QUOTE(Medufsaid @ Jan 8 2024, 09:30 PM)

finally got time to do non-office hours comparison

RM3.4955 market mid-rate as verified by Wise

Thanks for the data. Looks like need to sign up for duitnow. Haha.RM3.4955 market mid-rate as verified by Wise

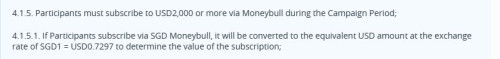

| S$850 | S$8562 | |

| DuitNow | 2982.46 | 30042.11 |

| MoneyMatch | 2992.40 + 5 | 30142.28 + 5 |

| sunway money | 2993.45 + 8 | 30140.09 + 8 |

| wise | 2991.81 | 30140.80 |

| bigpay | 2988.15 + 4.5 | 30099.39 + 4.5 |

Jan 9 2024, 03:26 AM

Jan 9 2024, 03:26 AM

Quote

Quote

0.0300sec

0.0300sec

0.46

0.46

7 queries

7 queries

GZIP Disabled

GZIP Disabled