QUOTE(ronnie @ Apr 22 2024, 02:53 PM)

That's why I don't have property. I refuse to sink in my hard earn money to see my ringgit drop some more.How much is your net worth?, gauging your financial performance.

How much is your net worth?, gauging your financial performance.

|

|

Apr 22 2024, 04:29 PM Apr 22 2024, 04:29 PM

|

All Stars

24,431 posts Joined: Feb 2011 |

|

|

|

|

|

|

Apr 22 2024, 04:36 PM Apr 22 2024, 04:36 PM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

Apr 22 2024, 04:46 PM Apr 22 2024, 04:46 PM

Show posts by this member only | IPv6 | Post

#2183

|

Junior Member

202 posts Joined: Nov 2015 |

QUOTE(Singh_Kalan @ Apr 22 2024, 03:17 PM) Investing in properties has alot of similarities with investing in stock. There are two component to look at, (1) capital appreciation / stock price gain and (2) rental / dividend. High rental/dividend will corellated to lower appreciation / stock price gain. At least this is true to most but not all and vice versa. actually no having owning both asset class. owning hard asset like property have a lot of hidden cost and in a way its not passive. u need to work renovation, find future tenant, lawyers, etc. The reward? its so small and high chance u will lose money. U are taking up a lot of risk.So just aiming for high rental to cover your installment is just short term view, ignoring the other component all together, which is a long term view. Your definition of correct way of investing property mostly apply to distress properties that has low resale value but command a high rental due to its location and maturity. Stock dividend i can literally sleep and take it. the real definition of passive cashflow This post has been edited by jyll92: Apr 22 2024, 04:47 PM Ramjade liked this post

|

|

|

Apr 22 2024, 04:47 PM Apr 22 2024, 04:47 PM

|

Senior Member

1,263 posts Joined: Oct 2016 |

QUOTE(ronnie @ Apr 22 2024, 04:36 PM) Interest paid by rental $$. if can cover the whole installment means house also paid by rental...I only pay other $$ such as quit rent,management fee etc....its a good deal to me....how bout the hassle to handle tenant? you can engage 3rd party to handle everything A to Z, but need pay for certain fees...so this is depends on the investor preference. if i dun buy the property, no rental, then no fully paid property after 30 years, equities = 0 if i buy the property, got rental, after 30 years fully paid, equities = Property market values 30 years later. Sell the property 30 years later, you got cash, or continue collect rent.... be it in MYR, rather then equities = 0 |

|

|

Apr 22 2024, 04:50 PM Apr 22 2024, 04:50 PM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(Rinth @ Apr 22 2024, 04:47 PM) Interest paid by rental $$. if can cover the whole installment means house also paid by rental...I only pay other $$ such as quit rent,management fee etc....its a good deal to me.... property will never be as liquid as equities, if you need to cash outhow bout the hassle to handle tenant? you can engage 3rd party to handle everything A to Z, but need pay for certain fees...so this is depends on the investor preference. if i dun buy the property, no rental, then no fully paid property after 30 years, equities = 0 if i buy the property, got rental, after 30 years fully paid, equities = Property market values 30 years later. Sell the property 30 years later, you got cash, or continue collect rent.... be it in MYR, rather then equities = 0 |

|

|

Apr 22 2024, 05:01 PM Apr 22 2024, 05:01 PM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(jyll92 @ Apr 22 2024, 04:46 PM) actually no having owning both asset class. owning hard asset like property have a lot of hidden cost and in a way its not passive. u need to work renovation, find future tenant, lawyers, etc. The reward? its so small and high chance u will lose money. U are taking up a lot of risk. i agree with you on this.... the "extra work" to maintain the property is not for layperson to do. Unless you have the passion like Sean Tan of iherngStock dividend i can literally sleep and take it. the real definition of passive cashflow Wedchar2912 liked this post

|

|

|

|

|

|

Apr 22 2024, 05:11 PM Apr 22 2024, 05:11 PM

|

Senior Member

1,263 posts Joined: Oct 2016 |

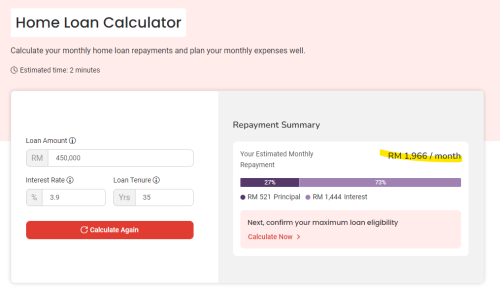

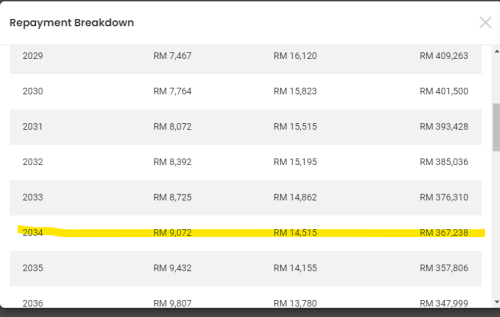

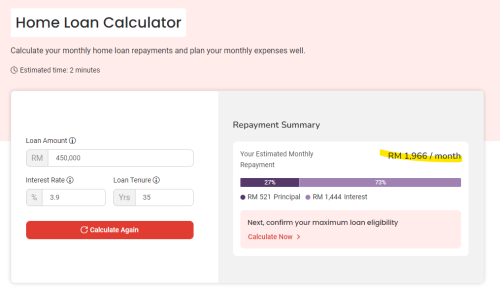

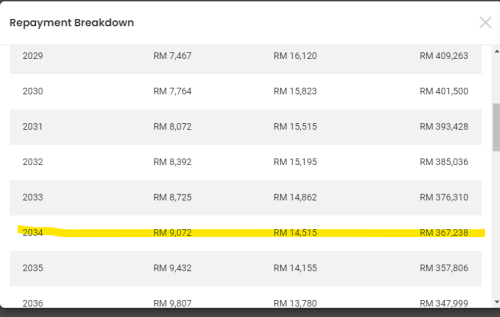

QUOTE(jyll92 @ Apr 22 2024, 04:46 PM) actually no having owning both asset class. owning hard asset like property have a lot of hidden cost and in a way its not passive. u need to work renovation, find future tenant, lawyers, etc. The reward? its so small and high chance u will lose money. U are taking up a lot of risk. Maybank stock, 10 years history, Stock dividend i can literally sleep and take it. the real definition of passive cashflow average dividend yield = 6% Maybank price 2014 , RM 9.80 vs 2024 (Now) RM 9.75 = 0% appreciation if i got RM 50k downpayment to purchase properties(worth RM 500k, loan 450k 3.9% interest) vs buy maybank stock , rental cover installment = Yield 4.7%. Property price RM 500k (0% appreciation, balance loan RM 367k , Equities = RM 133k) vs Maybank Stock + dividend 6% CAGR 10 years = RM 84k so conclusion, property with 4.7% yield Equities build RM 133k > maybank stock 6% yield Equities RM 84k..... Ok next question is can the property price sell at 500k? how bout other cost quit rent insurance chase tenant payment etc etc...... if RM 133k vs RM 84k, i will rather busy chasing tenant and make payment for quit rent insrance etc etc... About sleep and take it, how many ppl really buy stock and ignore it for 5 10 15 20 25 30 years? yes if u buy bluechips banking stock maybe can...other stock how? buy and close eyes i dapao u bleed till dead.... This post has been edited by Rinth: Apr 22 2024, 05:51 PM |

|

|

Apr 22 2024, 05:18 PM Apr 22 2024, 05:18 PM

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Rinth @ Apr 22 2024, 04:47 PM) Interest paid by rental $$. if can cover the whole installment means house also paid by rental...I only pay other $$ such as quit rent,management fee etc....its a good deal to me.... Er. Not everyone that lucky. I got one friend for 3 property, telling me she is net negative. Tenant rent cannot even cover the loan payment. She needs to fork out own money.how bout the hassle to handle tenant? you can engage 3rd party to handle everything A to Z, but need pay for certain fees...so this is depends on the investor preference. if i dun buy the property, no rental, then no fully paid property after 30 years, equities = 0 if i buy the property, got rental, after 30 years fully paid, equities = Property market values 30 years later. Sell the property 30 years later, you got cash, or continue collect rent.... be it in MYR, rather then equities = 0 QUOTE(Rinth @ Apr 22 2024, 05:11 PM) Maybank stock, 10 years history, Some stocks can close eye. Just keep an eye on their earnings. I am talking overseas stocks Vs Malaysia based.average dividend yield = 6% Maybank price 2014 , RM 9.80 vs 2024 (Now) RM 9.75 = 0% appreciation if i got RM 50k downpayment to purchase properties(worth RM 500k, loan 450k 4% interest) vs buy maybank stock , rental cover installment = Yield 4.7%. Property price RM 500k (0% appreciation, balance loan RM 367k , Equities = RM 133k) vs Maybank Stock + dividend 6% CAGR 10 years = RM 84k so conclusion, property with 4.7% yield Equities build RM 133k > maybank stock 6% yield Equities RM 84k..... Ok next question is can the property price sell at 500k? how bout other cost quit rent insurance chase tenant payment etc etc...... if RM 133k vs RM 84k, i will rather busy chasing tenant and make payment for quit rent insrance etc etc... About sleep and take it, how many ppl really buy stock and ignore it for 5 10 15 20 25 30 years? yes if u buy bluechips banking stock maybe can...other stock how? buy and close eyes i dapao u bleed till dead.... |

|

|

Apr 22 2024, 05:25 PM Apr 22 2024, 05:25 PM

|

Senior Member

1,263 posts Joined: Oct 2016 |

QUOTE(Ramjade @ Apr 22 2024, 05:18 PM) Er. Not everyone that lucky. I got one friend for 3 property, telling me she is net negative. Tenant rent cannot even cover the loan payment. She needs to fork out own money. Same rules mah......not everyone that lucky with stock.....i myself burned close to 6 digit liao....can downpayment 2 Rm500k properties liao..... choose wrong stock = choose wrong properties....Some stocks can close eye. Just keep an eye on their earnings. I am talking overseas stocks Vs Malaysia based. Indeed if talk about overseas, i no comment lah.....not that i dun agree on investing overseas, but i rather close eye investing in properties than investing and earn more in overseas stock.... I need to focus on my daily job..... i will still invest in stock in future, but really on blue chips dividend stock only.....others growth stock property stock whatsover that not giving decent Dividend i wont touch anymore... This post has been edited by Rinth: Apr 22 2024, 05:25 PM |

|

|

Apr 22 2024, 05:28 PM Apr 22 2024, 05:28 PM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(Rinth @ Apr 22 2024, 05:11 PM) Maybank stock, 10 years history, why don't you compare your own property to give a better example against bluechip stocks at the same time.average dividend yield = 6% Maybank price 2014 , RM 9.80 vs 2024 (Now) RM 9.75 = 0% appreciation if i got RM 50k downpayment to purchase properties(worth RM 500k, loan 450k 4% interest) vs buy maybank stock , rental cover installment = Yield 4.7%. Property price RM 500k (0% appreciation, balance loan RM 367k , Equities = RM 133k) vs Maybank Stock + dividend 6% CAGR 10 years = RM 84k so conclusion, property with 4.7% yield Equities build RM 133k > maybank stock 6% yield Equities RM 84k..... Ok next question is can the property price sell at 500k? how bout other cost quit rent insurance chase tenant payment etc etc...... if RM 133k vs RM 84k, i will rather busy chasing tenant and make payment for quit rent insrance etc etc... About sleep and take it, how many ppl really buy stock and ignore it for 5 10 15 20 25 30 years? yes if u buy bluechips banking stock maybe can...other stock how? buy and close eyes i dapao u bleed till dead.... S&P Agreement date = price stocks of MBB how can 4.7% yield beats 6% yield ? ??? This post has been edited by ronnie: Apr 22 2024, 05:31 PM |

|

|

Apr 22 2024, 05:28 PM Apr 22 2024, 05:28 PM

Show posts by this member only | IPv6 | Post

#2191

|

Junior Member

202 posts Joined: Nov 2015 |

QUOTE(Rinth @ Apr 22 2024, 05:11 PM) Maybank stock, 10 years history, I used your 4.7% yield as an example it translate to RM28.2K/year Not sure how u get 133k. Your Loan will be approximately 25.2k (im using average loan 4.25% based on 450k). Maintenance? Cukai Tanah? Cukai Pintu? Renovation? Your cashflow is 3k/Year and u havent deduct so many things. and u already paid up up front capital of 50k.average dividend yield = 6% Maybank price 2014 , RM 9.80 vs 2024 (Now) RM 9.75 = 0% appreciation if i got RM 50k downpayment to purchase properties(worth RM 500k, loan 450k 4% interest) vs buy maybank stock , rental cover installment = Yield 4.7%. Property price RM 500k (0% appreciation, balance loan RM 367k , Equities = RM 133k) vs Maybank Stock + dividend 6% CAGR 10 years = RM 84k so conclusion, property with 4.7% yield Equities build RM 133k > maybank stock 6% yield Equities RM 84k..... Ok next question is can the property price sell at 500k? how bout other cost quit rent insurance chase tenant payment etc etc...... if RM 133k vs RM 84k, i will rather busy chasing tenant and make payment for quit rent insrance etc etc... About sleep and take it, how many ppl really buy stock and ignore it for 5 10 15 20 25 30 years? yes if u buy bluechips banking stock maybe can...other stock how? buy and close eyes i dapao u bleed till dead.... Lets use maybank as example. I take a business loan at 4.25% for 35 years. Yield 6% 0 upfront capital. 500k x 0.06% = 30k. 30K-25.2K = 4.8K nett free cash flow i dont have to do anything. Over time the difference will compound. The trick to growing wealth is having free cash flow and reinvest it overtime it will compound. Yes your property will increase in price but you are likely suffering from negative cashflow over time. Factor in periods where there are no tenants, damaged item, cukai, renovation, etc many more. Is the risk justifiable? This post has been edited by jyll92: Apr 22 2024, 05:29 PM Ramjade liked this post

|

|

|

Apr 22 2024, 05:30 PM Apr 22 2024, 05:30 PM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

QUOTE(jyll92 @ Apr 22 2024, 05:28 PM) I used your 4.7% yield as an example it translate to RM28.2K/year Not sure how u get 133k. Your Loan will be approximately 25.2k (im using average loan 4.25% based on 450k). Maintenance? Cukai Tanah? Cukai Pintu? Renovation? Your cashflow is 3k/Year and u havent deduct so many things. and u already paid up up front capital of 50k. exactly what i wanted to say.... Lets use maybank as example. I take a business loan at 4.25% for 35 years. Yield 6% 0 upfront capital. 500k x 0.06% = 30k. 30K-25.2K = 4.8K nett free cash flow i dont have to do anything. Over time the difference will compound. The trick to growing wealth is having free cash flow and reinvest it overtime it will compound. Yes your property will increase in price but you are likely suffering from negative cashflow over time. Factor in periods where there are no tenants, damaged item, cukai, renovation, etc many more. Property is all about location, location, location Ramjade liked this post

|

|

|

Apr 22 2024, 05:37 PM Apr 22 2024, 05:37 PM

|

Senior Member

1,263 posts Joined: Oct 2016 |

QUOTE(ronnie @ Apr 22 2024, 05:28 PM) why don't you compare your own property to give a better example against bluechip stocks at the same time. Yep, notice or not the RM 500k property market value and the 10% RM 50k illustration....i'm not talking about those rebates markup nonsense. I'm illustrating using real market price & paying 10% RM 50k..S&P Agreement date = price stocks of MBB My own properties i also use nett price, i dun look at SPA price. The same property illustrated above can be SPA price 700k but i still treat it as selling at market value 500k mah... |

|

|

|

|

|

Apr 22 2024, 05:43 PM Apr 22 2024, 05:43 PM

|

Senior Member

1,263 posts Joined: Oct 2016 |

QUOTE(jyll92 @ Apr 22 2024, 05:28 PM) I used your 4.7% yield as an example it translate to RM28.2K/year Not sure how u get 133k. Your Loan will be approximately 25.2k (im using average loan 4.25% based on 450k). Maintenance? Cukai Tanah? Cukai Pintu? Renovation? Your cashflow is 3k/Year and u havent deduct so many things. and u already paid up up front capital of 50k. sorry i used 3.9% interest lol i cheated...nah i typo not 4% haha..Lets use maybank as example. I take a business loan at 4.25% for 35 years. Yield 6% 0 upfront capital. 500k x 0.06% = 30k. 30K-25.2K = 4.8K nett free cash flow i dont have to do anything. Over time the difference will compound. The trick to growing wealth is having free cash flow and reinvest it overtime it will compound. Yes your property will increase in price but you are likely suffering from negative cashflow over time. Factor in periods where there are no tenants, damaged item, cukai, renovation, etc many more. Is the risk justifiable? property price remain 500k 10 years later loan balance RM 367k, hence RM 133k   about business loan, where your collateral? what is the opportunity cost for the collateral? if pure business loan interest rate BLR +% effective 7-8% hor... |

|

|

Apr 22 2024, 05:46 PM Apr 22 2024, 05:46 PM

|

Senior Member

1,263 posts Joined: Oct 2016 |

QUOTE(ronnie @ Apr 22 2024, 05:28 PM) why don't you compare your own property to give a better example against bluechip stocks at the same time. Because u borrow banks 90% money mah...bigger quantum.... S&P Agreement date = price stocks of MBB how can 4.7% yield beats 6% yield ? ??? wongmunkeong liked this post

|

|

|

Apr 22 2024, 05:57 PM Apr 22 2024, 05:57 PM

|

Junior Member

202 posts Joined: Nov 2015 |

QUOTE(Rinth @ Apr 22 2024, 05:43 PM) sorry i used 3.9% interest lol i cheated...nah i typo not 4% haha.. My stock portfolio is my collateral, company and I have property. Bank is not dumb they won't simply give out loansproperty price remain 500k 10 years later loan balance RM 367k, hence RM 133k   about business loan, where your collateral? what is the opportunity cost for the collateral? if pure business loan interest rate BLR +% effective 7-8% hor... This post has been edited by jyll92: Apr 22 2024, 05:58 PM |

|

|

Apr 22 2024, 05:59 PM Apr 22 2024, 05:59 PM

|

Senior Member

1,263 posts Joined: Oct 2016 |

QUOTE(jyll92 @ Apr 22 2024, 05:57 PM) wtf u play more cheat then me.....i take your stock portfolio and borrow more to buy more property lo like this =.=...... Serious note is your business loan 500k 4.25% calculation doesnt work because u shud use 7-8% to calculate........ |

|

|

Apr 22 2024, 06:00 PM Apr 22 2024, 06:00 PM

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

everyone has their own investment philosophy... not right nor wrong. but it's good to have healthy debate on it.

for newbies to evaluate For me : 1. property investment = having good debts 2. stock investment = having no debts, but better cash flow and liquidity. When an emergency hits you, (1) will be slow to liquidate at a good price. (1) if a tenant dies in there.... there goes your "property value" This post has been edited by ronnie: Apr 22 2024, 06:02 PM |

|

|

Apr 22 2024, 06:01 PM Apr 22 2024, 06:01 PM

|

All Stars

24,431 posts Joined: Feb 2011 |

QUOTE(Rinth @ Apr 22 2024, 05:59 PM) wtf u play more cheat then me..... Haiyaa. Whatever floats your boat. If you feel property good, good for you. For me I like less hassle and pay less tax. Everything online. Make my life easier.i take your stock portfolio and borrow more to buy more property lo like this =.=...... Serious note is your business loan 500k 4.25% calculation doesnt work because u shud use 7-8% to calculate........ |

|

|

Apr 22 2024, 06:02 PM Apr 22 2024, 06:02 PM

|

Junior Member

202 posts Joined: Nov 2015 |

QUOTE(Rinth @ Apr 22 2024, 05:59 PM) wtf u play more cheat then me..... I actually have long term loan at 4% I won't share u in detail. What I can say if you are bankable u have a lot of competitive edge. And this is just one I have credit line in my trading accounti take your stock portfolio and borrow more to buy more property lo like this =.=...... Serious note is your business loan 500k 4.25% calculation doesnt work because u shud use 7-8% to calculate........ |

| Change to: |  0.0168sec 0.0168sec

0.43 0.43

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 06:49 PM |