QUOTE(luminaryxi @ Sep 9 2025, 02:11 PM)

Sorry, I'm not a sifu. Just that I spend more time averaging 6 hours a day on back testing

After 6 months I found this solution

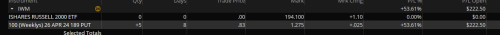

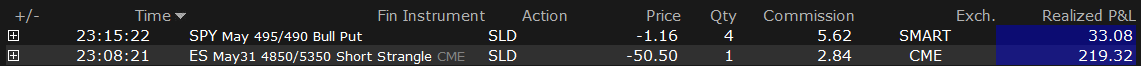

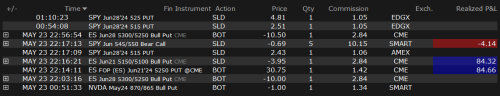

This is pure SPX index, as there is no need to exercise the stocks

open trade on 8 DTE ( reason behind is the value still there, and you have 4 days to edit your position, if the balance 3DTE will be hard to adjust rolling or close part of it)

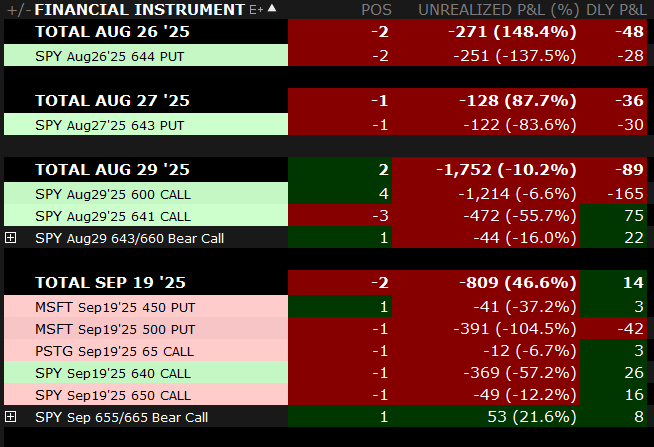

1.5 SD reason I factor in risk, to reduce the risk of being in the money (because the average SPX move 32point or range 28 - 45 point in the normal time)

but it can reduce or add in between,

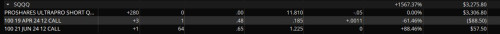

I use a little TA - 15 days High/low (majority time looking at the low open 20 to 30 points lower)

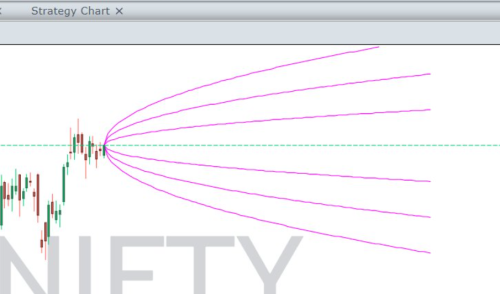

I do calculate using TA, projecting the price is heading toward what value

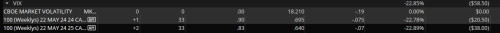

Option live data from quant will show me the direction of money based on Delta, Gamma, and Vanna

spread size

10 spread, 15 spread, and 20 spread each has its own winning ratio

Be reminded, don't be over greedy, open multiple at the same contact, spread it at different places

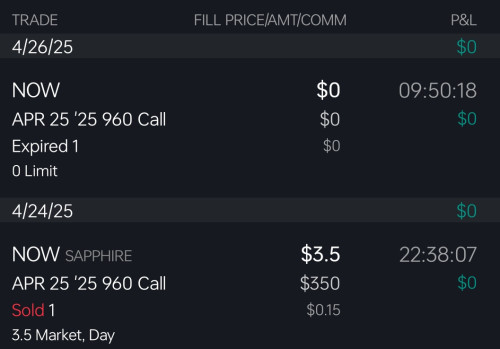

Unfortunately I don't for expire, start to close from 50% and above

Please avoid keeping the contract on the FMCO rate decision, or the president of the FED talk

Sometimes you may see red in your portfolio, but as the time decay you make your profit

Apr 16 2024, 01:10 PM, updated 3 months ago

Apr 16 2024, 01:10 PM, updated 3 months ago

Quote

Quote

0.0934sec

0.0934sec

0.42

0.42

6 queries

6 queries

GZIP Disabled

GZIP Disabled