Outline ·

[ Standard ] ·

Linear+

Opening a Bank Account in Singapore

|

Ramjade

|

Feb 14 2024, 09:26 AM Feb 14 2024, 09:26 AM

|

|

QUOTE(Afterburner1.0 @ Feb 14 2024, 09:14 AM) If i am in Singapore physically for a few days..... r we allowed to open bank account n placed fd in SG banks? Just need IC & Passport will do? Can. Need to beg. Only sg banks that let you open without any working pass is DBS. But need to open DBS Vickers as well. Try it at mbfc. Nowadays no pass, no account unless you are priority customer. Priority customer is need cause officer want to earn money/bonus, bank also want to earn money. |

|

|

|

|

|

Ramjade

|

Feb 14 2024, 04:41 PM Feb 14 2024, 04:41 PM

|

|

QUOTE(Medufsaid @ Feb 14 2024, 10:55 AM) i can testify to this. i opened my DBS account in parkway parade branch in 2009 with passport only Someone reported my post. Lol. Must be because I mentioned b****n. |

|

|

|

|

|

Ramjade

|

Feb 14 2024, 11:07 PM Feb 14 2024, 11:07 PM

|

|

QUOTE(privatequity @ Feb 14 2024, 11:01 PM) yeah i have some SGD in tiger brokers MMF. Already have cimb sg, thinking if i should open one more - just to standby in case cimb sg down or what. Im using maybank. Do u recommend to open sg maybank, or better sg bank like ocbc (apply online)? Cimb. Don't bother with Maybank. No need OCBC unless you want to have multicurrency account. I think they have one. But not sure how much is the lockup money. My cimb only have SGD0.10 inside. Lol. |

|

|

|

|

|

Ramjade

|

Feb 14 2024, 11:09 PM Feb 14 2024, 11:09 PM

|

|

QUOTE(privatequity @ Feb 14 2024, 11:08 PM) how do u transfer ur SGD to tiger brokers? from bank to tiger brokers via wise? I use moomoo for my mmf. Tiger only for seeing price of stock and options. DDA from DBS into moomoo. Same options available for tiger. You can use FAST transfer (sg version of duitnow) This post has been edited by Ramjade: Feb 14 2024, 11:10 PM |

|

|

|

|

|

Ramjade

|

Feb 14 2024, 11:18 PM Feb 14 2024, 11:18 PM

|

|

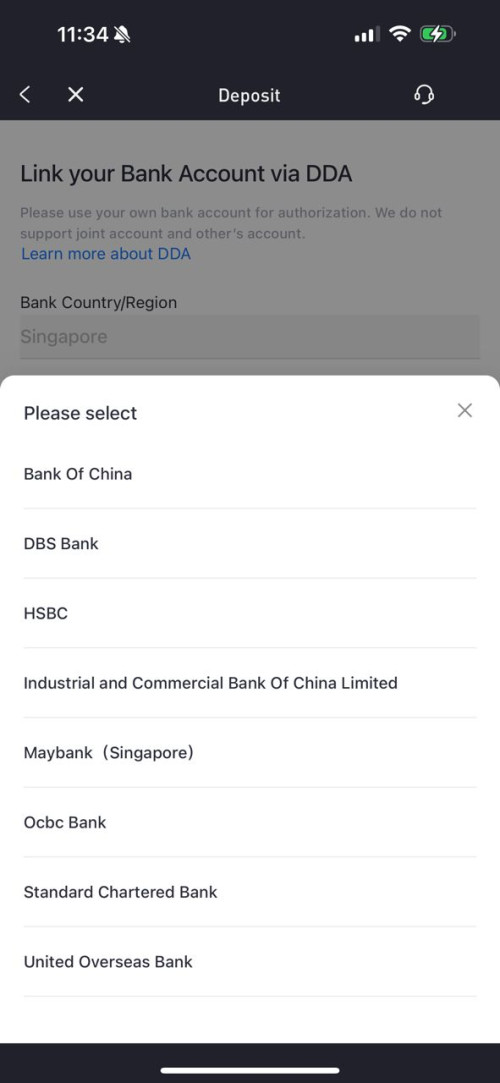

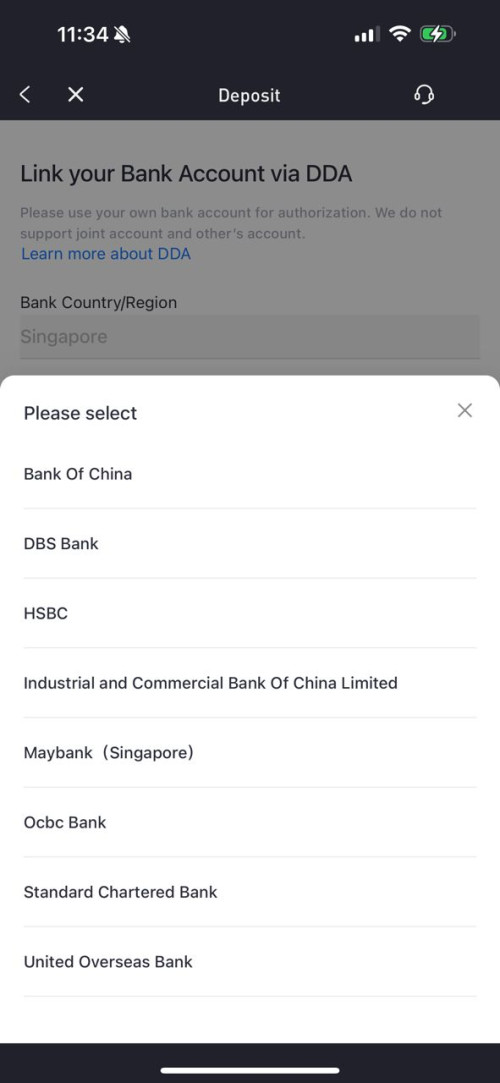

QUOTE(privatequity @ Feb 14 2024, 11:10 PM) ohh, i dont have DBS. Should i create one maybank SG so i can DDA from maybank into tiger? You can only DDA with DBS. No need waste time and money with Maybank. |

|

|

|

|

|

Ramjade

|

Feb 14 2024, 11:37 PM Feb 14 2024, 11:37 PM

|

|

QUOTE(privatequity @ Feb 14 2024, 11:35 PM) can for tiger brokers. these few banks. I only have cimb sg, cannot DDA. so thinking which one i should create. i oredi have maybank MY. wat u think  Thanks. From support only mentioned DBS. No need. Use FAST transfer. Good enough. No benefit for DDA or opening Maybank sg. This post has been edited by Ramjade: Feb 14 2024, 11:37 PM |

|

|

|

|

|

Ramjade

|

Feb 14 2024, 11:49 PM Feb 14 2024, 11:49 PM

|

|

QUOTE(privatequity @ Feb 14 2024, 11:39 PM) thanks, any reasons u dont like maybank sg that much? haha 1. I already have DBS which is a multicurrency account and again I only keep SGD0.10 inside my DBS. 2. I already have cimb sg. Maybank does not have a multicurrency account, got minimum lockup, and lousy rates (if you want to send money back to Malaysia). It's basically redundant. So no point I have Maybank sg. |

|

|

|

|

|

Ramjade

|

Feb 15 2024, 12:28 AM Feb 15 2024, 12:28 AM

|

|

QUOTE(TOS @ Feb 14 2024, 11:56 PM) 3. My Maybank SG debit card kena hacked last May/June... Fraudsters transferred money out of it... Have to complaint to get back refund. CIMB SG (no debit card), DBS and OCBC SG account + debit cards are working well, no sign of hacking attempts or frauds... I use my bank cards very conservatively, only pay for food at hawker centers/uni canteents and public transports. No tie up with any ewallets, no Google Pay/Apple Pay etc. and I never let greed fail me by hunting for "cashbacks"... Since then, I closed both my Maybank MY and Maybank SG accounts. Not Maybank fault. It's normal thing. Bigpay also kena. I got rid of biopay once they start charging fees for credit card. All banks can kena this regardless of where you are. |

|

|

|

|

|

Ramjade

|

Feb 18 2024, 06:48 PM Feb 18 2024, 06:48 PM

|

|

QUOTE(privatequity @ Feb 18 2024, 04:21 PM) where to check the minimum balance? |

|

|

|

|

|

Ramjade

|

Feb 21 2024, 02:29 PM Feb 21 2024, 02:29 PM

|

|

QUOTE(TOS @ Feb 21 2024, 12:47 PM) The last bonus interest is in yesterday for those started in August 2023. While interest rate is high. See how when interest rate lowers. |

|

|

|

|

|

Ramjade

|

Feb 29 2024, 07:01 PM Feb 29 2024, 07:01 PM

|

|

QUOTE(!@#$%^ @ Feb 29 2024, 06:44 PM) any simplified method to save-invest usd dollars in some low risk instrument? Yes. Open up moomoo Malaysia or tiger sg. Buy CSOP USD MMF. Giving around 5%p.a |

|

|

|

|

|

Ramjade

|

Feb 29 2024, 07:17 PM Feb 29 2024, 07:17 PM

|

|

QUOTE(!@#$%^ @ Feb 29 2024, 07:07 PM) but wun be 'holding' usd in cash when i sell right? You will be. Better double confirm with customer service. |

|

|

|

|

|

Ramjade

|

Mar 6 2024, 11:33 AM Mar 6 2024, 11:33 AM

|

|

QUOTE(Afterburner1.0 @ Mar 6 2024, 11:30 AM) I guess the diff is all the misc fees we need to pay ofr the multi currency acc.... bank needs to make a profit all the time! However need advise from all sifu here..... if i open SG CIMB acc purely just for FD purposes is it worth it? can i use CIMB SG as my core base and transfer the amount to other banks FD in SG? or to have an FD in SG it is mandatory to open a savings account first b4 depositing the FD amount? FD interest won't stay high. If you have been around long enough you will know before COVID, the rates are only 1.x%p a. What then? Singapore FD rarely on par with Malaysian rates in the olden days. This post has been edited by Ramjade: Mar 6 2024, 11:39 AM |

|

|

|

|

|

Ramjade

|

Mar 6 2024, 12:15 PM Mar 6 2024, 12:15 PM

|

|

QUOTE(Afterburner1.0 @ Mar 6 2024, 11:58 AM) yes ive been around that long enuff...... yeah its pathetic back then 1.xx % only..... but now its almost 3.4% but for 3 mths only.... worth it to open an sg acc just for FD purposes? Nope. Opening sg bank account is not for FD purpose. That is just me. But having an account in sg is always worth it. This post has been edited by Ramjade: Mar 6 2024, 12:17 PM |

|

|

|

|

|

Ramjade

|

Mar 8 2024, 03:46 AM Mar 8 2024, 03:46 AM

|

|

QUOTE(mavistan89 @ Mar 8 2024, 01:01 AM) Last time fixed deposit rate normally at what rate? Like from year 2010 to 2019 precovid? All the while 1.2 to1.5%? Depends on banks. But generally I think 1-1.2%p.a |

|

|

|

|

|

Ramjade

|

Mar 9 2024, 07:35 PM Mar 9 2024, 07:35 PM

|

|

QUOTE(247365 @ Mar 9 2024, 04:28 PM) any recommendation for malaysians to easily open offshore bank account other than singapore without going through premier banking? diversify more. Singapore is the only country that let you open offshore account without needing priority or private banking. Good luck if you find other country that accept you. |

|

|

|

|

|

Ramjade

|

Mar 10 2024, 12:07 AM Mar 10 2024, 12:07 AM

|

|

QUOTE(john123x @ Mar 9 2024, 11:56 PM) i think our next target should be research to open US bank account. You can't. I have check. They need social security number. |

|

|

|

|

|

Ramjade

|

Apr 3 2024, 12:49 PM Apr 3 2024, 12:49 PM

|

|

QUOTE(coolguy99 @ Apr 3 2024, 12:38 PM) I have this concern too. Actually we can do a separate will in Malaysia for SG asset? Can check out this page. A bit old https://blog.seedly.sg/will-writing-service...state-planning/ |

|

|

|

|

|

Ramjade

|

Apr 26 2024, 01:01 PM Apr 26 2024, 01:01 PM

|

|

QUOTE(tropik @ Apr 26 2024, 12:28 PM) Those with CIMB MY & SG, how did you perform the 1st transfer between these 2 accounts, now that remittance service not allowed? Is it using the Foreign Transfer or some other feature (DuitNow possible?) Using Foreign Transfer, saw the requirement to declare the purpose. What category you normally use? I got local sg bank account so just transfer using my local sg bank account. Use cimb Malaysia. Telegraphic transfer the whole SGD1k |

|

|

|

|

|

Ramjade

|

Apr 26 2024, 01:16 PM Apr 26 2024, 01:16 PM

|

|

QUOTE(Avangelice @ Apr 26 2024, 01:04 PM) Huh? What no money lah said was the first 1sgd you transfer from cimb my to cimb sg. Then the rest of 999 sgd can use wise transfer Cannot use that way anymore Cimb not earning money. Only way is cimb Malaysia or as intended local sg bank account under your name. |

|

|

|

|

Feb 14 2024, 09:26 AM

Feb 14 2024, 09:26 AM

Quote

Quote

0.0273sec

0.0273sec

0.53

0.53

7 queries

7 queries

GZIP Disabled

GZIP Disabled