good rate.

Best rate for car loan for 5 years?

Best rate for car loan for 5 years?

|

|

May 28 2024, 03:15 PM May 28 2024, 03:15 PM

|

Senior Member

1,053 posts Joined: Oct 2010 From: meow meow city / selangor |

good rate.

|

|

|

|

|

|

May 28 2024, 03:16 PM May 28 2024, 03:16 PM

Show posts by this member only | IPv6 | Post

#22

|

Senior Member

5,750 posts Joined: Jan 2003 From: Sri Kembangan |

QUOTE(WaCKy-Angel @ May 28 2024, 03:13 PM) U mean insurance for the car loan? Ok what in case jew dieded before finish serving loan ur beneficiary gets the car for free. Ya like MRTA mortgage reducing insurance. If you kena jackpot second year fully repay car loan can cancel n get money back from your insurance |

|

|

May 28 2024, 03:40 PM May 28 2024, 03:40 PM

Show posts by this member only | IPv6 | Post

#23

|

Senior Member

3,559 posts Joined: Sep 2005 From: Shenzhen Bahru |

QUOTE(WaCKy-Angel @ May 28 2024, 03:13 PM) U mean insurance for the car loan? Ok what in case jew dieded before finish serving loan ur beneficiary gets the car for free. It’s a Personal Accident insurance. It’s not a MRTA like propertyQUOTE(g5sim @ May 28 2024, 03:14 PM) Very good. It's lower than my fix deposit rate. God sent! If I am you I loan 15year take the money n put into deposit 😜🤔 under taking deal with car salesman. You think too simplistic. You gotta calculate the Effective Interest Rate for loan.QUOTE(g5sim @ May 28 2024, 03:16 PM) Ya like MRTA mortgage reducing insurance. If you kena jackpot second year fully repay car loan can cancel n get money back from your insurance No such thing |

|

|

May 28 2024, 03:50 PM May 28 2024, 03:50 PM

|

All Stars

21,962 posts Joined: Dec 2004 From: KL |

|

|

|

May 28 2024, 03:57 PM May 28 2024, 03:57 PM

Show posts by this member only | IPv6 | Post

#25

|

Junior Member

487 posts Joined: Sep 2006 |

From my understanding, loan rate is based on multitude criteria:

amount (higher loan amount, better rate), tenure, type of car (not just ckd/cbu but also brand name), new/recond/second hand, your credit rating Some banks may give slightly better rate but difference not very big. Usually, I just go for the 2 best rates & nego. Some banks may force you to take credit card together with the loan. If above certain age, have to purchase insurance on the loan amount. This post has been edited by Lanchio: May 28 2024, 03:58 PM |

|

|

May 28 2024, 03:58 PM May 28 2024, 03:58 PM

Show posts by this member only | IPv6 | Post

#26

|

Senior Member

3,559 posts Joined: Sep 2005 From: Shenzhen Bahru |

|

|

|

|

|

|

May 28 2024, 04:00 PM May 28 2024, 04:00 PM

Show posts by this member only | IPv6 | Post

#27

|

Junior Member

429 posts Joined: Jan 2003 |

QUOTE(codercoder @ May 28 2024, 10:13 AM) If my car loan amount is RM30k for 5 years, Maybank offer me 2.82% rate ok? Any other better rate besides maybank? It all depends on the loan amount. Mine was 250k / 5 years @ 2.3% something before double OPR increase. The fewer u loan and shorter period the higher the interest. But for ur case only 30k bunga over 5 years also pun tak banyak. Other banks pun more less the same 0.5% difference only. |

|

|

May 28 2024, 04:30 PM May 28 2024, 04:30 PM

|

All Stars

21,962 posts Joined: Dec 2004 From: KL |

QUOTE(knwong @ May 28 2024, 03:58 PM) Another option is must take up Auto Life Takaful Plan (more expensive). Whatever it is you need to buy their other financial product in order to get that low interest This one ok lah since add premium for insurance about same as other banks, but this get extra insurance. |

|

|

May 28 2024, 08:39 PM May 28 2024, 08:39 PM

|

Junior Member

281 posts Joined: Dec 2021 |

Anything below 3 is good rate

|

|

|

May 28 2024, 09:11 PM May 28 2024, 09:11 PM

|

Senior Member

4,706 posts Joined: May 2008 |

|

|

|

May 28 2024, 09:16 PM May 28 2024, 09:16 PM

Show posts by this member only | IPv6 | Post

#31

|

Senior Member

5,539 posts Joined: Aug 2011 |

QUOTE(g5sim @ May 28 2024, 03:14 PM) Very good. It's lower than my fix deposit rate. God sent! If I am you I loan 15year take the money n put into deposit 😜🤔 under taking deal with car salesman. LMAO you have no clue how this works do you? A fixed rate loan at 2.5% is more expensive than an FD yielding 4.0%. |

|

|

May 28 2024, 09:31 PM May 28 2024, 09:31 PM

Show posts by this member only | IPv6 | Post

#32

|

Senior Member

5,750 posts Joined: Jan 2003 From: Sri Kembangan |

|

|

|

May 28 2024, 09:39 PM May 28 2024, 09:39 PM

Show posts by this member only | IPv6 | Post

#33

|

Junior Member

214 posts Joined: Mar 2015 |

Try ask bank rakyat

|

|

|

|

|

|

May 28 2024, 09:56 PM May 28 2024, 09:56 PM

Show posts by this member only | IPv6 | Post

#34

|

Senior Member

5,539 posts Joined: Aug 2011 |

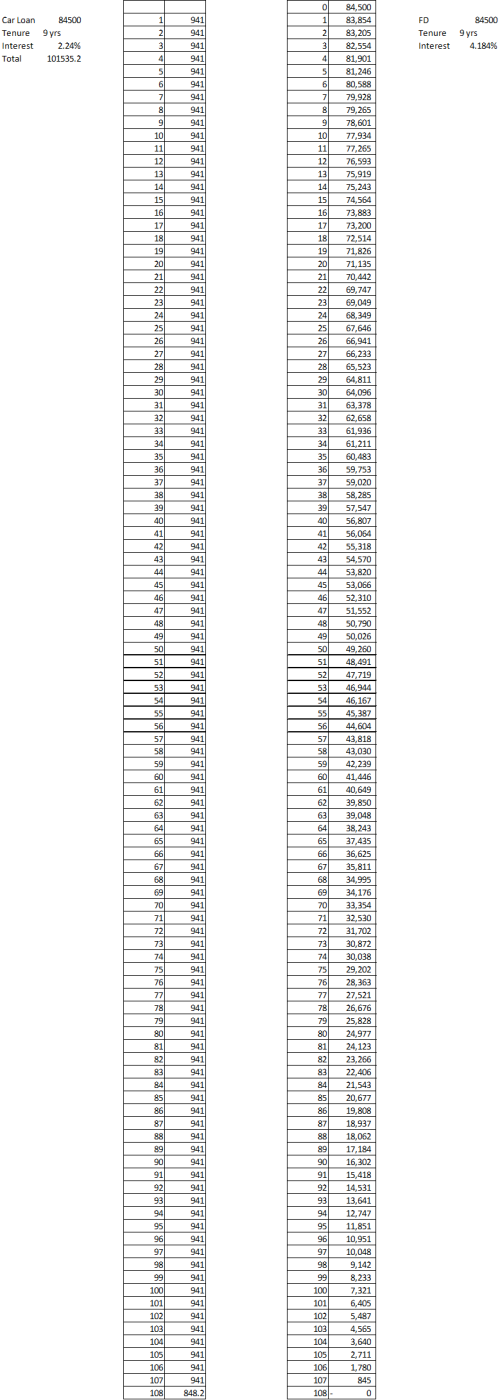

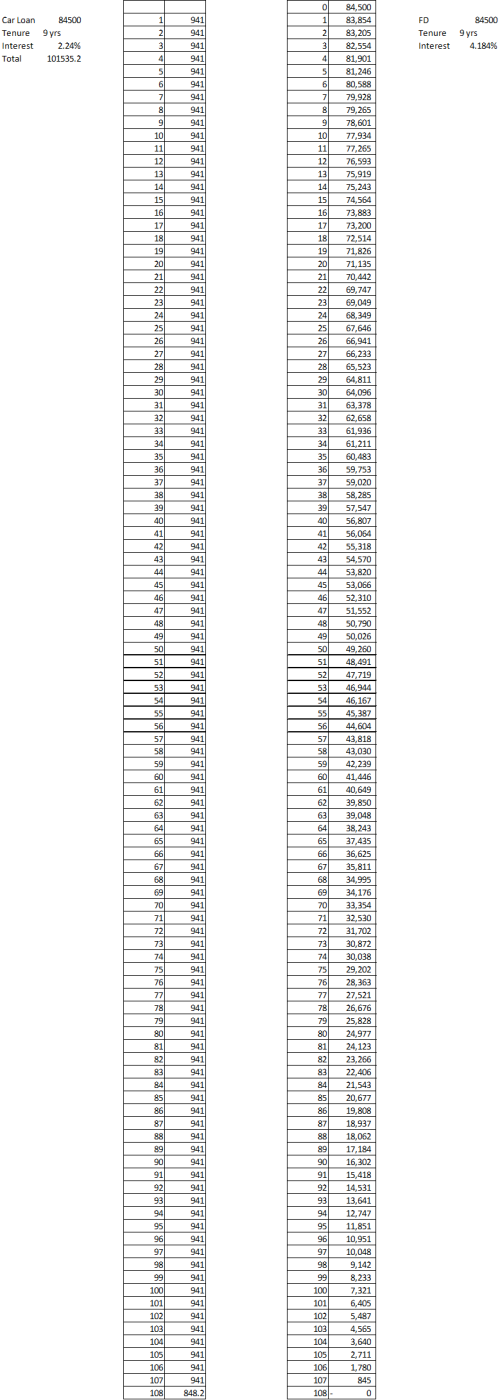

QUOTE(g5sim @ May 28 2024, 09:31 PM) Di count for me genius. The rate for 5y 60k loan at 2.5% VS a 60k 5y FD at 3.3%. If you set up a RM50k monthly rolling FD at 3.3% and withdraw to pay your monthly car installment at 2.5%, you'll exhaust the FD before the car is paid off. I counted 7500RM for 2.5% VS 9900RM 3.3% My calculation below is for my loan at 2.24%, I need an FD of 4.184% to match the car loan interest.  This post has been edited by contestchris: May 28 2024, 10:08 PM yhtan liked this post

|

|

|

May 28 2024, 10:30 PM May 28 2024, 10:30 PM

|

Senior Member

4,706 posts Joined: May 2008 |

QUOTE(contestchris @ May 28 2024, 09:56 PM) If you set up a RM50k monthly rolling FD at 3.3% and withdraw to pay your monthly car installment at 2.5%, you'll exhaust the FD before the car is paid off. i believe he meant keeping that 50k FD untouched then monthly installment with additional cash from else whereMy calculation below is for my loan at 2.24%, I need an FD of 4.184% to match the car loan interest.  |

|

|

May 28 2024, 10:33 PM May 28 2024, 10:33 PM

|

Junior Member

148 posts Joined: Jan 2023 |

No tricks can beat the banks lol

|

|

|

May 28 2024, 10:33 PM May 28 2024, 10:33 PM

Show posts by this member only | IPv6 | Post

#37

|

Senior Member

5,539 posts Joined: Aug 2011 |

|

|

|

May 28 2024, 10:39 PM May 28 2024, 10:39 PM

|

Senior Member

4,706 posts Joined: May 2008 |

|

|

|

May 30 2024, 10:07 AM May 30 2024, 10:07 AM

|

Junior Member

148 posts Joined: Jan 2023 |

public bank lower 2.77%

|

|

|

May 31 2024, 03:50 PM May 31 2024, 03:50 PM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

|

| Change to: |  0.0197sec 0.0197sec

1.10 1.10

5 queries 5 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 05:15 PM |