QUOTE(tr3xsdccc @ Aug 19 2020, 07:25 PM)

Ouhhh meaning the bank is deducting the 'principal' for the accured moratorium interest lah kan bro? So we no need to pay them back laaa?

Example if my monthly installment is rm1000 per month, so before moratorium 150k loan balance after moratorium is 156k.ryte? But now it's adding the amount owe instead of deducting it? Heyooo peningnye moratorium...

Y bank dunwan give us options upfront and explanation 😔

Because...

1. They are bank... They must make money and most times it’s through vague explanations, TnCs, etc.. So must always do due diligence before signing.

2. It’s a loan and YOU as the taker is expected to fully understand all possible pitfalls that may occur whilst utilising the banks money.. Yes, it’s still the banks money. It’s NOT yours until you settle. Which also means, it’s in their best interests to keep milking as much as they can.

3. I believe the moratorium though was sprung upon them by BNM or the government.. Then the blame and major works of how to implement...thrust upon them. There wasn’t enough time I guess to come up with clean clear or standard options at the time. So i won’t blame them.. Either way, due to system glitch, wasn’t opted in to the moratorium.. So not particularly concerned about what happens after.

QUOTE(haziqnet @ Aug 21 2020, 08:57 AM)

you will get more by doing asbf. Use a potion of that 100k to pay for 1 year asbf installment.

Next year onwards use dividen to pay the installment every year. The balance of your 100k can park into asb2 or other platform u want. If asb2 also open for financing than make 200k x 2.

No.. just no.. Meagre returns some more, not even sure will cover. I would just leave it all in to keep compounding over the years and be withdrawing from the 100k each month (if parked elsewhere earning) or annually and pay upfront. Why annually? Because it instantly reduces your principal = lesser interest charged in the beginning..

QUOTE(haziqnet @ Aug 21 2020, 09:14 AM)

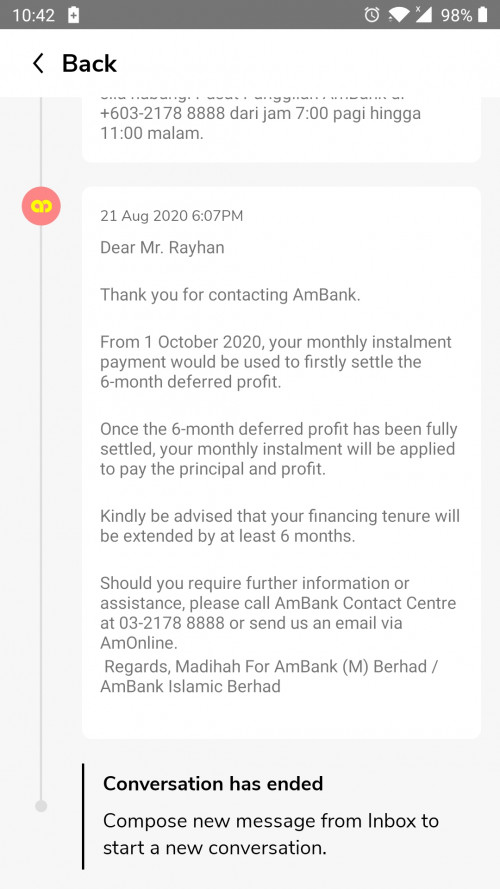

well if u understand it, i said dun worry because basically during moratorium period is like u get your profit early. thats all. Just dont freak out when you see yours outstanding balanced increase after moratorium. Your asbf still profit even you take moratorium longer just dont forget to include the installment you not pay during moratorium into your termination calculation when you terminate your asbf.

I think Bora2 guy just wants simply explanation about if we earning or not after this. While you know, I know la.. We understand the numbers and pitfalls.. Here got some who don’t.. For instance, your earlier calculations shows that for those who opt in...principal owed would be higher in the end and that means interest will be calculated higher.. So technically, does not paying even save us much? Particularly if we still have to pay all 6 months accrued interest in one shot else face more charges. Versus, some repayment plan that spreads the payments out SEPARATELY so principal stays as if one has fully paid off the accrued interests.. At this point my brain’s

with the possibilities.. So as earlier, I know we just speculating je.. See how in a few months..

Welcome back by the way.... Wildcard dude seems to have been taken down by his own hubristic personality.. I did warn him about it.. But of course, his ego & bigoted self won’t let him see past that. Hope you don’t follow in his footsteps. /K does not forgive or forget.

QUOTE(Bora Prisoner @ Aug 21 2020, 09:29 AM)

Very condescending reply from an agent I have to say.

I am not worried, I am not even bothered about taking the moratorium just to gain pennies.

If you are addressing to those who are actually worried, perhaps you can clarify for them what the banks are not doing. Explain to them if there will be accrued interests, will one have to pay deferred payment in lumpsum or will it be spread out, will it apply to either or both conventional or islamic loans etc

These are the sort of info people seek that is useful and as an agent you should be able to offer some kind of advice, instead of insulting people's intelligence by explaining the moratorium payment is principal+interest (duh!) and no other explanation beyond that.

'Still profit' is not a good enough explanation. Does one stand to gain or lose by taking moratarium, and explain why!

Haiya... rileks fam... I’m sure he meant no harm.

QUOTE(Bora Prisoner @ Aug 21 2020, 10:18 AM)

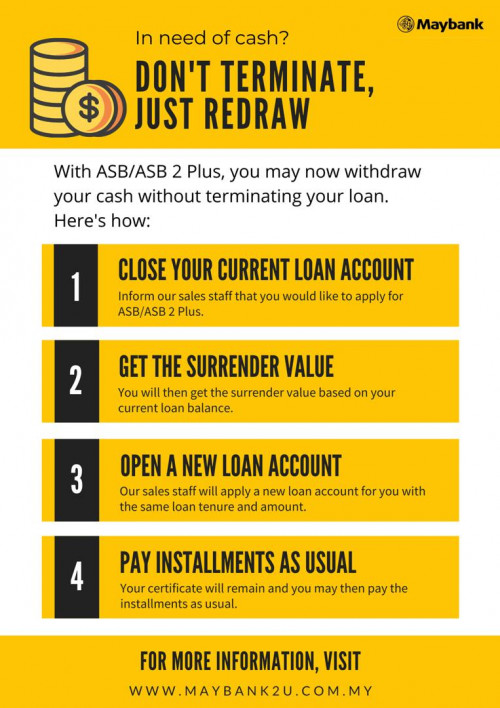

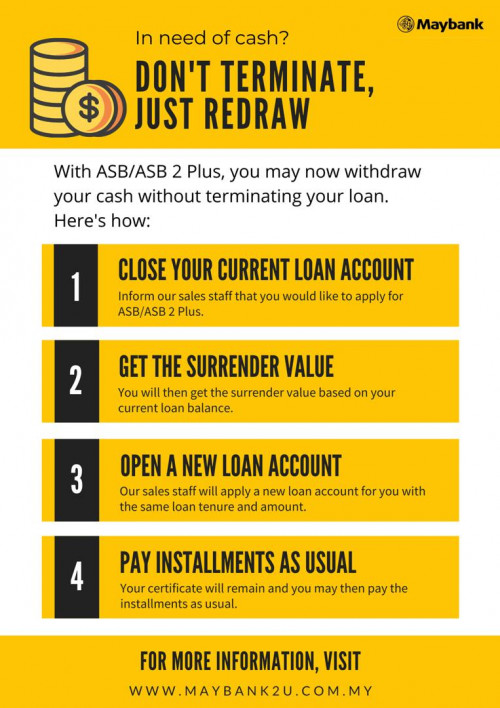

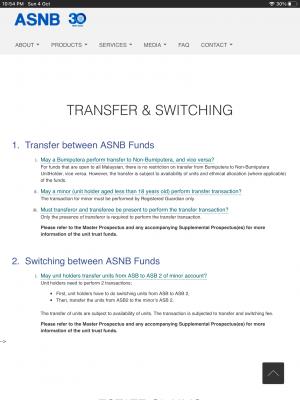

Just wanted to share this, good for old timers like @buggie and me. While @buggie did his refinancing, I didnt proceed with mine because the interest rate offered was higher than my existing one, so be careful to check that if you're considering this. Some agents dont highlight it, just try to push so they meet their sales.

Great.. Can “refinance” without having to start from zero on the ASB side.

Aug 12 2020, 11:39 AM

Aug 12 2020, 11:39 AM

Quote

Quote

0.0297sec

0.0297sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled