QUOTE(GalaxyV @ Jun 20 2025, 02:33 PM)

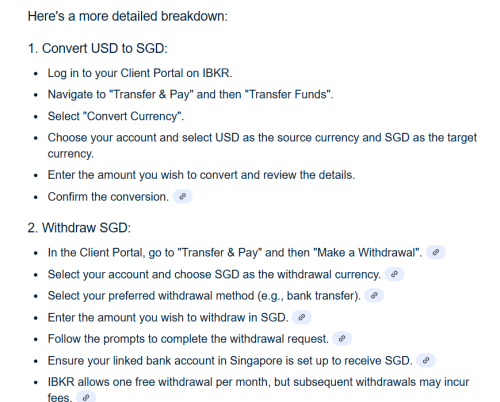

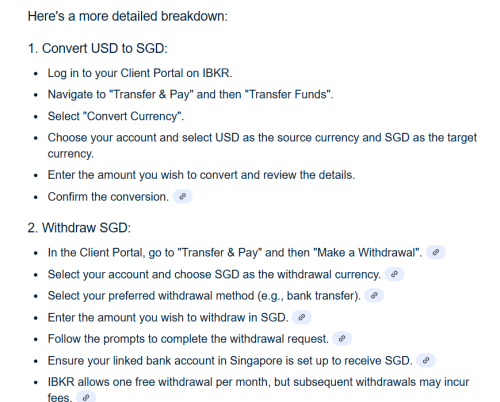

My previous deposit was in USD. Can I then withdraw my USD to SGD to my Singapore bank account?

got it

You can always withdraw SGD to a SG bank account. But if you withdraw USD to a pure SGD account the USD will be converted into SGD at bank rate which is not cheap and not ideal unless you have a multi currency account.

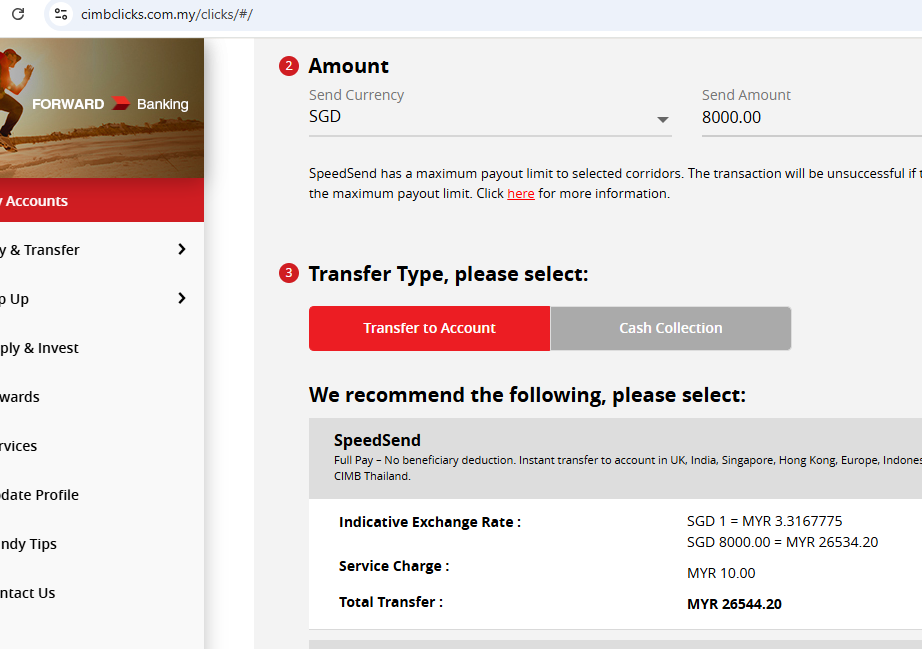

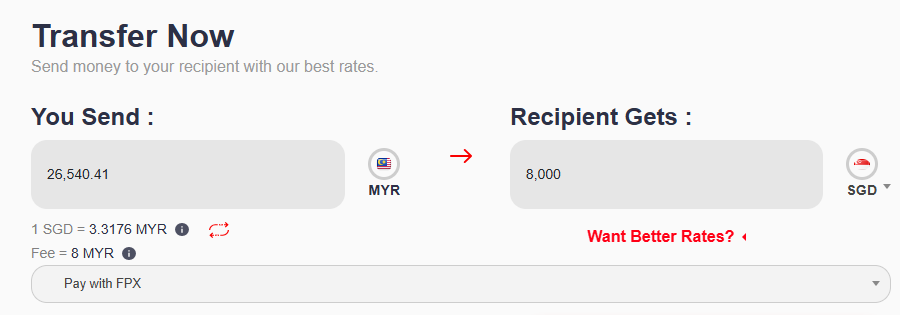

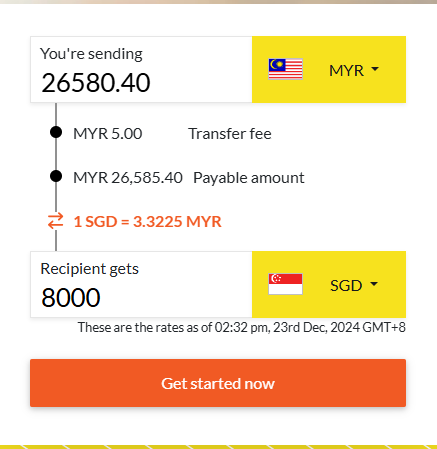

Since Malaysia does not really have a multi currency account, everytime you withdraw money back to Malaysia (which you should not be doing), banks take a chunk of it like 3% and auto convert it to ringgit.

That's why I open SG bank account so there is no auto conversion.

QUOTE(Hansel @ Jun 20 2025, 02:56 PM)

I have another option here :-

I have DBS Multi-Currency Acct and Tiger Brokers acct..

I can move funds, USD & SGD in and out betw my DBS MCA and TB acct. for FREE.

I use DBS MCA to convert my funds betw USD & SGD at close to interbank rates.

I am now waiting for counter-reprisals to my statements above, especially the last statement,...

Bro not everyone have DBS and not everyone can open DBS and DBS charges for incoming wire feess something which Cimb sg does not.

The closest Malaysian can get without crossing the border is RHB multi currency account.

This post has been edited by Ramjade: Jun 20 2025, 03:06 PM

Dec 19 2024, 07:17 AM

Dec 19 2024, 07:17 AM

Quote

Quote

0.1532sec

0.1532sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled