Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

Ramjade

|

Apr 26 2024, 01:29 PM Apr 26 2024, 01:29 PM

|

|

QUOTE(Avangelice @ Apr 26 2024, 01:23 PM) Weird. I just got my sister to remit 150 sgd to my cimb sg bank from her hscb bank yesterday and I haven't banked in the 1k sgd yet You cannot use other people bank account. The money must come from your bank account under you own name. They will close the account and refund you the money if you cannot deposit SGD1K by I think 30 days. Of course once open and activated can received money from anyone. Only the first SGD1k must come from money under your own name. This post has been edited by Ramjade: Apr 26 2024, 01:30 PM |

|

|

|

|

|

Ramjade

|

Apr 26 2024, 03:54 PM Apr 26 2024, 03:54 PM

|

|

QUOTE(Avangelice @ Apr 26 2024, 03:30 PM) 10 sgd from Ekyc and that 150 sgd was for my dad's birthday ang pow. How did I get my account activated? Wait 30 days and see if account will be close. Maybe mistake on cimb part. |

|

|

|

|

|

Ramjade

|

Apr 26 2024, 04:14 PM Apr 26 2024, 04:14 PM

|

|

QUOTE(Avangelice @ Apr 26 2024, 03:56 PM) I'll still hv to transfer money but since it's activated I would use money match then instead of the compulsory cimb my to cimb sg. BTW guys wise is not cheap any longer. Money match is cheaper by 25 myr? Use money match or Sunway money for transfer above 10k. Office hour time. Compare both and see how got the best rate. See how you the most SGD per RM. |

|

|

|

|

|

Ramjade

|

May 13 2024, 07:01 AM May 13 2024, 07:01 AM

|

|

QUOTE(bokbokchai @ May 12 2024, 11:37 PM) Lately I saw money match rate seems to be cheaper than wise rate. If I don’t have any cimb sg or mbb sg account. Can I actually use money match to remit money into wise account’s sg balance? Learn to open a sg bank account. Maybank, OCBC sg all can be open online. If you don't want to open a sg bank account, open rhb multi currency account then. It have very good rates. |

|

|

|

|

|

Ramjade

|

May 13 2024, 08:41 AM May 13 2024, 08:41 AM

|

|

QUOTE(Medufsaid @ May 13 2024, 08:26 AM) Ramjade rhb mca won't fix his issue which is ibkr I think it will. Why? Cause you can change inside RHB and wire it over to IBKR. Of course unless wiring to IBKR is kinda of block by BNM as I have seen some people said they cannot wire money to IBKR using Maybank. Rhb multicurrency is a real multi currency account. It should have ability to send and receive foreign currency. |

|

|

|

|

|

Ramjade

|

May 16 2024, 02:40 PM May 16 2024, 02:40 PM

|

|

QUOTE(derravile @ May 16 2024, 02:16 PM) hi guys just curious for those who have SG bank account is it possible for us to receive USD payments? i have CIMB SG, wonder if it can be done or not? else is there any alternative to receive USD in SG for malaysians? Yes. Can received USD. It will be auto converted into SGD by Cimb SG. If you want to received USD, best is DBS my account (if you can open). If no luck, RHB mukticurrency. |

|

|

|

|

|

Ramjade

|

May 16 2024, 06:30 PM May 16 2024, 06:30 PM

|

|

QUOTE(Hexlord @ May 16 2024, 06:19 PM) Curious, which SG bank account you currently have there? Cimb sg, Maybank sg, DBS. |

|

|

|

|

|

Ramjade

|

May 16 2024, 07:04 PM May 16 2024, 07:04 PM

|

|

QUOTE(Hexlord @ May 16 2024, 06:37 PM) I mean specifically, for example DBS Multiplier etc. Currently looking for high yield accounts there. I don't keep money in my sg bank accounts. All acocunt only have SGD0.10  except for Maybank. That one have SGD500. Just go with MMF. Straight forward. Tiger or moomoo. Pick either one. This post has been edited by Ramjade: May 16 2024, 07:05 PM |

|

|

|

|

|

Ramjade

|

Jun 2 2024, 04:16 PM Jun 2 2024, 04:16 PM

|

|

QUOTE(tropik @ Jun 2 2024, 02:42 PM) Anyone here with Maybank SG account who didnt activate the debit card? Any issue with that? I'm getting 2nd SMS reminder to activate it. Thought of not activating it at all since not using the card and to avoid fraud like TOS experienced. Any card regardless where you are can kena the scam. You activate the card only if you want to use it. If you are like me with no usage for it, no need bother activating. |

|

|

|

|

|

Ramjade

|

Jun 5 2024, 11:29 AM Jun 5 2024, 11:29 AM

|

|

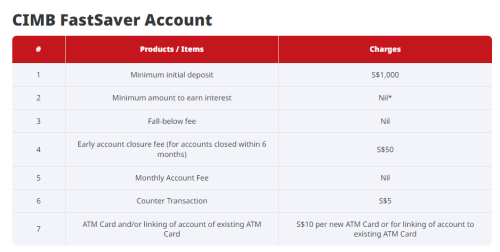

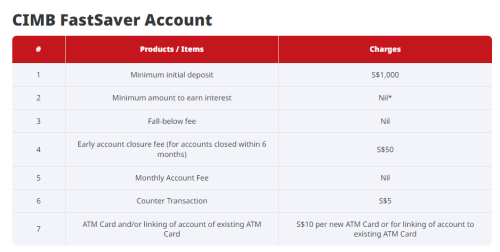

QUOTE(CommodoreAmiga @ Jun 5 2024, 11:12 AM) Can anyone with CIMB SG and MY account help me with this? Can you withdraw SGD from CIMB SG account using CIMB MY debit card? My accounts are already linked and can see online. I am going to SG tomorrow. 😅 Cannot. Also cimb ATM is found at one spot in Singapore, which is at their office. So not worth getting the atm card. Just go to counter and withdraw 😅 |

|

|

|

|

|

Ramjade

|

Jun 5 2024, 11:42 AM Jun 5 2024, 11:42 AM

|

|

QUOTE(CommodoreAmiga @ Jun 5 2024, 11:37 AM) Thanks bro! Aiya...i don't want to open account lah bro. Tomorrow go already. Lol. But yes, i actually thought just that, transfer from my CIMB SG to Wise SGD. Just now tested transfer SGD50 to see. It is pending review (i have submitted my internet bill) and the timeframe shows it should be done by 5pm if all goes well. Withdraw SGD using WISE from ATM got how much charges in Singapore? In Japan it was 100 yen for 2000 yen or something like that. Just use gxbank to withdraw money from any ATM card in Singapore. No need get cimb debit card. QUOTE(Medufsaid @ Jun 5 2024, 11:34 AM) Ramjade not worth it. S$5  I just saw the fees. Lol. This post has been edited by Ramjade: Jun 5 2024, 11:45 AM |

|

|

|

|

|

Ramjade

|

Jun 5 2024, 12:07 PM Jun 5 2024, 12:07 PM

|

|

QUOTE(Medufsaid @ Jun 5 2024, 11:59 AM) i linked wise virtual card to google pay. no surcharge when paying SGD in singapore. just that SMRT you'll have 60 cents daily surcharge as the Wise card is M'sia registered only issue is is S$289 in paper money (wise withdrawal) sufficient for a sg trip paper SGD i change in midvalley anyway. since it's still cheaper than moneymatchHmmm. Maybe need to make yearly trip. |

|

|

|

|

|

Ramjade

|

Jun 10 2024, 11:46 PM Jun 10 2024, 11:46 PM

|

|

QUOTE(ShinG3e @ Jun 10 2024, 11:35 PM) Same goes with Stand Chart also. But I cancelled mine this year already after 3 yrs 🥹 Because of the Stand Chart priority status, they’ll assist you to open SG/HK account Standard charged told me you need to have priority both places. Anyway I won't waste my time with priority banking. Lol. |

|

|

|

|

|

Ramjade

|

Jun 10 2024, 11:56 PM Jun 10 2024, 11:56 PM

|

|

QUOTE(ShinG3e @ Jun 10 2024, 11:51 PM) Things changed? I opened mine on 2021. To be frank, their priority service is getting shittier day by day. Make 0 different when i opt out 🥹 Still looking into DBS 2017 time. Still student that time. DBS got very good priority service that no banks got. DBS MTRL. The interest is really low last time. Not sure about now. But need SGD500k. If there is one priority that I want to get, it wine with DBS. Lol. This post has been edited by Ramjade: Jun 10 2024, 11:58 PM |

|

|

|

|

|

Ramjade

|

Jun 13 2024, 07:13 AM Jun 13 2024, 07:13 AM

|

|

QUOTE(PseudomonasSA @ Jun 13 2024, 06:03 AM) Have an interesting question. Are non residents able to buy life insurance policies in Singapore? For example, Malaysians working in Malaysia. Singaporean policies offer more protection per equivalent unit of premium paid Yes can. You will need to travel down and sign the documents. When you file claim may need notary sign. They also have term and whole life. With term being cheaper. You can choose coverage for xyz years or say max 20 years Vs full for life. Of course for life is going to be more expensive. Also keep in mind premium will be in SGD which means it will be increasing with time if you are paying with RM. Also some company want the cases to be in Singapore itself only. Eg. Some critical life illness insurance need to diagnosed in Singapore hospital. Some accept worldwide on condition it is in English. This post has been edited by Ramjade: Jun 13 2024, 07:15 AM |

|

|

|

|

|

Ramjade

|

Jun 17 2024, 06:38 AM Jun 17 2024, 06:38 AM

|

|

QUOTE(kslim888 @ Jun 17 2024, 01:29 AM) Btw, I was digging some earlier post at this discussion, and found that we can open OCBC singapore too. After opening OCBC Statement Savings Account, then we can use that as reference account to open DBS bank right? Saw from this post also https://forum.lowyat.net/index.php?showtopi...ost&p=109764512You cannot. He got Singapore pass. That's why I said his post of opening sg account are not relevant to us. This post has been edited by Ramjade: Jun 17 2024, 10:03 AM |

|

|

|

|

|

Ramjade

|

Jun 17 2024, 10:03 AM Jun 17 2024, 10:03 AM

|

|

QUOTE(TOS @ Jun 17 2024, 09:59 AM) Malaysian can open OCBC SG, CIMB SG and Maybank SG only (without visiting SG). As for DBS, prior to 1MDB and before 2015, it's possible to open a DBS account easily via DBS Vickers in DBS's head office at Marina Bay Financial Center in SG. Post-2015, not aware of anyone who manage to open DBS account successfully without depositing huge sum of money with their private banking side... So just stick to OCBC SG for now, that's reasonable good for general banking purposes in SGD. You can also proceed to open a CDP account thereafter, which will allow you to purchase SG Treasury bills, bonds and saving bonds. Yea Ramjade is right haha, I got a student pass right now to study in SG, though in the coming months i may just stay in Penang to date with my high school classmate and connect to NTU servers via VPN  Earn SGD, spend MYR...  I am one of those who opened account at height of 1mdb  |

|

|

|

|

|

Ramjade

|

Jun 17 2024, 04:16 PM Jun 17 2024, 04:16 PM

|

|

QUOTE(hksgmy @ Jun 17 2024, 01:08 PM) Was your account with DBS? Yes sir. My account was and is still DBS. I have Maybank and Cimb. I think want to close my Maybank account. |

|

|

|

|

|

Ramjade

|

Jul 4 2024, 11:36 AM Jul 4 2024, 11:36 AM

|

|

QUOTE(!@#$%^ @ Jul 4 2024, 11:28 AM) seems like maybank sg not very email friendly. refuse to entertain banking matters via email. calling them would be expensive. so i asked them to call me, wonder if they will. Use IDD calls. Cheap. |

|

|

|

|

|

Ramjade

|

Jul 4 2024, 12:32 PM Jul 4 2024, 12:32 PM

|

|

QUOTE(!@#$%^ @ Jul 4 2024, 11:51 AM) is it? i guess so. cimb sg called me when i asked stg via secure mail. unfortunately maybank sg doesn't have it, their email respond was to ask me to call the hotline. I always use IDD to call Singapore Vs using normal call. Saves money. |

|

|

|

|

Apr 26 2024, 01:29 PM

Apr 26 2024, 01:29 PM

Quote

Quote

0.0244sec

0.0244sec

0.54

0.54

7 queries

7 queries

GZIP Disabled

GZIP Disabled