Outline ·

[ Standard ] ·

Linear+

SSPN, Skim Simpanan Pendidikan Nasional

|

Avangelice

|

Jun 25 2024, 09:30 AM Jun 25 2024, 09:30 AM

|

|

QUOTE(LostAndFound @ Jun 25 2024, 09:24 AM) You gave a misleading example for total at Dec 31 2024. I already made it simple. Total credit and total debit. Then you go in masuk div pulak. Making something so simple to be complicated pulak. Just remember your first year masuk 2020 = 8k 2021 = 16k 2022 = 24k 2023 = 32k 2024 = 40k Simpke. Don't care about div. Don't care about how much you took out by the end of 2025 the total account in SSPN should be 48k.you take out 100 myr Kah. 30k Kah at the end of 2025. Make sure it's 48k at the end. If still continue to worry then make a lejar. On the other page just record in total div each year. |

|

|

|

|

|

Avangelice

|

Nov 15 2024, 04:02 PM Nov 15 2024, 04:02 PM

|

|

QUOTE(joice11 @ Nov 15 2024, 12:53 PM) yes, can withdraw at office, take few day to reach your bk acc, no bk islam also can So what's all the hoohah at the beginning of the year madani blocked the loop hole of withdrawing? Why now can withdraw without bank Islam account |

|

|

|

|

|

Avangelice

|

Dec 30 2024, 10:23 AM Dec 30 2024, 10:23 AM

|

|

QUOTE(cenkudu @ Dec 28 2024, 10:31 PM) tomorrow (29/1) can still transfer right via FPX and get tax relief? routine tasks every 29 Dec each year Not sure about u, I don't do it last min only for a fuck up to happen. Add on did the transfer first week of December This post has been edited by Avangelice: Dec 30 2024, 10:23 AM |

|

|

|

|

|

Avangelice

|

Jan 1 2025, 12:52 AM Jan 1 2025, 12:52 AM

|

|

Anyone taking their money out now?

|

|

|

|

|

|

Avangelice

|

Jan 1 2025, 11:30 AM Jan 1 2025, 11:30 AM

|

|

QUOTE(MGM @ Jan 1 2025, 07:02 AM) I tot better to withdraw after 6th day of month to entitle for previous month's interest? QUOTE(ruben7389 @ Jan 1 2025, 08:31 AM) Can take out after the freezing period for year end calculations. Usually in about 10 days to 2 weeks can perform redi. Need to check daily and see if can I honestly don't care for the interest tbh. I just in it for the tax relief and I straight put into another investment vehicle |

|

|

|

|

|

Avangelice

|

Jan 1 2025, 12:09 PM Jan 1 2025, 12:09 PM

|

|

Double post

This post has been edited by Avangelice: Jan 1 2025, 12:10 PM

|

|

|

|

|

|

Avangelice

|

Jan 1 2025, 11:51 PM Jan 1 2025, 11:51 PM

|

|

QUOTE(ineser @ Jan 1 2025, 03:25 PM) I would think that once your tax relief is firm eg no more "Anggaran", most likely can withdraw.  How do you check on this? |

|

|

|

|

|

Avangelice

|

Jan 2 2025, 09:45 AM Jan 2 2025, 09:45 AM

|

|

QUOTE(Jack&Guild @ Jan 2 2025, 09:44 AM) logon to myptptn and check under semakan penyata tab. Thanks buddy |

|

|

|

|

|

Avangelice

|

Jan 2 2025, 09:49 AM Jan 2 2025, 09:49 AM

|

|

AMAUN LAYAK PELEPASAN CUKAI BAGI TAHUN TAKSIRAN 2024

7,999.50

The fuck? How did myr0.5 dissappear

|

|

|

|

|

|

Avangelice

|

Jan 3 2025, 09:06 AM Jan 3 2025, 09:06 AM

|

|

Attempted to withdraw through the new BIMB web and app and my sspn that was once linked cannot be linked now. The space to fill the ic number is greyed out

|

|

|

|

|

|

Avangelice

|

Jan 11 2025, 09:07 AM Jan 11 2025, 09:07 AM

|

|

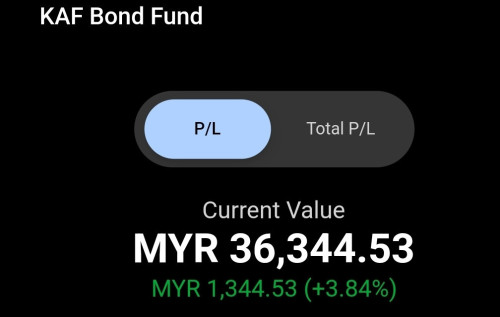

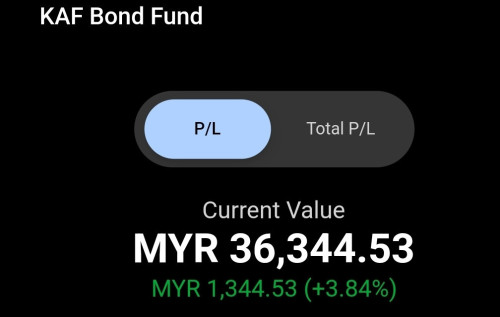

QUOTE(guy3288 @ Jan 10 2025, 06:07 PM) dividend unlikely 4% right? FD ada promo catch first  I take out for kaf bond fund in January Take out from kaf bond in December Any proceeds from kaf bond I put into prs So I end up maxing out both prs and sspn. |

|

|

|

|

|

Avangelice

|

Jan 11 2025, 11:35 AM Jan 11 2025, 11:35 AM

|

|

QUOTE(MGM @ Jan 11 2025, 11:07 AM) U mean u put into PRS in Dec2024 n get 1 year returns in Jan2025? Any other cost in&out of funds? No bro. Whatever interest I got from putting in bond fund. Goes to prs. I don't even look at sspn returns. Just for the tax alone I get a hefty profit |

|

|

|

|

|

Avangelice

|

Feb 10 2025, 11:29 AM Feb 10 2025, 11:29 AM

|

|

QUOTE(virgoguy @ Feb 10 2025, 10:53 AM) anyone look else where to park your SSPN fund? Any recommendation? Starting 2025 onward only either one(Husband/wife) are entitle for kid SSPN tax relief. U don't tell us your risk appetite. U want safe? Better than FD? I park it under fixed income fund in fsm. Kaf bond fund |

|

|

|

|

|

Avangelice

|

Feb 10 2025, 01:13 PM Feb 10 2025, 01:13 PM

|

|

QUOTE(talexeh @ Feb 10 2025, 12:50 PM) Both husband & wife are still entitled for SSPN tax relief provided the total of both claims don't exceed RM8,000. This. I don't know why we are still arguing about this when its alreafy stated black and white |

|

|

|

|

|

Avangelice

|

Apr 30 2025, 04:44 PM Apr 30 2025, 04:44 PM

|

|

QUOTE(fuzzy @ Apr 30 2025, 03:41 PM) Hmm.. Tempting but given no more tax rebate - I will still consider to withdraw it and pump into EPF instead for higher returns. Huh? Where u got the news |

|

|

|

|

|

Avangelice

|

Apr 30 2025, 09:13 PM Apr 30 2025, 09:13 PM

|

|

QUOTE(fuzzy @ Apr 30 2025, 06:05 PM) Starting from YA 2025, only one parent can claim the tax relief for SSPN up to RM8,000 on the net savings even if both parents deposit monies into their SSPN accounts. So we did an rough analysis on which one of us could generate more return based on it, it was about the same so I am letting my spouse that the rebate and I'll invest the money in other places. As such, there's no point of maintaining SSPN. I know we can withdraw and deposit last time, but I malas. But with this change, I can fully withdraw it. Your previous statement doesn't match what you said, I assumed they remove the tax relief for sspn but it's actually reducing it to one single spouse. |

|

|

|

|

|

Avangelice

|

Apr 30 2025, 11:23 PM Apr 30 2025, 11:23 PM

|

|

QUOTE(fuzzy @ Apr 30 2025, 09:54 PM) So, if you have two person, it's removed for one? Ya la tu. I can still claim. Wife cannot obv. Means the tax relief is still on for sspn. Just that no longer for both couple |

|

|

|

|

|

Avangelice

|

Nov 4 2025, 09:22 AM Nov 4 2025, 09:22 AM

|

|

Almost to the tail end of the year and it looks like for the first time, keeping money in sspn is better than taking out & investing in a bond fund. Sigh Thinking of skipping the hassle of withdrawing and putting it in like I do every year.  This post has been edited by Avangelice: Nov 4 2025, 09:24 AM This post has been edited by Avangelice: Nov 4 2025, 09:24 AM |

|

|

|

|

Jun 25 2024, 09:30 AM

Jun 25 2024, 09:30 AM

Quote

Quote

0.0393sec

0.0393sec

0.58

0.58

7 queries

7 queries

GZIP Disabled

GZIP Disabled