QUOTE(mrPOTATO @ Oct 22 2009, 10:10 AM)

Ahaha.. i had a deprived childhood.

Hey, those analysts over in usa keep talking abt asia leading recovery. Pessimistic lot.

Is china/hk ah a better place to trade i wonder.

Or how about investing in nyse chinese stocks like unicom, china mobile etc ?

refer post #1487 stock market moves in anticipation of the future, most news u wil read is old & stale Hey, those analysts over in usa keep talking abt asia leading recovery. Pessimistic lot.

Is china/hk ah a better place to trade i wonder.

Or how about investing in nyse chinese stocks like unicom, china mobile etc ?

imo, whereever can make $$$, its alwiz a good place

izit ok if we do a surprise test on u for trading & investing101 classs?

wat is ur opinion on unicom & china mobile? come on dun be shy... we all wanna see is tis thread working?

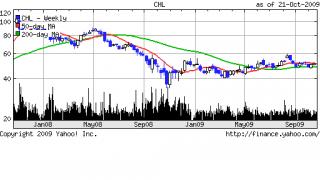

in same sector,here is a sample of uptrend, breakout after $5 & supported by volume, but y can it do tat? can u find out?

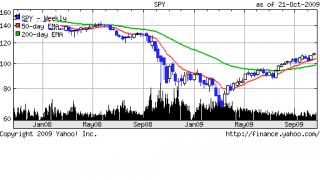

in same sector,here is a sample of gap up with high volume, but y can it do tat? can u/ any volunteer find out?

come come... anyone out there can participate in this class to make thread active. there is no right or wrong answer.

if u r right, ur bank ac got lots of zero & vice versa if u r wrong. i'm not a fan of buffet, but for those buffet lovers :

In the business world, the rearview mirror is always clearer than the windshield.

Warren Buffett

US financier & investment businessman (1930 - )

This post has been edited by sulifeisgreat: Oct 22 2009, 10:59 AM

Oct 22 2009, 10:37 AM

Oct 22 2009, 10:37 AM

Quote

Quote

0.0659sec

0.0659sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled