QUOTE(luminaryxi @ Aug 25 2025, 10:02 AM)

i think premium not so lucrative if really want to put far OTM.

scouring through seekingalpha to find stocks to open csp.just wanna target 1-2% monthly good enough already, but limited BP

Have you traded options before, and if so, how much experience do you have?

I ask because a proper cash-secured put involves no leverage. But you mentioned BP (buying power), which suggests you might be planning to use leverage. (If I misunderstood, feel free to ignore the rest.)

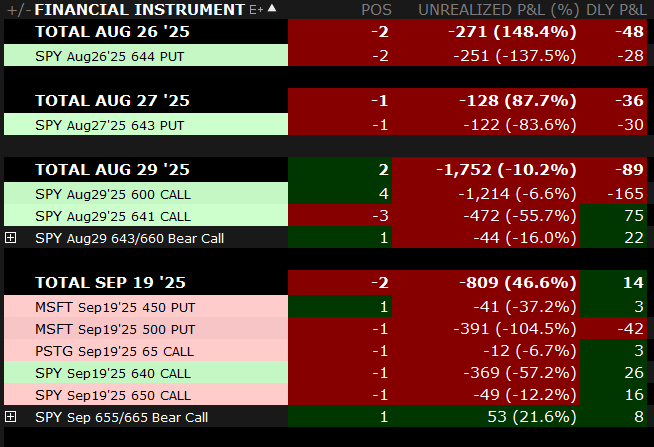

Once you bring leverage into the mix, you need to be very mindful of mtm swings, which can cut deeply.

1 to 2% monthly (12 to 24% p.a.) is definitely achievable with CSPs, though on the aggressive side,but still reasonable. For example, if your notional (the cash secured part) is 100K, then you might expect 1 to 2K pm.

However, if you use leverage (BP is tied to your trading account), you could end up writing puts worth 1.5x, 2x, or even 2.5x actual capital. That can look attractive. For instance, at 2x, you could be making 2 to 4K RM on a 100K base, but it comes with significant risk: margin call before expiration.

So, if you go down the leverage route, you’ll need to monitor your positions closely, pretty much 24/7.

Sep 16 2024, 09:54 PM

Sep 16 2024, 09:54 PM

Quote

Quote

0.0307sec

0.0307sec

1.51

1.51

7 queries

7 queries

GZIP Disabled

GZIP Disabled