As usual, I will be summarising my ASB2f performance.

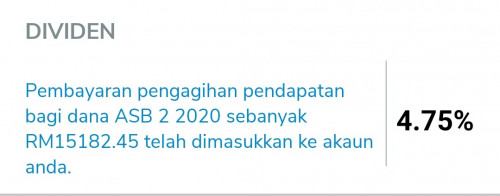

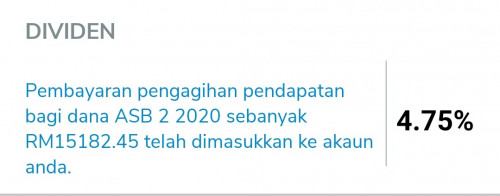

Before AmmortizationDividend : @ 4.75 % = 15,182.45

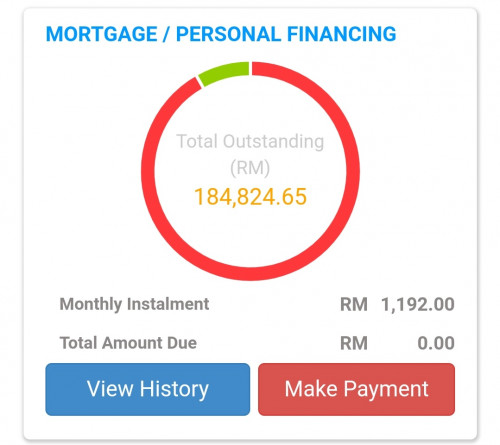

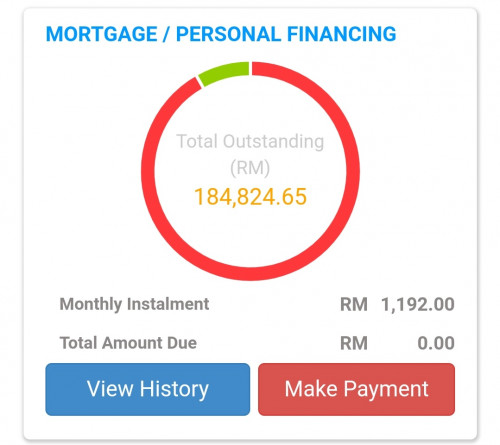

Payout : 1,192.00 x 12 = 14,304.00

Difference : 878.45

ROI : 878.45 / 14,304.00 =

6.14%Ammortization- 6 years loan 200k @ 4.6% interest = approximately 18,000.00

- 18,000 / 6years = 3000 per year.

ROI after Ammortization - 878.45 + 3000 = 3878.45

- 3878.45 / 14,304 =

27.11%(unrealized as did not terminate)

This year is a little tough. And so will next year. And let's not kid ourselves, a few more years to come. Don't think we've ever seen an inevitable recession quite like this. Not in my lifetime for sure. Brace yourselves.

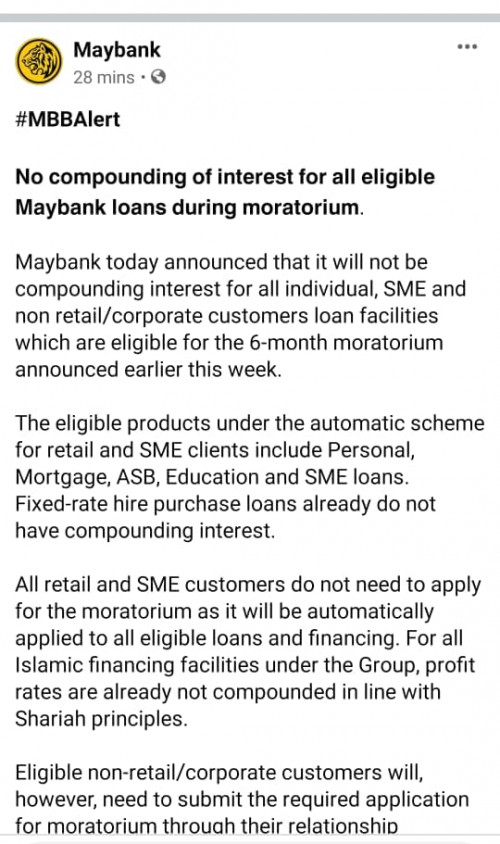

Need the assistance of ammortization to actually show great returns. Even if you're year one investor, you'd actually just about break even if you factor in the principal you'd get back.

But even without ammortization, there was a return of 6.14% for ASB2, for me anyways. It's not jump out of my seat and punch the air type excitement but at these troubled times, i'll take it.

As mentioned many times the way this game is played is playing the long game. That's why people like Bora can still weather the storm.

But if you ask me, even in these bad times, I'd jump in for the sole purpose of increasing capital and building that softcap. As when the dividends eventually goes back up, you'd have already positioned yourself with that bloated softcap, ripe for the taking while others are just starting to get back in the game.

But that's just me. Not many people can see beyond 1 year before panic sets in. And my advice to anyone who can't stand the heat in the kitchen, just terminate. Save yourself the grief and stress.

This post has been edited by buggie: Apr 1 2020, 09:48 AM

Mar 8 2020, 07:57 AM

Mar 8 2020, 07:57 AM

Quote

Quote

0.5606sec

0.5606sec

0.26

0.26

7 queries

7 queries

GZIP Disabled

GZIP Disabled