QUOTE(epalbee3 @ Feb 4 2010, 12:40 AM)

TNA seems quite a volatile one..

small cap 3xETF..

oil price up, but ERX not up, may be got other energy factors?

Oil is leading indicator but ERX is energy play for Oil companies (XOM,CVX,OXY, etc).

ERX follows the Dow or S&P movement but mostly $RIENG (Russell 1000).

Use stop when dealing with 3x or buy in incremental small batches.

Good luck!

Update: 12:50amThe WTIC inventory report for Oil just came in.. up 2.3 million (bearish) in line with API the prior day,

Oil price rose earlier today in anticipation of lower inventory but Oil inventory grew instead since last week.

I see Oil could back down to $75-76 level in next two days but it may not last as gasoline inventory has dropped.

This will cause the upstream demand the following week, but I will remain cautious.

I will close out ERX if it drops below 38 at close (hopefully, it won't).

Added on February 4, 2010, 1:10 amQUOTE(David_Brent @ Feb 4 2010, 12:41 AM)

What is so ridiculous is stuff like this:

"US Stocks Fall As Pfizer Earnings Weigh On Health Care

NEW YORK (Dow Jones)--U.S. stocks fell Wednesday as health care stocks lagged after Pfizer posted a disappointing earnings outlook and U.S. service-sector activity increased by less than expected last month.

The Dow Jones Industrial Average recently dropped 39 points, or 0.4%, to 10255. Pfizer was its worst performer, off 2.6%, after posting earnings. The drug giant said its fourth-quarter profit more than doubled to $767 million, but the result lagged Wall Street estimates. It also scaled back 2012 revenue estimates and weighed on other health-care stocks, including Dow component Merck, down 2.3%. "So...we have the DJIA weakened (at the moment) because two of its bigger components fell 2.x%.

One of which posted more than doubled Q4 profit.

Madness - sheer madness

Anyone who relies on these indices for more than +/- 5% of their decision making serious needs their heads examined IMHO.

Yes, they are ridiculous. That's why, as trader, I tend to ignore most news.

It depends on your investment time horizon. On the longer trend, it is bullish. Short term, it is still a trader game play.

Remember, the market has short term memory.

Closing update:

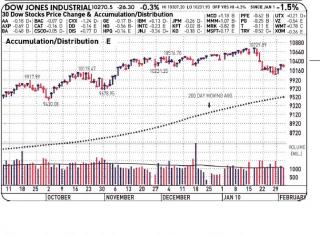

Closing update:Dow 10270.91

-26.30 -0.26%Nasdaq 2190.01

+0.85 +0.04%S&P 500 1097.28

-6.04 0.55%Just a small pullback. No biggie.

After hours: I'm glad to read my one my fav. tech stock CSCO reported great earnings!

Nasdaq will get a boost tonight.

This post has been edited by danmooncake: Feb 4 2010, 05:40 AM

Feb 4 2010, 12:08 AM

Feb 4 2010, 12:08 AM

Quote

Quote

0.0308sec

0.0308sec

0.64

0.64

6 queries

6 queries

GZIP Disabled

GZIP Disabled