annoymous1234 if you have SGD in your CIMB sg or MBB sg acct, it's free to send SGD to IBKR

Opening a Bank Account in Singapore

Opening a Bank Account in Singapore

|

|

Sep 12 2024, 12:12 PM Sep 12 2024, 12:12 PM

|

Senior Member

3,491 posts Joined: Jan 2003 |

annoymous1234 if you have SGD in your CIMB sg or MBB sg acct, it's free to send SGD to IBKR

|

|

|

|

|

|

Sep 12 2024, 12:23 PM Sep 12 2024, 12:23 PM

|

Senior Member

7,616 posts Joined: Mar 2009 |

QUOTE(Medufsaid @ Sep 12 2024, 12:12 PM) Because I currently have both CIMB and MBB MY account, no sg account yet, so I'm not sure which is cheaper cost to transfer to IBKR, so u mean no difference right whichever bank I choose, since it's free to transfer? What about the conversion of MYR to SGD by bank, do they charge a fee like wise?This post has been edited by annoymous1234: Sep 12 2024, 12:30 PM |

|

|

Sep 12 2024, 12:45 PM Sep 12 2024, 12:45 PM

|

Senior Member

3,491 posts Joined: Jan 2003 |

annoymous1234 we use

This post has been edited by Medufsaid: Sep 12 2024, 12:53 PM jayb2 liked this post

|

|

|

Sep 12 2024, 01:06 PM Sep 12 2024, 01:06 PM

|

Senior Member

7,616 posts Joined: Mar 2009 |

QUOTE(Medufsaid @ Sep 12 2024, 12:45 PM) annoymous1234 we use Thanks!

|

|

|

Sep 12 2024, 02:37 PM Sep 12 2024, 02:37 PM

|

Senior Member

3,491 posts Joined: Jan 2003 |

CIMB sg has high interest promo https://www.cimb.com.sg/en/personal/banking...sting-customers

QUOTE Earn flat 3.30%** p.a. interest rate on incremental fresh funds# till 30 November2024 by simply topping up a minimum of S$5,000 incremental fresh funds# (compared to month-end balance of 31 August 2024) into your account from 1 to 30 September 2024. |

|

|

Sep 12 2024, 02:55 PM Sep 12 2024, 02:55 PM

Show posts by this member only | IPv6 | Post

#5886

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Medufsaid @ Sep 12 2024, 02:37 PM) Don't be fooled by that. I looked at that before, I don't post it in Lowyat because if you read the terms and conditions... https://www.cimb.com.sg/content/dam/cimbsg/...a-3.3-sep24.pdfa) the bonus interests will be paid in December b) you must maintain the miminum 5k SGD EVERY DAY above the benchmark to earn the bonus interests. This is no different from a fixed deposit... The IRR is never as high as 3.5% p.a... more like 2.5-2.75% p.a. only. Fullerton SGD cash fund (purchased via Moomoo/WiseSaver/FSM One etc.) will yield better rates with more flexibility. They fooled me once last year, not gonna be fooled by them again this year. This post has been edited by TOS: Sep 12 2024, 02:56 PM poooky liked this post

|

|

|

|

|

|

Sep 13 2024, 10:30 AM Sep 13 2024, 10:30 AM

|

Senior Member

3,821 posts Joined: May 2016 |

QUOTE(TOS @ Sep 12 2024, 02:55 PM) Don't be fooled by that. I looked at that before, I don't post it in Lowyat because if you read the terms and conditions... https://www.cimb.com.sg/content/dam/cimbsg/...a-3.3-sep24.pdf i got it at 3.2% at MBB Sg Time Deposit for Half yeara) the bonus interests will be paid in December b) you must maintain the miminum 5k SGD EVERY DAY above the benchmark to earn the bonus interests. This is no different from a fixed deposit... The IRR is never as high as 3.5% p.a... more like 2.5-2.75% p.a. only. Fullerton SGD cash fund (purchased via Moomoo/WiseSaver/FSM One etc.) will yield better rates with more flexibility. They fooled me once last year, not gonna be fooled by them again this year. |

|

|

Sep 13 2024, 02:17 PM Sep 13 2024, 02:17 PM

Show posts by this member only | IPv6 | Post

#5888

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(Ckmwpy0370 @ Sep 13 2024, 10:30 AM) Now you are telling everyone you deposit a minimum of 20k SGD at Maybank SG https://www.maybank2u.com.sg/en/promotions/...me-deposit.page But yea, 6-month 3.2% is about the same rate as 6-month SG T-bills. Not overpriced, not underpriced, considering the SDIC deposit up to 100k SGD... |

|

|

Sep 13 2024, 02:31 PM Sep 13 2024, 02:31 PM

Show posts by this member only | IPv6 | Post

#5889

|

Junior Member

504 posts Joined: Jul 2015 |

better to keep SGD in tiger brokers than OCBC SG?

since tiger brokers u can easily withdraw to any banks. any opinion is greatly appreciated |

|

|

Sep 17 2024, 10:16 AM Sep 17 2024, 10:16 AM

Show posts by this member only | IPv6 | Post

#5890

|

Probation

10 posts Joined: Nov 2019 |

Hi guys, seek opinion on FD in either cimb or Maybank sg.

For 12 mths rates, not much of a different 2.65 vs 2.8. My intention is to let it compound for the next 10 years++ Question : which is more convenient in the sense of any withdrawal upon maturity, only fresh fund applicable for any new placement etc Ps: I do have an existing dbs but the rates are horrendous for any amount more than 20k |

|

|

Sep 17 2024, 10:37 AM Sep 17 2024, 10:37 AM

Show posts by this member only | IPv6 | Post

#5891

|

Junior Member

664 posts Joined: Jun 2017 |

QUOTE(hellowkerbau @ Sep 17 2024, 10:16 AM) Hi guys, seek opinion on FD in either cimb or Maybank sg. if you want to put money into FD, mind as well put in money market fund which has flexible withdrawal and better rate. For example, you can create Sfye SG without being employed in SG.For 12 mths rates, not much of a different 2.65 vs 2.8. My intention is to let it compound for the next 10 years++ Question : which is more convenient in the sense of any withdrawal upon maturity, only fresh fund applicable for any new placement etc Ps: I do have an existing dbs but the rates are horrendous for any amount more than 20k |

|

|

Sep 17 2024, 10:52 AM Sep 17 2024, 10:52 AM

|

Senior Member

3,491 posts Joined: Jan 2003 |

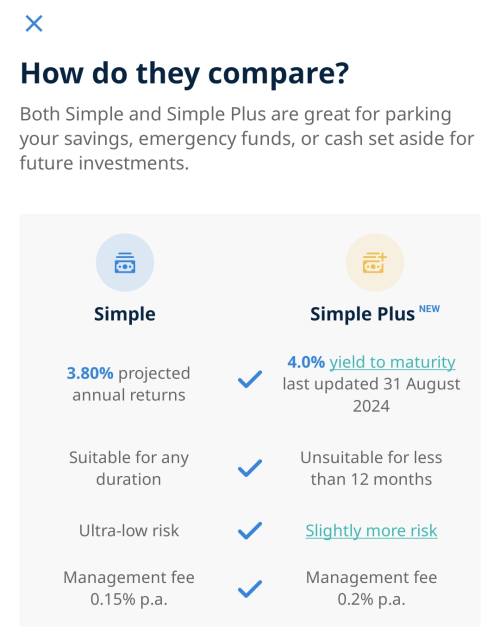

hellowkerbau wow stashaway SG simple (open stashaway SG with your m'sian passport) returns is now better than Fullerton SGD  sam93xxxxx liked this post

|

|

|

Sep 23 2024, 05:08 PM Sep 23 2024, 05:08 PM

|

Junior Member

65 posts Joined: Sep 2011 |

Hi guys, any bank savings account which doesnt charge Rm15 annual debit card (ie: CIMB EcoSave i) to recommend?

|

|

|

|

|

|

Sep 26 2024, 12:06 AM Sep 26 2024, 12:06 AM

Show posts by this member only | IPv6 | Post

#5894

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Poor people are always discriminated by bankers

Citibank to close last branch in Singapore in October amid shift to wealth hubs (no paywall) https://www.straitstimes.com/business/banki...-to-wealth-hubs |

|

|

Sep 27 2024, 11:52 PM Sep 27 2024, 11:52 PM

Show posts by this member only | IPv6 | Post

#5895

|

Probation

35 posts Joined: Nov 2021 |

wow, can't imagine citibank to become so picky. 'Poor' people in Singapore are considered high income earning in Malaysia

QUOTE(TOS @ Sep 26 2024, 12:06 AM) Poor people are always discriminated by bankers Citibank to close last branch in Singapore in October amid shift to wealth hubs |

|

|

Sep 27 2024, 11:53 PM Sep 27 2024, 11:53 PM

Show posts by this member only | IPv6 | Post

#5896

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

Oct 1 2024, 10:25 PM Oct 1 2024, 10:25 PM

Show posts by this member only | IPv6 | Post

#5897

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

Hi sifus,

After eons, I finally open a TnG eWallet account (don't laugh at me, I don't see any point opening an eWallet account when Duitnow QR is everywhere, except my favourite cheap foodstalls... they all provide TnG eWallet QR only...) So, I discover that TnG eWallet allows DuitNow Cross border remittance from Malaysia to Singapore (but not the other way round, still have to use CIMB SG -> MY for that). Have anyone tried checking TnG eWallet's rate for remittance from MY to SG, is it better than Maybank MY's rate? (I know the daily limit is 3000 MYR, and not comparable with large volume transfer providers like Sunway Money or Wise or MoneyMatch). CIMB MY still haven't updated me why my transfer months ago failed... I give up on them... -------------------------- Also, have anyone tried Liquid Pay in Singapore? How are the FX rates like for Cross Border transfer from SG -> MY? https://www.duitnow.my/Cross-Border/fund-transfer.html I know OCBC charges a 1% spread (worse than the 0.3% imposed by CIMB SG -> MY) route. Don't have account with UOB and I don't trust Maybank SG or MY account after my card was hacked last time. That leaves Liquid Pay as the remaining option. This post has been edited by TOS: Oct 1 2024, 11:08 PM |

|

|

Oct 2 2024, 11:34 AM Oct 2 2024, 11:34 AM

|

Junior Member

335 posts Joined: Mar 2014 |

QUOTE(TOS @ Oct 1 2024, 10:25 PM) Hi sifus, just wondering.. anyone ever compare whether the rate for DuitNow Cross Border is the same or different across different providers?After eons, I finally open a TnG eWallet account (don't laugh at me, I don't see any point opening an eWallet account when Duitnow QR is everywhere, except my favourite cheap foodstalls... they all provide TnG eWallet QR only...) So, I discover that TnG eWallet allows DuitNow Cross border remittance from Malaysia to Singapore (but not the other way round, still have to use CIMB SG -> MY for that). Have anyone tried checking TnG eWallet's rate for remittance from MY to SG, is it better than Maybank MY's rate? (I know the daily limit is 3000 MYR, and not comparable with large volume transfer providers like Sunway Money or Wise or MoneyMatch). CIMB MY still haven't updated me why my transfer months ago failed... I give up on them... -------------------------- Also, have anyone tried Liquid Pay in Singapore? How are the FX rates like for Cross Border transfer from SG -> MY? https://www.duitnow.my/Cross-Border/fund-transfer.html I know OCBC charges a 1% spread (worse than the 0.3% imposed by CIMB SG -> MY) route. Don't have account with UOB and I don't trust Maybank SG or MY account after my card was hacked last time. That leaves Liquid Pay as the remaining option. eg. DuitNow Cross Border for MYR to SGD on the same day for the same amount.. are the rates same/different for MBB MY -> SGD as compared to TnG -> SGD? |

|

|

Oct 2 2024, 12:19 PM Oct 2 2024, 12:19 PM

|

Senior Member

3,491 posts Joined: Jan 2003 |

Can someone show me the steps for TnG duitnow overseas transfer?

I did compare before CIMB my-> Singapore and MBB my-> Singapore comparison for duitnow overseas transfer. It's identical so I expect tng to have identical rates |

|

|

Oct 2 2024, 07:53 PM Oct 2 2024, 07:53 PM

|

Junior Member

335 posts Joined: Mar 2014 |

QUOTE(Medufsaid @ Oct 2 2024, 12:19 PM) Can someone show me the steps for TnG duitnow overseas transfer? so it's the same across the platform..I did compare before CIMB my-> Singapore and MBB my-> Singapore comparison for duitnow overseas transfer. It's identical so I expect tng to have identical rates |

| Change to: |  0.0203sec 0.0203sec

0.47 0.47

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 09:46 PM |