Proceeds from its initial public offering (IPO) are intended to finance the opening of 12 new Tealive stores and 13 Bask Bear stores, and to repay existing borrowings, according to Loob's draft prospectus filed with the Securities Commission Malaysia.

The IPO will comprise a public issue of 58.46 million new shares, representing 5% of the company's enlarged share base, and an offer for sale of 292.3 million existing shares that represent 25% of its enlarged share base.

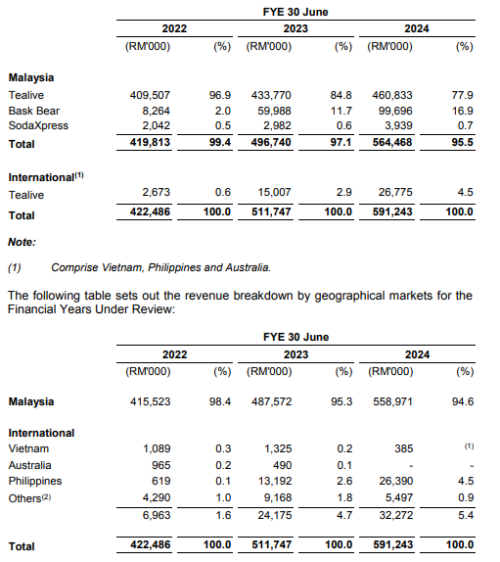

Loob said it is the "largest brand owner by number of stores in the F&B services industry in Malaysia" through Tealive and Bask Bear. The group had 831 Tealive stores as at Feb 28, comprising 547 Tealive corporate stores and 284 Tealive franchised stores; and 135 Bask Bear stores, comprising 129 Bask Bear corporate stores and six Bask Bear licensed stores.

Loob also operates 121 Tealive franchised stores across the Philippines, Myanmar, Brunei, Mauritius, Vietnam, Cambodia, and Canada.

In addition to its F&B business, the company also sells sparkling water machines and carbonated gas cylinders to both businesses and consumers.

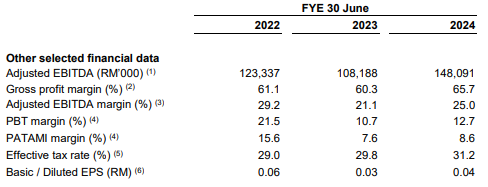

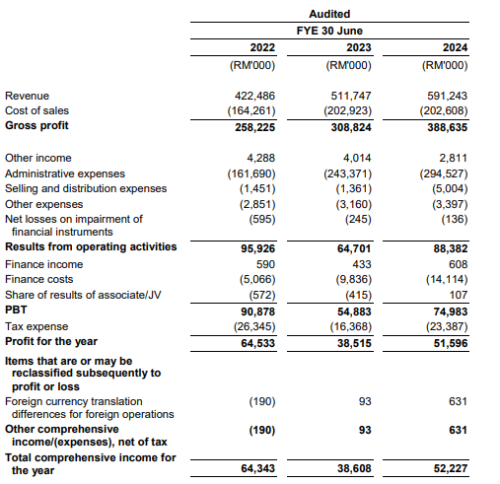

Loob made a profit after tax of RM51.6 million for its financial year ended June 30, 2024 (FY2024), up 33.96% from RM38.52 million in FY2023, but less than the RM64.53 million it achieved in FY2022. Revenue, meanwhile, grew to RM591.24 million in FY2024, from RM511.75 million in FY2023 and RM422.49 million in FY2022.

Of the 350.76 million shares under the public issue and offer for sale, 134.46 million shares (11.5% of the enlarged share base) will be reserved for the Malaysian public under the retail offering, and 11.69 million shares (1%) will be allocated to eligible persons of the group, both via application.

The remaining 204.61 million shares will be offered to institutional investors as follows: 58.46 million shares (5% of enlarged share base) to selected investors and 146.15 million shares (12.5%) to Bumiputera investors approved by the Ministry of Investment, Trade and Industry, both through bookbuilding.

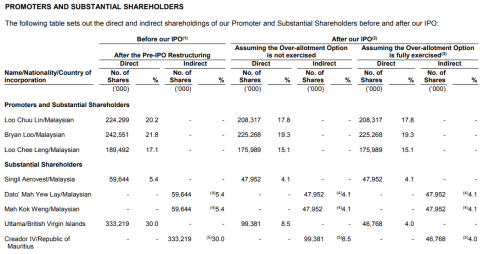

The 292.3 million existing shares under the offer for sale will be offered by substantial shareholders Uttama Ltd, Loob executive director and chief executive officer Bryan Loo, his father and director Loo Chuu Lin, his sister and executive director and chief operating officer Loo Chee Leng, and Singli Aerovest Sdn Bhd.

Based on the company's current share base, Uttama holds a 30% stake, followed by Bryan with 21.8%, Chuu Lin (20.2%), Chee Leng (17.1%), and Singli Aerovest (5.4%).

Uttama is wholly owned by Creador IV LP, while Singli Aerovest is 70% owned by Datuk Mah Yew Lay and 30% by Mah Kok Weng.

Uttama will offer the largest portion under the offer for sale with 233.84 million shares (20% of the enlarged share base), followed by Bryan with 17.28 million shares (1.5%), Chuu Lin with 15.98 million shares (1.4%), Chee Leng with 13.5 million shares (1.2%), and Singli Aerovest with 11.69 million shares (1%).

Post-listing, Uttama’s stake is projected to fall to 8.5%, Bryan's to 19.3%, Chuu Lin's to 17.8%, Chee Leng's to 15.1%, and Singli Aerovest's to 4.1%.

Maybank Investment Bank Bhd is the principal adviser and sole managing underwriter for the IPO. It is also the joint bookrunner and underwriter with AmInvestment Bank Sdn Bhd.

someone is cooking

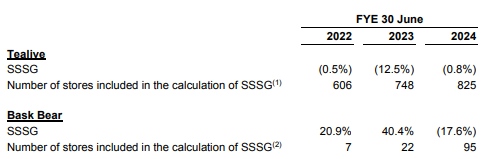

revenue up, but SSSG drop

Loob_Berhad_IPO_Prospectus.pdf ( 12.44mb )

Number of downloads: 71

Loob_Berhad_IPO_Prospectus.pdf ( 12.44mb )

Number of downloads: 71This post has been edited by premier239: Jun 6 2025, 09:34 AM

Jun 6 2025, 09:18 AM, updated 7 months ago

Jun 6 2025, 09:18 AM, updated 7 months ago

Quote

Quote

0.0168sec

0.0168sec

1.09

1.09

6 queries

6 queries

GZIP Disabled

GZIP Disabled