QUOTE(danmooncake @ Oct 27 2009, 02:44 AM)

do u hav the symbol/ does it exist for Direxion Daily Small Cap Bear 3X Shares & Direxion Daily Energy Bear 3X Shares... Investing in US stocks, Does anyone know how?

Investing in US stocks, Does anyone know how?

|

|

Oct 27 2009, 07:46 AM Oct 27 2009, 07:46 AM

Return to original view | Post

#41

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

|

|

|

|

|

|

Oct 27 2009, 09:17 AM Oct 27 2009, 09:17 AM

Return to original view | Post

#42

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(danmooncake @ Oct 27 2009, 12:08 AM) Heck..what do you know, Dollar suddenly rise again. China is happy. really interesting to be consider for trading This is like a clockwork... up and down.. This time, the trend is lower. Looks like we are going down more as we closer to end of this month. Maybe time to look at bear share again. Need another day to confirm. BGU - Direxion Daily Large Cap Bull 3X Shares BGZ - Direxion Daily Large Cap Bear 3X Shares TNA - Direxion Daily Small Cap Bull 3X Shares TZA - Direxion Daily Small Cap Bear 3X Shares fuqi also approaching cut loss level during after hours, most likely to exit position too wms exiting others in entertainment watchlist still watching & holding till any signs to exit or etc occurs This post has been edited by sulifeisgreat: Oct 27 2009, 09:56 AM |

|

|

Oct 27 2009, 09:19 AM Oct 27 2009, 09:19 AM

Return to original view | Post

#43

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(danmooncake @ Oct 27 2009, 09:16 AM) Wait-lah! We haven't even break below 9800 yet, how can we get 9700? so wat other commodities/ industries etf u recommend Today, we only have small pullback. Not big enough yet. We need another day of 3 digits drop. IMO, bulls are still in control at the moment. Plenty of dip buyers. Will need to see 2-3 trading sessions to see if bears can win before major break down. As for why USD suddenly rise, that's because what's goes down, must come up. It can bounce like a basketball and when it does, it will kill all short sellers of USD and equities will tank, treasuries will rise. Be ready. Commodities like Oil, Copper, Iron, etc will fall. |

|

|

Oct 27 2009, 03:19 PM Oct 27 2009, 03:19 PM

Return to original view | Post

#44

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

|

|

|

Oct 28 2009, 12:06 AM Oct 28 2009, 12:06 AM

Return to original view | Post

#45

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(danmooncake @ Oct 27 2009, 10:33 PM) Like I said, buy the dip. yes, lots of new low after low & haha all breakout looks fail Like Zaman has mentioned, sell the rally, we are still channeling the price range for now. But, the wave seems to be weakening as we get closer to end of month. We may gap down soon. Watch the Dollar Index and Oil price. Update: Bought 100 FAS @ 76 trend seems to be shifting lower & activating cut losses rtk 1.39 cut fuqi 20.5 gymb 43 ddrx 25 clw 44.5 (options clwdj, shiok le now 6.9 from buy point of 10.7 spar 4.5 (dunno got chance st 7) ge 14.3 (dunno got chance st 15.9) today is watching day, gambling101 buy put option LFCPN.X $5.70

buy ntes at 35.7

after stock gap up, wil they hav tendency to go down back to before gap price or wil it go higher, in a market that seems to be shifting direction no idea, tis is case study

This post has been edited by sulifeisgreat: Oct 28 2009, 12:31 AM |

|

|

Oct 28 2009, 12:35 AM Oct 28 2009, 12:35 AM

Return to original view | Post

#46

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

|

|

|

|

|

|

Oct 28 2009, 10:19 AM Oct 28 2009, 10:19 AM

Return to original view | Post

#47

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(zamans98 @ Oct 28 2009, 09:34 AM) WOW - 4th day straight.. imo, most likely all the remaining breakouts or swing trade case study may reach cut loss tis or nex few week Open GREEN, mid-day SUPER green, the lose steam from 11, then up a bit then close either RED or light GREEN MGM 9.63 -1.37 (-12.45%) LVS 14.31-1.75 (-10.90%) WYNN 56.13 -6.94 (-11.00%) C, ETFC, S, URE, UYG all down.. woot! but URE/UYG holding quite well, as it is ETF, not single share gap down sighted on individual stocks & trend shifting lower, signal being trigger, who knows i may be wrong but buying market open bgz, mwn & tza. in meantime, looking for breakout stocks to short can't beat them, so prepare to join them gambling101, caveat emptor since expecting breakdown, no target profit but got cut loss level ready

QGMON.X @ $9.5

UFROL.X @ $6

UPUPH.X @ $4.2

APVPT.x @ $20.5

GOPOY.X @ $40.6

as usual, hope market goes up & trigger case study cut loss again This post has been edited by sulifeisgreat: Oct 28 2009, 12:08 PM |

|

|

Oct 28 2009, 11:50 AM Oct 28 2009, 11:50 AM

Return to original view | Post

#48

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(zamans98 @ Oct 28 2009, 11:40 AM) I'm a dummy in OPTIONS. from wat i read, it can exercise anytime, but need to inform ur broker Need more info before thinking to venture into it. Err - can you excercise it anytime, before the closing? http://en.wikipedia.org/wiki/Exercise_%28options%29 i never exercise, i use it as gambling tool |

|

|

Oct 28 2009, 07:58 PM Oct 28 2009, 07:58 PM

Return to original view | Post

#49

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(zamans98 @ Oct 28 2009, 01:26 PM) Thanks for the link. What I want to know is how it is done, and possibly anyone who have tried. good luck waiting for answer, refer to bottom of page, second last question's answer Mostly are just theory - no practical stuffs. http://www.888options.com/help/faq/exercise.jsp?prt=nyse |

|

|

Oct 28 2009, 09:09 PM Oct 28 2009, 09:09 PM

Return to original view | Post

#50

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

[quote=zamans98,Oct 28 2009, 08:23 PM]

all bad news this coming week. today - home sales, sure RED, Core Durable Goods Orders sure RED Thu : Advance GDP q/q, Unemployment Claims - all RED Monday 2nd Nov - ISM Manufacturing PMI, Pending Home Sales m/m Tuesday 3rd Nov:ADP Non-Farm Employment Change & ISM Non-Manufacturing PMI WED 4th Nov: Federal Funds Rate, mother of all, if rate unchanged, then RALLY RESUME else bearish for long. Can Start SHORTS FRIDAY 6th Nov: the father of all : Non-Farm Employment Change & Unemployment Rate [/quote] Who knows, maybe got good news as some stocks r up in pre-trade. well, as the previous posts sums it drops on speculations, raise when announcement. By the time of announcement, there is no more space to drop. So it will surge.. [/quote][/QUOTE] That it... think positive BUT, do alwiz have one eye on the exit door, coz if anyone yells 'fire' in a cinema, we know wat happens nex there'll be bargains galore after tat or maybe the market makers r laying mine to test pre-trade  This post has been edited by sulifeisgreat: Oct 28 2009, 09:10 PM |

|

|

Oct 29 2009, 06:24 PM Oct 29 2009, 06:24 PM

Return to original view | Post

#51

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

reading the interesting threads last night. imo, most of u still use the klse mindset to invest in usa

if it makes $$$, its fine if not, suggest u all gotta step back, analyse & do some deep soul searching

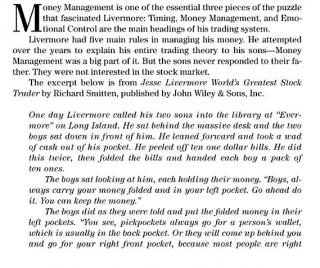

frankly speaking, i have no idea where market is going. but i choose short who knows? maybe it'll cut loss like the earlier breakouts anyway, still waiting for FA to present their analysis & picks, so this thread can be well represented for our learning i'm sure we all learn sumting during this past week of active thread activity http://www.jesse-livermore.com/blog/index.php?s=greed i respect those of u who decide to retake a look at ur portfolio & take a cut loss, its something not easy to do coz if market up, u'll feel silly but if market down, u'll be glad, as stil got bullets to last another day its kinda weird to see u all panic altogether well, since u r in usa to invest, all the best for the future & dun get burn like arang batu hope tis thread wil hav more stock picks from the newbies & silent lurkers u all can pool ur mind resources together, since most r newbies & go thru the market learning cycle together or ask dmc, rosdi, zaman, redken & others for advise  its story time again, understand some of u no like TA or Jesse Livermore, then can giv below a skip otherwise, can read up as theory101 (since theory & practice is entirely 2 different things)

|

|

|

Oct 30 2009, 12:09 AM Oct 30 2009, 12:09 AM

Return to original view | Post

#52

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

the market has voted with an up, on the 3.5% gdp growth report but feels like a dead cat bounce &

i smell a rat for shorts covering...any recovery means nothing unless it’s by the private sector & now growth is generated by the government????? wtf - wil be watching nex week data before making any decision & below is a long read from analyst report on recession over in usa????? Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 3.5 percent in the third quarter of 2009, (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.7 percent. Looks good, right? Hmmmm.... or is it? Motor vehicle output added 1.66 percentage points to the third-quarter change in real GDP after adding 0.19 percentage point to the second-quarter change. Real federal government consumption expenditures and gross investment increased 7.9 percent in the third quarter, compared with an increase of 11.4 percent in the second. Ok, from this we can compute a few things. 3.5 - 1.66 - (7.9 * 30%) = -0.53% Now let's adjust for inventories: The change in real private inventories added 0.94 percentage point to the third-quarter change in real GDP after subtracting 1.42 percentage points from the second-quarter change. -0.53% - 0.94% = -1.47%. Ok, that's bad but not catastrophic and is an actual improvement compared to the second quarter. But.... Current-dollar personal income decreased $15.5 billion (0.5 percent) in the third quarter, in contrast to an increase of $19.1 billion (0.6 percent) in the second. Personal current taxes increased $4.8 billion in the third quarter, in contrast to a decrease of $119.1 billion in the second. Eeeeehhh... those are both going the wrong way. Taxes up, income down. And... Disposable personal income decreased $20.4 billion (0.7 percent) in the third quarter, in contrast to an increase of $138.2 billion (5.2 percent) in the second. Real disposable personal income decreased 3.4 percent, in contrast to an increase of 3.8 percent. That's worse. A lot worse. Disposable personal income decreased in nominal terms q/o/q by 5.9% while in real terms (inflation adjusted) it decreased q/o/q by 7.4%! That is an enormous swing in purchasing power and not in the right direction! Personal outlays increased $148.2 billion (5.8 percent) in the third quarter, compared with an increase of $8.2 billion (0.3 percent) in the second. Personal saving -- disposable personal income less personal outlays -- was $364.6 billion in the third quarter, compared with $533.1 billion in the second. The personal saving rate -- saving as a percentage of disposable personal income -- was 3.3 percent in the third quarter, compared with 4.9 percent in the second. So into decreasing personal income and disposable personal income people tried to spend anyway. Best guess: most of this was "cash for clunkers", which is the worst sort of "spending" - it is the taking on of more debt by replacing a paid-off car with one that now comes with a shiny (and nasty) payment book. The Trade: Go long auto repo outfits (aside: as far as I know there are no publicly-traded repo companies.) Nothing in here I like; to the contrary, this report sucks and on a drill-down appears to be full of outright lies. Looking inside the data, the "big change" in private domestic investment is all residential fixed - up 23.4%. I don't believe it. I've been scouring the homebuilder earnings releases and data, and I don't see the numbers that support this. An improvement over the ditch-diving of the last many quarters, yes - but a 23.4% increase, a swing of fifty percent from Q2-Q3? Oh hell no. Where is it? It's not in Home Depot's or Lowe's quarterly results, it's not in the homebuilders, and I can't find it in the suppliers (lumber companies, etc) either. This sort of move would result in monstrous top-line revenue increases reported by firms in this sector and that simply has not happened. Nor do the export and import numbers look right. Port of Long Beach and LA anyone? Those numbers also don't add up - swings of 20-25% in one quarter? Not reflected in container volumes and freight loadings. Yet it has to be - how do you get something in or out of here without it going through a port? Government looks right, both federal and state/local. The "Obama will cut defense and war spending" folks have to be bashing themselves with a hammer - there's no evidence for that in the data, now three quarters into his administration. If you're anti-war and "bring the troops home", you may want to re-think whether voting for Barry was a wise decision - he sure as hell hasn't kept that promise. (Note that I didn't think he would either but that lie sure played well in San Francisco, didn't it?) Forward the big problem is the deterioration in personal income. You can't spend what you don't have without credit creation, and that's fallen off a cliff. The Fed's credit reports continue to come in with huge contractions - this should not surprise, as demanding that banks lend to people who are seeing their income shrink is into the realm of pure idiocy. The market likes the numbers although a lot of the move - perhaps all of it - is Bucky getting thrown under the bus once again. You can't expect the cheerleaders on CNBC to read beyond the headline numbers, and they (once again) did not disappoint in this regard. The first 20 minutes of "analysis" brought not one mention of the decease in personal income or disposable personal income, yet on a forward basis this is in fact the most important piece of information in the report. You cannot have an economic recovery when on a q/o/q basis real disposable income is contracting at a 7.4% annual rate and worse, the spread between nominal and real income is widening, indicating that mandatory purchases such a food, energy and health care - are increasing. |

|

|

Oct 30 2009, 12:35 AM Oct 30 2009, 12:35 AM

Return to original view | Post

#53

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

|

|

|

|

|

|

Oct 30 2009, 12:38 AM Oct 30 2009, 12:38 AM

Return to original view | Post

#54

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

|

|

|

Oct 30 2009, 07:57 AM Oct 30 2009, 07:57 AM

Return to original view | Post

#55

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(rosdi1 @ Oct 30 2009, 04:44 AM) DJ close at around 9950 i'm with u on tis very god move. But still in a very volatile zone. i had decided to sideline until it pass the 10K back. Still worried ... get suck in into the trap again. Calls ... still very risky VIX is still way above 20 (24.7) If still interested in calls look at the OEX for day trading. so i'm maintaining short position & watching tis few weeks before doing any postion shifting as has not reach cut loss level anyway, no harm, buying into dip

This post has been edited by sulifeisgreat: Oct 30 2009, 08:22 AM |

|

|

Oct 30 2009, 11:33 AM Oct 30 2009, 11:33 AM

Return to original view | Post

#56

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(danmooncake @ Oct 30 2009, 01:35 AM) One very important thing that I've learned as trader is DON'T FIGHT THE FED, even tho the TA telling you that we're suppose to go down. After reading this piece of news, you know why: http://www.upi.com/Real-Estate/2009/10/29/.../6661256816327/ Just enjoy the fireworks with DRN and URE.

dun fight the fed - no doubt, tat is numbah one but i saw the lyn thread headline, tis thread is about investing not trading...

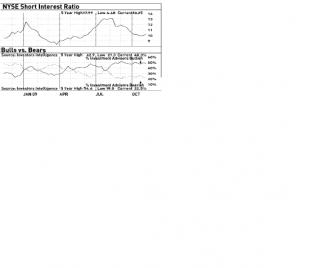

hmm... some posters say got reports of unusual PUT Options increase? would appreciate share some data for us to view it in a neutral manner

oh well, we hope market up for more shiok sendiri session haha... below as usual is from louyah analyst report Stocks posted nice gains Thursday, but lower volume suggested the big money remained on the sidelines. The NYSE composite advanced 2.8%, the S&P 500 2.3% and the Dow 2%. The Nasdaq trailed with a 1.8% pop. All the major indexes retook their 50-day moving averages. Volume was down across the board. While the indexes chugged upward through Thursday's session with only minor hesitation, the lack of volume was a letdown. Recent sessions have seen declines in increasing volume and advances in dwindling volume. That's exactly opposite of what a healthy market does.

This post has been edited by sulifeisgreat: Oct 30 2009, 11:47 AM |

|

|

Oct 30 2009, 08:17 PM Oct 30 2009, 08:17 PM

Return to original view | Post

#57

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(rosdi1 @ Oct 30 2009, 04:44 AM) DJ close at around 9950 can't help but need to comment on ur above statement very god move. But still in a very volatile zone. i had decided to sideline until it pass the 10K back. Still worried ... get suck in into the trap again. Calls ... still very risky VIX is still way above 20 (24.7) If still interested in calls look at the OEX for day trading. i definitely understand how u & ur emotions + ur bank ac felt, coz i also been thru it many times liao & hav paid my tiution fees on this & went thru finger cut, shorts fried, die standing, lose arm, leg + wateva tornados situations before i not sure about those newbies tho HAHA

for options, one need to kamikaze early, coz if market goes way up or down, the premium to enter is priced at ridiculous level jus wanna let the newbies know tat they all need to go thru the learning cycle in this washing machine HEHE...  have to say tat i alwiz heard abt the theory on buy the dip & day trading the etf but i jus could not find its practical & profitable application, till i stumble on tis forum, thanx dmc btw i think the newbies would really need u soon...  currently all my charts showed none available chart on breakout, breakdown nor swing trade so when opportunities arise, i would buy the dip, day trade the etf & incorporate those method into my trading arsenal lets hope the market goes up & kill the octobear (its now after 29 days & wonder octobear sesat in which hutan rimba?????) This post has been edited by sulifeisgreat: Oct 30 2009, 08:22 PM |

|

|

Oct 30 2009, 08:47 PM Oct 30 2009, 08:47 PM

Return to original view | Post

#58

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(danmooncake @ Oct 30 2009, 08:24 PM) Today.. market is taking a breather. It may pullback a little due to profit taking. wei! wat abt those newbies who r holding their loss? i think they shivering leh, haha...Heck,.. I'm surprise LVS popped above 16 after hours yesterday. Crazy isn't it, even after they reported much wider loss. Aha! One can never predict US market. I'm taking my profit now. |

|

|

Oct 30 2009, 09:45 PM Oct 30 2009, 09:45 PM

Return to original view | Post

#59

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

almost near green to kill octobear, jus 2 points , come on bulls - kill octobear

|

|

|

Oct 30 2009, 10:31 PM Oct 30 2009, 10:31 PM

Return to original view | Post

#60

|

Senior Member

1,121 posts Joined: Oct 2009 From: transiting asteroid |

QUOTE(danmooncake @ Oct 30 2009, 09:51 PM) IMO, October is still bullish 'coz from we started on Oct 1st with DJ at 9500 and S&P 1020. agreed! - i was running thru all the other threads & some posters prefer to stay out due to octobear mythWe've gone up 3%~4% since then. S&P will stay at 1055-1065, DJ around 9850-9940 for now. as u said earlier, the usa market is very unpredictable & i agree too imo, myth r jus myth but as tis bear or bull no wear kasut, they do leave some signs for us to sniff out |

|

Topic ClosedOptions

|

| Change to: |  0.0290sec 0.0290sec

0.20 0.20

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 03:45 AM |