QUOTE(mofadz @ Mar 19 2011, 09:46 AM)

BIMB - Strong Buy!

BIMB - Strong Buy!

|

|

Mar 19 2011, 01:29 PM Mar 19 2011, 01:29 PM

|

Senior Member

3,807 posts Joined: Jan 2006 |

|

|

|

|

|

|

Mar 19 2011, 01:47 PM Mar 19 2011, 01:47 PM

|

Senior Member

3,807 posts Joined: Jan 2006 |

Dato' Zamani Abdul Ghani Yang Berbahagia Dato’ Zamani Abdul Ghani Chairman of Bank Islam Malaysia Berhad Master’s degree in Management from the Asian Institute of Management, Manila, the Philippines and a Bachelor degree in Economics (Analytical) from the University of Malaya, Kuala Lumpur. Y.Bhg. Dato’ Zamani Abdul Ghani has been appointed as Chairman of Bank Islam effective 1 March 2011. He was, until 15 November 2010, a Deputy Governor of Bank Negara Malaysia and a member of its Board of Directors since 2004. He was Special Advisor in Bank Negara Malaysia (BNM) prior to his appointment to Bank Islam. Dato’ Zamani Abdul Ghani oversaw then various departments in the Bank responsible for the regulation and supervision of financial institutions, units combating abuses in and of the financial system as well as the Bank’s corporate, personnel, property, security and related services. The financial services he oversaw include both conventional and Islamic banks, insurance entities and development financial institutions. Dato’ Zamani started his career in the Bank early in 1971 and has served in a number of different capacities and departments. He was first attached with the Economics Department before being promoted as a Deputy Director in the Treasury Operations Department and later as Director of the Bank Regulation Department. He then headed the Bank’s representative offices in London and New York between 1986 and 1989 and was then appointed as the Director of both the Insurance Regulation and Insurance Inspection Departments. Dato’ Zamani was promoted as an Assistant Governor in 1995 and served as an Executive Director in the International Monetary Fund (IMF) between 1996 and 1998. He was also, between 1998 and 1999, the Director General of the Labuan Offshore Financial Services Authority (LOFSA), now known as the Labuan Financial Services Authority (LabuanFSA). Dato’ Zamani was the Chairman of the Credit Guarantee Corporation and Danamodal Nasional Berhad, both since 2004 until recently. He was a Commissioner for the Securities Commission of Malaysia between 2000 and 2004 and a member of the Board of Directors, Lembaga Tabung Haji between 2004 and 2008. He represented Malaysia, between 2006 and 2010, as the Asia Chair in the Egmont Committee, the policy setting body of the Egmont Group of international financial intelligence units (FIUs). He is a Fellow Member of the Malaysia Institute of Bankers. Dato’ Zamani was also involved with the International Centre for Education in Islamic Finance (INCEIF), and was a member of the Governing Council and the Executive Committee of INCEIF. He was a Trustee of the INCEIF Trust Fund, the IBBM Staff Training Fund and the International Centre for Leadership in Finance (ICLIF) Trust Fund. This post has been edited by monkeyking: Mar 19 2011, 01:52 PM Attached image(s)  |

|

|

Mar 19 2011, 02:23 PM Mar 19 2011, 02:23 PM

|

Senior Member

3,807 posts Joined: Jan 2006 |

Attached File(s)  5Q2010.pdf ( 279.03k )

Number of downloads: 4

5Q2010.pdf ( 279.03k )

Number of downloads: 4 6Q2010.pdf ( 279.97k )

Number of downloads: 8

6Q2010.pdf ( 279.97k )

Number of downloads: 8 15_months_ended_30_September_2010.pdf ( 457.01k )

Number of downloads: 7

15_months_ended_30_September_2010.pdf ( 457.01k )

Number of downloads: 7 bimb.pdf ( 124.18k )

Number of downloads: 16

bimb.pdf ( 124.18k )

Number of downloads: 16 MD_Operations_Review_09.pdf ( 621.77k )

Number of downloads: 5

MD_Operations_Review_09.pdf ( 621.77k )

Number of downloads: 5 risk_managing_in_islamic_financial_institutions.pdf ( 1011.8k )

Number of downloads: 7

risk_managing_in_islamic_financial_institutions.pdf ( 1011.8k )

Number of downloads: 7 Update_Report___110223___BIMB.pdf ( 313.82k )

Number of downloads: 22

Update_Report___110223___BIMB.pdf ( 313.82k )

Number of downloads: 22 |

|

|

Mar 21 2011, 05:16 PM Mar 21 2011, 05:16 PM

|

Senior Member

3,807 posts Joined: Jan 2006 |

KUALA LUMPUR: Bank Islam Malaysia Bhd is aiming to issue 50,000 new credit cards this year but expects competition for new customers to intensify among banks particularly for existing credit card holders. Its general manager of consumer banking, Khairul Kamarudin said on Monday, March 21 the bank has about 500,000 credit cards issued and conceded the 10% growth target could be an uphill task following the increase in service tax to 6% from this year and the central bank's move to tighten the rules . Speaking to reporters after launching Bank Islam's "Debit = Myvi" campaign, Khairul said competition for credit card customers is set to intensify among the banks particularly for existing credit card holders. Last Friday, March 18, BNM raised the minimum income requirement for new card holders to RM24,000 per annum from RM18,000 a year. The central bank also limited the maximum credit limit for card holders earning RM36,000 a year or less to two times their monthly income of card holder per issuer. However, Khairul added: "Other considerations related to creditworthiness remain intact. We didn't expect this to happen but we have planned ahead and we are offering debit cards to customers that are not eligible for credit cards". Khairul also said Bank Islam was targeting issuance of 500,000 debit cards by this year and had issued almost 27,000 debit cards during the campaign's soft launch in the last three weeks. "There is demand for convenience with debit cards and we just want to ride on it," he added. |

|

|

Mar 21 2011, 05:22 PM Mar 21 2011, 05:22 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

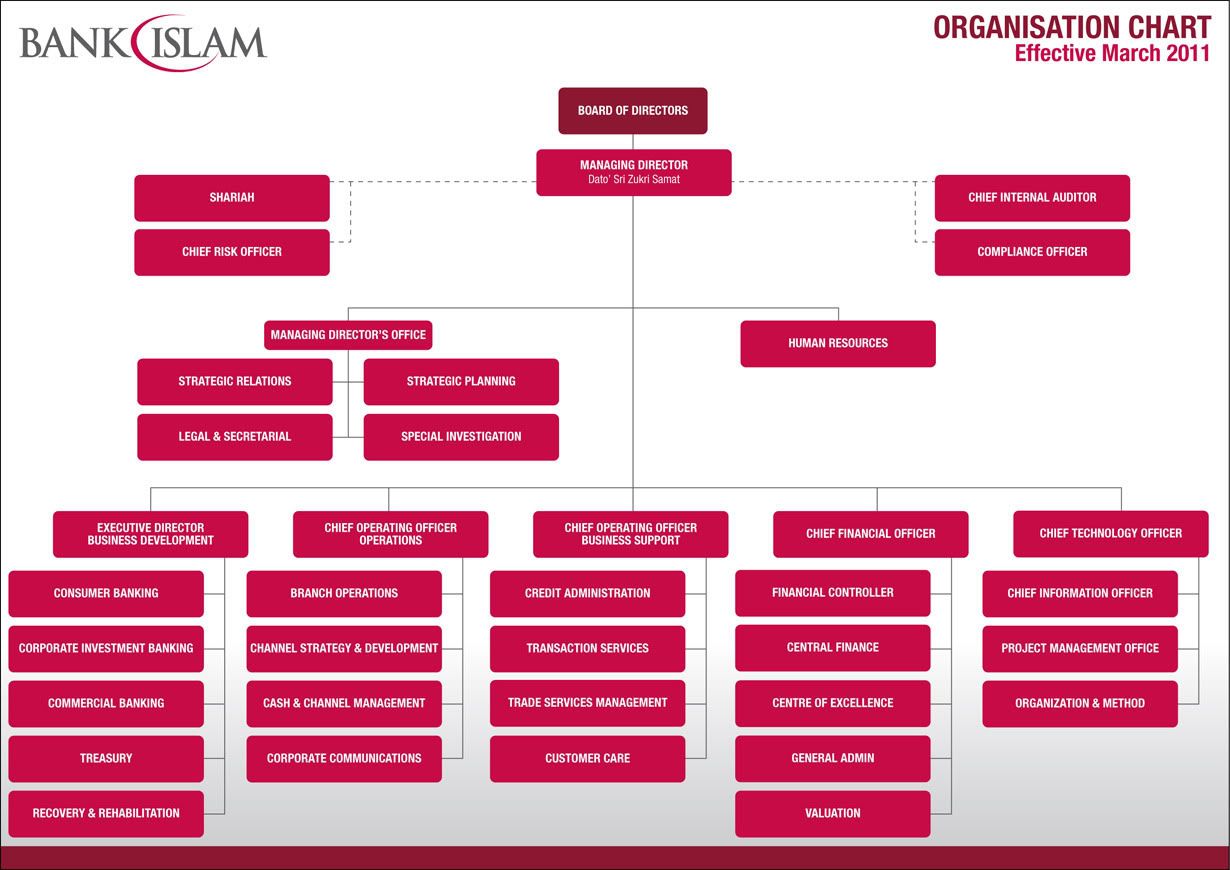

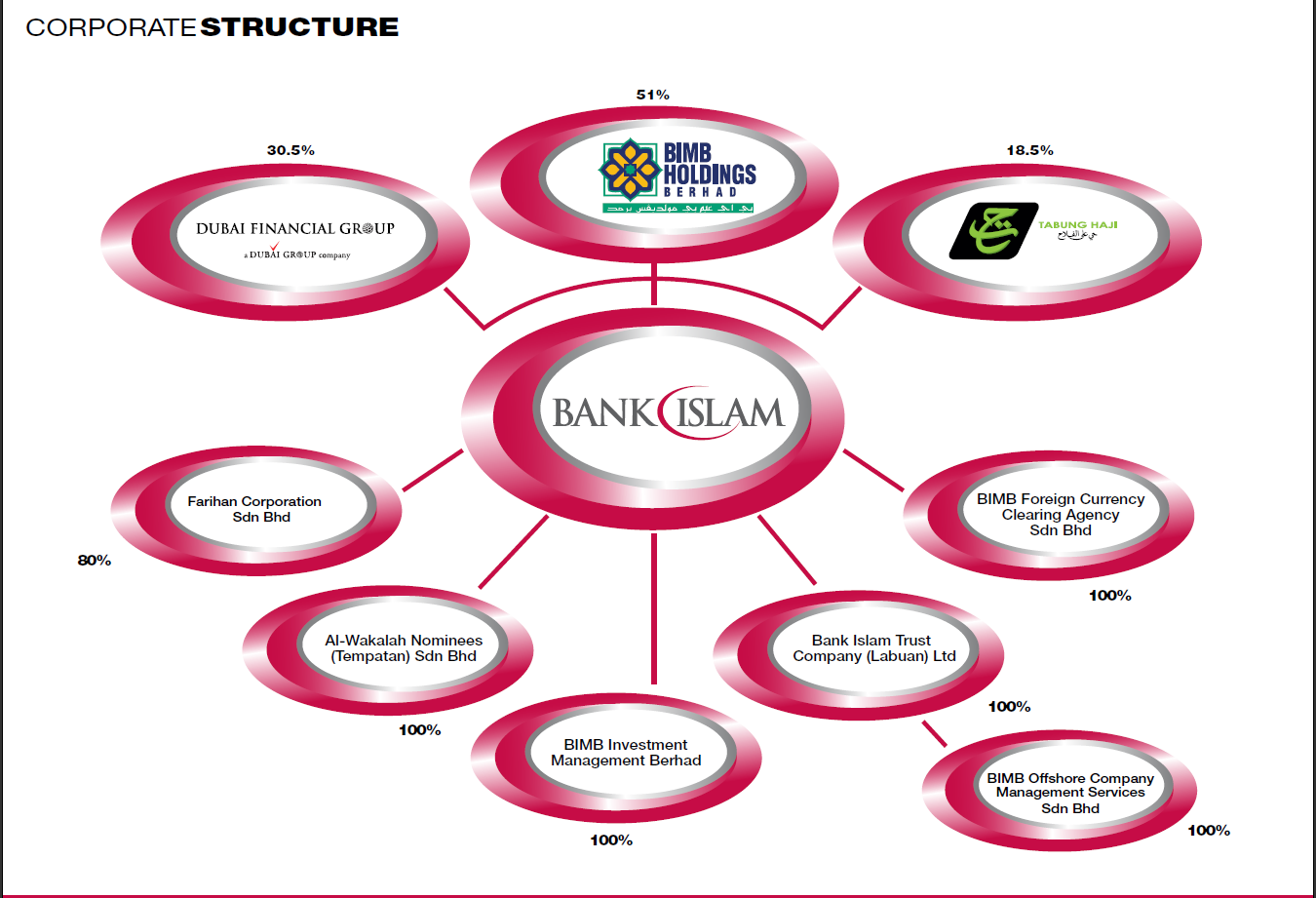

Nice information on the corporate structure.

Should be flying soon !!! |

|

|

Mar 21 2011, 05:32 PM Mar 21 2011, 05:32 PM

|

Senior Member

3,807 posts Joined: Jan 2006 |

|

|

|

|

|

|

Mar 21 2011, 06:16 PM Mar 21 2011, 06:16 PM

|

Senior Member

28,187 posts Joined: Mar 2007 From: Underworld |

QUOTE(monkeyking @ Mar 21 2011, 05:32 PM)        Suddenly feel that money is not enough to invest everything.. Now everything is like so good.. Hahaha |

|

|

Mar 21 2011, 06:57 PM Mar 21 2011, 06:57 PM

|

Senior Member

3,807 posts Joined: Jan 2006 |

QUOTE(Bonescythe @ Mar 21 2011, 07:16 PM) Time to check in and top up Suddenly feel that money is not enough to invest everything.. Now everything is like so good.. Hahaha         |

|

|

Mar 21 2011, 07:39 PM Mar 21 2011, 07:39 PM

|

Senior Member

3,807 posts Joined: Jan 2006 |

1. First Najib & the Malaysian government said it wants to make Malaysia the Islamic Banking hub of Asia. 2. Then push a few excellent bankers to BIMB......example ex-deputy Governor of Bank Negara as well as Public Bank's Director of Deposit and Channel Management with 25 years of banking experience.....all this is to give credibility to BIMB. 3. Announce & proposed a coming 4.75 cents dividend which is the 1st time BIMB is giving such a big amount compared to previous yearly dividend of 1.5 cents......to give some hope to shareholders & to look forward to future income. 4. Then to set up a Islamic Bank in Sri Lanka which is to be launch in a few months time. Be a taikoh in another Islamic Bank in Bangladesh as well as to take a major stake in Indonesia's Bank Maalumat.....temporary setback as some one try to potong jalan.......so another big pow pow will be held with the Bank Maalumat major shareholders.........yes, spreading it's wings overseas to generate more profit & income for BIMB. 5. Thereafter, the 1st time to be an IPO underwriters albeit a small one.......more to come perhaps with some push by the government. 6. Then to launch 2 UNIT TRUST FUNDS...total $500 million. 7. Now to promote and get 50k new credit cards customers. 8. More to come soon....now you all fill this up. Cheers to all......much love & happy investing too.   This post has been edited by monkeyking: Mar 21 2011, 07:46 PM |

|

|

Mar 21 2011, 07:55 PM Mar 21 2011, 07:55 PM

|

Junior Member

462 posts Joined: Feb 2007 |

cheapest banking and with lots of potential.

|

|

|

Mar 22 2011, 10:05 AM Mar 22 2011, 10:05 AM

|

Senior Member

3,928 posts Joined: Oct 2009 |

finally get my osk account approved yesterday. may i ask isit a good time to buy in some of the BIMB now?

|

|

|

Mar 22 2011, 11:41 AM Mar 22 2011, 11:41 AM

|

Senior Member

2,526 posts Joined: Feb 2011 |

Hi i hope so, i entered at 1.3x level and now on paper profit liao

I have confidence lah.. Else hard to wait it to drop to 1.2x level now. Maybe u can see the trend for a couple of days as it started going steady since 2 days ago only. |

|

|

Mar 22 2011, 11:56 AM Mar 22 2011, 11:56 AM

|

Senior Member

8,510 posts Joined: Dec 2004 From: KayEL |

Considering BIMB only when it crossed 1.50. Now still in yo-yo.

|

|

|

|

|

|

Mar 22 2011, 09:06 PM Mar 22 2011, 09:06 PM

|

Senior Member

5,587 posts Joined: May 2007 From: KL |

Bank Islam(BIMB subsidiary) going to up its stake to 20% in Sri Lanka Bank

Bank Islam kuasai bank Sri Lanka BANGUNAN Ibu pejabat Bank Islam di Jalan Dungun, Kuala Lumpur. -------------------------------------------------------------------------------- KUALA LUMPUR 21 Mac – Bank Islam (M) Bhd. (Bank Islam) bakal muncul sebagai pemegang saham utama dalam Amana Bank Ltd. (ABL) berikutan cadangannya meningkatkan pegangan dalam institusi perbankan yang berpusat di Sri Langka. Perjanjian pembelian ekuiti dalam ABL yang akan menyaksikan pegangannya meningkat kepada 20 peratus dijangka termeterai dalam tempoh dua minggu lagi, sumber industri memberitahu Utusan Malaysia di sini. Pengarah Urusan Bank Islam, Datuk Seri Zukri Samat ketika ditemui baru-baru ini enggan memberikan sebarang ulasan. Sebaliknya beliau berkata: ‘Anda tunggu sahaja dalam tempoh terdekat ini atau sebelum April, kita akan panggil media nanti’’. Bank Islam yang kini mempunyai 12 peratus kepentingan dalam ABL dijangka meningkatkan sebanyak lapan peratus lagi menjadikan kesemua 20 peratus. Bagaimana, nilai kepentingan itu tidak diketahui. Selain Bank Islam, kepentingan ABL turut dikuasai oleh AB Bank Bangladesh sebanyak 15 peratus dan Islamic Development Bank Arab Saudi dan Akbar Brothers, masing-masing menguasai 10 peratus. Sumber industri berkata, pembelian itu diramal meletakkan Bank Islam pada kedudukan terbaik untuk mengukuhkan namanya di rantau ini dan pasaran-pasaran berhampiran. ABL yang sebelum ini dikenali sebagai Amana Investments Limited ditubuhkan pada 1997, merupakan bank komersial pertama di Sri Lanka yang menjalankan operasi perniagaannya mengikut prinsip perbankan Islam. Bank itu yang dianggap sebagai trendsetter dalam sektor perkhidmatan kewangan Sri Lanka menguasai dalam hampir semua produknya termasuk perbankan Islam, kewangan, sewa dan industri takaful. ABL yang beroperasi di ibu pejabatnya di Colombo kini memiliki kini 11 buah cawangan. Sumber berkata, penguasaan Bank Islam itu adalah tepat pada masanya kerana ia menepati rancangannya untuk mengembangkan operasi bank Islam pertama negara itu, selain meningkatkan nilai pemegang sahamnya. Sementara itu, Utusan Malaysia difahamkan Bank Islam juga aktif mengintai pasaran berhampiran negara namun masih belum ada kata putus. Sebelum ini, Bank Islam dikatakan telah mengadakan perbincangan untuk mengambil alih PT Bank Muamalat, antara bank Islam terbesar di Indonesia. Bank Islam dimiliki oleh BIMB Holdings Bhd dengan memiliki 51 peratus kepentingan dan Lembaga Tabung Haji pula sembilan peratus. Manakala baki 40 peratus lagi dimiliki Dubai Financial Group LLC, syarikat pegangan pelaburan yang dikuasai oleh pemerintah Dubai. |

|

|

Mar 23 2011, 01:36 AM Mar 23 2011, 01:36 AM

|

Senior Member

3,807 posts Joined: Jan 2006 |

QUOTE(sharesa @ Mar 22 2011, 10:06 PM) Bank Islam(BIMB subsidiary) going to up its stake to 20% in Sri Lanka Bank Bank Islam kuasai bank Sri Lanka BANGUNAN Ibu pejabat Bank Islam di Jalan Dungun, Kuala Lumpur. » Click to show Spoiler - click again to hide... «   QUOTE KUALA LUMPUR, March 21 - Bank Islam (M) Bhd. (Bank Islam) will emerge as a major shareholder in Bank Ltd Amana. (ABL) as a proposal to increase its stake in banking institutions based in Sri Lanka. Equity purchase agreement in the ABL to be seen to increase to 20 per cent stake is expected to signed in the next two weeks, industry sources told The Star here. Bank Islam managing director Datuk Seri Zukri Samat when met recently refused to give any comment. Instead, he said: 'You just wait in the near future or before April, we will later call''the media. Islamic Bank currently has a 12 percent stake in the ABL is expected to increase by eight per cent more to make all 20 percent. How, the importance is not known. Apart from Bank Islam, the importance of the ABL is also controlled by the Bangladesh Bank AB by 15 percent and the Islamic Development Bank in Saudi Arabia and Akbar Brothers, each capture 10 percent. Industry sources said the purchase is expected to put the Bank in the best position to establish its name in the region and markets nearby. ABL formerly known as the Amana Investments Limited was established in 1997, is the first commercial bank in Sri Lanka which operates its business according to Islamic principles. The bank is regarded as a trendsetter in the financial services sector in Sri Lanka dominated in almost all products, including Islamic banking, finance, lease and takaful industry. ABL is in operation at its headquarters in Colombo today has now 11 branches. Sources said, the acquisition of Bank Islam is timely as it meets its plan to expand the country's first Islamic bank, in addition to increasing shareholder value. Meanwhile, the New Straits Times understands Islamic Bank also actively markets lurking near the country but still not have the final say. Previously, Bank Islam said to have held talks to acquire PT Bank, the largest Islamic bank in Indonesia. Islamic banks are owned by Holdings Holdings Bhd with a 51 percent stake and the Fund Board was nine percent. While the remaining 40 percent is owned by Dubai Financial Group LLC, an investment holding company controlled by the government of Dubai.  |

|

|

Mar 23 2011, 08:02 AM Mar 23 2011, 08:02 AM

|

Senior Member

5,587 posts Joined: May 2007 From: KL |

QUOTE(monkeyking @ Mar 23 2011, 01:36 AM) [/spoiler] thank you for translating to other forummers, Monkeyking    BIMB is aggresively expanding its networks and services |

|

|

Mar 23 2011, 08:12 AM Mar 23 2011, 08:12 AM

|

Junior Member

193 posts Joined: May 2008 |

QUOTE(sharesa @ Mar 22 2011, 09:06 PM) Bank Islam(BIMB subsidiary) going to up its stake to 20% in Sri Lanka Bank Bank Islam kuasai bank Sri Lanka BANGUNAN Ibu pejabat Bank Islam di Jalan Dungun, Kuala Lumpur. -------------------------------------------------------------------------------- KUALA LUMPUR 21 Mac – Bank Islam (M) Bhd. (Bank Islam) bakal muncul sebagai pemegang saham utama dalam Amana Bank Ltd. (ABL) berikutan cadangannya meningkatkan pegangan dalam institusi perbankan yang berpusat di Sri Langka. Perjanjian pembelian ekuiti dalam ABL yang akan menyaksikan pegangannya meningkat kepada 20 peratus dijangka termeterai dalam tempoh dua minggu lagi, sumber industri memberitahu Utusan Malaysia di sini. Pengarah Urusan Bank Islam, Datuk Seri Zukri Samat ketika ditemui baru-baru ini enggan memberikan sebarang ulasan. Sebaliknya beliau berkata: ‘Anda tunggu sahaja dalam tempoh terdekat ini atau sebelum April, kita akan panggil media nanti’’. Bank Islam yang kini mempunyai 12 peratus kepentingan dalam ABL dijangka meningkatkan sebanyak lapan peratus lagi menjadikan kesemua 20 peratus. Bagaimana, nilai kepentingan itu tidak diketahui. Selain Bank Islam, kepentingan ABL turut dikuasai oleh AB Bank Bangladesh sebanyak 15 peratus dan Islamic Development Bank Arab Saudi dan Akbar Brothers, masing-masing menguasai 10 peratus. Sumber industri berkata, pembelian itu diramal meletakkan Bank Islam pada kedudukan terbaik untuk mengukuhkan namanya di rantau ini dan pasaran-pasaran berhampiran. ABL yang sebelum ini dikenali sebagai Amana Investments Limited ditubuhkan pada 1997, merupakan bank komersial pertama di Sri Lanka yang menjalankan operasi perniagaannya mengikut prinsip perbankan Islam. Bank itu yang dianggap sebagai trendsetter dalam sektor perkhidmatan kewangan Sri Lanka menguasai dalam hampir semua produknya termasuk perbankan Islam, kewangan, sewa dan industri takaful. ABL yang beroperasi di ibu pejabatnya di Colombo kini memiliki kini 11 buah cawangan. Sumber berkata, penguasaan Bank Islam itu adalah tepat pada masanya kerana ia menepati rancangannya untuk mengembangkan operasi bank Islam pertama negara itu, selain meningkatkan nilai pemegang sahamnya. Sementara itu, Utusan Malaysia difahamkan Bank Islam juga aktif mengintai pasaran berhampiran negara namun masih belum ada kata putus. Sebelum ini, Bank Islam dikatakan telah mengadakan perbincangan untuk mengambil alih PT Bank Muamalat, antara bank Islam terbesar di Indonesia. Bank Islam dimiliki oleh BIMB Holdings Bhd dengan memiliki 51 peratus kepentingan dan Lembaga Tabung Haji pula sembilan peratus. Manakala baki 40 peratus lagi dimiliki Dubai Financial Group LLC, syarikat pegangan pelaburan yang dikuasai oleh pemerintah Dubai. |

|

|

Mar 23 2011, 04:42 PM Mar 23 2011, 04:42 PM

|

Senior Member

2,178 posts Joined: Oct 2006 From: The Pearl of the Orient - MY |

Ah... today BIMB... STRONG!!!!!! Power

|

|

|

Mar 23 2011, 04:46 PM Mar 23 2011, 04:46 PM

|

Junior Member

186 posts Joined: Feb 2011 From: Sabah |

BIMB~~~!!!!! this the ONLY one i missed out~~!!!

so hard to get!!! que up que up que up~~~ then it kept run away... |

|

|

Mar 23 2011, 04:46 PM Mar 23 2011, 04:46 PM

|

Senior Member

2,526 posts Joined: Feb 2011 |

Hope it sustains.. Anyway not gonna sell it anytime soon as this is for long term

|

| Change to: |  0.0230sec 0.0230sec

0.46 0.46

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 12th December 2025 - 02:56 AM |