QUOTE(sulifeisgreat @ Nov 21 2009, 01:13 PM)

guess u did not join our longkang party

suggest expand ur horizon & step out of ur comfort zone

u FA / TA / forever fans?

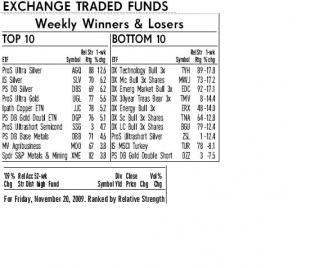

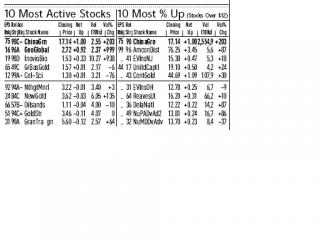

no doubt, most of u like below $10 as its cheap, but not much momo play there

if can, later upgrade & practice those $10-$20, then once, u can contribute to this thread via stock / etf selection

u will learn to see more + play more

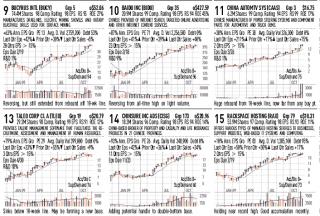

also, can go gamble above $20 for day trade / swing trade

better still, pick up roket skill,

but from my personal experience, it is super hard man...

u recall the luck story? i never know when my time is up on earth

so, if u have live long enough on planet earth...

of coz, it is safe & fun to be a spectator, but r u learning anyhting? check ur bank ac pls

,

My Safe Investment Guide

=================

Rule no. 1: Don't put all eggs in a basket.

Rule no. 2: Don't trade something you are not familiar with.

Rule no. 3: Buy on dip and sell on rally (only for bull market; in bear market use short instead.)

Rule no. 4: Take profit or cut loss within the range (let's say 5-10%).

Ok, I am following Rule no. 2.

Too bad I only familiar with C and MGM, no time to study more, just enough to "cari makan".

As long as dun buy the bankrupt stock, you are safe.

I think news is sometimes useful, but don't believe in full, big bosses might be able to control the news.

Buffet said: "The first and most important thing in investment is not earning; it is to preserve your capital."

Without being able to stay in a no-lost position, talk nothing about earning roket. There comes Rule no. 4.

Rule no. 3 is picked from some sifus here, which really work in most of the times, to get some real earning.

As for Rule no. 1, it is the golden rule of investment, based on the fact that all investments have risks.

BUT, i do feel great if someone can teach me the rocketing skill (which I dunno), like earn enough to go Hawaii.. but.. you must prove to me it works first. I am not going to risk myself without concrete example.. haha... My aim is just can earn more peanuts..

Nov 20 2009, 11:50 PM

Nov 20 2009, 11:50 PM

Quote

Quote

0.0266sec

0.0266sec

0.24

0.24

6 queries

6 queries

GZIP Disabled

GZIP Disabled