QUOTE(abcn1n @ Oct 15 2023, 08:04 PM)

A question for the experts. When you transfer larger amount of money from RM to USD/SGD, do you transfer RM30k per transaction or lesser amount? Currently, I am transferring RM10k/transaction instead of RM30k. Downside is you incur more cost. Is there more scrutiny/risk if transfer RM30k at a time?

QUOTE(Ramjade @ Oct 15 2023, 08:13 PM)

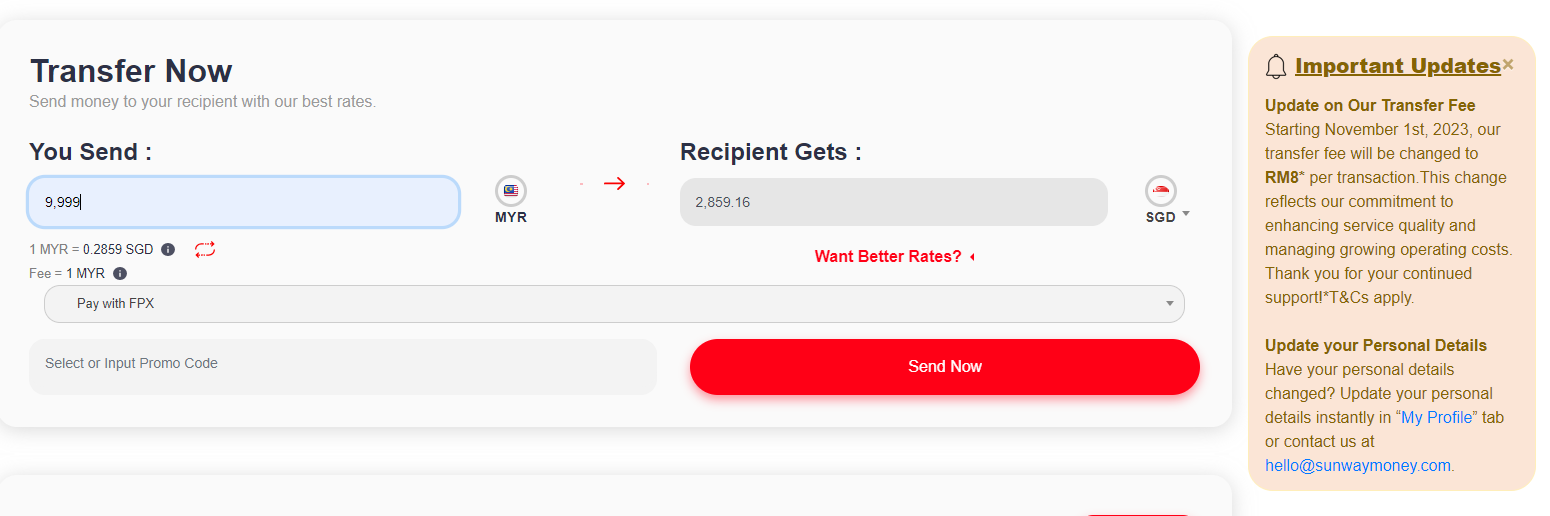

I don't know what more cost. Cause moneymatch and Sunway pyramid fees are fixed at RM8.00 and RM1.00/transaction. Unless you are counting amount/RM8.00 or RM1.00.

No issue. Just show them where your money comes from. Moneymatch and Sunway money have asked me for proof of income numerous time, give them bank statement and money will go though.

In case readers are confused, our bro Ramjade means Sunway Money, not Sunway pyramid or any money changers in it...No issue. Just show them where your money comes from. Moneymatch and Sunway money have asked me for proof of income numerous time, give them bank statement and money will go though.

Oct 15 2023, 09:04 PM

Oct 15 2023, 09:04 PM

Quote

Quote

0.1763sec

0.1763sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled