.6% - 4.01%) Correct. For example : $10k for 5 years @ 4.6% - Rm460/yearly Took out the $10k at 12th month, u will receive your principal minus (Rm460 minus Rm401) = $10k - Rm59 So total u will be able to withdraw out from principal is Rm9941 Of course not forgetting the monthly/fortnightly interest u have accumulated. QUOTE(MilesAndMore @ Jan 7 2012, 10:30 AM) QUOTE A board rate means a normal FD rate QUOTE So this confirms that OCBC GIA rate is NOT fixed. QUOTE Based on OCBC GIA product description, it is the same as HSBC Amanah AGIA-i, so it means the profit rate is fixed. However, it is an Islamic product, so the product description is a little bit different than conventional FD product. Instead of telling you the profit rate is fixed, they will tell you that you will get the profit based on an agreed profit sharing ratio when you opened the account. MBSB is not a bank unlike Bank Rakyat. MBSB is something like a financial house only. I don't know much about MBSB. There are a few types. Profit can be paid on a monthly basis, on maturity or on the day the account is opened similar to HSBC Amanah TD-i (upfront payment scheme) and RHB Islamic Commodity Murabahah Deposit-i. It depends on which Bank Rakyat "FD" you go for. No. Yes. Yes u r right. I have double confirmed this with OCBC staff. QUOTE(Gen-X @ Jan 7 2012, 12:11 PM) The monthly interest payment is applicable for the 12 months tenure? If you do try them out, please update us on the product. Once again, 12 months? If yes, I should drop by and check it out myself. Firstly, most humans are Kiasi but not everyone is Kiasu. Yes. Monthly interest payout is applicable for 12 mth tenure. QUOTE haha, we are depositing into FD because we are not risk takers. Actually what does MBSB stands for? Is it a financial institution or a Bank?As for MBSB: In my opinion, 5 years is a long time, (unless FD rate was like the last time when it was 14% or so), you'll never know what will happen. MBSB deposits are not insured by PIDM right. MBSB is a listed company, looks like last 2 years were good years for them. You can get their announcements here, take a look at 4th quarter 2009. And there was a right issue too in 2011. And if you go read the annual reports (from MBSB website), they were loosing money up to 2003. If you read the 2009 Annual Report (link to their past annual report are available at their website), there is a chart showing that their profit have been on the increase since 2005. And in 2009, they had a new CEO who has been concentrating on personal finance. Anyway, go google MBSB NPL and MBSB rights issue for some weekend reading. And guess who is the major shareholder of MBSB? It is EPF. So I guess your money should be save with MBSB as I don't think the government will allow MBSB to collapse. **post edited to fix the quote's code. Kindly refrain from using multiple quotes in the same quote in future posting as it got me all dizzy too. This post has been edited by MilesAndMore: Jan 9 2012, 09:15 PM |

|

|

|

|

|

Jan 9 2012, 08:57 PM Jan 9 2012, 08:57 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(TSOM @ Jan 9 2012, 07:05 AM) There's no Bank Persatuan in Sabah!! The only good thing about MBSB at this time being perhaps is theirOnly MBSB .. Added on January 9, 2012, 7:09 amWhat is good with MBSB? Is it their shares like bank rakyat/bank persatuan or their FD products? 4.7% FD rate for 5 years tenure, and interest will be paid in every 6 months. So, depositors will receive 10 times of interest in 5 years time (pay interest twice per year). Pay interest in every 6 months applies to their Exclusive 5 category (4.7% rate p.a. for 5 years tenure) only. MBSB is still using very an old and traditional type of photostating IC method whereas nowadays most banks are using a small device to save and verify customers' identifications from customers' ICs. In my opinion, MBSB cannot compare to major banks in terms of professionalism and company management. But in overall, MBSB is acceptable as a medium size financial institution based on Malaysia standards. About Bnak Rakyat, I just read an article yesterday, Bank Raykat has been developing their finance business to government workers very successfully for quite some time. Bank Raykat is MBSB main competitor. I do not know anything about Bank Persatuan. This post has been edited by BoomChaCha: Jan 9 2012, 08:59 PM |

|

|

Jan 9 2012, 09:20 PM Jan 9 2012, 09:20 PM

|

|

Moderator

9,301 posts Joined: Mar 2008 |

Guys, how can you all forget about Kuwait Finance House ? It's been offering 4% return since last month for 6, 12 and 24 months tenure and this promotion is due to expire at the end of next month. It needs a minimum deposit of RM20,000 and there doesn't seem to be a maximum limit for this promotion. There is no need to split your money between normal board rate and this promotion rate either!

I saw the banner when i walked pass a KFH branch this morning. I was on my way to UOB to buy new banknotes and to get their ang pow for this year This post has been edited by MilesAndMore: Jan 9 2012, 09:21 PM |

|

|

Jan 9 2012, 09:24 PM Jan 9 2012, 09:24 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(ultraman29 @ Jan 9 2012, 03:40 PM) if i read this right, this hsbc u have to leave the total funds (the part which is not in FD) with the bank for 3 months, to enjoy up to 6.88%. This is what I found out about HSBC latest FD promotions for Premier Account. Minimum FD placement is RM 200K:whereas for ocbc, u can enjoy 5% but the funds not in FD u can take it out and use it elsewhere. (1) Deposit from RM 200K to RM 500K at 4.88% rate for 3 months. First RM 100K will get 4.88%, the remaining balance will get board rate from 3% or 3.05% (Islamic) Average FD rate for 3 months tenure is 3.965% (4.88% + 3.05%) /2 = 3.965 (2) Deposit from RM 500001.00 to RM 999999.00 at 5.88% rate for 3 months. First RM 250K will get 5.88%, the remaining balance will get board rate from 3% or 3.05% (Islamic) Average FD rate for 3 months tenure is 4.465% (5.88% + 3.05%) /2 = 4.465% (3) Deposit above 1 RM million at 6.88% rate for 3 months. First RM 500K will get 6.88%, the remaining balance will get board rate from 3% or 3.05% (Islamic) Average FD rate for 3 months tenure is 4.965% (6.88% + 3.05%) /2 = 4.965% Note: HSBC will have a RM 150 monthly charge for Premier account if the Premier account balance drops below RM 200K. But The RM said he will change from Premier account to normal saving account once the depositors withdraw the funds upon FD maturity. |

|

|

Jan 9 2012, 09:29 PM Jan 9 2012, 09:29 PM

|

|

Moderator

9,301 posts Joined: Mar 2008 |

QUOTE(BoomChaCha @ Jan 9 2012, 09:24 PM) HSBC will have a RM 150 monthly charge for Premier account if the Premier account balance drops below RM 200K. Actually, HSBC will first send out letters to you to remind you to top up your fund in HSBC but you will have to pay the RM150 account service fee on the first month your total relationship balance falls below RM200k.But The RM said he will change from Premier account to normal saving account once the depositors withdraw the funds upon FD maturity. A HSBC Premier account will only be converted to an Advance or any other normal savings account types upon the customer's request or when the customer fail to top up the balance to at least RM200k for three consecutive months. |

|

|

Jan 9 2012, 09:33 PM Jan 9 2012, 09:33 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(turion64 @ Jan 9 2012, 08:32 PM) the rate is pretty good. 1% more than Bank Rakyat's 5 year 4.6% Tuan, please check out MBSB here:I have just signed up for OCBC 12mth 4% tenure. Staff told me the rate is fixed and does not fluctuates. Also to add on, if u withdraw after 90days, u will be compensated half of the interest. So, this means that the principal money will not be lost if premature withdrawal? They just took back the given interest but depositor can still make a small amount of interest? (4.6% - 4.01%) Correct. For example : $10k for 5 years @ 4.6% - Rm460/yearly Took out the $10k at 12th month, u will receive your principal minus (Rm460 minus Rm401) = $10k - Rm59 So total u will be able to withdraw out from principal is Rm9941 Of course not forgetting the monthly/fortnightly interest u have accumulated. Yes u r right. I have double confirmed this with OCBC staff. Yes. Monthly interest payout is applicable for 12 mth tenure. Actually what does MBSB stands for? Is it a financial institution or a Bank? **post edited to fix the quote's code. Kindly refrain from using multiple quotes in the same quote in future posting as it got me all dizzy too. www.mbsb.com.my Fixed Deposits: http://www.mbsb.com.my/deposits_fixed.html QUOTE(MilesAndMore @ Jan 9 2012, 09:20 PM) Guys, how can you all forget about Kuwait Finance House ? It's been offering 4% return since last month for 6, 12 and 24 months tenure and this promotion is due to expire at the end of next month. It needs a minimum deposit of RM20,000 and there doesn't seem to be a maximum limit for this promotion. There is no need to split your money between normal board rate and this promotion rate either! Kuwait Finance House..??? I saw the banner when i walked pass a KFH branch this morning. I was on my way to UOB to buy new banknotes and to get their ang pow for this year I had never heard of it before you mentioned it here... Thank you for the info.... All right, let's check it out here... http://www.kfh.com.my/kfhmb/ **post edited to fix the quote's code Added on January 9, 2012, 10:02 pm QUOTE(MilesAndMore @ Jan 9 2012, 09:29 PM) Actually, HSBC will first send out letters to you to remind you to top up your fund in HSBC but you will have to pay the RM150 account service fee on the first month your total relationship balance falls below RM200k. All right... got it..and thanks.. A HSBC Premier account will only be converted to an Advance or any other normal savings account types upon the customer's request or when the customer fail to top up the balance to at least RM200k for three consecutive months. This post has been edited by BoomChaCha: Jan 9 2012, 10:02 PM |

|

|

Jan 9 2012, 10:08 PM Jan 9 2012, 10:08 PM

|

|

Elite

8,601 posts Joined: Jan 2003 From: KL |

QUOTE(MilesAndMore @ Jan 9 2012, 09:20 PM) Guys, how can you all forget about Kuwait Finance House ? It's been offering 4% return since last month for 6, 12 and 24 months tenure and this promotion is due to expire at the end of next month. It needs a minimum deposit of RM20,000 and there doesn't seem to be a maximum limit for this promotion. There is no need to split your money between normal board rate and this promotion rate either! wah, 6 months too I saw the banner when i walked pass a KFH branch this morning. I was on my way to UOB to buy new banknotes and to get their ang pow for this year O.T. You changing new notes - you are married and giving Ang Pows or you just like new notes QUOTE(BoomChaCha @ Jan 9 2012, 09:33 PM) All right, let's check it out here... Thanks. And it pays the interest in "advance" and you need to open a current or savings account.http://www.kfh.com.my/kfhmb/ Click here for T&C Posted in Post #1  QUOTE(MilesAndMore @ Jan 9 2012, 09:29 PM) Actually, HSBC will first send out letters to you to remind you to top up your fund in HSBC but you will have to pay the RM150 account service fee on the first month your total relationship balance falls below RM200k. My ex-SCB RM told me that SCB will charge RM100/month, but she said she can always appeal to get it waived for me if I have intention to top up soon. But I don't think I will be depositing anytime soon with them so asked her to close my account instead of me requesting the monthly charges to be waived and her having work to do. So, she said she will first downgrade my account before I can close.A HSBC Premier account will only be converted to an Advance or any other normal savings account types upon the customer's request or when the customer fail to top up the balance to at least RM200k for three consecutive months. This post has been edited by Gen-X: Jan 9 2012, 10:34 PM |

|

|

Jan 9 2012, 11:00 PM Jan 9 2012, 11:00 PM

|

|

Moderator

9,301 posts Joined: Mar 2008 |

QUOTE(Gen-X @ Jan 9 2012, 10:08 PM) wah, 6 months too I was just helping my mom to change it O.T. You changing new notes - you are married and giving Ang Pows or you just like new notes QUOTE(Gen-X @ Jan 9 2012, 10:08 PM) Yah, most banks started to distribute Ang Pows today. I managed to buy some new RM10 (still in old design) from HSBC while UOB told me they will only start selling the new banknotes next week. HSBC said they don't have much in stock as they too won't be officially start to sell the new banknotes for CNY until next Monday. The staff at HSBC also told me that HSBC HQ in KL hasn't couriered this year's ang pow to them yet and asked me to come back next week. So last minute Anyway, any of you managed to buy the new banknotes (new design) ? QUOTE(Gen-X @ Jan 9 2012, 10:08 PM) Thanks. And it pays the interest in "advance" and you need to open a current or savings account. Yes. Upfront payment a là HSBC Amanah TD-i upfront payment scheme Click here for T&C QUOTE(Gen-X @ Jan 9 2012, 10:08 PM) My ex-SCB RM told me that SCB will charge RM100/month, but she said she can always appeal to get it waived for me if I have intention to top up soon. But I don't think I will be depositing anytime soon with them so asked her to close my account instead of me requesting the monthly charges to be waived and her having work to do. So, she said she will first downgrade my account before I can close. How nice of her to offered to help. HSBC on the other hand, is very strict about this.This post has been edited by MilesAndMore: Jan 9 2012, 11:01 PM |

|

|

|

|

|

Jan 9 2012, 11:30 PM Jan 9 2012, 11:30 PM

|

Senior Member

2,490 posts Joined: Sep 2011 |

Ask you guys a question:

Do you guys feel comfortable when every time you sign-up a new bank account, you need to fill out your personal information like your home address, home phone number, work phone number and etc on the bank form? I know this is a must requirement to provide this personal information to the banks in order to open a new bank account, but I do not feel comfortable to disclose my personal information to many banks because this is my privacy especially when the banks know how much money I have. I do not mean the bank will come to our house to rob me. In my opinion, it is always better not to disclose our home address and phone number in order to safeguard ourselves. Bank staffs are human being also.. Furthermore, banks sometime call me and convince me to apply for their credit cards and etc... I do not like this at all..! HLB was doing this very often to me last time, even I had closed my FD account with them. I am thinking to put down a fake home address and fake home phone on the bank form, but only put down my real hand phone number.. What do you guys think..? |

|

|

Jan 9 2012, 11:44 PM Jan 9 2012, 11:44 PM

|

Junior Member

163 posts Joined: Apr 2010 |

QUOTE(MilesAndMore @ Jan 9 2012, 09:20 PM) Guys, how can you all forget about Kuwait Finance House ? It's been offering 4% return since last month for 6, 12 and 24 months tenure and this promotion is due to expire at the end of next month. It needs a minimum deposit of RM20,000 and there doesn't seem to be a maximum limit for this promotion. There is no need to split your money between normal board rate and this promotion rate either! Thanks for sharing with us. I have never heard of KFH before, didn't sound like a bank. Upfront interest payment is awesome. I am considering the 6-month tenure, that is, if the deposit is PIDM protected. I saw the banner when i walked pass a KFH branch this morning. I was on my way to UOB to buy new banknotes and to get their ang pow for this year |

|

|

Jan 10 2012, 12:07 AM Jan 10 2012, 12:07 AM

|

Senior Member

1,332 posts Joined: Oct 2005 |

QUOTE(BoomChaCha @ Jan 9 2012, 11:30 PM) Ask you guys a question: To be honest, I have friends that worked in the marketing line and shockingly, they told me banks do sell their information to marketeers. Its not really the bank that have sold it, but the staff sold it without the company's knowledge. Actually nothing can be done about it, probably just give your housephone instead to avoid getting spams on your cellphone.Do you guys feel comfortable when every time you sign-up a new bank account, you need to fill out your personal information like your home address, home phone number, work phone number and etc on the bank form? I know this is a must requirement to provide this personal information to the banks in order to open a new bank account, but I do not feel comfortable to disclose my personal information to many banks because this is my privacy especially when the banks know how much money I have. I do not mean the bank will come to our house to rob me. In my opinion, it is always better not to disclose our home address and phone number in order to safeguard ourselves. Bank staffs are human being also.. Furthermore, banks sometime call me and convince me to apply for their credit cards and etc... I do not like this at all..! HLB was doing this very often to me last time, even I had closed my FD account with them. I am thinking to put down a fake home address and fake home phone on the bank form, but only put down my real hand phone number.. What do you guys think..? |

|

|

Jan 10 2012, 12:30 AM Jan 10 2012, 12:30 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(turion64 @ Jan 10 2012, 12:07 AM) To be honest, I have friends that worked in the marketing line and shockingly, they told me banks do sell their information to marketeers. Its not really the bank that have sold it, but the staff sold it without the company's knowledge. Actually nothing can be done about it, probably just give your housephone instead to avoid getting spams on your cellphone. The worst thing what if the personal information pass to kidnapper or robber?No, I would provide my hand phone number rather than my house phone. Call to house is more annoying and is more dangerous if the caller has bad intention to cheat money. Don't you read newspaper lately there are many con people (pretended calling from bank) call to house and say your bank account is suspended because of committing crime? and they will request you to transfer your fund to other people bank account in order to safeguard the rest of your money.... This post has been edited by BoomChaCha: Jan 20 2012, 06:02 PM |

|

|

Jan 10 2012, 12:45 AM Jan 10 2012, 12:45 AM

|

Senior Member

1,332 posts Joined: Oct 2005 |

QUOTE(BoomChaCha @ Jan 10 2012, 12:30 AM) The worst thing what if the personal information pass to kidnapper or robber? well it all depends. as my housephone hardly anyone pick it up. as everyone has their own cellphones. registered it just for sake of internet.heheNo, I would provide my hand phone number rather than my house phone. Call to house is more annoying and is more dangerous if the caller has bad intention to cheat money. Don't you read newspaper lately there are many con people (pretended calling from bank) call to house and say your bank account is suspended because of committing crime? and they will request you to transfer your fund to other people bank account in order to safeguard the rest of your money.... Added on January 10, 2012, 12:41 amI have been thinking about to use Mail Box Etc service, so that I can put down Mail Box Etc address (street address) on my IC instead of my real home address. Please check out Mail Box Etc website: http://www.mbe.com.my/ps_ms.php |

|

|

Jan 10 2012, 12:54 AM Jan 10 2012, 12:54 AM

|

Senior Member

2,490 posts Joined: Sep 2011 |

QUOTE(turion64 @ Jan 10 2012, 12:45 AM) well it all depends. as my housephone hardly anyone pick it up. as everyone has their own cellphones. registered it just for sake of internet.hehe I have received many phone calls from foreign con women who called to my house phone, they said I won a lottery and bla..bla.. This post has been edited by BoomChaCha: Jan 20 2012, 06:03 PM |

|

|

Jan 10 2012, 01:04 AM Jan 10 2012, 01:04 AM

|

Senior Member

1,332 posts Joined: Oct 2005 |

QUOTE(BoomChaCha @ Jan 10 2012, 12:54 AM) I have received many phone calls from foreign con women who well there isnt really any 100% privacy in bolehland..even UK have phone hacking scandal...lolcalled to my house phone, they said I won a lottery and bla..bla.. I am not saying I am rich, but I want to try my best to protect my privacy... |

|

Topic ClosedOptions

|

| Change to: |  0.0258sec 0.0258sec

0.76 0.76

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 09:19 PM |