1. ASB-f

A. Incomplete question. What is the current outstanding of the loan, and what is the cash-value of the ARTA? This is why I always recommend clients not to take ARTA, people who do are getting bad advises, because when they need to refinance or settle the account, they would have to incur some losses (through the premium of the insurance agent which happens to be the bank itself). Currently the best rate is 4.9%, and some clients who took up ASB financing is currently being charged 5.45%, it would be a mismanagement of one's own finances if you do not look into the market rate and refinance the loan into something that is of better rates

Incomplete question, which suggests inexperience of the person asking the question. Please try again

B. As above, incomplete question (what is the original loan amount), but this is more doable. I assume John has paid for the financing for a few years, thus making the current outstanding reduced by a bit. He would have to ask the current bank to close the ASB-financing account, all the units (non-dividend, non-cash) would be sold off. Refinancing that loan would allow him to get 190k or 200k from the new bank, at the rate of 4.9%, he can take a reduced tenure or l. I dont understand what you are trying to do here.

By the way, may I suggest that you use the correct terms when posting your questions/assertions. Using the right terms, there are differences between the loan limit (original loan amount) and current principal outstanding. However you chose to write these instead:

"currently has a loan of 209k" . Which is confusing and allows room for miscommunication. Usually I would visit INVESTOPEDIA when i am not sure about some terms because I avoid using the wrong terms, since as you can see in here and in the mortgage threads, I see myself as an educator of sorts.

2. On to the property side, I noticed that you love using anecdotal examples to back your points, of which I am not going to address mainly due to 3 reasons:

1. they are anecdotal and personal which do not represent the whole real-estate industry as a whole.

2. It could be coming out of your behind for all i know, a.k.a bullshit

3. There is no way that I can argue against personal experiences, we can hear about it, talk about it, but please don't use anecdotal experiences to prove you points.

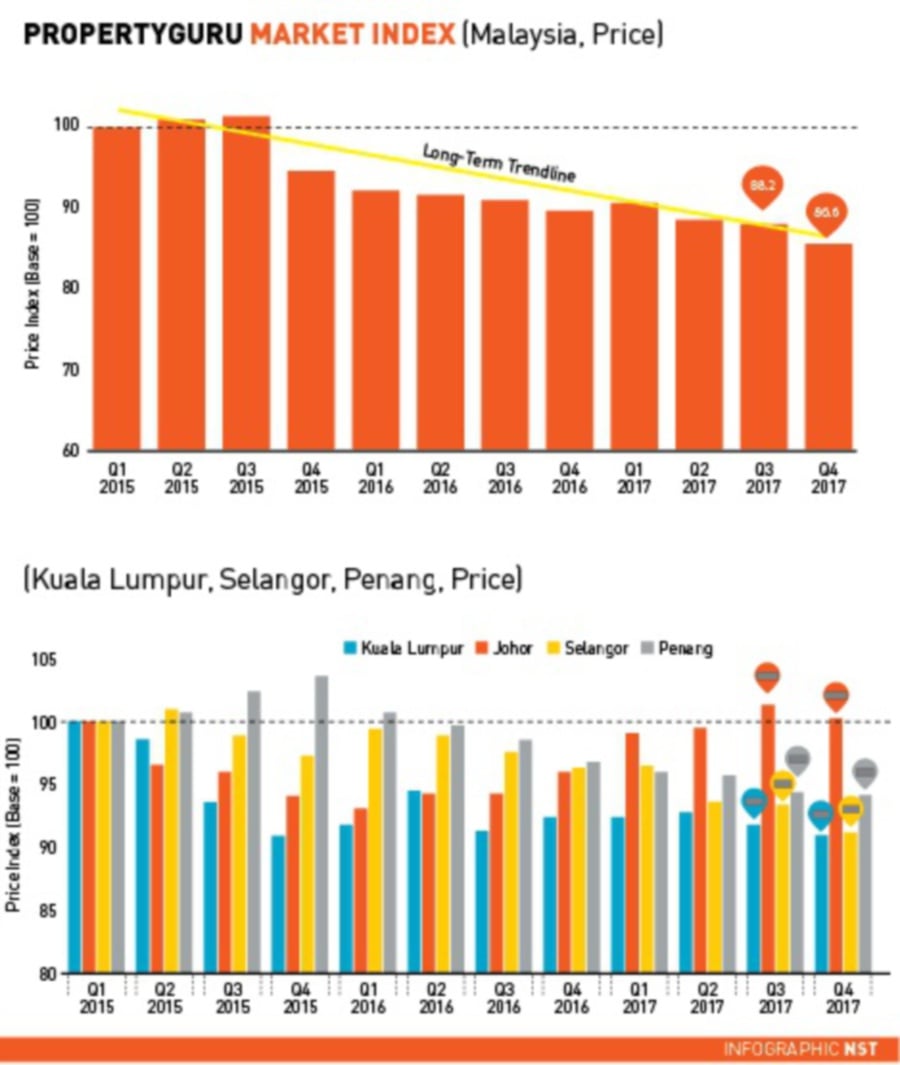

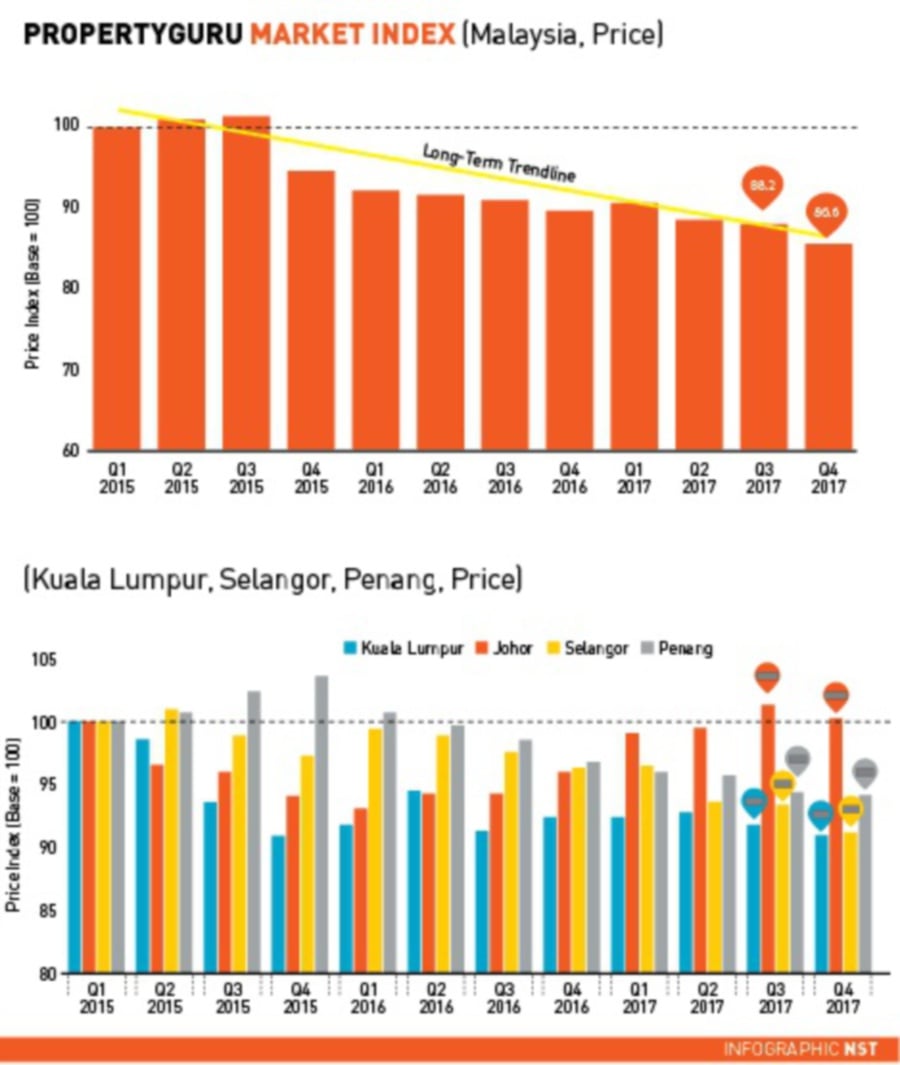

What I claim is true though, a lot of publications are saying the same thing, here is one of them:

Downtrend in property prices

On top of this, paper gains are not gains unless you sell it off. You need to understand the differences between liquid assets like cash/ut/asb vs real estate that takes between 3 to 6 months for the transaction to complete, if that.

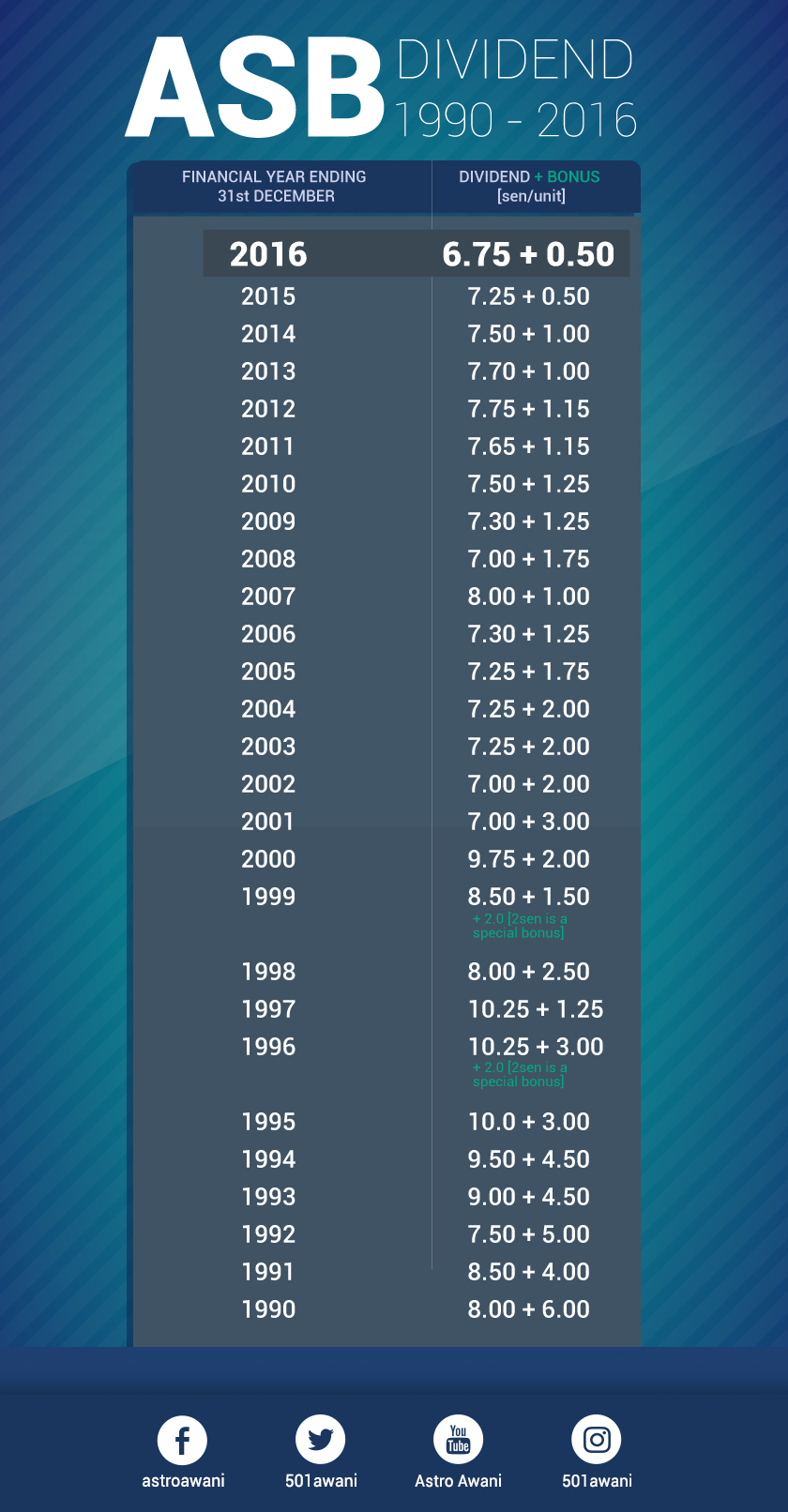

You are right, with ASB-financing you can close the account in as soon as 10 days, as per my experience. So it is a good liquid investment. In the event when you need to buy a house, you can just call up the bank, fill up some forms, and the loan will be closed in a very short time.

Dividend income from the ASB can also be used as part of your total income, useful when the banks are calculating your debt-service-ratio. It will not be able to cancel out your commitments as a whole, but it is better than having the commitment but without the income (i.e hire purchase)

Really... So it's okay to use your anecdotes to prove your point but I can't to prove mine? Even though mine is definitely plausible and easily verifiable from public records. There are reputable websites one can visit to find out real transaction values done today and compare it against price of the same property when it was launched.. As a "Pro", this should be common knowledge to you.. What's all these bla blas above? An essay? Haha.. Dude, take a chill pill.. I asked simple questions and they required simple answers. I also crafted the questions in a manner in which you a pro should have no issues understanding it. Perhaps I need to dumb it down even further.. Here goes..

During your refinancing, does it involve settling previous loan and balance with previous bank AND taking up another loan from your recommended bank? It's a simple yes or no question.. You pull out another graph for this...?

Jul 1 2018, 09:51 PM

Jul 1 2018, 09:51 PM

Quote

Quote

0.7681sec

0.7681sec

0.51

0.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled