Outline ·

[ Standard ] ·

Linear+

Private Retirement Fund, What the hell is that??

|

cklimm

|

Dec 8 2020, 12:22 AM Dec 8 2020, 12:22 AM

|

|

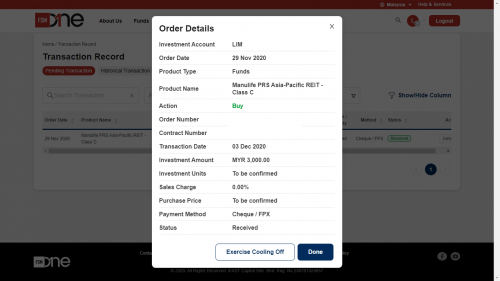

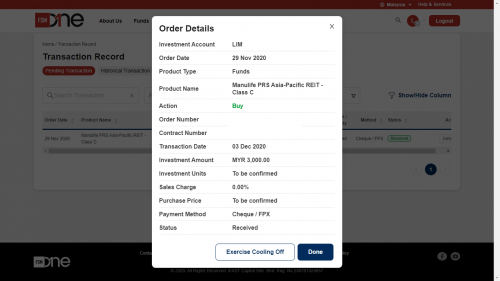

QUOTE(memorylane @ Dec 7 2020, 10:00 PM) this pic seems like not FSM interface wor... you sure you buy the fund from FSM website? you sure you send the form to FSM and not Manulife directly right? show us the transaction history in FSM portal see see... the money should be paid via FSM website, not to manulife directly. I have been using FSM for PRS for many years and always get only 0% sale charge. If you recognize the interface below, yes, its still pending at FSM end.  |

|

|

|

|

|

cklimm

|

Dec 8 2020, 02:55 PM Dec 8 2020, 02:55 PM

|

|

QUOTE(!@#$%^ @ Dec 7 2020, 07:11 PM) how can it be? i haven't gotten mine. https://www.fsmone.com.my/funds/tools/facts...und=MYMLPRSAPRCclearly stated 0% sales charge QUOTE(ironman16 @ Dec 7 2020, 07:49 PM) i though u said that u purchase manulife PRS from FSM, how come FSM still charge u 3?......should b 0%.....  Just Curious: why u choose Asia Pac Reits? why dont choose Manulife Shariah PRS - Global REIT - Class C?  QUOTE(memorylane @ Dec 8 2020, 12:35 PM) you can see FSM there stated 0% sale charge... always check your transaction from FSM portal... Manulife side, they might have internal agreement with FSM (my guess: like commission for FSM from Manulife) which results FSM able to give 0% charge to us. Update: FSM: "We do not incur any sales charge on your Manulife PRS investment currently, thus we will forward the statement to fund house for further investigation. " |

|

|

|

|

|

cklimm

|

Dec 8 2020, 02:57 PM Dec 8 2020, 02:57 PM

|

|

QUOTE(xgen123 @ Dec 7 2020, 09:54 PM) Is it advisable to lump sum 3k into Principal PRS Plus Asia Pacific Ex Japan Equity, knowing that its all time high now? Take APAC Reit from Manulife then, its like one year low now |

|

|

|

|

|

cklimm

|

Dec 8 2020, 03:15 PM Dec 8 2020, 03:15 PM

|

|

QUOTE(ironman16 @ Dec 8 2020, 03:02 PM) hope u settle ur case soon......  u didnt buy from the agent (single mom that almost same age as ur son ha)???  Unker kiamsiap, unker tak bayar sales charge |

|

|

|

|

|

cklimm

|

Dec 9 2020, 08:17 PM Dec 9 2020, 08:17 PM

|

|

QUOTE(!@#$%^ @ Dec 9 2020, 08:13 PM) any luck with that? mine haven't still haven't appear on FSM although payment made on 3 Dec as well. it already appear on PPA site, seems like there is 3% charge as well. Same thing here, you received anything from Manulife yet? |

|

|

|

|

|

cklimm

|

Dec 11 2020, 03:25 PM Dec 11 2020, 03:25 PM

|

|

QUOTE(!@#$%^ @ Dec 10 2020, 11:55 AM) mine priced on fsm already. it shows all 3k were used to buy units. waiting for it to appear in my holdings. OK we are now good |

|

|

|

|

|

cklimm

|

Dec 13 2020, 10:57 PM Dec 13 2020, 10:57 PM

|

|

QUOTE(blibala @ Dec 13 2020, 10:19 PM) Finally my first top up of RM3k at FSM reflected in FSM and PPA portal. I notice that that the net amount is RM2.99k only. RM10 should go for account opening. Just wonder next year tax filling is normally RM2.99k or RM3k? Thanks. they wont kacau you for RM10 difference lah |

|

|

|

|

|

cklimm

|

Dec 17 2020, 11:49 AM Dec 17 2020, 11:49 AM

|

|

PRS is intended to withdrawn upon age of 55,

hence the name private retirement scheme

This post has been edited by cklimm: Dec 17 2020, 11:49 AM

|

|

|

|

|

|

cklimm

|

Dec 18 2020, 02:16 PM Dec 18 2020, 02:16 PM

|

|

QUOTE(GrumpyNooby @ Dec 18 2020, 08:22 AM) Introducing Online Retirement Consultation Assistance (ORCA) Private Pension Administrator Malaysia (PPA) is pleased to introduce the Online Retirement Consultation Assistance (ORCA) – an online service that provides a platform for PRS Members to schedule an appointment to get advice on retirement planning and savings. Developed by PPA, ORCA is a complimentary service for PRS Members to access licensed Financial Planners administered by Financial Planning Association of Malaysia (FPAM) under the SmartFinance initiative. https://orca.ppa.my/ Although I am old enough, but what to prepare ahead of a session? |

|

|

|

|

|

cklimm

|

Dec 21 2020, 07:33 PM Dec 21 2020, 07:33 PM

|

|

QUOTE(honsiong @ Dec 21 2020, 06:23 PM) Then where do the dividends go? add into the units loh |

|

|

|

|

|

cklimm

|

Jan 2 2021, 11:21 AM Jan 2 2021, 11:21 AM

|

|

QUOTE(blibala @ Jan 2 2021, 10:11 AM) HI all. I want to ask about nomination. I purchased this PRS thru FSM using formless application. During the application, i just initial on the last page. When i want to submit the nomination form to PRS provider or PPA, can i use full signature or must follow back previous initial as signature? 1st try with initial, if fail use signature |

|

|

|

|

|

cklimm

|

Jan 4 2021, 08:37 PM Jan 4 2021, 08:37 PM

|

|

QUOTE(onthefly @ Jan 4 2021, 05:39 PM) anybody got news for last year promote for rm40 tng Latest by Jan they said, keep an eye on email inbox https://www.fsmone.com.my/funds/research/ar...=12661&isRcms=N |

|

|

|

|

|

cklimm

|

Jan 7 2021, 02:55 PM Jan 7 2021, 02:55 PM

|

|

QUOTE(Barricade @ Jan 6 2021, 09:59 PM) No wonder suddenly my portfolio positive.  Thanks all for the recommendation. That's lumpsum RM3010 mid of December. Starting January 2021 I will put RM250 monthly into it. QUOTE(cempedaklife @ Jan 7 2021, 01:59 PM) checked and compared a few PRS, macam Principal PRS Plus Asia Pacific Ex Japan Equity - Class C still the better one. Yes, it outperforms my ManuReit PRS, bought early Dec. |

|

|

|

|

|

cklimm

|

Jan 14 2021, 09:37 AM Jan 14 2021, 09:37 AM

|

|

QUOTE(chichabom @ Jan 13 2021, 02:41 PM) No rush la. But on hindsight maybe this RM40 may mean alot to some at current tough times. Yeah, if RM40 spent on roti and maggi, some can sustain for 1 week. |

|

|

|

|

|

cklimm

|

Jan 14 2021, 09:46 AM Jan 14 2021, 09:46 AM

|

|

QUOTE(GrumpyNooby @ Jan 14 2021, 09:41 AM) So you're also anxiously waiting for the RM 40 to fill your hunger? I thought PRS contribution is meant for those who can afford to participate. Even you're not capable of bringing food to the table for yourself or your family, why even bother to contribute to PRS when everybody out there is lauding to even take money from EPF?  Don't tell me that one is contributing to PRS campaign just to get RM 40 to bring food on the table. Sounded very irony right?  Not all could've foreseen the return of MCO, now even I also feel the pinch. |

|

|

|

|

|

cklimm

|

Jan 20 2021, 08:27 PM Jan 20 2021, 08:27 PM

|

|

QUOTE(blibala @ Jan 20 2021, 02:47 PM) Finally received tng pin. QUOTE(talexeh @ Jan 20 2021, 02:51 PM) Got mine too, maybe 3 minutes later than yours. QUOTE(victorian @ Jan 20 2021, 02:52 PM) QUOTE(sybari @ Jan 20 2021, 03:35 PM) rm40 tng reload from fsm's prs promo already in inbox. fyi  Good, we can all now last till 26th payday. |

|

|

|

|

|

cklimm

|

Jan 20 2021, 08:35 PM Jan 20 2021, 08:35 PM

|

|

QUOTE(GrumpyNooby @ Jan 20 2021, 08:29 PM) But my salary is only in on 31st. How? too bad, have you applied for i-sinar?  |

|

|

|

|

|

cklimm

|

Jan 20 2021, 09:22 PM Jan 20 2021, 09:22 PM

|

|

QUOTE(GrumpyNooby @ Jan 20 2021, 08:36 PM) Maybe I eat instant noodle like Ir Dr Wee for few more days after 26th. iSinar disbursement also not so fast right?  jokes aside, with the arrival of RM40 cashback, combined with tax relief and appreciation, my Manureit is now making 8.3% of profit (RM120+40+90). You guys who bought Principal should have done better. |

|

|

|

|

|

cklimm

|

Jan 21 2021, 05:26 PM Jan 21 2021, 05:26 PM

|

|

QUOTE(JimK @ Jan 21 2021, 01:35 PM) But, the promo ended 11 Dec |

|

|

|

|

|

cklimm

|

Jan 23 2021, 03:24 PM Jan 23 2021, 03:24 PM

|

|

QUOTE(CSW1990 @ Jan 23 2021, 02:55 PM) My opinion: 1. DCA, If don’t want to consider too much just DCA all the way 2. Dump 3k at year end when promotion from FSM- can earn rm40?! 3. Dump 3k when market in deep red, but this one need patience and monitor the market from time to time. If wait until Nov also no big crash, then go #2 Anyway, PRS is locked till retirement age and one just need to maximise 3k for the tax relief as the main purpose... for me I will go #3 #1 is the safest way, the best way of course is #3, but usually we all keep waiting for the stock crash till #2, take RM40 as saguhati |

|

|

|

|

Dec 8 2020, 12:22 AM

Dec 8 2020, 12:22 AM

Quote

Quote

0.1273sec

0.1273sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled