QUOTE(jenny Ngel @ Oct 20 2020, 06:39 PM)

I duno if this is reliable, my father who bought education investment XXXXX ended in lost. Speaking honestly, how reliable is this?

Education investment/insurance/fund is not PRS. Private Retirement Fund, What the hell is that??

|

|

Oct 20 2020, 06:44 PM Oct 20 2020, 06:44 PM

Return to original view | IPv6 | Post

#121

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Oct 21 2020, 08:34 AM Oct 21 2020, 08:34 AM

Return to original view | Post

#122

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 21 2020, 09:06 AM Oct 21 2020, 09:06 AM

Return to original view | Post

#123

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 21 2020, 09:13 AM Oct 21 2020, 09:13 AM

Return to original view | Post

#124

|

All Stars

12,387 posts Joined: Feb 2020 |

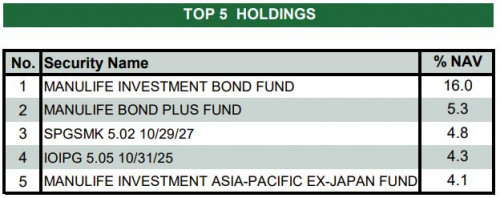

QUOTE(dopp @ Oct 21 2020, 09:09 AM) Not the Shariah version right?If so, this is a little strange. Since it's Growth Fund, it is weird to see the top 4 holdings are into bond/fixed income securities.  https://www.fundsupermart.com.my/fsmone/adm...eetMYMLPRS3.pdf |

|

|

Oct 21 2020, 09:26 AM Oct 21 2020, 09:26 AM

Return to original view | Post

#125

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(dopp @ Oct 21 2020, 09:23 AM) Nope, not shariah. You can sell anytime if you pay for the 8% tax penalty.In fact, at the same time we have also invested quite a lot with this manulife agent in UT. 4 yrs + i have never seen a profit P&L . and he now parking all our fund in Money Market.... I'll wait for Oct dividend from Manulife money market, and just dump and switch to FSM managed profile. About PRS, i was told by him... If we sell and withdraw the PRS, we can longer buy .. bullshit or what. Otherwise, you can switch for free to other PRS fund within the same PRS provider. Or pay RM 25 to transfer to another PRS provider. Alternatively, there's pre-retirement withdrawal like EPF and also PENJANA withdrawal. |

|

|

Oct 21 2020, 12:24 PM Oct 21 2020, 12:24 PM

Return to original view | Post

#126

|

All Stars

12,387 posts Joined: Feb 2020 |

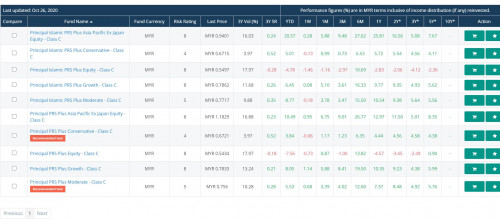

QUOTE(dopp @ Oct 21 2020, 12:23 PM) Try this: Principal PRS Plus Asia Pacific Ex Japan Equity - Class CHighly recommended by a Singaporean. |

|

|

|

|

|

Oct 24 2020, 08:49 AM Oct 24 2020, 08:49 AM

Return to original view | IPv6 | Post

#127

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(CoronaV @ Oct 24 2020, 06:56 AM) Investment amount : RM11000 How long have you been investing? Consolidated current value : RM13213.00 Profit/loss: RM2213.00 (+20.12%) How to interpret this? Yearly average 20.12 %? You should know better than us right? That is just a simple return for the overall portfolio. This post has been edited by GrumpyNooby: Oct 24 2020, 08:50 AM |

|

|

Oct 24 2020, 09:05 AM Oct 24 2020, 09:05 AM

Return to original view | IPv6 | Post

#128

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(TechnoG @ Oct 24 2020, 08:56 AM) why principal asia pacific PRS and not the ex japan equity one? If you're referring to the ex japan equity ine fund from Principal, it is just normal unit trust fund and not eligible for tax relief under PRS clauselooking to throw RM 3k for tax relief before end of nov for investment till retirement, wonder which funds should I get |

|

|

Oct 24 2020, 09:50 AM Oct 24 2020, 09:50 AM

Return to original view | IPv6 | Post

#129

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(TechnoG @ Oct 24 2020, 09:49 AM) Yeah the ex japan equity fund form Principal. PPA website will be the best as they're the administrator of the scheme.May I know where do I find the comprehensive list for the eligible funds? I'm basing the selection off the PPA website: https://www.ppa.my/prs-providers/list-of-scheme-funds/ ironman16 liked this post

|

|

|

Oct 24 2020, 09:56 AM Oct 24 2020, 09:56 AM

Return to original view | IPv6 | Post

#130

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Oct 24 2020, 09:53 AM) The PPA portal doesn't list out Public Mutual PRS? |

|

|

Oct 24 2020, 10:07 AM Oct 24 2020, 10:07 AM

Return to original view | IPv6 | Post

#131

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(TechnoG @ Oct 24 2020, 10:05 AM) sort by 6 months return and it's on the top hahaha The link by MorningStar could assist you but past performance doesn't dictate future performance of the fund.I'm still thinking which fund I should buy as I'm still clueless which fund is eligible under the PRS.. ironman16 liked this post

|

|

|

Oct 24 2020, 10:53 AM Oct 24 2020, 10:53 AM

Return to original view | IPv6 | Post

#132

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 26 2020, 12:29 PM Oct 26 2020, 12:29 PM

Return to original view | Post

#133

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Oct 26 2020, 04:49 PM Oct 26 2020, 04:49 PM

Return to original view | IPv6 | Post

#134

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(proJay @ Oct 26 2020, 04:45 PM) From this table generated from FSMONE. Why you want to buy Class A instead Class C?I can't see any Principal PRS from class A. First I still thought I can buy with < 1.75% or even 0% sales charge via FSMONE, but actually not applicable.  Class A: sales charge is up to 3% Class C: sales charge is up to 0.5% |

|

|

Oct 26 2020, 06:12 PM Oct 26 2020, 06:12 PM

Return to original view | IPv6 | Post

#135

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(proJay @ Oct 26 2020, 05:58 PM) Because of I already have Class A, so plan to top up 3k for this year tax relief. Just curious, from which channel you bought the Class A fund? I have no idea any new fund to buy and don't think we can get low NAV like March the time. Current plan: 1. Buy any fund from Affin Hwang, Kenanga, and Principal PRS. 2. Buy via FSMOne Mobile WEB because it does not required any forms and 0% sales charges. 3. Get Touch N Go E-wallet RM40. Or 1. Switch to other PRS(maybe Principal PRS class C) for my current Principal Class A. -Not sure switch fund can be done via FSM or not. 2. Top up 3k to Principal Class C for this year tax relief. 3. Get Touch N Go E-wallet RM40. Direct from Principal or CIMB? |

|

|

Oct 28 2020, 07:55 AM Oct 28 2020, 07:55 AM

Return to original view | Post

#136

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Cyclopes @ Oct 27 2020, 05:43 PM) Hi semua! This was sent to your email?*Private Pension Administrator Malaysia (PPA)* sedang mengadakan soal selidik untuk mendapatkan pendapat anda berkenaan simpanan dan perancangan persaraan dalam norma baru. Oleh itu, kami meminta kerjasama anda untuk mengisi borang soal selidik ini di https://www.ppa.my/prslive/borang-soal-seli...rusan-kewangan/ *Nota:* Sebarang maklumat yang dikemukakan adalah *SULIT* dan hanya digunakan untuk tujuan kajian ini sahaja. *Terima kasih* |

|

|

Oct 28 2020, 08:12 AM Oct 28 2020, 08:12 AM

Return to original view | Post

#137

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 28 2020, 08:09 PM Oct 28 2020, 08:09 PM

Return to original view | IPv6 | Post

#138

|

All Stars

12,387 posts Joined: Feb 2020 |

Private Pension Administrator Malaysia (PPA), the central administrator for Private Retirement Schemes (PRS), is hosting a complimentary financial education webinar exclusively for PRS Members on 19 November 2020 (Thursday) at 11.30am.

As a saver in PRS, you know the importance of setting aside a portion of your income for the future. To help you get closer to your PRS savings goal, this webinar will familiarise you with the essential characteristics of PRS funds – such as asset classes, core vs. non-core and conventional vs. Shariah-compliant, to name a few. You won’t want to miss this webinar as we will also highlight to you about the Default Option and its unique Auto Glide feature, as well as how you can use the Fund Fact Sheets, Product Highlights Sheets and Disclosure Documents to learn more about PRS funds and its performance. Join PPA’s CEO Husaini Hussin in this special webinar for a deeper understanding about PRS and the benefits you can also enjoy when you make PRS your preferred choice for retirement savings. Besides that, Morningstar will also make a special appearance to explain how you can take advantage of resources and tools which are created specifically to review and stay up to date on the performance of PRS funds. Registration link: https://zoom.us/webinar/register/2016021459...ySaOcLN3nJ8aAdg |

|

|

Oct 28 2020, 09:00 PM Oct 28 2020, 09:00 PM

Return to original view | IPv6 | Post

#139

|

All Stars

12,387 posts Joined: Feb 2020 |

PRS Webinar with Affin : Take Charge On Your Retirement Savings Today

Feeling anxious about your retirement goals? Or probably unsure what those goals should be in? Join us as we share some of the ways you can take charge of your retirement savings to achieve your Financial Goals. Event link: https://www.fundsupermart.com.my/fsmone/art...t-Savings-Today Registration link: https://www.fundsupermart.com.my/main/home/...d=Evt2010280001 |

|

|

Oct 31 2020, 10:43 AM Oct 31 2020, 10:43 AM

Return to original view | IPv6 | Post

#140

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(kart @ Oct 31 2020, 10:39 AM) No worries, !@#$%^. Please share your experience of Principal PRS Pre-Retirement Withdrawals, during June, so that I can understand the previous withdrawal procedure. Well don't underestimate largest unit trust manager in Malaysia while Principal is nothing compared to them. For sure, I will send e-mail to service@principal.com.my, to know about the current withdrawal procedure. Steps for Principal PRS Pre-Retirement Withdrawals? 1) At first, in early June, you first sent an e-mail to service@principal.com.my. 2) Then, Principal Customer Service Executive sent the withdrawal form to you, via e-mail. 3) You filled up the withdrawal form and sent the withdrawal form, to service@principal.com.my. 4) Answer the telephone call-back from Principal Customer Service Executive for verification, on the same day the withdrawal form was submitted. 5) Withdrawal was processed, based on NAV which was dated one day later after the verification call by Principal Customer Service Executive. !@#$%^, did I get the steps correct? Please correct me, if I miss out anything. Principal's FAQ regarding PRS Pre-Retirement Withdrawals is vaguely written. https://www.principal.com.my/en/faq-taking-...out-tax-penalty Principal will require more working time to process the withdrawal, since the withdrawal forms are manually sent by Principal investors. Even for berated Public Mutual, Public Mutual investors can apply for PRS Pre-Retirement Withdrawals in https://www.publicmutualonline.com.my. Just insert the withdrawal amount in the website, and authenticate the withdrawal with TAC sent to handphone, and withdrawal is completed. No manual form needs to be filled by investors, so Public Mutual do not need to manually process the withdrawal forms. |

| Change to: |  0.1379sec 0.1379sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 18th December 2025 - 01:56 AM |