QUOTE(tadashi987 @ Aug 20 2020, 10:15 PM)

I have both in my portfolio. Private Retirement Fund, What the hell is that??

Private Retirement Fund, What the hell is that??

|

|

Aug 20 2020, 10:19 PM Aug 20 2020, 10:19 PM

Return to original view | IPv6 | Post

#81

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Sep 25 2020, 02:06 PM Sep 25 2020, 02:06 PM

Return to original view | Post

#82

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 25 2020, 05:37 PM Sep 25 2020, 05:37 PM

Return to original view | IPv6 | Post

#83

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 25 2020, 07:04 PM Sep 25 2020, 07:04 PM

Return to original view | IPv6 | Post

#84

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 26 2020, 02:16 PM Sep 26 2020, 02:16 PM

Return to original view | IPv6 | Post

#85

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Sep 26 2020, 12:41 PM) If u can timing the market, buy at the lowest point. 😁😁😁 Only good recently but falls back to red sea later how? If u can't timing the market, just like me lo, dca or if got dip like march, in again. Although PM recently is good but i won't consider bcoz the performance is only recently n come with sales charge oso, unless u can get the 0% sales charge for PRS 😁😁 Even u can timing the market but prs is for long term, like me still got almost 20 years to go, sure got up down up down ma. Tak akan when up i said my prs is pro n good, n down i sumpah itu prs providers n switch?? |

|

|

Sep 26 2020, 06:34 PM Sep 26 2020, 06:34 PM

Return to original view | IPv6 | Post

#86

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Sep 29 2020, 01:59 PM Sep 29 2020, 01:59 PM

Return to original view | Post

#87

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Sep 30 2020, 09:57 AM Sep 30 2020, 09:57 AM

Return to original view | Post

#88

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 1 2020, 03:27 PM Oct 1 2020, 03:27 PM

Return to original view | Post

#89

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Oct 1 2020, 03:24 PM) I don't know how u ppl choose. You should share which you bought in your PRS portfolio.I definitely will choose the fund with consistent return in each calendar year. Not the highest nvm but consistently give me better return. I don't like low performance previous year but suddenly spike high fund. ### i don't choose Conservative fund. Prefer growth /moderate /equity. |

|

|

Oct 7 2020, 07:20 AM Oct 7 2020, 07:20 AM

Return to original view | Post

#90

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 7 2020, 07:36 AM Oct 7 2020, 07:36 AM

Return to original view | Post

#91

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Oct 7 2020, 07:31 AM) No, i got moderate only, but normally i seldom enter same fund house twice for prs. This year just enter am REITs. Affin PRS Growth Fund is feeding mainly into Affin Hwang Select Asia (ex Japan) Opportunity Fund MYRI flip2 n just realise this affin growth not bad. Just recommend only. Whether wan or not is up to him Affin PRS Moderate Fund is feeding mainly into Affin Hwang Select Asia Pacific (ex Japan) Balanced Fund MYR Given recent stealth performance of both funds capturing upside opportunity in Greater China region, no doubt that both PRS funds are gaining too. ironman16 liked this post

|

|

|

Oct 7 2020, 08:11 AM Oct 7 2020, 08:11 AM

Return to original view | Post

#92

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Oct 7 2020, 08:09 AM) I'm also holding Affin PRS Moderate Fund. I'm only investing into existing funds; not employing your strategy of 1 new PRS fund per calendar year. ironman16 liked this post

|

|

|

Oct 7 2020, 08:19 AM Oct 7 2020, 08:19 AM

Return to original view | Post

#93

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(familyfirst @ Oct 7 2020, 08:14 AM) Thanks for this info. I have both so was wondering if I should top up instead of finding a new fund. A lot of us have this too: Principal PRS Plus Asia Pacific Ex Japan Equity - Class C.Would you kindly recommend another better performing fund pls? cempedaklife liked this post

|

|

|

|

|

|

Oct 7 2020, 08:24 AM Oct 7 2020, 08:24 AM

Return to original view | Post

#94

|

All Stars

12,387 posts Joined: Feb 2020 |

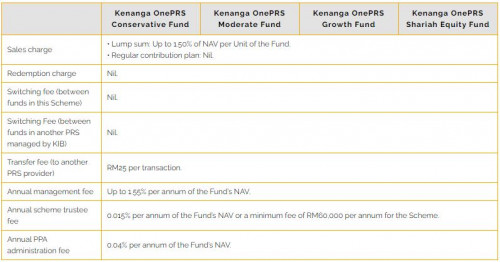

QUOTE(ironman16 @ Oct 7 2020, 08:22 AM) No right or wrong, up to us nia. I used to have Kenanga OnePRS Growth Fund. I just dun wan pay the rm8 to fund house nia. 😜 Haven't decide next year what fund 😅 May b pay rm8 go affin if no choice. Last time i hampir wanna gi kenanga oledi. But I switched it to Kenanga Shariah OnePRS Conservative Fund due to lack confidence for Malaysian equity in coming months. |

|

|

Oct 7 2020, 08:27 AM Oct 7 2020, 08:27 AM

Return to original view | Post

#95

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Oct 7 2020, 08:26 AM) Switching funds between same PRS provider is free. ironman16 liked this post

|

|

|

Oct 7 2020, 08:35 AM Oct 7 2020, 08:35 AM

Return to original view | Post

#96

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 7 2020, 09:01 AM Oct 7 2020, 09:01 AM

Return to original view | Post

#97

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 7 2020, 09:14 AM Oct 7 2020, 09:14 AM

Return to original view | Post

#98

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(mroys@lyn @ Oct 7 2020, 09:08 AM) Me too, have been keeping with this fund for 3 years consecutively for tax relieve purposes. 3 years with average total returns of 15%, not bad. My average annualized return is only 4% with total return over the course is 30%Well, I don't expect PRS fund to fly. |

|

|

Oct 7 2020, 09:49 AM Oct 7 2020, 09:49 AM

Return to original view | Post

#99

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Oct 7 2020, 09:45 AM) Can I switch my PRS funds? Can I switch my PRS funds to a different fund house? Switching and Transfer are not same. Yes, you can switch within same fund house and between different fund houses. You may login into your investment account and click on Funds >> Transactions >> Sell/Switch to execute the switching transaction. There is no switching fee and also no restriction to the number of switching transactions EXCEPT for the fund houses below: •CIMB Principal Asset Management - 12 times* free switch per calendar year •Manulife Asset Management Services Berhad - 12 times free switch per calendar year *one time switching per month However, for switching of PRS funds between different fund houses, you are subjected to the conditions below: 1. Transfers are permitted once a calendar year for each PRS Provider; 2. The transfer is only allowed after one year from the first subscription date; 3. There is sufficient units in the fund(s); 4. Each transfer request is only between two PRS Providers; and 5. All accrued benefits to be transferred from a particular fund must be transferred correspondingly to one other fund managed by the Transferee Provider. Please be advised that you will need to pay a PPA transfer fee of MYR 25.00 per request. so, what is the highligthed sentence means??? means for different fund house???  https://www.ppa.my/prs-providers/kenangainvestors/ ironman16 liked this post

|

|

|

Oct 7 2020, 02:58 PM Oct 7 2020, 02:58 PM

Return to original view | Post

#100

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(familyfirst @ Oct 7 2020, 02:32 PM) For AmReit I have to go to Ambank personally to buy the first time right? With Covid-19 and many working from home, will REITs produce similar results in the next few years? Whats your thoughts? Maybe you can join this Webinar session by Manulife Registration link: https://us02web.zoom.us/meeting/register/tZ...4yBtpe48gf-w7VE |

| Change to: |  0.0350sec 0.0350sec

0.81 0.81

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 08:14 PM |