QUOTE(Catnip @ May 21 2025, 07:57 PM)

No one’s asking for a thousand‑page thesis; just a bit more nuance. If you’re going to discuss workforce dynamics and retirement policy, you need more than a bumper‑sticker slogan.

Oversimplifying labor economics and age demographics doesn’t make you pragmatic; it makes you part of the problem.

Pointing fingers at a 60‑year‑old still delivering results is easy. Holding companies accountable for lazy HR, nonexistent succession planning, and wage‑suppression tactics—now that’s the hard work.

So no, you don’t need a thousand pages. You just need more depth than:

“Old people working = young people jobless.”That’s not analysis. That’s pub talk.

We can understand why governments are raising the official retirement age, simple so that civil servants won't be claiming for their pensions for early payouts.

But for the private sector and most others, once you're over 40yo+ midlifers now with all the mass layoffs and age discrimination when hiring what are they going to do? Their EPF widthdrawal age are going to be extended with the retirement extension age what are they going to survive on?

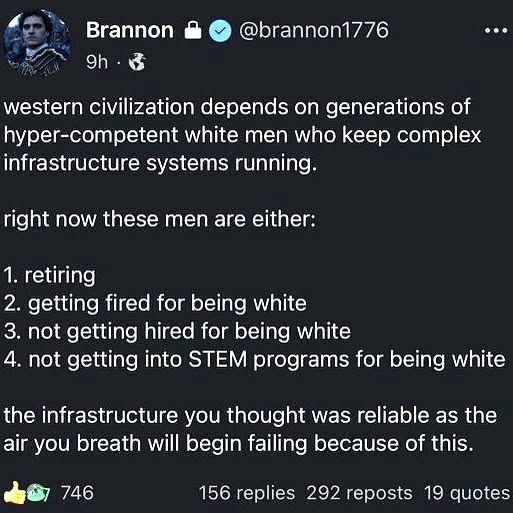

Also I think the elite globalist are stirring the youth to blame the millennials, and Gen-Xers who are still not ready to retire yet claiming they're hoarding the jobs. If these 2 older generations put up a good resistance the younger Gen-Z and Alphas are going to be done for.

All they will do is keep their skills to themselves, do not transfer any of their knowledge to new recruits and refuse to highlight any improvements/errors in the system. Let the new comers take the blame and slowly the system will collapse.

This is what I am observing and the prediction with movies such as Idiocracy is becoming a reality.

We are seeing a slow collapse of the industry and degradation of staff quality over the past few years.

If you compare those online merchant companies such as Shopee/Lazada, telco service sectors, so much blunders and deterioration is their service quality going on. I guess those midlifers who felt the threat of being laid off to make way for newcormers aren't going to part their skills and knowledge to the entitled younger generations who are told that the older staffs are "hoarding" their jobs.

May 21 2025, 07:55 PM

May 21 2025, 07:55 PM

Quote

Quote

0.0434sec

0.0434sec

0.73

0.73

8 queries

8 queries

GZIP Disabled

GZIP Disabled