Sorry. I realised I did not answer your question properly. Was watching some movie earlier...

Are you try exit/sell away now at 7.67 that is why you lost in 7yrs or 1.65% gain only?I was writing on the basis of investing in Mayban for its dividends. Now to test the theory, the furthest point back I used for reference is 2013. 7 years should be a fair experiment. Now the price I chose was based on the lowest price recorded in the year. So for year 2013, the lowest price was 8.90, recorded on Jan 2013.

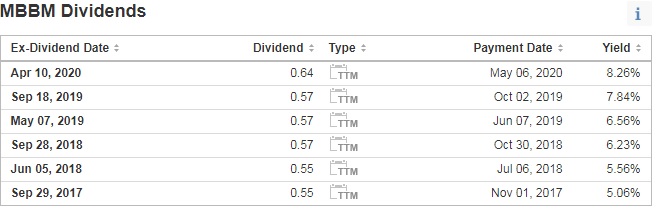

So assuming I invested 1,000 shares in Maybank in 2013, at the lowest price, 8.90, I asked myself, how much dividends would I have received?

My answer was 4.255

So for an investment of 8900, I would have received 4,255 in dividends.

But based on the current share price of 7.67 (I have to base it versus what the stock is trading now and not in the future, yes?) , the share would be incurring a paper loss of 1.23)

Which means the total current gain is only 4.255 - 1.23 = 3.025

So if one bought Maybank at the lowest price in 2013, at 8.90 and held it till today, one is looking at a 'total current gain' of 3.025.

since everything in investing is based on CAGR, this represents a CAGR gain of only 4.3% for 7 years.

Is this acceptable? Compare the gain vs FD rate or EPF rate....

which it's ok but it's not really a market beating kind of yield, yes?

So I work it out for every subsequent year. Each year, assuming I buy at the lowest price of the year.... and again, as the result show, it's not really terror, yes?

so far ok?

What happen if you sell at next yrs if the price is 8.5 or 9?

Well... anything can happen. Of course if next year can sell at 8.50 or 9, then everything is handsome lo.

But what if next year, the price only 7?

Just simply saying la... next year ma... price can be even 10, 11 or 6 or 5.... who knows....

Let say I buy 20lots now at 7.5, sell it 3yrs later or which come 1st at 9.5, already earn me of 40k.

Average div 0.56/yrs for 3yrs earn me 33.6k.

That is 73.6k total.Well, that's your game plan. Which sounds nice. Cos you have a target and you know what you are aiming for.

But have to say that every time the stock gives a dividend, the stock price is 'price adjusted' according to the dividend paid.

Sometimes the stock goes up, despite giving the dividend but sometimes it doesn't.

You just got to acknowledge that it can go either way....

But you enter mainly for div? Yes, this is an experiment, back testing the outcome if one invest for the dividend. Is the dividend play such power that it can yield superior result?

Sadly, from what I see, the result is macam average only....

If I want to continue with div, look for it dip back to >8.5 (probably no more <8 catergory price). And look for sell at 10.5 maybe?

Different strategy yield higher? Not understanding.

What you mean looking for it to dip >8.5?

When the stock dips, it means it fall, isn't it?

ok?

not suggesting anything for Maybank.

If you think it is good, then good luck to you.

May your game plan works out good for you.

If you're not selling now and solely for div, I don't see you're in loss. Just stop see the market and comeback next yrs.

Here my experience with bank stock. Not local.

Back in 2009, brought some citibank when it dip. Than forget it for over 11yrs. Div earn for 11yrs. (dump in and forget strategy)

This yrs reveal back. Sell it even in bad market. Still earn 2+X profit with div. Reinvest in another counter for fast track.

Same I repeat this way on Maybank now. But this time not put it that long. And reveal every month/yrs for a good sell price.

Jul 31 2020, 07:12 PM

Jul 31 2020, 07:12 PM

Quote

Quote

0.1133sec

0.1133sec

0.37

0.37

7 queries

7 queries

GZIP Disabled

GZIP Disabled