QUOTE(Zot @ May 21 2025, 02:45 PM)

You meant the old one can still perform better than the young one or the old cannot be replaced even if the performance is below par compare o the young one?

The old cant be replace even the young are better.Raise Retirement Age to 65

|

|

May 21 2025, 02:49 PM May 21 2025, 02:49 PM

|

Junior Member

110 posts Joined: Jul 2016 |

|

|

|

|

|

|

May 21 2025, 02:50 PM May 21 2025, 02:50 PM

|

Senior Member

7,938 posts Joined: Mar 2014 |

|

|

|

May 21 2025, 02:50 PM May 21 2025, 02:50 PM

Show posts by this member only | IPv6 | Post

#123

|

Newbie

14 posts Joined: Oct 2014 From: Bandar Damai dan Indah |

Follow Madey

|

|

|

May 21 2025, 02:58 PM May 21 2025, 02:58 PM

Show posts by this member only | IPv6 | Post

#124

|

Senior Member

4,357 posts Joined: Oct 2010 From: KL |

there are numerous reports around the world that ageing population impact the younger generation.

it doenst take a lot of thinking to understand that with people delaying retirement and still working and commanding big pay check, it will reduce opportunity for young grads and their salary. should just leave it as it is, if you are over 50/60/65 and still struggling and need to work, if you are contributing well according to your paycheck, i trust your company will retain you even after retirement age. retirement age doesn't mean you are not allowed to work anyway. this give the company more leverage to stop your service without consequences. and will be able to deploy their resources better eg: recruiting more young blood, promoting the next level of managers. |

|

|

May 21 2025, 02:58 PM May 21 2025, 02:58 PM

Show posts by this member only | IPv6 | Post

#125

|

Senior Member

1,609 posts Joined: Sep 2005 From: KL |

QUOTE(katijar @ May 21 2025, 06:42 AM) You don't understand the retirement age rule.The retirement age is the minimum age, not the maximum age. You can choose to retire before the minimum retirement age The employer is required to provide a job to the employee until the minimum legal retirement age. As for politicians, they are not working for an employer. Self-employed can work until any age. |

|

|

May 21 2025, 05:23 PM May 21 2025, 05:23 PM

Show posts by this member only | IPv6 | Post

#126

|

All Stars

21,457 posts Joined: Jul 2012 |

QUOTE(CoffeeDude @ May 21 2025, 02:58 PM) You don't understand the retirement age rule. In the contrary, anyone could choose for early retirement. When one reached retirement age, it is compulsory to retire except that company could extend by contract.The retirement age is the minimum age, not the maximum age. You can choose to retire before the minimum retirement age The employer is required to provide a job to the employee until the minimum legal retirement age. As for politicians, they are not working for an employer. Self-employed can work until any age. lurkingaround liked this post

|

|

|

|

|

|

May 21 2025, 05:26 PM May 21 2025, 05:26 PM

Show posts by this member only | IPv6 | Post

#127

|

Junior Member

933 posts Joined: Jul 2005 |

follow kutimama... keje sampai 100 je la...

|

|

|

May 21 2025, 05:52 PM May 21 2025, 05:52 PM

Show posts by this member only | IPv6 | Post

#128

|

Junior Member

587 posts Joined: May 2016 |

QUOTE(cempedaklife @ May 21 2025, 02:58 PM) there are numerous reports around the world that ageing population impact the younger generation. it doenst take a lot of thinking to understand that with people delaying retirement and still working and commanding big pay check, it will reduce opportunity for young grads and their salary. should just leave it as it is, if you are over 50/60/65 and still struggling and need to work, if you are contributing well according to your paycheck, i trust your company will retain you even after retirement age. retirement age doesn't mean you are not allowed to work anyway. this give the company more leverage to stop your service without consequences. and will be able to deploy their resources better eg: recruiting more young blood, promoting the next level of managers. Yup, give opportunities to the younger workforce. If retirement age keeps on going up from 55-60 and 60-65, the young will have less opportunities to climb up the ladder. Delay from 5 to 10 years. |

|

|

May 21 2025, 06:22 PM May 21 2025, 06:22 PM

Show posts by this member only | IPv6 | Post

#129

|

Junior Member

569 posts Joined: Jul 2007 |

QUOTE(khusyairi @ May 21 2025, 01:19 PM) He's not working. He's destroying Malaysia, that's his hobby. |

|

|

May 21 2025, 07:32 PM May 21 2025, 07:32 PM

Show posts by this member only | IPv6 | Post

#130

|

Senior Member

1,633 posts Joined: Jul 2007 |

QUOTE(cempedaklife @ May 21 2025, 02:58 PM) there are numerous reports around the world that ageing population impact the younger generation. That’s a simplistic take. The issue isn’t older workers “hogging jobs”. It’s companies failing to invest in succession planning and fair wage structures. This isn’t a zero-sum game where a 60-year-old cancels out a fresh grad. In fact, seasoned professionals raise the bar and often mentor the next wave.it doenst take a lot of thinking to understand that with people delaying retirement and still working and commanding big pay check, it will reduce opportunity for young grads and their salary. should just leave it as it is, if you are over 50/60/65 and still struggling and need to work, if you are contributing well according to your paycheck, i trust your company will retain you even after retirement age. retirement age doesn't mean you are not allowed to work anyway. this give the company more leverage to stop your service without consequences. and will be able to deploy their resources better eg: recruiting more young blood, promoting the next level of managers. And let’s not kid ourselves: companies already hold the sword. They can (and do) cut people loose whenever they want. Adjusting the retirement age doesn’t suddenly hand them new “leverage” — they’ve always had it. If you truly want to empower young talent, push for better training, smarter hiring, and actual innovation — not lazy age-based offloading. Respecting experience isn’t charity; it’s strategic. And if a 60-something is still the man pulling results? Like Ric Flair said: “To be the man, you gotta beat the man! Woooo!” If junior can’t step up and outperform, that’s not the veteran’s fault. That’s just the game. Taikor.Taikun liked this post

|

|

|

May 21 2025, 07:42 PM May 21 2025, 07:42 PM

Show posts by this member only | IPv6 | Post

#131

|

Senior Member

4,357 posts Joined: Oct 2010 From: KL |

QUOTE(Catnip @ May 21 2025, 07:32 PM) That’s a simplistic take. The issue isn’t older workers “hogging jobs”. It’s companies failing to invest in succession planning and fair wage structures. This isn’t a zero-sum game where a 60-year-old cancels out a fresh grad. In fact, seasoned professionals raise the bar and often mentor the next wave. Of course it’s a simplistic take. What do you want? A study of multiple years and produce a thousand pages book to debate it?And let’s not kid ourselves: companies already hold the sword. They can (and do) cut people loose whenever they want. Adjusting the retirement age doesn’t suddenly hand them new “leverage” — they’ve always had it. If you truly want to empower young talent, push for better training, smarter hiring, and actual innovation — not lazy age-based offloading. Respecting experience isn’t charity; it’s strategic. And if a 60-something is still the man pulling results? Like Ric Flair said: “To be the man, you gotta beat the man! Woooo!” If junior can’t step up and outperform, that’s not the veteran’s fault. That’s just the game. |

|

|

May 21 2025, 07:55 PM May 21 2025, 07:55 PM

Show posts by this member only | IPv6 | Post

#132

|

Senior Member

1,030 posts Joined: Jan 2022 |

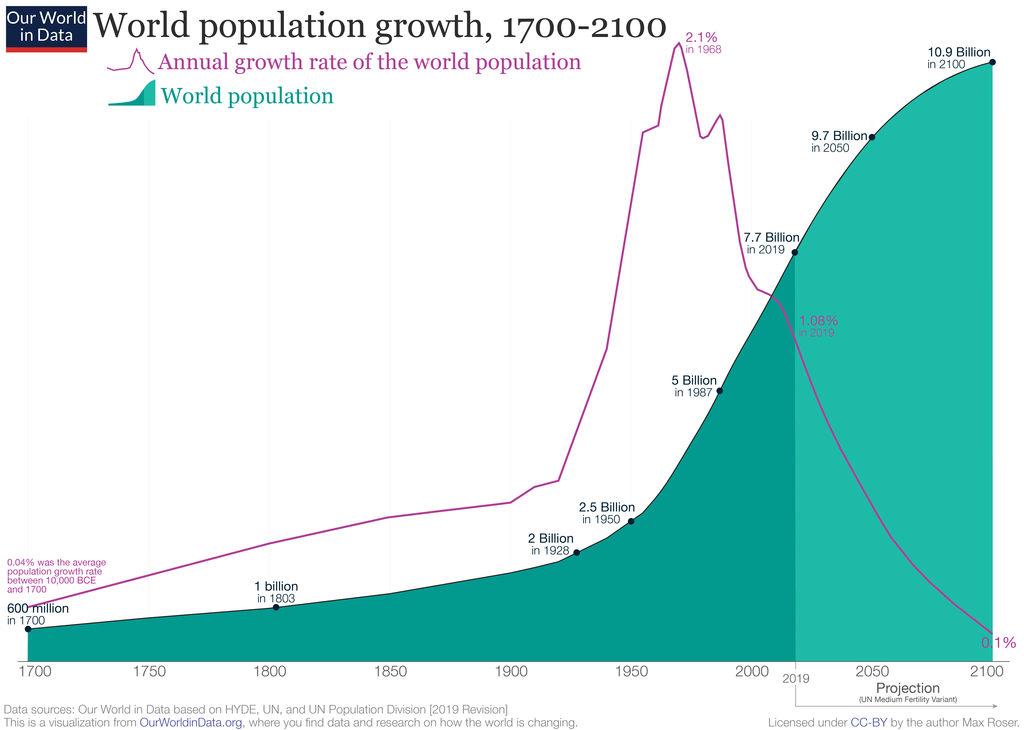

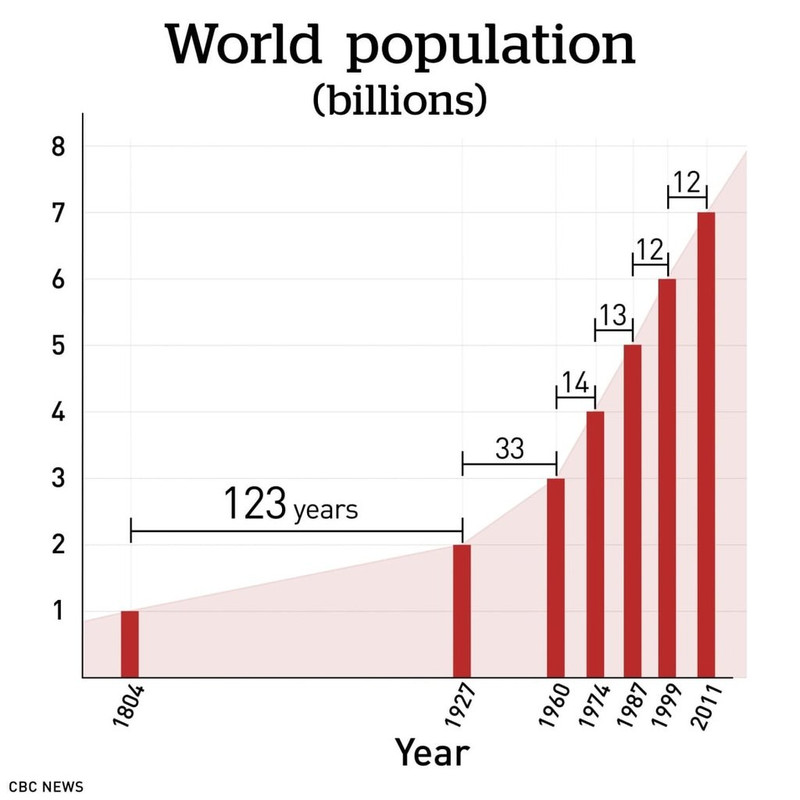

Government extend retirement age is to delay the needed pension payouts! The budget expenditure will have tremendous savings.

For private sector it's actually the other way around. Many already now openly restricting hiring candidates no more than 40yo in their ads. Meaning many in private sector are already forced into much earlier retirement and made delinquents in society. No wonder homeless is increasing on our streets in cities such as KL. It's crazy what the WEF globalist is ensuring all governments and countries around the world are trying to purge the 8B population now which they intend to lower to what our boomer parents enjoyed around half to 4B. The most ideal way is to get the middle ages out of their jobs and hope it'll shorten most people's lifespan much earlier.  Boomer in their 30s(during 70s-80s), some 50 years ago...population was just about 4B over Modern day midlifers over 30yo..   This post has been edited by petpenyubobo: May 21 2025, 07:57 PM |

|

|

May 21 2025, 07:57 PM May 21 2025, 07:57 PM

Show posts by this member only | IPv6 | Post

#133

|

Senior Member

1,633 posts Joined: Jul 2007 |

QUOTE(cempedaklife @ May 21 2025, 07:42 PM) Of course it’s a simplistic take. What do you want? A study of multiple years and produce a thousand pages book to debate it? No one’s asking for a thousand‑page thesis; just a bit more nuance. If you’re going to discuss workforce dynamics and retirement policy, you need more than a bumper‑sticker slogan.Oversimplifying labor economics and age demographics doesn’t make you pragmatic; it makes you part of the problem. Pointing fingers at a 60‑year‑old still delivering results is easy. Holding companies accountable for lazy HR, nonexistent succession planning, and wage‑suppression tactics—now that’s the hard work. So no, you don’t need a thousand pages. You just need more depth than: “Old people working = young people jobless.” That’s not analysis. That’s pub talk. |

|

|

|

|

|

May 22 2025, 01:32 PM May 22 2025, 01:32 PM

|

Senior Member

8,363 posts Joined: Feb 2014 |

QUOTE(cempedaklife @ May 21 2025, 02:58 PM) there are numerous reports around the world that ageing population impact the younger generation. +1 on your post! it doenst take a lot of thinking to understand that with people delaying retirement and still working and commanding big pay check, it will reduce opportunity for young grads and their salary. should just leave it as it is, if you are over 50/60/65 and still struggling and need to work, if you are contributing well according to your paycheck, i trust your company will retain you even after retirement age. retirement age doesn't mean you are not allowed to work anyway. this give the company more leverage to stop your service without consequences. and will be able to deploy their resources better eg: recruiting more young blood, promoting the next level of managers. QUOTE This is inevitable. But raising the retirement age is actually more beneficial to citizens. Currently, your employer only pays you until you’re 60. After that, they can choose to terminate you even if you still can and want to work. By raising the retirement age, those who still have the capability to work can continue doing so and receive mandatory contributions to EPF. cempedaklife liked this post

|

|

|

May 22 2025, 07:54 PM May 22 2025, 07:54 PM

Show posts by this member only | IPv6 | Post

#135

|

Senior Member

1,030 posts Joined: Jan 2022 |

QUOTE(Catnip @ May 21 2025, 07:57 PM) No one’s asking for a thousand‑page thesis; just a bit more nuance. If you’re going to discuss workforce dynamics and retirement policy, you need more than a bumper‑sticker slogan. We can understand why governments are raising the official retirement age, simple so that civil servants won't be claiming for their pensions for early payouts.Oversimplifying labor economics and age demographics doesn’t make you pragmatic; it makes you part of the problem. Pointing fingers at a 60‑year‑old still delivering results is easy. Holding companies accountable for lazy HR, nonexistent succession planning, and wage‑suppression tactics—now that’s the hard work. So no, you don’t need a thousand pages. You just need more depth than: “Old people working = young people jobless.” That’s not analysis. That’s pub talk. But for the private sector and most others, once you're over 40yo+ midlifers now with all the mass layoffs and age discrimination when hiring what are they going to do? Their EPF widthdrawal age are going to be extended with the retirement extension age what are they going to survive on? Also I think the elite globalist are stirring the youth to blame the millennials, and Gen-Xers who are still not ready to retire yet claiming they're hoarding the jobs. If these 2 older generations put up a good resistance the younger Gen-Z and Alphas are going to be done for. All they will do is keep their skills to themselves, do not transfer any of their knowledge to new recruits and refuse to highlight any improvements/errors in the system. Let the new comers take the blame and slowly the system will collapse. This is what I am observing and the prediction with movies such as Idiocracy is becoming a reality. We are seeing a slow collapse of the industry and degradation of staff quality over the past few years. If you compare those online merchant companies such as Shopee/Lazada, telco service sectors, so much blunders and deterioration is their service quality going on. I guess those midlifers who felt the threat of being laid off to make way for newcormers aren't going to part their skills and knowledge to the entitled younger generations who are told that the older staffs are "hoarding" their jobs.  |

|

|

May 23 2025, 01:52 AM May 23 2025, 01:52 AM

|

||||||||

Senior Member

1,633 posts Joined: Jul 2007 |

QUOTE(petpenyubobo @ May 22 2025, 07:54 PM) But for the private sector and most others, once you're over 40yo+ midlifers now with all the mass layoffs and age discrimination when hiring what are they going to do? Their EPF widthdrawal age are going to be extended with the retirement extension age what are they going to survive on? I'm going to focus on current EPF Withdrawal Rules, based on official guidelines:

This system already gives a flexible and practical structure for retirement planning. And yes, if the retirement age is officially extended in the future, it’s highly likely EPF will simply create another contribution account (post-60) with withdrawal at 65, following the same structure. Also, don’t forget; Dividends continue to be paid on all savings until age 100. There’s no loss of returns just because you don’t withdraw early. If you're uncertain about any details, just give EPF a call or drop them an email. They’re pretty helpful. Look, I love the X-Files, The Lone Gunmen, and Strange World as much as the next guy; But let’s not turn every policy discussion into another conspiracy thread. Facts help people plan. Fear just makes them panic. |

||||||||

|

|

May 23 2025, 08:34 PM May 23 2025, 08:34 PM

Show posts by this member only | IPv6 | Post

#137

|

||||||||

Senior Member

1,030 posts Joined: Jan 2022 |

QUOTE(Catnip @ May 23 2025, 01:52 AM) I'm going to focus on current EPF Withdrawal Rules, based on official guidelines: A lot of companies in the private sectors are not longer hiring if you've passed the age of 35 above. What you expect them to do in between these 15-20 years before they can touch their EPFs? What you want them to beg on the streets for survival?

This system already gives a flexible and practical structure for retirement planning. And yes, if the retirement age is officially extended in the future, it’s highly likely EPF will simply create another contribution account (post-60) with withdrawal at 65, following the same structure. Also, don’t forget; Dividends continue to be paid on all savings until age 100. There’s no loss of returns just because you don’t withdraw early. If you're uncertain about any details, just give EPF a call or drop them an email. They’re pretty helpful. Look, I love the X-Files, The Lone Gunmen, and Strange World as much as the next guy; But let’s not turn every policy discussion into another conspiracy thread. Facts help people plan. Fear just makes them panic. This is not conspiracy but a real disaster in making for countries around the world including China, South Korea and even Japan. As I said I can understand why the world governments want to keep extending the retirement age to avoid feeding its people too early for pensions. But how about the private sectors? Do you think about them especially in this country where Nons are less likely to join the civil sector and receive pensions? |

||||||||

|

|

May 25 2025, 08:01 AM May 25 2025, 08:01 AM

Show posts by this member only | IPv6 | Post

#138

|

Senior Member

1,633 posts Joined: Jul 2007 |

Where do you get your numbers from? Don’t believe everything you hear at the kopitiam or from conspiracy theorists. Let’s ground this discussion in actual data: According to the Department of Statistics Malaysia (DOSM) Labour Market Review, Q1 2025, the total labour force stands at 17.23 million, with a labour force participation rate of 70.1% and an employment-to-population ratio of 67.4%. The unemployment rate is just 3.1%, reflecting a stable and generally healthy job market across age groups. What about workers over 35? It’s true that some sectors make it harder to re-enter the job market after 35—especially without continuous upskilling. But to claim that companies no longer hire anyone above 35 just isn’t supported by the facts. Many industries—healthcare, education, skilled trades, engineering, IT, and professional services—value maturity, expertise, and leadership experience, often preferring individuals with 10–20 years of insight. In fact, workers aged 40–59 consistently make up a substantial share of the Malaysian workforce, as confirmed by previous DOSM reports. Why raise the retirement age? It’s not about governments avoiding pensions. It’s about longer life expectancy, healthier ageing, and the need to sustain pension systems amid declining birth rates. Nations like Germany, Japan, the UK, and even China are raising retirement ages toward 65–67, not out of malice, but necessity. Instead of doom-posting, we should be pushing for:

Source: DOSM Labour Market Review Q1 2025 (PDF) https://storage.dosm.gov.my/analysis/lmr_2025-q1_en.pdf In the legendary words of Macho Man Randy Savage:  If you've got the skills, the drive, and the grit—age ain't nothing but a number. This post has been edited by Catnip: May 25 2025, 08:02 AM Taikor.Taikun liked this post

|

|

|

May 26 2025, 07:05 AM May 26 2025, 07:05 AM

|

Senior Member

6,660 posts Joined: Jan 2003 From: Palace of sexology |

Raising retirement age can delay retirement fund withdrawal.

Due to large aging population of GenX. Knowing aging genX with million RM in EPF is a ticking timebomb. |

|

|

May 26 2025, 07:09 AM May 26 2025, 07:09 AM

Show posts by this member only | IPv6 | Post

#140

|

Junior Member

395 posts Joined: Dec 2017 |

Instead of raising wages, raise retirement age. Smart. Another 5 years a slave.

|

| Change to: |  0.0506sec 0.0506sec

0.34 0.34

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 06:39 AM |