Hi guys. After discussing with Cherroy, I have decided to do a noob guide for our stock market section. As I’m just a baby ikan bilis in stocks and I'm not in the financial field, would appreciate it if you guys could help me out.

My plan is to make it as simple as possible, and cover common issues that are FREQUENTLY asked.

Index

Part 1 - T+3

Part 2 - Dividends

Part 3 - Commissions & brokerage fees

Part 4 - Taxes and stocks/dividend

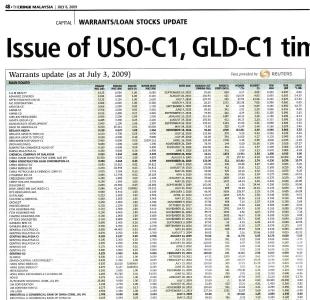

Part 5 - Warrants - The confusion, the headache and the frustration

Part 6 - Warrants - How and when to trade warrants?

Part 7 - Rights Issue

Post #5 - Trading accounts

Post #6 - Can I ask when is the best time to buy stocks or the TP for a stock?

Post #7 - etc

Post #10 and above – for noob to ask questions (including me!!!!)

Going to start off with T+3 first. Please help or give opinion. No spamming please.

Note : Let me draft out the rough outline on T+3 first then you guys can comment/help/give opinion. Thx!

This post has been edited by kmarc: Mar 30 2011, 09:18 PM

May 23 2009, 09:14 PM, updated 15y ago

May 23 2009, 09:14 PM, updated 15y ago Quote

Quote

0.1037sec

0.1037sec

1.03

1.03

6 queries

6 queries

GZIP Disabled

GZIP Disabled