QUOTE(koja6049 @ Nov 4 2021, 07:58 PM)

a CEO "indulge in stock market" vs a CEO buying his own company shares are two very different things. The motivations are very different.

for the record, all the big 4 glove companies have made stock buybacks, just to varying degrees

Let me paste some of my comments from last year.... you be the judge... for the record, all the big 4 glove companies have made stock buybacks, just to varying degrees

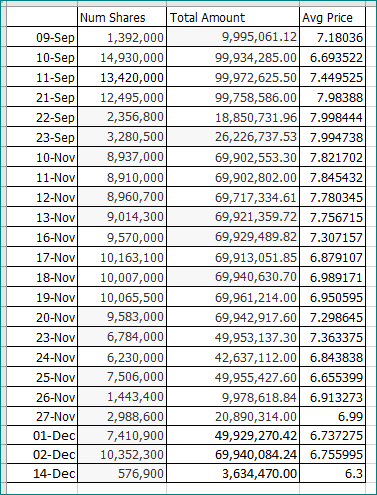

11 Sep.. this day was way too drastic!!

The trading detail of Top Glove on that day..

Open price 6.45

high 8.03

Close 7.76

That was a great day for Top Glove shares.

On that day, Top Glove bought back 13,420,000 shares valued at 99.972 million.

Price range of the buyback = 6.2 to 8.00

Source: https://www.bursamalaysia.com/market_inform...?ann_id=3087742

Is there a reason why Top Glove share buyback to be so aggressive that the price bought back ranged from 6.20 to 8.00?

Nov 4 2021, 08:10 PM

Nov 4 2021, 08:10 PM

Quote

Quote

0.0260sec

0.0260sec

0.41

0.41

6 queries

6 queries

GZIP Disabled

GZIP Disabled