QUOTE(GrumpyNooby @ Feb 17 2021, 09:10 PM)

Last year, there was no tax penalty for PRS withdrawal. It will be great if extendedPrivate Retirement Fund, What the hell is that??

Private Retirement Fund, What the hell is that??

|

|

Feb 18 2021, 09:37 AM Feb 18 2021, 09:37 AM

Return to original view | IPv6 | Post

#61

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

|

|

|

Mar 31 2021, 09:18 AM Mar 31 2021, 09:18 AM

Return to original view | IPv6 | Post

#62

|

Senior Member

2,338 posts Joined: Oct 2014 |

Eh guys, look at fund performance, Amfunds really kns wei

https://www.ppa.my/wp-content/uploads/2021/...ormance_All.pdf |

|

|

Apr 5 2021, 04:13 PM Apr 5 2021, 04:13 PM

Return to original view | IPv6 | Post

#63

|

Senior Member

2,338 posts Joined: Oct 2014 |

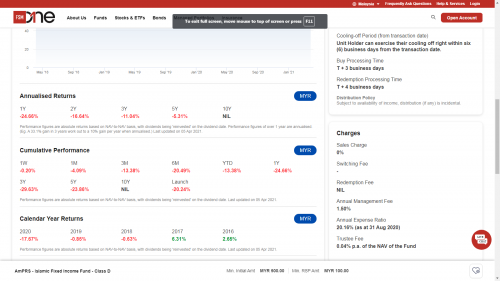

AmPRS - Islamic Fixed Income Fund has dropped 30% value in 3 years time. Upon enquiry, a girl over there said that they are closing this fund, maybe its the 1st for a PRS fund to be closed. https://www.fsmone.com.my/funds/tools/facts...rc=fund-details  Takudan liked this post

|

|

|

Apr 5 2021, 05:08 PM Apr 5 2021, 05:08 PM

Return to original view | IPv6 | Post

#64

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(Takudan @ Apr 5 2021, 04:24 PM) Is the closure the cause, or the result, of the drop in value? additional info: she said the fund size has become too small to maintain, hence the decision to close it. A bit confused with how you worded it, as if it's the "cause", as in they somehow purposely report in losses because they want to close it I neither ask why it (size) become so small, nor why the 30% drop. But to my knowledge, most bond funds mainly subscribes to only a handful of wholesale bonds, any of them gone bad, the nav can see a sharp drop Takudan liked this post

|

|

|

Apr 5 2021, 07:53 PM Apr 5 2021, 07:53 PM

Return to original view | IPv6 | Post

#65

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Apr 9 2021, 08:17 PM Apr 9 2021, 08:17 PM

Return to original view | IPv6 | Post

#66

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(onthefly @ Apr 9 2021, 12:41 AM) QUOTE(Ramjade @ Apr 9 2021, 07:38 AM) Don't wait for promo by FSM. Wait for promo by market. Market promo usually more than what FSM can give you. Above is the best way.Say 10% discount from current price Vs some RM40 eWallet discount. You tell me. I never wait for FSM promo. If I had waited for FSM promo, I would have miss out March low of last year. But in case you have missed the boat(s), just buy the top losers during the promotion, then you will have promo in both world. |

|

|

|

|

|

Apr 16 2021, 01:48 PM Apr 16 2021, 01:48 PM

Return to original view | IPv6 | Post

#67

|

Senior Member

2,338 posts Joined: Oct 2014 |

Any RHB Retirement Series - Islamic Balanced Fund holder here?

Has it been a bonus issue recently? I have seen a sharp drop for like 15% https://www.fsmone.com.my/funds/tools/facts...?fund=MYRHBRSIB |

|

|

Apr 16 2021, 05:32 PM Apr 16 2021, 05:32 PM

Return to original view | IPv6 | Post

#68

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(MUM @ Apr 16 2021, 02:40 PM) i maybe wrong,...i think it maybe related to Mex 1.... Guess so, the top 2 holdings are Mex sukuks, valued about 37% of the entire fund.Downgrade of MEX I Capital Sukuk On 19 March 2021, RAM Ratings downgraded MEX I Capital Bhd’s RM1.35 billion Sukuk Musharakah (2014/2031) by 8 notches to C3 (which is one notch above Default) from BB1 due to the company’s continued liquidity problems and increased default risk due to lower Maju Expressway (MEX) traffic volumes and delays in the restructuring exercise. https://www.fsmone.com.my/funds/research/ar...=article-search Factsheet: https://www.fsmone.com.my/admin/buy/factshe...etMYRHBRSIB.pdf |

|

|

Apr 17 2021, 10:11 AM Apr 17 2021, 10:11 AM

Return to original view | IPv6 | Post

#69

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(MUM @ Apr 16 2021, 02:40 PM) i maybe wrong,...i think it maybe related to Mex 1.... Downgrade of MEX I Capital Sukuk On 19 March 2021, RAM Ratings downgraded MEX I Capital Bhd’s RM1.35 billion Sukuk Musharakah (2014/2031) by 8 notches to C3 (which is one notch above Default) from BB1 due to the company’s continued liquidity problems and increased default risk due to lower Maju Expressway (MEX) traffic volumes and delays in the restructuring exercise. https://www.fsmone.com.my/funds/research/ar...=article-search QUOTE(jorgsacul @ Apr 17 2021, 10:07 AM) Which it leads to next question: buy on weakness shall we? |

|

|

Apr 17 2021, 10:24 AM Apr 17 2021, 10:24 AM

Return to original view | IPv6 | Post

#70

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(jorgsacul @ Apr 17 2021, 10:15 AM) Those with minimal exposure, have no drops in NAV price.QUOTE(MUM @ Apr 17 2021, 10:13 AM) seems like both1. poor choices of fund house 2. the bad market made it worse Should the government will bail these sukuk, then a rebound will be expected. Is Maju Holdings a GLC? |

|

|

Apr 21 2021, 11:27 PM Apr 21 2021, 11:27 PM

Return to original view | IPv6 | Post

#71

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

Apr 22 2021, 08:58 AM Apr 22 2021, 08:58 AM

Return to original view | IPv6 | Post

#72

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(MUM @ Apr 16 2021, 02:40 PM) i maybe wrong,...i think it maybe related to Mex 1.... Downgrade of MEX I Capital Sukuk On 19 March 2021, RAM Ratings downgraded MEX I Capital Bhd’s RM1.35 billion Sukuk Musharakah (2014/2031) by 8 notches to C3 (which is one notch above Default) from BB1 due to the company’s continued liquidity problems and increased default risk due to lower Maju Expressway (MEX) traffic volumes and delays in the restructuring exercise. https://www.fsmone.com.my/funds/research/ar...=article-search QUOTE(jorgsacul @ Apr 17 2021, 10:07 AM) QUOTE(MUM @ Apr 17 2021, 10:31 AM) then for your question on "buy on weakness shall we?".... i would not buy due to your above 2 factors... Things are getting fun now, cant wait to see their latest NAVHighway operator MEX II defers bond coupon payment https://www.theedgemarkets.com/article/high...-coupon-payment |

|

|

May 7 2021, 01:34 PM May 7 2021, 01:34 PM

Return to original view | IPv6 | Post

#73

|

Senior Member

2,338 posts Joined: Oct 2014 |

I've seen most PRS funds have lost 2% in a single week, that's about half of the YTD gains.

Is it time to enter now? |

|

|

|

|

|

May 7 2021, 07:37 PM May 7 2021, 07:37 PM

Return to original view | Post

#74

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

May 14 2021, 11:08 AM May 14 2021, 11:08 AM

Return to original view | IPv6 | Post

#75

|

Senior Member

2,338 posts Joined: Oct 2014 |

|

|

|

May 28 2021, 09:10 PM May 28 2021, 09:10 PM

Return to original view | IPv6 | Post

#76

|

Senior Member

2,338 posts Joined: Oct 2014 |

Following the announcement of full lockdown,

next week we will likely to witness blood bath across all funds, good for those seeking to buy the dip |

|

|

Jul 5 2021, 07:16 AM Jul 5 2021, 07:16 AM

Return to original view | IPv6 | Post

#77

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(daniellehu @ Jul 4 2021, 11:58 PM) QUOTE(ironman16 @ Jul 5 2021, 12:29 AM) Once deposited, earliest withdrawal date will be 2060Hope we all live till that day to see you kid announce your retirement |

|

|

Jul 7 2021, 08:23 PM Jul 7 2021, 08:23 PM

Return to original view | IPv6 | Post

#78

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(familyfirst @ Jul 7 2021, 02:40 PM) I find that the longer we keep the fund (above 10 yrs) the return is lower per annum. How ah? To keep or withdraw after around 7-8 yrs? QUOTE(thecurious @ Jul 7 2021, 02:48 PM) You can't just see longer period going down oh no. Decide to withdraw every 7 years because of one time period you observed. does switching to conservative fund helps to lock the profit?See that Asia peaked in 2018, downtrend until 2020 then picked up from 2020 to 2021. Since the last few years that you see in your cut off period are down trends and below the peak, obviously the longer trend is lower returns. What if you saw the chart or returns from 2016 to 2018? Will your decision be to withdraw every 3 years? |

|

|

Jul 10 2021, 04:03 PM Jul 10 2021, 04:03 PM

Return to original view | IPv6 | Post

#79

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(wayn3san @ Jul 10 2021, 03:57 PM) Hi guys, seeking your kind professional advice here. Yes, I am a FSM user also, convenient and they usually have PRS promo in year end. Looking to start a PRS acc mainly for tax relief purposes. Was reading up the thread here and would like to confirm, opening a PRSaccount through FSM makes the most cost saving sense since there is no/minimal sales charge incurred. But just to confirm, mgmt fees are incurred from the fund houses right, not from the FSM platform itself. So in other words - cannot lari from this charges. Thanks in advance for your replies. regarding management fees, sifu Ramjade knows better than me. |

|

|

Jul 21 2021, 09:43 AM Jul 21 2021, 09:43 AM

Return to original view | IPv6 | Post

#80

|

Senior Member

2,338 posts Joined: Oct 2014 |

QUOTE(ironman16 @ Jul 20 2021, 05:25 PM) where u saw the info? wow, like this i rather wait for FSM promotion (0 sales charge)kasi link , boss ## ok, i saw it oledi https://asia.manulifeam.com/ifunds-offers-my.html Only investment into PRS Class C funds will be eligible for this campaign -online -3k lump sum and hold 6 months -get rm100 e voucher Based on this Sales charge see page 64 Sales Charge = (amount to be invested) x 3.00% = RM3,000 x 3.00% = RM90 u gonna pay rm3090 to manulife, i think so , actually u only earn rm10 (rm100 - rm90) i oso explore a bit their platform , Manulife iFUNDS .....cant find the sales charge gonna pay if buy any UT from their platform.... |

| Change to: |  0.1373sec 0.1373sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 21st December 2025 - 06:02 AM |