another noob question

assuming scenario 1 :-

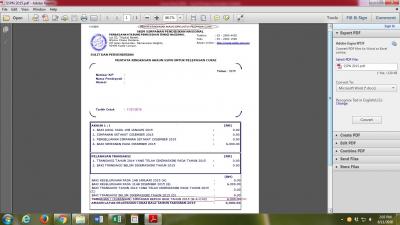

start savings in 2015

cumulative balance 2015 RM6k --- eligible tax relief RM6k

cumulative balance 2016 RM6K+RM6K (RM12k) --- eligible tax relief RM6k

cumulative balance 2017 RM6k+RM6K+RM3K (RM15k) --- eligible tax relief RM3k

cumulative balance 2018 RM6k+RM6K+RM3K+RM3k (RM18k) --- eligible tax relief RM3k

assuming scenario 2 :-

start savings in 2017

cumulative balance 2017 RM3k --- eligible tax relief RM6k ---

Max relief is 6k but you have only 3k net savings so you can only claim 3k reliefcumulative balance 2018 RM3K+RM3K (RM6k) --- eligible tax relief RM3k

cumulative balance 2019 RM3k+RM3K+RM3K (RM9k) --- eligible tax relief RM3k

cumulative balance 2020 RM3k+RM3K+RM3K+RM3k (RM12k) --- eligible tax relief RM3k

so for those that started their savings in SSPN earlier...this means their cumulative balance has to be more at the end of the term to be eligible for the subsequent tax relief, compared to those start saving in 2017, where the

relief is set at RM3k?

Yes.betul ka?

Jan 27 2016, 06:43 AM

Jan 27 2016, 06:43 AM

Quote

Quote

0.0282sec

0.0282sec

1.19

1.19

7 queries

7 queries

GZIP Disabled

GZIP Disabled