QUOTE(giko @ Mar 2 2017, 09:46 AM)

I could not find any option for that..SSPN, Skim Simpanan Pendidikan Nasional

SSPN, Skim Simpanan Pendidikan Nasional

|

|

Mar 2 2017, 10:12 AM Mar 2 2017, 10:12 AM

Return to original view | Post

#61

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

|

|

|

|

|

|

Mar 5 2017, 04:46 PM Mar 5 2017, 04:46 PM

Return to original view | Post

#62

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(repusez @ Mar 5 2017, 04:11 PM) the SSPN dividend rate for 2016 is 4% as announced in feb, is the value already reflected on you guys statement ? Dividend is reflected a few days later, after that announcement.http://www.thestar.com.my/business/busines...nd-sspn-i-plus/ |

|

|

Mar 10 2017, 02:56 PM Mar 10 2017, 02:56 PM

Return to original view | Post

#63

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(teckc @ Mar 10 2017, 02:22 PM) SSPN-i it's a saving for your children and qualifies for tax relief if you have net savings on that year of assessment.SSPN-i Plus it's an insurance product + savings. To your question, yes, SSPN-i savings for your children does qualify for SSPN tax relief. You can print out the tax relief statement from the website when you login into it. https://www.ptptn.gov.my/saving/sspnlogin.html This post has been edited by rapple: Mar 10 2017, 02:57 PM |

|

|

Mar 11 2017, 08:12 AM Mar 11 2017, 08:12 AM

Return to original view | Post

#64

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(LostAndFound @ Mar 11 2017, 07:50 AM) Sure? Last round when I was there I was told it applies to the insurance category not the SSPN category for tax relief.

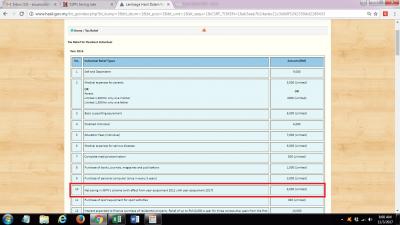

http://www.hasil.gov.my/bt_goindex.php?bt_...242330dd2186433 See for yourself. You sure that staff didn't misunderstood what you said? SSPN-i and SSPN-i Plus are both different products |

|

|

Mar 11 2017, 07:20 PM Mar 11 2017, 07:20 PM

Return to original view | Post

#65

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(LostAndFound @ Mar 11 2017, 03:15 PM) That covers SSPN savings. SSPN-i is a new product, and hasil's website doesn't specifically mention it. SSPN's own advertising says RM12k deduction but Hasil says 6k for net SSPN savings, hence the additional 6k comes from where? The only other 6k is life insurance/KWSP... SSPN-i Plus is a new product (insurance cum savings)SSPN-i it's the one we put in for SSPN tax relief. Maybe you should read again. |

|

|

Mar 11 2017, 11:21 PM Mar 11 2017, 11:21 PM

Return to original view | Post

#66

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(MNet @ Mar 11 2017, 07:46 PM) Probably won't get the pro-rated of 4%. I put in 6k in 15th Dec 2015.. the dividend I got for that year rm0.57 QUOTE(virgoguy @ Mar 11 2017, 07:53 PM) Ah gosh just found this post. I missed the boat of rm6k tax relief. 😭. Luckily still got 2017 to claim. So if i open an sspn account from bank at dec 2017, then when can I print the the tax relief statement?. Plan to print it out then withdraw. Did my withdrawal in Jan 2016 and Jan 2017.SSPN tax relief is given if the account is register under your child name and not for your own. This post has been edited by rapple: Mar 11 2017, 11:22 PM |

|

|

|

|

|

Mar 11 2017, 11:27 PM Mar 11 2017, 11:27 PM

Return to original view | Post

#67

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

|

|

|

Mar 12 2017, 01:31 PM Mar 12 2017, 01:31 PM

Return to original view | Post

#68

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(giko @ Mar 12 2017, 10:29 AM) don't know how ptptn calculates dividend. to get 57 sen, the rate is 3.4675% (if based on 1 day ala EPF) but it was 4% for 2015 deposits! however 4% x 1/365 = 66 sen. :confused: Probably they have another % for deposits less than "x" months.at least for EPF we know that EPF will use 1 day for the month of deposit irregardless of the date of deposit. Even in 2016 when I put in 11,500 in Dec, I only get rm0.02. Only the balance of rm500 which I didn't withdraw gets the full 4% |

|

|

Nov 2 2017, 10:17 AM Nov 2 2017, 10:17 AM

Return to original view | Post

#69

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(Amanda85 @ Nov 2 2017, 10:07 AM) If 2018 will revert back to 3k only, is it still worth putting in? Anyone did some analysis? Tax noob here. Why you need an analysis for a saving account that gives 4% dividend on average yearly and also entitled for tax relief.And the savings it's protected by the government This post has been edited by rapple: Nov 2 2017, 10:18 AM |

|

|

Nov 7 2017, 04:05 PM Nov 7 2017, 04:05 PM

Return to original view | Post

#70

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(yfiona @ Nov 7 2017, 03:57 PM) Hi guys, if my child is only 1 year old, is it not advisable to put the funds in this sspn account since the fund will be locked for another 17 years? If you have the time to read back this thread, you will find out SSPN allow us to withdraw the money at anytime.Assuming 24% tax bracket, my saving would be 24%/17years=1.4% plus whatever dividend declared annually, am I on the right track? and another thing is about withdrawal: Full withdrawal is only allowed in the following situations: 1) Child offered a place in approved higher learning institution. 2) Child voluntary withdrawal from education system. 3) Child has been expelled. 4) Suffering from incurable critical illness certified by doctor. 5) Depositor/child total and permanent disability or death. Meaning that if my child going to oversea for uni, I wouldn't be able to withdraw my saving in sspn? Thanks in advance for the clarification. |

|

|

Nov 13 2017, 03:57 PM Nov 13 2017, 03:57 PM

Return to original view | Post

#71

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(spiderman17 @ Nov 13 2017, 03:02 PM) so...the rule can withdraw only once a year, and only after 1yr of account opening no longer applies? I never withdraw more than once a year so I'm not sure.ptptn page says, and i quote: "Pendeposit boleh membuat pengeluaran/ penutupan akaun pada bila-bila masa tertakluk kepada peraturan yang ditetapkan oleh PTPTN." where to find out what are the latest "peraturan"? Latest ptptn peraturan, maybe ask ptptn staff when you go deposit that time. |

|

|

Nov 23 2017, 08:49 AM Nov 23 2017, 08:49 AM

Return to original view | Post

#72

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

|

|

|

Nov 27 2017, 03:43 PM Nov 27 2017, 03:43 PM

Return to original view | Post

#73

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(alesi616 @ Nov 27 2017, 11:17 AM) Any charges for open account / add $$ / withdrawal / close account if done at maybank/rhb/ejen SSPN-I ? (other than at PTPTN branch) I've check with MBB before for withdrawal, they can't do it from their side.Becoz I saw this at PTPTN website: Soalan 21: Adakah caj dikenakan jika ingin mengeluarkan simpanan SSPN-i? Jawapan: Tiada caj dikenakan kecuali melalui ejen yang dilantik.. Looks like withdrawal at bank will get charges ?? You have to go PTPTN office to do withdrawal. For opening of account and withdrawal no charges. For deposit, i've always use bill payment through M2U to do it. No charges as well. |

|

|

|

|

|

Nov 27 2017, 04:59 PM Nov 27 2017, 04:59 PM

Return to original view | Post

#74

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(alesi616 @ Nov 27 2017, 04:53 PM) thanks for the info, from your previous post, it seems that you had made withdrawal on January 2016/17, are those withdrawal did at PTPTN branch? PTPTN branch.Thinking want to go MBB or PTPTN office do account opening, not sure they give free gift or not. Also MBB will be easier coz I can direct transfer fund. PTPTN have to bring cheque or other method.. |

|

|

Nov 28 2017, 08:58 AM Nov 28 2017, 08:58 AM

Return to original view | Post

#75

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

|

|

|

Nov 29 2017, 10:16 AM Nov 29 2017, 10:16 AM

Return to original view | Post

#76

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

|

|

|

Feb 5 2018, 01:01 PM Feb 5 2018, 01:01 PM

Return to original view | Post

#77

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

SSPN tax statement can ge generated.

Dividend is credited into the account as well. |

|

|

Apr 2 2018, 03:33 PM Apr 2 2018, 03:33 PM

Return to original view | Post

#78

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE(ivzh @ Apr 2 2018, 03:28 PM) too bad my kids is not eligible for the free rm500 Key word, NET DEPOSIT.anyway for tax rebate purpose, i m still abit confuse for eg year 2018 -deposit rm 6k , LHDN can claim 6k year 2019 - withdraw all, tak boleh claim year 2020 - deposit 6k, can i claim ? 2020 at least 12k only can claim 6k tax relief. |

|

|

Nov 2 2018, 06:15 PM Nov 2 2018, 06:15 PM

Return to original view | Post

#79

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

QUOTE Individual income tax breaks for the National Education Saving Scheme will also be increased from RM6,000 to RM8,000 Read more at https://www.thestar.com.my/news/nation/2018...hF7kVelOtUjJ.99 |

|

|

Nov 7 2018, 09:03 AM Nov 7 2018, 09:03 AM

Return to original view | Post

#80

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

|

| Change to: |  0.0308sec 0.0308sec

0.56 0.56

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 1st December 2025 - 03:52 PM |