QUOTE(Emily Ratajkowski @ Jun 6 2025, 09:23 AM)

He's cashing out?Topkek Bursa allowing Tealive to IPO soon, another pump & dump by Creador?

Topkek Bursa allowing Tealive to IPO soon, another pump & dump by Creador?

|

|

Jun 6 2025, 01:26 PM Jun 6 2025, 01:26 PM

|

All Stars

11,058 posts Joined: Jun 2008 |

|

|

|

|

|

|

Jun 6 2025, 01:27 PM Jun 6 2025, 01:27 PM

|

Senior Member

3,971 posts Joined: Nov 2007 |

QUOTE(Matchy @ Jun 6 2025, 01:23 PM) he managed to add more outlets to grow revenue. even if some outlets' business drop, the business overall still growing. now expanding overseas to thai, uae.grew to RM591.24 million in FY2024, from RM511.75 million in FY2023 and RM422.49 million in FY2022. |

|

|

Jun 6 2025, 01:28 PM Jun 6 2025, 01:28 PM

Show posts by this member only | IPv6 | Post

#63

|

Junior Member

126 posts Joined: Dec 2008 |

|

|

|

Jun 6 2025, 01:31 PM Jun 6 2025, 01:31 PM

Show posts by this member only | IPv6 | Post

#64

|

Senior Member

6,249 posts Joined: Jul 2006 |

hahhaha this fella is a known crook

still got people going to buy into his shit? i wanna see |

|

|

Jun 6 2025, 01:37 PM Jun 6 2025, 01:37 PM

Show posts by this member only | IPv6 | Post

#65

|

Senior Member

1,006 posts Joined: Mar 2019 |

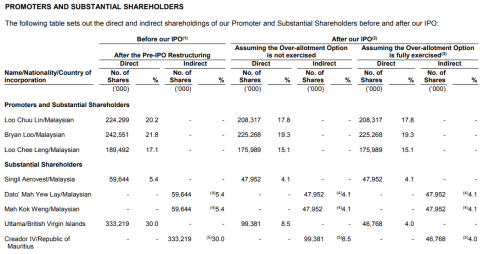

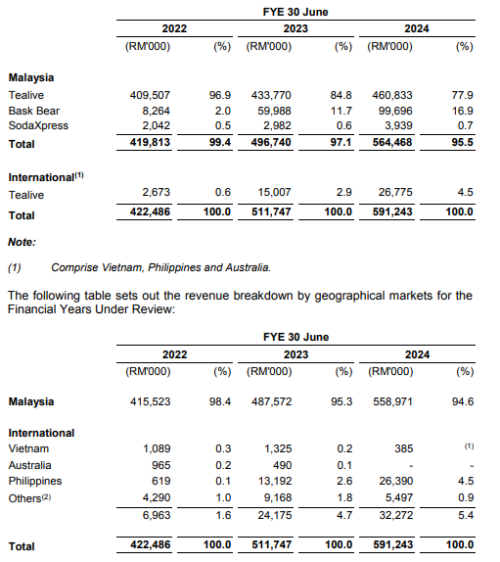

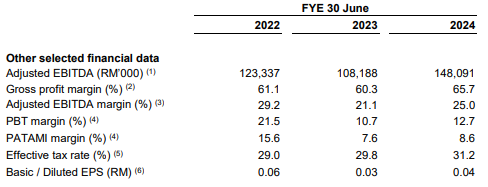

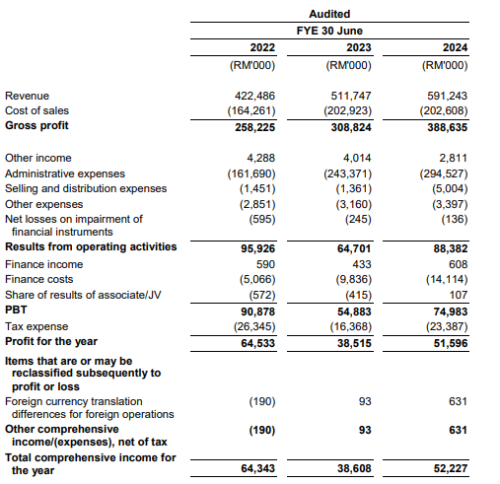

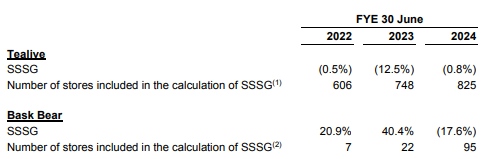

QUOTE(premier239 @ Jun 6 2025, 09:18 AM) KUALA LUMPUR (June 5): Loob Bhd, the operator behind popular food and beverage (F&B) brands Tealive and Bask Bear, is preparing for a listing on the Main Market of Bursa Malaysia. Is call dumb for dump Proceeds from its initial public offering (IPO) are intended to finance the opening of 12 new Tealive stores and 13 Bask Bear stores, and to repay existing borrowings, according to Loob's draft prospectus filed with the Securities Commission Malaysia. The IPO will comprise a public issue of 58.46 million new shares, representing 5% of the company's enlarged share base, and an offer for sale of 292.3 million existing shares that represent 25% of its enlarged share base. Loob said it is the "largest brand owner by number of stores in the F&B services industry in Malaysia" through Tealive and Bask Bear. The group had 831 Tealive stores as at Feb 28, comprising 547 Tealive corporate stores and 284 Tealive franchised stores; and 135 Bask Bear stores, comprising 129 Bask Bear corporate stores and six Bask Bear licensed stores. Loob also operates 121 Tealive franchised stores across the Philippines, Myanmar, Brunei, Mauritius, Vietnam, Cambodia, and Canada. In addition to its F&B business, the company also sells sparkling water machines and carbonated gas cylinders to both businesses and consumers. Loob made a profit after tax of RM51.6 million for its financial year ended June 30, 2024 (FY2024), up 33.96% from RM38.52 million in FY2023, but less than the RM64.53 million it achieved in FY2022. Revenue, meanwhile, grew to RM591.24 million in FY2024, from RM511.75 million in FY2023 and RM422.49 million in FY2022. Of the 350.76 million shares under the public issue and offer for sale, 134.46 million shares (11.5% of the enlarged share base) will be reserved for the Malaysian public under the retail offering, and 11.69 million shares (1%) will be allocated to eligible persons of the group, both via application. The remaining 204.61 million shares will be offered to institutional investors as follows: 58.46 million shares (5% of enlarged share base) to selected investors and 146.15 million shares (12.5%) to Bumiputera investors approved by the Ministry of Investment, Trade and Industry, both through bookbuilding. The 292.3 million existing shares under the offer for sale will be offered by substantial shareholders Uttama Ltd, Loob executive director and chief executive officer Bryan Loo, his father and director Loo Chuu Lin, his sister and executive director and chief operating officer Loo Chee Leng, and Singli Aerovest Sdn Bhd. Based on the company's current share base, Uttama holds a 30% stake, followed by Bryan with 21.8%, Chuu Lin (20.2%), Chee Leng (17.1%), and Singli Aerovest (5.4%). Uttama is wholly owned by Creador IV LP, while Singli Aerovest is 70% owned by Datuk Mah Yew Lay and 30% by Mah Kok Weng. Uttama will offer the largest portion under the offer for sale with 233.84 million shares (20% of the enlarged share base), followed by Bryan with 17.28 million shares (1.5%), Chuu Lin with 15.98 million shares (1.4%), Chee Leng with 13.5 million shares (1.2%), and Singli Aerovest with 11.69 million shares (1%). Post-listing, Uttama’s stake is projected to fall to 8.5%, Bryan's to 19.3%, Chuu Lin's to 17.8%, Chee Leng's to 15.1%, and Singli Aerovest's to 4.1%. Maybank Investment Bank Bhd is the principal adviser and sole managing underwriter for the IPO. It is also the joint bookrunner and underwriter with AmInvestment Bank Sdn Bhd.     someone is cooking revenue up, but SSSG drop  [attachmentid=11514419] |

|

|

Jun 6 2025, 01:40 PM Jun 6 2025, 01:40 PM

|

Senior Member

5,159 posts Joined: Jan 2003 |

|

|

|

|

|

|

Jun 6 2025, 01:44 PM Jun 6 2025, 01:44 PM

Show posts by this member only | IPv6 | Post

#67

|

Senior Member

6,249 posts Joined: Jul 2006 |

|

|

|

Jun 6 2025, 02:50 PM Jun 6 2025, 02:50 PM

|

Junior Member

236 posts Joined: Sep 2008 |

QUOTE(pisces88 @ Jun 6 2025, 01:24 PM) i know, this is why they choose to listing, but why only nowbcos they have the first hand info, they may not be so profit due to so many brand coming in same for cuckoo, eco-shop, DIY, etc... they balloon the number by loan, spending etc... so they can rip off the chinese chives... |

|

|

Jun 6 2025, 03:32 PM Jun 6 2025, 03:32 PM

|

Senior Member

8,653 posts Joined: Sep 2005 From: lolyat |

QUOTE(pisces88 @ Jun 6 2025, 01:22 PM) looks good on paper, big enough to list. infact i think they should list few years back, but probably wanna kasi the accounts cantik and compliance issue baru list QUOTE(pisces88 @ Jun 6 2025, 01:27 PM) he managed to add more outlets to grow revenue. even if some outlets' business drop, the business overall still growing. now expanding overseas to thai, uae. Year Tealive Bask Bear Total Outlets YoY Growth grew to RM591.24 million in FY2024, from RM511.75 million in FY2023 and RM422.49 million in FY2022. 2022 ~730 ~52 ~782 - 2023 ~850 ~94 ~944 +20.7% 2024 (LPD) 952 135 1,087 +15.1% Revenue YOY growth 2023 - +21.1% 2024 - +15.5% Which mean the growth is mainly coming from the expansion of outlet, the existing outlet sales sudah stagnant. In fact it will be worsen if Mixue and Bingxue keep penetrating, especially those franchise unit. |

|

|

Jun 6 2025, 03:35 PM Jun 6 2025, 03:35 PM

|

Senior Member

3,971 posts Joined: Nov 2007 |

QUOTE(yhtan @ Jun 6 2025, 03:32 PM) Year Tealive Bask Bear Total Outlets YoY Growth yup you are right2022 ~730 ~52 ~782 - 2023 ~850 ~94 ~944 +20.7% 2024 (LPD) 952 135 1,087 +15.1% Revenue YOY growth 2023 - +21.1% 2024 - +15.5% Which mean the growth is mainly coming from the expansion of outlet, the existing outlet sales sudah stagnant. In fact it will be worsen if Mixue and Bingxue keep penetrating, especially those franchise unit. |

|

|

Jun 6 2025, 03:35 PM Jun 6 2025, 03:35 PM

|

Senior Member

3,460 posts Joined: Nov 2009 From: KL |

creative accounting

|

|

|

Jun 6 2025, 03:46 PM Jun 6 2025, 03:46 PM

Show posts by this member only | IPv6 | Post

#72

|

Senior Member

1,773 posts Joined: Dec 2013 |

now dont even look at tealive

straight go to mixue or if at mall, buy chagee or beautea. More exp but more yummy |

|

|

Jun 6 2025, 03:49 PM Jun 6 2025, 03:49 PM

|

Junior Member

877 posts Joined: Oct 2010 |

QUOTE(cloudwan0 @ Jun 6 2025, 02:50 PM) i know, this is why they choose to listing, but why only now Eco-shop also losing? Which brand top ecoshop?bcos they have the first hand info, they may not be so profit due to so many brand coming in same for cuckoo, eco-shop, DIY, etc... they balloon the number by loan, spending etc... so they can rip off the chinese chives... |

|

|

|

|

|

Jun 6 2025, 03:49 PM Jun 6 2025, 03:49 PM

Show posts by this member only | IPv6 | Post

#74

|

Senior Member

1,770 posts Joined: Feb 2008 |

Common sense, cashing out

|

|

|

Jun 6 2025, 05:58 PM Jun 6 2025, 05:58 PM

Show posts by this member only | IPv6 | Post

#75

|

Senior Member

4,692 posts Joined: Jan 2003 |

QUOTE(premier239 @ Jun 6 2025, 09:26 AM) All fking joke because you can tell through the book building process 🤦♀️This happens because Creador is impatient and waiting to cash out because they vested too long their usual period for their 10x |

|

|

Jun 9 2025, 06:28 PM Jun 9 2025, 06:28 PM

|

Senior Member

5,529 posts Joined: Oct 2007 |

|

|

|

Jun 9 2025, 07:17 PM Jun 9 2025, 07:17 PM

Show posts by this member only | IPv6 | Post

#77

|

Junior Member

256 posts Joined: Aug 2010 |

they have been tidying up the accounts since 7 years ago or more. some of my ex colleagues were approached to lead their IPO project 7 years ago. heard their accounts and operations super messy, throwing $ to hire people to help fix.

anyway, Tealive still got their fanbase. but of course now will get threatened crazily by mixue, chagee, zus etc. but IPO just to open 25 more stores... what is 25 compared to the 800+ stores that they are having now. if they are good and strong financially, can open 25 extra stores easily. definitely majority of the $ will be used to service debt and the family is cashing out. they dont really have a good solid long term plan aint it... This post has been edited by callmecool: Jun 9 2025, 07:18 PM |

|

|

Jun 9 2025, 07:20 PM Jun 9 2025, 07:20 PM

Show posts by this member only | IPv6 | Post

#78

|

Junior Member

499 posts Joined: Oct 2008 From: Perth, Western Australia |

QUOTE(dlwk1988 @ Jun 6 2025, 09:21 AM) Yes interbiu quite a number of kiosk workers lately They said now everyday setup stall and whack flies only Business not as good as last time during the boba tea fad era Consumers have smarten up. Yes family intends to cashout This post has been edited by carloz28: Jun 9 2025, 07:21 PM |

|

|

Jun 9 2025, 07:25 PM Jun 9 2025, 07:25 PM

|

Junior Member

79 posts Joined: Sep 2021 |

i tot now is era mixue

|

|

|

Jun 9 2025, 07:37 PM Jun 9 2025, 07:37 PM

Show posts by this member only | IPv6 | Post

#80

|

Junior Member

219 posts Joined: Nov 2021 |

Recent penny ipoS , do number cantik-cantik for quarter b4 ipo then after ipo earning all becom red , miracle

|

| Change to: |  0.0189sec 0.0189sec

0.70 0.70

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 06:17 PM |