Outline ·

[ Standard ] ·

Linear+

ASB loan, worth to get it???

|

SUSmonoikhwan

|

Jun 1 2017, 03:06 PM Jun 1 2017, 03:06 PM

|

|

anyone know how is the formula calculation for surrendering Maybank ASB loan? how much will i get if i surrender?

Loan details:

Loan type: Islamic

Loan amount: RM 50,000

Loan tenure: 25 year

Outstanding balance: -RM 132,695.51

Outstanding Cost of Finance: RM 47,374.18

Outstanding GPP: RM 0

|

|

|

|

|

|

SUSmonoikhwan

|

Jun 8 2017, 02:54 PM Jun 8 2017, 02:54 PM

|

|

QUOTE(aliffezwan87 @ Jun 8 2017, 02:23 PM) Dear brother HaziqNet, I am an Accountant, age 30, seek your advise on my financial profile below: 1. Cash Savings in ASB 1 : RM 115K 2. Considering to apply ASB 1 and 2 financing RM 200K each ( rm 1,050 per month, 4.8% interest) My question is: 1. Which method is the best for me to increase my savings? Compounding? 2. I plan to use my current savings to pay the monthly installment of ASB 1 and 2. Is it the right thing to do? I dont wish to use my future salary to pay the loan installment. 3. If i were to sign up asb 1 and 2 financing, where can i park / invest my cash savings in point (1)? Many Thanks. YNWA Wow. I was quoted RM1200 for RM200k loan. May I know which bank offer RM1050? |

|

|

|

|

|

SUSmonoikhwan

|

Jul 3 2017, 04:15 PM Jul 3 2017, 04:15 PM

|

|

QUOTE(facktura @ Jul 3 2017, 04:06 PM) Silly question. if wanna use proxy to invest another 200k on another person account, must use under their name right? meaning loan limit of that person definitely affected aite? can use my name. but T&C applies. agree? |

|

|

|

|

|

SUSmonoikhwan

|

Jan 5 2018, 03:58 PM Jan 5 2018, 03:58 PM

|

|

I have ASBF 50k with yellow bank for 5.0% profit rate.

Paid for about 4 years IINM now.

I'm thinking of applying for 150K.

Should i terminate the existing 50k and apply another 100k

OR

terminate the current one, and apply 150k from another bank?

Which one is better?

|

|

|

|

|

|

SUSmonoikhwan

|

Sep 11 2018, 12:02 AM Sep 11 2018, 12:02 AM

|

|

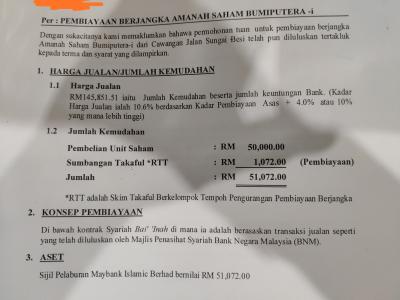

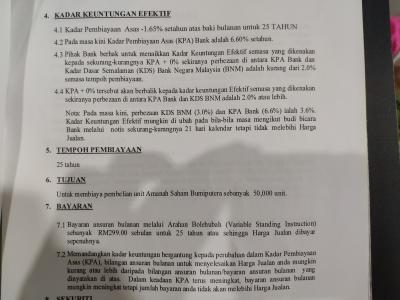

Guys, this is ASB financing doc I took 5 years ago. I choose RM50k loan, RM299 installment per month for 25 years. At that year, the bank's KPA is 6.6%. Recently after reviewing the doc, I would like to confirm with you guys, the RM145,851.51 is justifiable with the loan condition?

This post has been edited by monoikhwan: Sep 11 2018, 12:03 AM

This post has been edited by monoikhwan: Sep 11 2018, 12:03 AM |

|

|

|

|

Jun 1 2017, 03:06 PM

Jun 1 2017, 03:06 PM

Quote

Quote

0.0265sec

0.0265sec

0.27

0.27

7 queries

7 queries

GZIP Disabled

GZIP Disabled