QUOTE(ironman16 @ Nov 25 2020, 10:07 AM)

Another ATH as of 24/11/2020 with NAV = RM 1.2471Private Retirement Fund, What the hell is that??

Private Retirement Fund, What the hell is that??

|

|

Nov 25 2020, 05:39 PM Nov 25 2020, 05:39 PM

Return to original view | IPv6 | Post

#201

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Nov 25 2020, 10:07 AM) Another ATH as of 24/11/2020 with NAV = RM 1.2471 ironman16 liked this post

|

|

|

|

|

|

Nov 26 2020, 12:19 PM Nov 26 2020, 12:19 PM

Return to original view | Post

#202

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Nov 26 2020, 12:26 PM Nov 26 2020, 12:26 PM

Return to original view | Post

#203

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Nov 27 2020, 07:14 AM Nov 27 2020, 07:14 AM

Return to original view | IPv6 | Post

#204

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Nov 27 2020, 07:27 AM Nov 27 2020, 07:27 AM

Return to original view | IPv6 | Post

#205

|

All Stars

12,387 posts Joined: Feb 2020 |

cklimm liked this post

|

|

|

Nov 27 2020, 08:11 AM Nov 27 2020, 08:11 AM

Return to original view | IPv6 | Post

#206

|

All Stars

12,387 posts Joined: Feb 2020 |

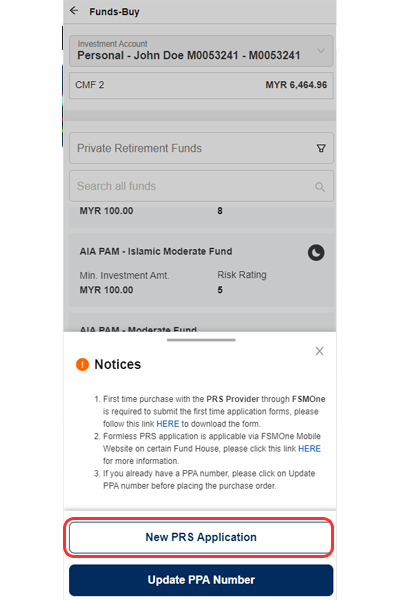

Only for Affin Hwang, Kenanga and Principal PRS Funds https://www.fsmone.com.my/funds/research/ar...=11419&isRcms=N T231H liked this post

|

|

|

|

|

|

Nov 27 2020, 03:09 PM Nov 27 2020, 03:09 PM

Return to original view | IPv6 | Post

#207

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(tsutsugami86 @ Nov 27 2020, 03:03 PM) If i already got PPA account, can direct invest PRS through FSM, or still need fill in particular & provide IC ? If you buy from a new PRS provider that is not in your PRS portfolio (in PPA database), you still need to fill in the forms.Not sure if that is also applicable for the e-forms for that 3 particular PRS providers. This post has been edited by GrumpyNooby: Nov 27 2020, 03:10 PM |

|

|

Dec 1 2020, 12:53 PM Dec 1 2020, 12:53 PM

Return to original view | Post

#208

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(whirlwind @ Dec 1 2020, 12:52 PM) I already have an account in FSM and downloaded the mobile app You want to open PRS account for the first time?I heard someone mentioned with the mobile app, I can apply for the PRS but I’ve checked my mobile app, no transactions button/icon Any advice? It's mobile web (not mobile app) based account creation. https://www.fsmone.com.my/funds/research/ar...=11419&isRcms=N This post has been edited by GrumpyNooby: Dec 1 2020, 12:55 PM ironman16 liked this post

|

|

|

Dec 1 2020, 01:54 PM Dec 1 2020, 01:54 PM

Return to original view | Post

#209

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(cempedaklife @ Dec 1 2020, 01:50 PM) once you have created the acc and purchase the first PRS, you should be able to continue purchase the same fund using app/website like normal. That link is meant for first time PPA account opening + PRS fund buying with e-documents/forms.Not meant for existing PPA users. |

|

|

Dec 1 2020, 02:50 PM Dec 1 2020, 02:50 PM

Return to original view | Post

#210

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Dec 1 2020, 02:47 PM) yes , my timing very accurate for AmPRS - Asia Pacific REITs - Class D this year except for the first shot Next year buy either one of this:30 Nov 2020 MYR 0.6574 finally finish my 3k for PRS this year......start prepare for next year.... 1. Manulife PRS Asia-Pacific REIT - Class C 2. Manulife Shariah PRS - Global REIT - Class C taiping... and WaNaWe900 liked this post

|

|

|

Dec 1 2020, 08:48 PM Dec 1 2020, 08:48 PM

Return to original view | IPv6 | Post

#211

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(AgentVIDIC @ Dec 1 2020, 08:46 PM) can i ask, if i bought Principal fund last year already, and this year i wannna buy affin hwang prs fund via Fundsupermart, i need to submit physical form? I thought transactions can be done electronically? ANyway has any idea? I believe physical form is needed.But you may try this e-Form for Affin Hwang PRS funds:  https://www.fsmone.com.my/funds/research/ar...=11419&isRcms=N This post has been edited by GrumpyNooby: Dec 1 2020, 08:52 PM |

|

|

Dec 1 2020, 08:54 PM Dec 1 2020, 08:54 PM

Return to original view | IPv6 | Post

#212

|

All Stars

12,387 posts Joined: Feb 2020 |

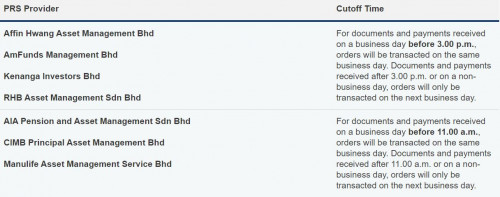

QUOTE(AgentVIDIC @ Dec 1 2020, 08:53 PM) i see, so if i submitted via FSM today, the fund nav will follow tomorrow's price or follow the price when they receive my physical form =.= Payment matters not form arrival I guess: If your payment reach them before cut-off time, it'll be using tomorrow NAV. This post has been edited by GrumpyNooby: Dec 1 2020, 08:57 PM |

|

|

Dec 1 2020, 09:55 PM Dec 1 2020, 09:55 PM

Return to original view | IPv6 | Post

#213

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(whirlwind @ Dec 1 2020, 09:54 PM) FSM will do it for you. whirlwind liked this post

|

|

|

|

|

|

Dec 2 2020, 12:14 PM Dec 2 2020, 12:14 PM

Return to original view | Post

#214

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(tehoice @ Dec 2 2020, 12:12 PM) hahah potential loophole, but sounds fantastic if this can be done ehhhhhh The taken out RM 1.5k is going back to buy PRS fund with additional RM 1.5k to make up for the RM 3k for tax relief.anyway, if you put in 1.5k = tax relief for 1.5k right. withdrawal also can claim tax meh? |

|

|

Dec 2 2020, 12:19 PM Dec 2 2020, 12:19 PM

Return to original view | Post

#215

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(tehoice @ Dec 2 2020, 12:18 PM) ohhh.... i don't see any thing that prevent one from doing such thing. highly possible if you ask me. Agreed with you.But from I heard, the withdrawal is very troublesome as there's no e-withdrawal like EPF. You need to deal with the respective PRS provider and submit physical original copy of the forms. |

|

|

Dec 2 2020, 02:30 PM Dec 2 2020, 02:30 PM

Return to original view | IPv6 | Post

#216

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(tehoice @ Dec 2 2020, 02:21 PM) oh? i thought we could do via PPA website? As far as I know upon reading the FAQ from PPA portal, PPA won't facilitate the withdrawal. You deal it yourself with PRS provider. Yes, the only dilemma is last year those funds didnt really make positive returns, so in another words, selling at a loss. hmm, still thinking if I should withdraw the money and put it into elsewhere like stashaway or others. but what is stopping me is the negative return for 2019. But also not to forget, we also do have instant profits when we claim our tax relief. so it's kinda even out. Also, I don't think there's sell or withdrawal feature at PPA portal. This post has been edited by GrumpyNooby: Dec 2 2020, 02:31 PM |

|

|

Dec 2 2020, 03:07 PM Dec 2 2020, 03:07 PM

Return to original view | Post

#217

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Dec 3 2020, 09:19 PM Dec 3 2020, 09:19 PM

Return to original view | IPv6 | Post

#218

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(sabrina222 @ Dec 3 2020, 09:16 PM) If you chargeable income is sizeable, then the amount of tax saving is not. Here's an expected tax saving according to tax brackets: https://www.fsmone.com.my/funds/research/ar...o=2965&isRcms=N Refer to Point (3): 3. Below is an example on tax relief. Let’s say you are an unmarried individual with a taxable income of RM118,000 for Y/A 2012. Assuming that you have no tax exemptions and after deducting tax reliefs comprising of RM9,000 personal relief and RM6,000 EPF relief, you arrive at your chargeable income of RM103,000. Based on the Inland Revenue Board of Malaysia’s scale rate, your tax payable would be RM15,105. If you had contributed to a PRS for the amount of RM3,000 and above during Y/A 2012, your tax payable would be reduced to RM14,325. That’s a tax savings of RM780! |

|

|

Dec 3 2020, 09:49 PM Dec 3 2020, 09:49 PM

Return to original view | IPv6 | Post

#219

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(Joey_Chin12 @ Dec 3 2020, 09:46 PM) Hi Guys, I want to ask a stupid question. can I withdraw the PRS money anytime or only can withdraw at certain year like 55 or 60 years old? 1. Anytime before retirement age -> pay 8% for tax penalty2. Pre-retirement withdrawal under PENJANA -> up to RM 1500 from Account B per PRS provider (expiring 31 December 2020) subject to certain conditions 3. Pre-retirement withdrawal for housing and healthcare -> like EPF Account II (2) and (3) exempted from the 8% tax penalty. This post has been edited by GrumpyNooby: Dec 3 2020, 09:56 PM Joey_Chin12 liked this post

|

|

|

Dec 3 2020, 09:55 PM Dec 3 2020, 09:55 PM

Return to original view | IPv6 | Post

#220

|

All Stars

12,387 posts Joined: Feb 2020 |

|

| Change to: |  0.1365sec 0.1365sec

1.04 1.04

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 17th December 2025 - 07:41 AM |