Outline ·

[ Standard ] ·

Linear+

SSPN, Skim Simpanan Pendidikan Nasional

|

SUSfuzzy

|

Mar 30 2021, 07:26 PM Mar 30 2021, 07:26 PM

|

|

QUOTE(rinapua @ Mar 30 2021, 07:01 PM) Hi....so if i want to pay exactly 1000 into SSPN-i, then i have to transfer in 1001. correct? one time how much i can top up for 1 account by using boost? 999. So u have to transfer the rm8 separately. Damn bodo one. |

|

|

|

|

|

SUSfuzzy

|

Feb 24 2023, 06:38 PM Feb 24 2023, 06:38 PM

|

|

QUOTE(Jack&Guild @ Feb 24 2023, 06:12 PM) End of speech and not mention. If confirm not more incentive, i will move out all funds nx month. Wait la, time limited so focus on big items. Usually we get more information few days down. |

|

|

|

|

|

SUSfuzzy

|

Mar 1 2023, 06:09 PM Mar 1 2023, 06:09 PM

|

|

If the tax relief is stopped, imma withdraw everything.

|

|

|

|

|

|

SUSfuzzy

|

Mar 4 2023, 09:29 AM Mar 4 2023, 09:29 AM

|

|

QUOTE(MUM @ Mar 2 2023, 09:38 AM) Mind sharing where to?. My bet is there is a very high chances of no more extension of the tax relief, as it was not mentioned in the latest budget touch point. Anyway it was mentioned in the Oct 22 budget proposal which were not approved before the parliament was disolved Given this was just to enjoy some tax savings, it'll either be back to FD or I'll just dump it back into my index funds. I'm long in SPY. |

|

|

|

|

|

SUSfuzzy

|

Mar 27 2023, 07:43 PM Mar 27 2023, 07:43 PM

|

|

QUOTE(chewlee @ Mar 27 2023, 06:10 PM) withdrawal maybe the best way to response Yep. Unless you think you cannot get the measly 3-4% anywhere else lol. |

|

|

|

|

|

SUSfuzzy

|

Mar 27 2023, 08:00 PM Mar 27 2023, 08:00 PM

|

|

QUOTE(!@#$%^ @ Mar 27 2023, 07:51 PM) sspn still has its role, but only once those who wanna withdraw etc done so - things will be clearer For most it's a nice education savings for the kid. But most here in out 50-100k, they are not in this for that purpose hehe. |

|

|

|

|

|

SUSfuzzy

|

Apr 4 2023, 04:29 PM Apr 4 2023, 04:29 PM

|

|

QUOTE(cybpsych @ Apr 4 2023, 04:25 PM) He said face means no good news la hahaha |

|

|

|

|

|

SUSfuzzy

|

Sep 6 2023, 02:44 PM Sep 6 2023, 02:44 PM

|

|

QUOTE(CPURanger @ Sep 6 2023, 02:29 PM) You can top up ShopeePay or Boost from Credit Card. Pay via ShopeePay or Boost with 1 ringgit charge per transaction. I just deposit SSPN via ShopeePay yesterday. CC topup to boost cannot use for SSPN la. U dun sabo people. I think if you buy topup pin from Zcity can topup to Boost still ok. ShopeePay still the best given you can buy and utilise the coins to reduce the total amount. |

|

|

|

|

|

SUSfuzzy

|

Sep 6 2023, 03:46 PM Sep 6 2023, 03:46 PM

|

|

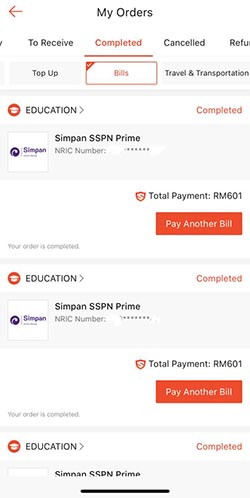

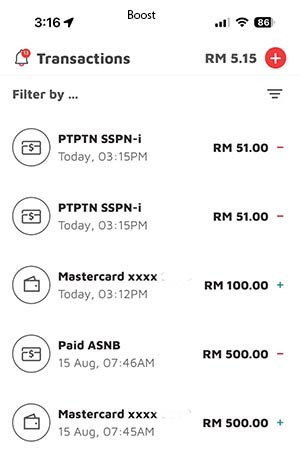

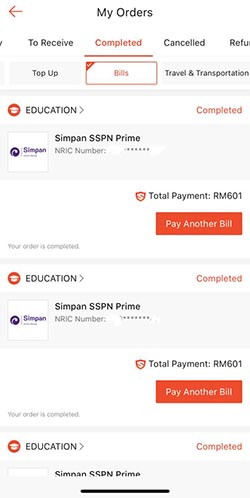

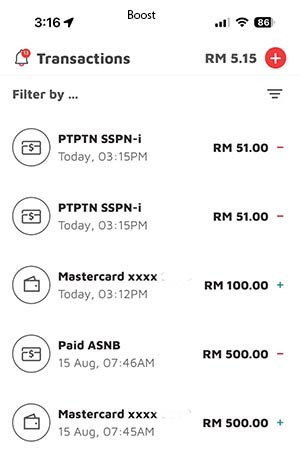

QUOTE(CPURanger @ Sep 6 2023, 03:24 PM) Don't simply accuse me of sabo people. No time for this nonsense. I understand the non transferable fund thingy. However it works for for SSPN. I have proof. Here is last month's transaction here. Got my CC cashback too. Bonus : For Boost can even pay ASNB via CC top up. Shopee   Boost, tested it just now.  As the other poster mentioned, majority account already kena banned. It is an official line from Boost. So best way for now is still Shopee at the moment. https://ringgitplus.com/en/blog/e-wallet/bo...ard%20top%2Dups. Edit: I mentioned can use zcity and buy boost pin, but I'm not sure if can pay with CC or not, so scrap that also. Currently I top-up my SP wallet and combine with coins for SSPN, also already uninstalled boost lol so can't try if mine works. This post has been edited by fuzzy: Sep 6 2023, 03:48 PM |

|

|

|

|

|

SUSfuzzy

|

Oct 9 2023, 01:06 PM Oct 9 2023, 01:06 PM

|

|

QUOTE(virtualgay @ Oct 9 2023, 10:18 AM) shopee  Weekend they malas kot. I top up 2nd Oct yesterday masuk via shopee. |

|

|

|

|

|

SUSfuzzy

|

Oct 10 2023, 06:22 PM Oct 10 2023, 06:22 PM

|

|

QUOTE(robt1013 @ Oct 10 2023, 12:13 PM) u means able to use credit card to top up shopeepay then pay sspn prime? Even better, buy coins and use it to offset come cost of SSPN  |

|

|

|

|

|

SUSfuzzy

|

Oct 13 2023, 09:23 PM Oct 13 2023, 09:23 PM

|

|

No mention of SSPN extension:(

|

|

|

|

|

|

SUSfuzzy

|

Oct 14 2023, 10:38 AM Oct 14 2023, 10:38 AM

|

|

QUOTE(poweredbydiscuz @ Oct 13 2023, 11:18 PM) Last budget already extend tax relief to 2024, so this budget no need to announce anything. Hopefully after people make noise they extend again. Else confirm no one gonna put it in for the measly 3% |

|

|

|

|

|

SUSfuzzy

|

Dec 4 2023, 10:42 PM Dec 4 2023, 10:42 PM

|

|

QUOTE(genesic @ Nov 15 2023, 05:16 PM) Check your PM. i have forwarded some details to you Me as well |

|

|

|

|

|

SUSfuzzy

|

Jan 15 2024, 06:15 PM Jan 15 2024, 06:15 PM

|

|

Hmm, means have to go PTPTN counter to withdraw and masuk EPF ni.

|

|

|

|

|

|

SUSfuzzy

|

Mar 22 2024, 11:09 PM Mar 22 2024, 11:09 PM

|

|

QUOTE(LightningZERO @ Mar 19 2024, 02:34 PM) True. I do like the tax relief. But since tax relief is only till 2024 YA, what happens next is the question. Next is withdrawal masuk EPF haha. |

|

|

|

|

|

SUSfuzzy

|

Mar 25 2024, 05:08 PM Mar 25 2024, 05:08 PM

|

|

QUOTE(MUM @ Mar 25 2024, 09:13 AM) If the SSPN dividends continued to be much higher than FD, then investors may not withdraw until they can find somewhere better with the same risk/ reward Which is not that hard, I feel. KDI itself already 4% up to 50k. Then Versa can pump in another 60k. That should cover almost all the SSPN that one might have. I have never withdraw because I lazy to do the in/out transfers, but once the tax relief is stopped, I'll be moving them out. |

|

|

|

|

|

SUSfuzzy

|

Mar 25 2024, 06:08 PM Mar 25 2024, 06:08 PM

|

|

QUOTE(guy3288 @ Mar 25 2024, 05:42 PM) my case a bit different if i dont withdraw i would have too much money stuck in SSPni, dividend only 3.05% rugi besar lo. not that hard as reply to this post? you meant sspni can easily raise dividend above FD? so not that hard la to prevent people from withdraw... did you know SSPni gave only 3.05% last year? you think can raise to 4.5% this time? i think susah. if you kept just RM110k in sspni you wouild have lost out RM1600 a year the cost of being lazy No, I mean it's not hard to find other things that pays higher than SSPN. It's higher vs conventional FD, but things like KDI is already at 4%. Some MMF can get more as well if one is rajin to hunt. So if the only reason to keep in SSPN (tax) is removed, I don't see the point of keeping it there still. I'll be withdrawing the very day the stop the relief. |

|

|

|

|

|

SUSfuzzy

|

Mar 25 2024, 06:45 PM Mar 25 2024, 06:45 PM

|

|

QUOTE(guy3288 @ Mar 25 2024, 06:35 PM) your reply like that can easily be misconstrued yes 4% easily available ourtside, i agree thus the querry why should we not withdraw them out? RM8k tax relief sudah dapat, takkan nak tunggu itu 3.05% jadi 4.5% Nothing, for me it's just laziness to deal with the hassle of moving it in and out. The fact is many is doing that, and many more will withdraw and stop contributing once they stop the relief. |

|

|

|

|

|

SUSfuzzy

|

May 28 2024, 12:49 PM May 28 2024, 12:49 PM

|

|

QUOTE(rinapua @ May 28 2024, 12:05 PM) I got balance RM30K in PTPTN (include pump in 8K this year) and never withdrawal before. Now I plan to withdraw 20K. I went PTPTN branch this morning. The staff told me if according to my plan above, the withdrawal calculation will be minus this year money pump in RM8K + balance in account RM12K. Meaning it will count as I didn't pump in any money in this year so will not entitle for 8K tax relief for 2024. Is it true? As what I understand from all the sifu (expert here), the calculation is totally different. Since you have 30k now, so that means you started the year at 22k. Only deposits above that 22k will count, so if you withdraw 20k, you only have 10k left, thus you will not be entitled to tax relief for 2024. |

|

|

|

|

Mar 30 2021, 07:26 PM

Mar 30 2021, 07:26 PM

Quote

Quote

0.0382sec

0.0382sec

0.60

0.60

7 queries

7 queries

GZIP Disabled

GZIP Disabled