QUOTE(wongmunkeong @ Jan 26 2012, 12:02 PM)

EmpireKhoo - if U really invested into Public Mutual itself, U should be laughing all the way to the bank

However, if U invested in one of Public Mutual's funds AND don't know which, you should be thanking your lucky stars it's not a negative return/loss - know the saying about "xxxxs and $ are soon parted"?

From your blog - you're working as an engineer and yet U do not state the specifics.

How are fellow forumers to digest the needed data/info and advise?

Specifics are:

a. What fund did you get into?

b. What's your definition of "less risky"?

c. What's your aim for this chunk of $ by when?

etc.

Engineers these days... (sorry old man's ramblings )

)

a. I'm posting while doing other stuff. it should be public GROWTH fund.. However, if U invested in one of Public Mutual's funds AND don't know which, you should be thanking your lucky stars it's not a negative return/loss - know the saying about "xxxxs and $ are soon parted"?

From your blog - you're working as an engineer and yet U do not state the specifics.

How are fellow forumers to digest the needed data/info and advise?

Specifics are:

a. What fund did you get into?

b. What's your definition of "less risky"?

c. What's your aim for this chunk of $ by when?

etc.

Engineers these days... (sorry old man's ramblings

let me go into slight deeper before i get flamed again. the way I've calculated '1.66%' PA is pretty vague. First noted that I'm investing in monthly basis. So a calculation including those in is very complex. I've simplified it by summing all i've invested, calculated to the current value.

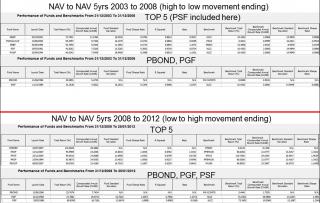

the performance chart in Public Mutual concur with my finding - it's about 2.91% PA (2 Jan 2008 - 25 Jan 2012 = 12.17%), not including 5.5% sales commission (I've always hated this). So my question is: is this fund underperforming?

b. less risky: less % of portfolio in equity. I think PSF is ~70%. It gives 15.86% (2 Jan 2008 - 25 Jan 2012). Or PBond 27% in the timeframe.

c. aim: to keep until i can afford a house. Timeframe 4-5 yr from now.

Anyway, do you guys happen to know any 'no loading' fund here? US does have some but.. ah well.

This post has been edited by empirekhoo: Jan 26 2012, 11:45 PM

Jan 26 2012, 11:11 PM

Jan 26 2012, 11:11 PM

Quote

Quote

0.0502sec

0.0502sec

0.30

0.30

6 queries

6 queries

GZIP Disabled

GZIP Disabled