AS topic.. since interest in semi flexi are calculated based on the capital u owe the bank..should i dump my part of saving into the semi flexi to tekan the interest...?

House Loan Semi Flexi, Thinking dump my saving in house loan

House Loan Semi Flexi, Thinking dump my saving in house loan

|

|

Apr 27 2024, 10:38 PM, updated 8 months ago Apr 27 2024, 10:38 PM, updated 8 months ago

Show posts by this member only | Post

#1

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

AS topic.. since interest in semi flexi are calculated based on the capital u owe the bank..should i dump my part of saving into the semi flexi to tekan the interest...?

|

|

|

|

|

|

Apr 27 2024, 10:43 PM Apr 27 2024, 10:43 PM

Show posts by this member only | Post

#2

|

Senior Member

7,847 posts Joined: Sep 2019 |

I would and I did. 100% debt free now kevinc liked this post

|

|

|

Apr 27 2024, 10:52 PM Apr 27 2024, 10:52 PM

Show posts by this member only | Post

#3

|

Senior Member

4,952 posts Joined: Jul 2010 |

My 2sen.

Do it if your savings earn lower interest rates. Do note your cashflow can be affected. I think almost all banks will charge you some fee if you decide to withdraw the excess fund - negating whatever savings you got. |

|

|

Apr 27 2024, 11:23 PM Apr 27 2024, 11:23 PM

Show posts by this member only | Post

#4

|

Senior Member

1,521 posts Joined: Apr 2005 From: too far to see |

I hope this is not in Serious kopitiam. The question is too shallow.

Semi fkex n flexi loans are there for interest saving purposes. And now you hv it with you for the same reason. It is a matter of math, not a matter of if we shd dump the money in... This post has been edited by taitianhin: Apr 27 2024, 11:26 PM |

|

|

Apr 27 2024, 11:38 PM Apr 27 2024, 11:38 PM

Show posts by this member only | Post

#5

|

Junior Member

535 posts Joined: Oct 2010 From: 4:44 am |

If you have no other plans for the idle money (for savings, FD and etc), then you should park it at your semi-flexi loan.

*I am not a personal finance consultant, engage one if you need appropriate advise. |

|

|

Apr 28 2024, 12:00 AM Apr 28 2024, 12:00 AM

Show posts by this member only | Post

#6

|

Senior Member

3,968 posts Joined: Nov 2007 |

if you have long term fd , yes you should.

|

|

|

|

|

|

Apr 28 2024, 12:17 AM Apr 28 2024, 12:17 AM

Show posts by this member only | IPv6 | Post

#7

|

Junior Member

571 posts Joined: Mar 2012 |

QUOTE(shyan90's @ Apr 27 2024, 10:38 PM) AS topic.. since interest in semi flexi are calculated based on the capital u owe the bank..should i dump my part of saving into the semi flexi to tekan the interest...? remember that for semi flexi, u hav to inform bank in order to lower the interest, where else full flexi is auto.if u full flexi & got on9 facility to redraw at any moment, parking your emergency or FD funds in mortgage is better than standard FD rate. |

|

|

Apr 28 2024, 12:24 AM Apr 28 2024, 12:24 AM

Show posts by this member only | IPv6 | Post

#8

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(shyan90's @ Apr 27 2024, 10:38 PM) AS topic.. since interest in semi flexi are calculated based on the capital u owe the bank..should i dump my part of saving into the semi flexi to tekan the interest...? Depends on market situation. Mine is fully flexi but similar, so I basically see it as another FD, just works the opposite way (tekan interest instead of giving you dividend/interests)Whatever effective interest rate I am charged (eg 4.25% in recent months) vs whatever else I can gain outside today (in today's context, not much). So dump dump dump! |

|

|

Apr 28 2024, 02:29 AM Apr 28 2024, 02:29 AM

Show posts by this member only | Post

#9

|

Senior Member

3,559 posts Joined: Sep 2005 From: Shenzhen Bahru |

Of course la. FD savings rate won't be higher than house loan

|

|

|

Apr 28 2024, 05:13 AM Apr 28 2024, 05:13 AM

Show posts by this member only | IPv6 | Post

#10

|

Senior Member

5,741 posts Joined: Apr 2019 |

i did for mine.

helping yourself from being charged thousands of interest (that goes into drain) per month is a very wise decision. |

|

|

Apr 28 2024, 06:33 AM Apr 28 2024, 06:33 AM

|

Senior Member

673 posts Joined: Dec 2009 |

Thinking of doing this as well upon full disbursement, currently still paying the progressive interest only.

|

|

|

Apr 28 2024, 09:41 AM Apr 28 2024, 09:41 AM

|

Senior Member

4,952 posts Joined: Jul 2010 |

QUOTE(unknown_2 @ Apr 28 2024, 12:17 AM) remember that for semi flexi, u hav to inform bank in order to lower the interest, where else full flexi is auto. What do you mean by "inform the bank to lower interest"? Inform them each time you put in money?if u full flexi & got on9 facility to redraw at any moment, parking your emergency or FD funds in mortgage is better than standard FD rate. Some banks like MBB calculate the daily interest automatically, based on how much you transfer money into the loan account. Imo, the semi-flexi part refers to the T&C when you draw down the loan account (some impose minimum amount to withdraw, and also incurs a service charge when you draw money). |

|

|

Apr 28 2024, 09:47 AM Apr 28 2024, 09:47 AM

|

Senior Member

7,847 posts Joined: Sep 2019 |

|

|

|

|

|

|

Apr 28 2024, 10:05 AM Apr 28 2024, 10:05 AM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

QUOTE(mushigen @ Apr 27 2024, 10:52 PM) My 2sen. Ya it does charge 1 fix amount to withdraw. Unless full flexi.Do it if your savings earn lower interest rates. Do note your cashflow can be affected. I think almost all banks will charge you some fee if you decide to withdraw the excess fund - negating whatever savings you got. QUOTE(unknown_2 @ Apr 28 2024, 12:17 AM) remember that for semi flexi, u hav to inform bank in order to lower the interest, where else full flexi is auto. I think it will automatically lower the interest.. during MCO time bank did lower my interest even i din ask for.if u full flexi & got on9 facility to redraw at any moment, parking your emergency or FD funds in mortgage is better than standard FD rate. This post has been edited by shyan90's: Apr 28 2024, 10:07 AM |

|

|

Apr 28 2024, 10:30 AM Apr 28 2024, 10:30 AM

|

Senior Member

4,952 posts Joined: Jul 2010 |

QUOTE(shyan90's @ Apr 28 2024, 10:05 AM) Ya it does charge 1 fix amount to withdraw. Unless full flexi. Full flexi usually incurs monthly maintenance fee. And some if not most banks impose cap on interest waiver. Semi flexi usually does not have cap.I think it will automatically lower the interest.. during MCO time bank did lower my interest even i din ask for. |

|

|

Apr 28 2024, 10:37 AM Apr 28 2024, 10:37 AM

Show posts by this member only | IPv6 | Post

#16

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(mushigen @ Apr 28 2024, 10:30 AM) Full flexi usually incurs monthly maintenance fee. And some if not most banks impose cap on interest waiver. Semi flexi usually does not have cap. This is true. In my case, the monthly account fee is -RM5, and minimum "outstanding" is -RM100K so even if I deposit and make my account balance 0, I'll still incur the bare minimum interest rate charges using RM100k as the outstanding base. Though when I did my comparison many years ago it was still worthwhile, considering that it's so much more flexible to have online and zero-notification facility without having to meet stringent requirements too. Back then the Semi-Flexi loans I compared had requirements like "must be in multiples of RM1000 to knock off principal; and must notify bank in writing/via counter". Should be better now I guess, but hasn't been comparing loans so don't know where the banking industry is taking us now |

|

|

Apr 28 2024, 10:48 AM Apr 28 2024, 10:48 AM

|

Senior Member

4,952 posts Joined: Jul 2010 |

QUOTE(polarzbearz @ Apr 28 2024, 10:37 AM) This is true. Which bank is that (the minimum 100k)?In my case, the monthly account fee is -RM5, and minimum "outstanding" is -RM100K so even if I deposit and make my account balance 0, I'll still incur the bare minimum interest rate charges using RM100k as the outstanding base. Though when I did my comparison many years ago it was still worthwhile, considering that it's so much more flexible to have online and zero-notification facility without having to meet stringent requirements too. Back then the Semi-Flexi loans I compared had requirements like "must be in multiples of RM1000 to knock off principal; and must notify bank in writing/via counter". Should be better now I guess, but hasn't been comparing loans so don't know where the banking industry is taking us now Few years back when I was shopping for a loan, PBB's cap is up to 70% of the balance in the current account. Meaning, if you put in 100k, 30k does nothing. HLB has 70% cap on remaining principle. At the same time, I found out about the no capping in semi flexi loans. The withdrawal service charge (something like RM25 or 50) and minimum payment/withdrawal amount didn't appeal to me. wawasan2200 liked this post

|

|

|

Apr 28 2024, 10:58 AM Apr 28 2024, 10:58 AM

Show posts by this member only | IPv6 | Post

#18

|

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(mushigen @ Apr 28 2024, 10:48 AM) Which bank is that (the minimum 100k)? Mine is Maybank. They did not specify percentage-based value but hardcoded(?) value. Loan on its inception was approximately ~500K so, 20% if percentage wise?Few years back when I was shopping for a loan, PBB's cap is up to 70% of the balance in the current account. Meaning, if you put in 100k, 30k does nothing. HLB has 70% cap on remaining principle. At the same time, I found out about the no capping in semi flexi loans. The withdrawal service charge (something like RM25 or 50) and minimum payment/withdrawal amount didn't appeal to me. At that point in time I only found two FULLY-FLEXI providers - Maybank and HSBC. HSBC obviously rejected the loan offer since it's a small ikan bilis package and they only goes for the big ones I had same conclusion as you for semi-flexi (CIMB and RHB) during my shopping. That troublesome minimum RM1000's tranche and withdrawal fees put me off so I just went with Maybank. Depending on economic situation next few years I may just wipe off my loan early, or keep it as a easy drawdown loan with mortgage-level interest rates for cashflow purposes. |

|

|

Apr 28 2024, 11:27 AM Apr 28 2024, 11:27 AM

|

Senior Member

4,952 posts Joined: Jul 2010 |

QUOTE(polarzbearz @ Apr 28 2024, 10:58 AM) Mine is Maybank. They did not specify percentage-based value but hardcoded(?) value. Loan on its inception was approximately ~500K so, 20% if percentage wise? Maybank didn't even have any flexi loan to offer me back then. 500k pun considered ikan bilis?At that point in time I only found two FULLY-FLEXI providers - Maybank and HSBC. HSBC obviously rejected the loan offer since it's a small ikan bilis package and they only goes for the big ones I had same conclusion as you for semi-flexi (CIMB and RHB) during my shopping. That troublesome minimum RM1000's tranche and withdrawal fees put me off so I just went with Maybank. Depending on economic situation next few years I may just wipe off my loan early, or keep it as a easy drawdown loan with mortgage-level interest rates for cashflow purposes. |

|

|

Apr 28 2024, 12:06 PM Apr 28 2024, 12:06 PM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

QUOTE(mushigen @ Apr 28 2024, 11:27 AM) For now is quite normal for 500k...maybe ikan bilis already. mushigen liked this post

|

|

|

Apr 28 2024, 12:10 PM Apr 28 2024, 12:10 PM

Show posts by this member only | IPv6 | Post

#21

|

||||||||||||

Senior Member

4,816 posts Joined: Apr 2007 |

QUOTE(mushigen @ Apr 28 2024, 11:27 AM) That's what the HSBC staff told me back then Also I just relooked at my loan offer letter, I might have remembered the RM100k wrong (or it was removed in my latest signing). There's no limit on paying down principal, it seems. I also just used my latest March 2024 statement (since I did dip below -RM100k balance after depositing some cash for few days) to calculate my daily interest. Cant get exact amount as Maybank but:

This post has been edited by polarzbearz: Apr 28 2024, 12:18 PM |

||||||||||||

|

|

Apr 28 2024, 01:17 PM Apr 28 2024, 01:17 PM

|

||||||||||||

Senior Member

4,952 posts Joined: Jul 2010 |

QUOTE(polarzbearz @ Apr 28 2024, 12:10 PM) That's what the HSBC staff told me back then Good to hear that. Tough times means saving every sen where possible. Also I just relooked at my loan offer letter, I might have remembered the RM100k wrong (or it was removed in my latest signing). There's no limit on paying down principal, it seems. I also just used my latest March 2024 statement (since I did dip below -RM100k balance after depositing some cash for few days) to calculate my daily interest. Cant get exact amount as Maybank but:

|

||||||||||||

|

|

Jan 27 2025, 09:01 AM Jan 27 2025, 09:01 AM

Show posts by this member only | IPv6 | Post

#23

|

Junior Member

52 posts Joined: Sep 2019 |

QUOTE(shyan90's @ Apr 27 2024, 10:38 PM) AS topic.. since interest in semi flexi are calculated based on the capital u owe the bank..should i dump my part of saving into the semi flexi to tekan the interest...? Already done? Online or need to go to branch? Now monthly payment same or reduce.Can share experience. Thanks |

|

|

Jan 27 2025, 10:03 AM Jan 27 2025, 10:03 AM

|

Senior Member

1,782 posts Joined: Jul 2022 |

at the end of my loan, my interest so low. About 70% are principal payments.

I only 3 more years left. |

|

|

Jan 27 2025, 10:10 AM Jan 27 2025, 10:10 AM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

QUOTE(RadenMasIV @ Jan 27 2025, 09:01 AM) Already done? Online or need to go to branch? Now monthly payment same or reduce. Online will do. Just like pay advance in your account.Can share experience. Thanks NinG liked this post

|

|

|

Feb 3 2025, 09:46 PM Feb 3 2025, 09:46 PM

Show posts by this member only | IPv6 | Post

#26

|

Junior Member

747 posts Joined: Nov 2014 |

|

|

|

Feb 4 2025, 09:18 AM Feb 4 2025, 09:18 AM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

QUOTE(jenern84 @ Feb 3 2025, 09:46 PM) If I am not mistaken, if you pay online without notifying the bank, the paid amount will be considered as advance payment, not reducing your principle. I think if you opted for semi flexi it will.I can see the differences of the interest changes when i dump few k |

|

|

Feb 4 2025, 10:30 AM Feb 4 2025, 10:30 AM

Show posts by this member only | IPv6 | Post

#28

|

Senior Member

2,096 posts Joined: Oct 2007 |

|

|

|

Feb 4 2025, 10:39 AM Feb 4 2025, 10:39 AM

|

Junior Member

115 posts Joined: Sep 2023 |

QUOTE(cmk96 @ Feb 4 2025, 10:30 AM) RHB they will deduct your monthly loan amount from the saving account like normal but i think u can pay direct to principle but in minimum of 1k (if not mistaken). Not sure if u can pay any amount to itThis post has been edited by Chadlonso: Feb 4 2025, 10:39 AM |

|

|

Feb 4 2025, 11:10 AM Feb 4 2025, 11:10 AM

Show posts by this member only | IPv6 | Post

#30

|

Senior Member

2,096 posts Joined: Oct 2007 |

QUOTE(Chadlonso @ Feb 4 2025, 10:39 AM) RHB they will deduct your monthly loan amount from the saving account like normal but i think u can pay direct to principle but in minimum of 1k (if not mistaken). Not sure if u can pay any amount to it I paid directly to principle. Got option for that. Monthly i still pay manually as usual. Chadlonso liked this post

|

|

|

Feb 4 2025, 11:15 AM Feb 4 2025, 11:15 AM

|

Junior Member

115 posts Joined: Sep 2023 |

|

|

|

Feb 4 2025, 11:44 AM Feb 4 2025, 11:44 AM

|

Senior Member

1,614 posts Joined: Apr 2010 |

QUOTE(shyan90's @ Feb 4 2025, 09:18 AM) I think if you opted for semi flexi it will. FYI. Not all banks work that way. E.g. PBB/HLB semi flexi needs to walk in and give notice, paying extra will just be advanced payment instead of principal prepayment for interest reduction.I can see the differences of the interest changes when i dump few k QUOTE(Chadlonso @ Feb 4 2025, 11:15 AM) No, not any amount. RHB full flexi minimum 1k and must be multiples of 1k.1k, 2k. Cannot be 1.2k, 1.3k. Chadlonso liked this post

|

|

|

Feb 4 2025, 12:00 PM Feb 4 2025, 12:00 PM

Show posts by this member only | IPv6 | Post

#33

|

Senior Member

2,096 posts Joined: Oct 2007 |

Chadlonso liked this post

|

|

|

Feb 4 2025, 12:18 PM Feb 4 2025, 12:18 PM

|

Junior Member

115 posts Joined: Sep 2023 |

|

|

|

Feb 4 2025, 12:21 PM Feb 4 2025, 12:21 PM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

QUOTE(xHj09 @ Feb 4 2025, 11:44 AM) FYI. Not all banks work that way. E.g. PBB/HLB semi flexi needs to walk in and give notice, paying extra will just be advanced payment instead of principal prepayment for interest reduction. maybank allow...dats why..No, not any amount. RHB full flexi minimum 1k and must be multiples of 1k. 1k, 2k. Cannot be 1.2k, 1.3k. |

|

|

Feb 4 2025, 12:26 PM Feb 4 2025, 12:26 PM

|

Senior Member

1,040 posts Joined: Dec 2008 |

QUOTE(unknown_2 @ Apr 28 2024, 12:17 AM) remember that for semi flexi, u hav to inform bank in order to lower the interest, where else full flexi is auto. Just need clarification on this. I did a semi flexi for one house. Lower the interest or the monthly instalment? The bank informed that the monthly instalment will be automatically reduced (but after a 6 mth cycle for recount). Interest should remain the same.if u full flexi & got on9 facility to redraw at any moment, parking your emergency or FD funds in mortgage is better than standard FD rate. |

|

|

Feb 4 2025, 01:56 PM Feb 4 2025, 01:56 PM

Show posts by this member only | IPv6 | Post

#37

|

Junior Member

743 posts Joined: Sep 2020 |

Depends,

If the property is for own stay with no rental income, then wise to dump money into the loan current account to save interest. If the property is for investment with rental income, then not wise to dump money into the loan current account to save interest. This is because the loan interest is Tax deductable. meaning it can help you to reduce your taxable income, hence gives you tax savings. Then you can put your money into places that can generate more money that is tax free such as FD, EPF, blue chip stock with high dividen yield (up to 100k) or growth stock. **remember to bank in to loan current account, no other account to save interest. Bank interest is DR (daily rated) which means, you bank in today, tomorrow can start to save interest d. This post has been edited by BL98: Feb 4 2025, 01:59 PM |

|

|

Feb 4 2025, 03:07 PM Feb 4 2025, 03:07 PM

Show posts by this member only | IPv6 | Post

#38

|

Senior Member

1,388 posts Joined: Apr 2014 |

|

|

|

Feb 4 2025, 05:14 PM Feb 4 2025, 05:14 PM

Show posts by this member only | IPv6 | Post

#39

|

Junior Member

487 posts Joined: Sep 2006 |

Read terms & conditions of your mortgage.

Some need you to inform bank in advance Some need minimum amount or maybe multiples of x,000 But, in general, pay more when you can. Reduce your principle amount as much & as soon as possible. Compounded interest is the killer. Was so happy to finally pay off my mortgage. |

|

|

Feb 4 2025, 08:27 PM Feb 4 2025, 08:27 PM

|

Senior Member

1,614 posts Joined: Apr 2010 |

|

|

|

Feb 4 2025, 08:48 PM Feb 4 2025, 08:48 PM

Show posts by this member only | IPv6 | Post

#41

|

Junior Member

172 posts Joined: Jan 2017 |

QUOTE(jenern84 @ Feb 3 2025, 09:46 PM) If I am not mistaken, if you pay online without notifying the bank, the paid amount will be considered as advance payment, not reducing your principle. One way to test it is directly make large advance payment like 20k, and see does it reduce your outstanding by said amount |

|

|

Feb 4 2025, 11:32 PM Feb 4 2025, 11:32 PM

Show posts by this member only | IPv6 | Post

#42

|

Senior Member

3,968 posts Joined: Nov 2007 |

maybank mcm dun need lock_82 liked this post

|

|

|

Feb 5 2025, 07:51 AM Feb 5 2025, 07:51 AM

|

Senior Member

3,833 posts Joined: Oct 2011 |

|

|

|

Feb 5 2025, 11:02 AM Feb 5 2025, 11:02 AM

|

Junior Member

365 posts Joined: Jul 2006 |

Few scenarios that are good to dump into flexi loan.

- you have savings, but have no idea where to park it. Parking in home mortgage helps to reduce daily interest - You want to improve monthly cashflow, each 50k dump is equivalent to 250 monthly free up. Else, it's better just dump the savings to higher interest rate 5-6% that will generate more value after 30 years. |

|

|

Feb 7 2025, 11:39 AM Feb 7 2025, 11:39 AM

Show posts by this member only | IPv6 | Post

#45

|

Junior Member

52 posts Joined: Sep 2019 |

QUOTE(viktorherald @ Feb 4 2025, 08:48 PM) One way to test it is directly make large advance payment like 20k, and see does it reduce your outstanding by said amount Yes for my maybank semi flexi outstanding is reduce. End of this month I will pay my monthly normal payment. Hope less go the interest and more to principal reduction. shyan90's liked this post

|

|

|

Feb 7 2025, 12:43 PM Feb 7 2025, 12:43 PM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

QUOTE(RadenMasIV @ Feb 7 2025, 11:39 AM) Yes for my maybank semi flexi outstanding is reduce. End of this month I will pay my monthly normal payment. Hope less go the interest and more to principal reduction. You can agak agak calculate your January interest is betul or not...example 100k balance @ 4.05% 100000x1.0405 = 104050 4050/365 = 11.09 11.09 x calendar day (31) = 343.79 (January 2025 interest) BTW, what is your interest rate for maybank? This post has been edited by shyan90's: Feb 7 2025, 12:56 PM |

|

|

Feb 9 2025, 06:59 AM Feb 9 2025, 06:59 AM

|

Junior Member

31 posts Joined: Oct 2014 |

my cimb full flexi financing started in may 2023.

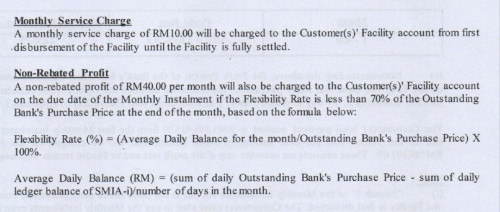

current profit rate is 4.65%. little by little i dump in the linked current account. till today it's only 21 months (1yr 9mth). from amortization table, principal payment suppose to be rm624. but for this month, the principal payment is rm954. which equivalent to 131 months (10yr 11mth) . not so sure if this is the most effective way. just that it is very liquid to withdraw. only rm10/mth service charge for current account. and i did this only for my own stay house. from what i understand I'll get charged rm40/mth if current account has more than 70% of financing outstanding balance.  This post has been edited by pakjat: Feb 9 2025, 07:07 AM |

|

|

Feb 9 2025, 08:04 AM Feb 9 2025, 08:04 AM

Show posts by this member only | IPv6 | Post

#48

|

Junior Member

822 posts Joined: Apr 2006 |

QUOTE(jenern84 @ Feb 3 2025, 10:46 PM) If I am not mistaken, if you pay online without notifying the bank, the paid amount will be considered as advance payment, not reducing your principle. depends, based on my exp, my semi flexi OCBC will consider advance payment to reduce the principal. while CIMB semi flex is the real CB. you would need give instruction on the advance payment to reduce principal. otherwise they will put into special account where this sum is just sitting there doing nothing. |

|

|

Feb 9 2025, 08:07 AM Feb 9 2025, 08:07 AM

Show posts by this member only | IPv6 | Post

#49

|

Junior Member

822 posts Joined: Apr 2006 |

QUOTE(shakku @ Feb 5 2025, 12:02 PM) Few scenarios that are good to dump into flexi loan. i add in one scenario which is good to dump, - you have savings, but have no idea where to park it. Parking in home mortgage helps to reduce daily interest - You want to improve monthly cashflow, each 50k dump is equivalent to 250 monthly free up. Else, it's better just dump the savings to higher interest rate 5-6% that will generate more value after 30 years. - when this is your 2nd house loan and you have plan for next purchase, you clear this one and your next purchase will eligible for 90% loan. shakku liked this post

|

|

|

Feb 13 2025, 03:34 PM Feb 13 2025, 03:34 PM

Show posts by this member only | IPv6 | Post

#50

|

Junior Member

571 posts Joined: Mar 2012 |

QUOTE(funnybone @ Feb 4 2025, 12:26 PM) Just need clarification on this. I did a semi flexi for one house. Lower the interest or the monthly instalment? The bank informed that the monthly instalment will be automatically reduced (but after a 6 mth cycle for recount). Interest should remain the same. BNM hav not adjusted BR since Q1 2023.when BNM raise BR, usually overnight u'll see your mortgage bank adjusted their rate & your payment overnight. however, if BNM slash BR, usually bank will take their sweet time, might even only lower their rate months later. |

|

|

Feb 13 2025, 04:12 PM Feb 13 2025, 04:12 PM

|

Senior Member

1,040 posts Joined: Dec 2008 |

QUOTE(unknown_2 @ Feb 13 2025, 03:34 PM) BNM hav not adjusted BR since Q1 2023. Understand about the BLR. But what I meant is for a semi flexi loan, I can gradually park money into the loan account but the interest would not change, only will reduce the monthly payment. That is what happening to one of my housing loan. Just seeking clarifications if the understanding is aligned.when BNM raise BR, usually overnight u'll see your mortgage bank adjusted their rate & your payment overnight. however, if BNM slash BR, usually bank will take their sweet time, might even only lower their rate months later. This post has been edited by funnybone: Feb 13 2025, 04:13 PM |

|

|

Apr 13 2025, 10:11 AM Apr 13 2025, 10:11 AM

Show posts by this member only | IPv6 | Post

#52

|

Junior Member

321 posts Joined: Jan 2013 |

QUOTE(funnybone @ Feb 13 2025, 04:12 PM) Understand about the BLR. But what I meant is for a semi flexi loan, I can gradually park money into the loan account but the interest would not change, only will reduce the monthly payment. That is what happening to one of my housing loan. Just seeking clarifications if the understanding is aligned. This statement does not seem correct. If you correctly perform a payment for principal reduction, then your remaining outstanding loan should reduce and therefore the portion of your instalment charged for the interest should reduce .The monthly payment (or instalment) should remain the same. You are still obligated to pay your instalments on time. |

|

|

Apr 14 2025, 02:52 PM Apr 14 2025, 02:52 PM

|

Senior Member

1,040 posts Joined: Dec 2008 |

QUOTE(lioncarlsberg @ Apr 13 2025, 10:11 AM) This statement does not seem correct. If you correctly perform a payment for principal reduction, then your remaining outstanding loan should reduce and therefore the portion of your instalment charged for the interest should reduce . Actually to clarify, I parked the extra sum to the loan account but did not issue an instruction to the bank to offset from the principal amount. And yes, the remaining outstanding still reduce and the instalment amount reduced as well (monthly payment). However, I still continue to pay a higher instalment amount to reduce the principal loan faster. That is what I was told....hope this is as what supposedly to happen. Quite confused when the loan officer explained this.The monthly payment (or instalment) should remain the same. You are still obligated to pay your instalments on time. |

|

|

Apr 14 2025, 04:50 PM Apr 14 2025, 04:50 PM

Show posts by this member only | IPv6 | Post

#54

|

Senior Member

673 posts Joined: Dec 2009 |

QUOTE(funnybone @ Apr 14 2025, 03:52 PM) Actually to clarify, I parked the extra sum to the loan account but did not issue an instruction to the bank to offset from the principal amount. And yes, the remaining outstanding still reduce and the instalment amount reduced as well (monthly payment). However, I still continue to pay a higher instalment amount to reduce the principal loan faster. That is what I was told....hope this is as what supposedly to happen. Quite confused when the loan officer explained this. May i know what bank? |

|

|

Apr 14 2025, 05:04 PM Apr 14 2025, 05:04 PM

|

Senior Member

1,911 posts Joined: Feb 2016 |

QUOTE(lioncarlsberg @ Apr 13 2025, 10:11 AM) This statement does not seem correct. If you correctly perform a payment for principal reduction, then your remaining outstanding loan should reduce and therefore the portion of your instalment charged for the interest should reduce . Free time, I kepoh a bitThe monthly payment (or instalment) should remain the same. You are still obligated to pay your instalments on time. This is correct. The incurred interest is reduced, monthly installment amount remains the same. Meaning a bigger portion of that month installment amount goes to principal reduction (after interest). Objective. 1. Reduce total incurred interest which is your finance cost 2. A reduced repayment tenure and a principal reduction are the 2 underlying factors to your total interest incurred. This post has been edited by jojolicia: Apr 14 2025, 05:18 PM |

|

|

Apr 14 2025, 05:53 PM Apr 14 2025, 05:53 PM

|

Senior Member

1,040 posts Joined: Dec 2008 |

|

|

|

Apr 14 2025, 07:05 PM Apr 14 2025, 07:05 PM

|

Senior Member

1,282 posts Joined: Aug 2014 |

QUOTE(funnybone @ Apr 14 2025, 02:52 PM) Actually to clarify, I parked the extra sum to the loan account but did not issue an instruction to the bank to offset from the principal amount. And yes, the remaining outstanding still reduce and the instalment amount reduced as well (monthly payment). However, I still continue to pay a higher instalment amount to reduce the principal loan faster. That is what I was told....hope this is as what supposedly to happen. Quite confused when the loan officer explained this. QUOTE(funnybone @ Feb 13 2025, 04:12 PM) Understand about the BLR. But what I meant is for a semi flexi loan, I can gradually park money into the loan account but the interest would not change, only will reduce the monthly payment. That is what happening to one of my housing loan. Just seeking clarifications if the understanding is aligned. this seems to me is an advance payment which does not reduce your principle amount and therefore does not reduce the interest advance payment really doesnt do anything monthly installment amount should not reduce, if reduce means its taking your previous extra payment as an advance This post has been edited by N9484640: Apr 14 2025, 07:06 PM |

|

|

Apr 14 2025, 07:43 PM Apr 14 2025, 07:43 PM

Show posts by this member only | IPv6 | Post

#58

|

Senior Member

673 posts Joined: Dec 2009 |

|

|

|

Apr 14 2025, 11:54 PM Apr 14 2025, 11:54 PM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

QUOTE(Gaia34 @ Apr 14 2025, 07:43 PM) My loan is with MBB as well, the mortgage officer told me that even if i put a large amount into my account, the monthly installment will remain the same, just that the bigger portion will go to reducing your principal. This is correct. But it actually what we want, reduce interest. |

|

|

Apr 15 2025, 01:33 AM Apr 15 2025, 01:33 AM

|

Junior Member

156 posts Joined: Jan 2018 |

Maybank islamic semi flexi, this is what my banker told me [24/07/2024, 15:43] N***: 1st option: U can pay extra to save the interest, example if loan released 500k, let say u pay 400k into loan acc. Then bank only charge u interest based on 100k This 400k still in your loan acc and if u want withdraw still can withdraw via online or branch, withdrawal fee RM25 per transaction. 2nd option: After u transfer the 400k into loan acc, fill in the service request form and hv to walk in any branch, to inform branch to off set the payment(direct pay to the bank), if u off set the payment u cannot withdraw anymore [24/07/2024, 15:45] m*******: Is there benefit on 2nd option? [24/07/2024, 15:45] N***: Actually both also same. Just 1st option u still got a flexibility for your cash flow Option 2 is direct pay to the bank, u can settle the loan faster shyan90's liked this post

|

|

|

Apr 15 2025, 09:34 AM Apr 15 2025, 09:34 AM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

QUOTE(jomonista @ Apr 15 2025, 01:33 AM) Maybank islamic semi flexi, this is what my banker told me unless your pretty sure you wont need that 400k amount in few years time, else option 1 always better.[24/07/2024, 15:43] N***: 1st option: U can pay extra to save the interest, example if loan released 500k, let say u pay 400k into loan acc. Then bank only charge u interest based on 100k This 400k still in your loan acc and if u want withdraw still can withdraw via online or branch, withdrawal fee RM25 per transaction. 2nd option: After u transfer the 400k into loan acc, fill in the service request form and hv to walk in any branch, to inform branch to off set the payment(direct pay to the bank), if u off set the payment u cannot withdraw anymore [24/07/2024, 15:45] m*******: Is there benefit on 2nd option? [24/07/2024, 15:45] N***: Actually both also same. Just 1st option u still got a flexibility for your cash flow Option 2 is direct pay to the bank, u can settle the loan faster |

|

|

Apr 16 2025, 01:44 PM Apr 16 2025, 01:44 PM

|

Senior Member

1,040 posts Joined: Dec 2008 |

QUOTE(Gaia34 @ Apr 14 2025, 07:43 PM) My loan is with MBB as well, the mortgage officer told me that even if i put a large amount into my account, the monthly installment will remain the same, just that the bigger portion will go to reducing your principal. That is weird. Semi-flexi loan? My instalment reduces. But I continue to pay the initial amt to reduce the principal (yes, this happens to me as well). But I have the option to pay the lower instalment amt also if I choose to do soThis post has been edited by funnybone: Apr 16 2025, 01:45 PM |

|

|

Apr 16 2025, 03:27 PM Apr 16 2025, 03:27 PM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

QUOTE(funnybone @ Apr 16 2025, 01:44 PM) That is weird. Semi-flexi loan? My instalment reduces. But I continue to pay the initial amt to reduce the principal (yes, this happens to me as well). But I have the option to pay the lower instalment amt also if I choose to do so What bank you using? Semi Flexi wont cut off your instalment usually but will reduce your interest. |

|

|

Apr 17 2025, 09:17 AM Apr 17 2025, 09:17 AM

|

Senior Member

1,040 posts Joined: Dec 2008 |

QUOTE(shyan90's @ Apr 16 2025, 03:27 PM) Maybank. The monthly instalment amt reduced as I put in more. The banker also told me before that the instalment amt will be re-calculated every cycle (6 mths if not mistaken) |

|

|

Apr 17 2025, 11:56 AM Apr 17 2025, 11:56 AM

|

Senior Member

1,198 posts Joined: Jun 2015 From: Malaysia |

|

|

|

Apr 17 2025, 12:01 PM Apr 17 2025, 12:01 PM

|

Senior Member

1,040 posts Joined: Dec 2008 |

|

| Change to: |  0.0270sec 0.0270sec

0.37 0.37

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 11:28 PM |