QUOTE(monoikhwan @ Sep 11 2018, 12:02 AM)

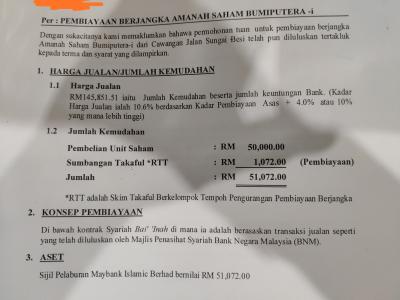

Guys, this is ASB financing doc I took 5 years ago. I choose RM50k loan, RM299 installment per month for 25 years. At that year, the bank's KPA is 6.6%.

Recently after reviewing the doc, I would like to confirm with you guys, the RM145,851.51 is justifiable with the loan condition?

Good afternoon

1. This is Islamic loan, with Islamic loans, everything has to be "clear" - well to some extent. It means the

maximum amount that you would have to pay in the next 25 years is clear. This amount is calculated

based on the 10.6% p.a capping/ceiling as per the LO

2. This figure would not change because whatever changes made to MBB's KPA (English: Base Financing Rate) would still make your

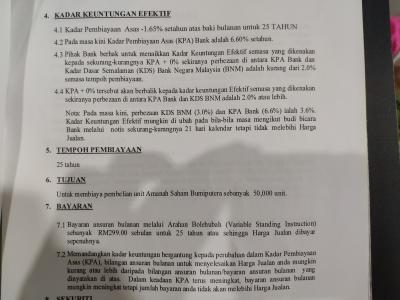

effective rate lower than the 10.6% capping mentioned above. Your rate is quoted as KPA - 1.65%, with MBB's KPA at 6.9%,

your effective rate is currently 5.25%3. If you need to verify what I said, take a "loan/mortgage calculator" (

I recommend this one) and key in RM51,072, 10.6%, 25 years) and the total payment will be RM145k. Any deviations visible are due to the differences of actual dates of the financing, internal interest rate that may be lower than presented, and other factors that are not presently mentioned in the LO.

4. You are

currently paying 5.25% p.a. and not 10.6% p.a. It will very UNLIKELY for you to end up paying RM145k in total because in the past 5 years, you have been paying your installments based on rates lower than 10.6% p.a, so even if suddenly the OPR is increased by BNM and MBB responds by increasing the BFR in tandem, and you start paying at the max 10.6% p.a rate, you would still NOT end up paying anywhere close to 145k in total.

This can be a little much especially when I do not get to explain it in person with pen and paper, but I hope you get the idea. As mentioned, you are paying 5.25% p.a, while the best rate available is 4.85% p.a now - and so I might add that it may be high time to refinance to get better rates

This post has been edited by wild_card_my: Sep 11 2018, 12:52 PM

Sep 7 2018, 08:31 AM

Sep 7 2018, 08:31 AM

Quote

Quote

0.0231sec

0.0231sec

0.54

0.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled