Outline ·

[ Standard ] ·

Linear+

Best rate for car loan for 5 years?

|

contestchris

|

May 28 2024, 09:16 PM May 28 2024, 09:16 PM

|

|

QUOTE(g5sim @ May 28 2024, 03:14 PM) Very good. It's lower than my fix deposit rate. God sent! If I am you I loan 15year take the money n put into deposit 😜🤔 under taking deal with car salesman. LMAO you have no clue how this works do you? A fixed rate loan at 2.5% is more expensive than an FD yielding 4.0%. |

|

|

|

|

|

contestchris

|

May 28 2024, 09:56 PM May 28 2024, 09:56 PM

|

|

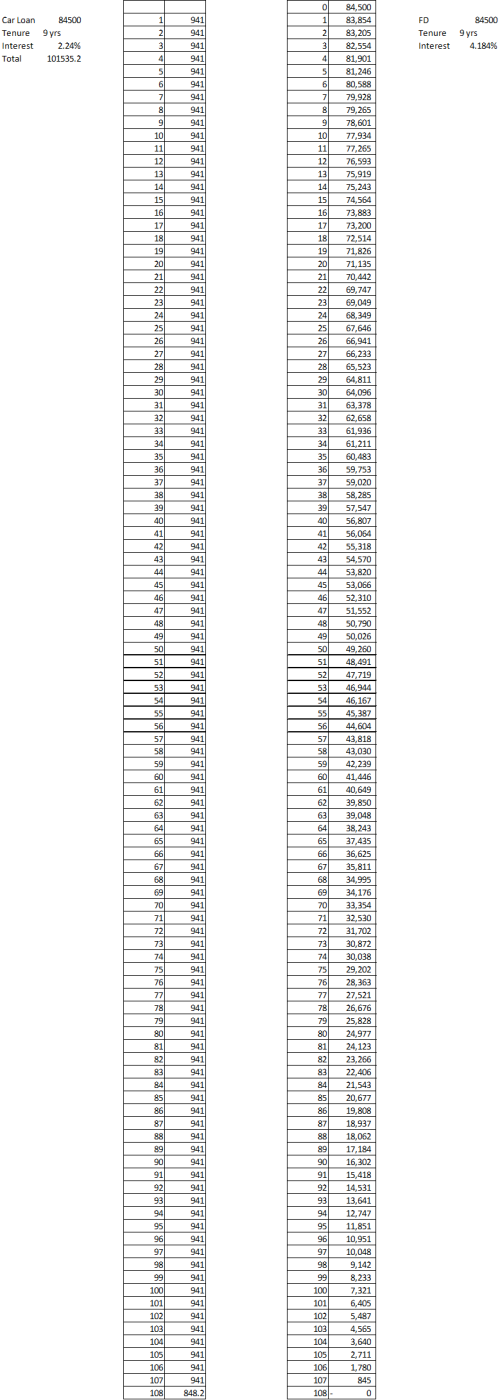

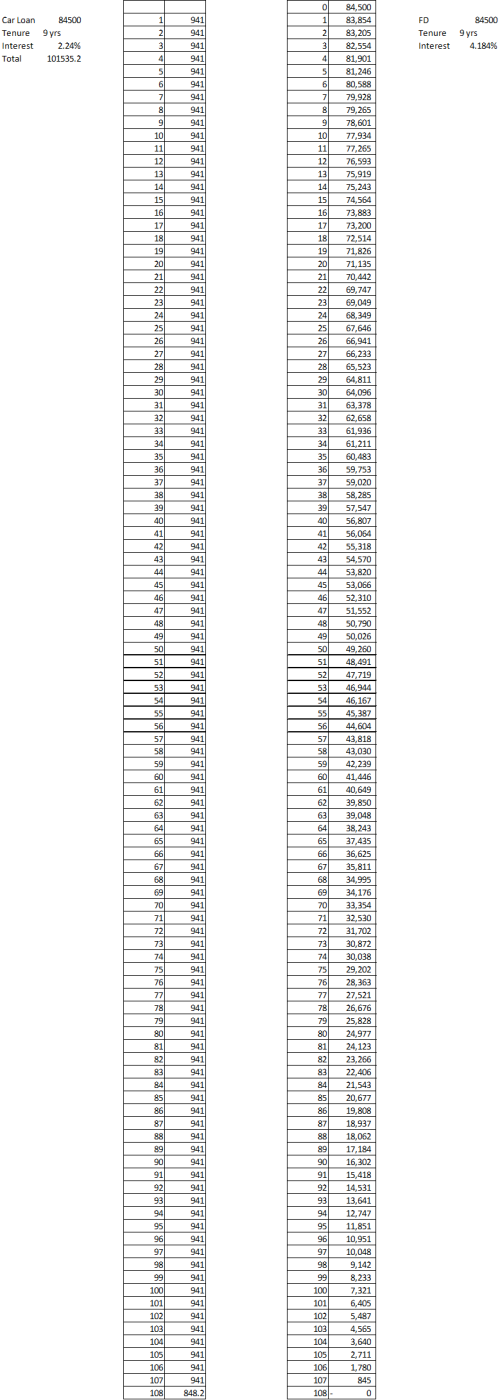

QUOTE(g5sim @ May 28 2024, 09:31 PM) Di count for me genius. The rate for 5y 60k loan at 2.5% VS a 60k 5y FD at 3.3%. I counted 7500RM for 2.5% VS 9900RM 3.3% If you set up a RM50k monthly rolling FD at 3.3% and withdraw to pay your monthly car installment at 2.5%, you'll exhaust the FD before the car is paid off. My calculation below is for my loan at 2.24%, I need an FD of 4.184% to match the car loan interest.  This post has been edited by contestchris: May 28 2024, 10:08 PM This post has been edited by contestchris: May 28 2024, 10:08 PM |

|

|

|

|

|

contestchris

|

May 28 2024, 10:33 PM May 28 2024, 10:33 PM

|

|

QUOTE(fantasy1989 @ May 28 2024, 10:30 PM) i believe he meant keeping that 50k FD untouched then monthly installment with additional cash from else where It's not an apple-to-apple comparison, and you're losing money anyways (the same logic applies to that "cash from elsewhere"). |

|

|

|

|

May 28 2024, 09:16 PM

May 28 2024, 09:16 PM

Quote

Quote

0.0149sec

0.0149sec

0.71

0.71

6 queries

6 queries

GZIP Disabled

GZIP Disabled