US Option trader, 0DTE to 2month DTE

|

|

Sep 24 2024, 02:41 PM Sep 24 2024, 02:41 PM

Return to original view | Post

#1

|

Senior Member

6,251 posts Joined: Jun 2006 |

... so 1 hr before closing...

|

|

|

|

|

|

Sep 24 2024, 08:21 PM Sep 24 2024, 08:21 PM

Return to original view | Post

#2

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(tkwfriend @ Sep 24 2024, 05:47 PM) yeah, so mine is 100% gain, and I have not gotten in trouble. cool... just reminding ppl in case they didn't realize why you keep saying 3am... trading market open and close need more skills yeah... One key info: don't be too greedy on the premium, know the market direction, if know a drown trend move, avoid that day using vertical the buying should be should be at least 30point above i used to chart n trade a lot... but stop liao 5-6 yrs... my youngest wanna learn, i tot id start her with options... |

|

|

Sep 25 2024, 09:59 AM Sep 25 2024, 09:59 AM

Return to original view | Post

#3

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(tkwfriend @ Sep 25 2024, 09:19 AM) I had been testing for a while and could only come out of the sweet spot. nice... can explain a bit about your automation? im trying to do the same... thankscurrently, I am in the middle of testing my automation for trading, on stock and options..this is to replace myself |

|

|

Sep 26 2024, 08:10 AM Sep 26 2024, 08:10 AM

Return to original view | Post

#4

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(tkwfriend @ Sep 26 2024, 12:24 AM) it will start with stock, after that with options which broker are you linking your bot to ?basically, it will be doing programming behind and collaborate with the broker to link account with, choose the symbol you think is good to trade, and all settings are ready, and is ready to run are you building the bot from scratch or is it a commercial bot that you configure and program to your strategy ? got many stock trading automation out there, for options i know of options alpha... so just curious how are you doing it... thanks This post has been edited by dwRK: Sep 26 2024, 08:16 AM |

|

|

Sep 26 2024, 01:53 PM Sep 26 2024, 01:53 PM

Return to original view | Post

#5

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Apr 16 2025, 05:10 PM Apr 16 2025, 05:10 PM

Return to original view | IPv6 | Post

#6

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(jasontoh @ Apr 16 2025, 03:58 PM) For those call/put, I think you also set aside higher amount of collateral, thus achievable, and the strike price is like 1-2 bid from the current price. A bit risky though. Maybe your portfolio way bigger than mine proper risk management is to find a stock that has high IV... this gives you the premium headroom... then pick a strike that has low probability of success/ITM, as a seller this is what you want... imho around 40% ITM is sweet spot... even better if one has some basic TA/charting skill... collateral required depends on the underlying... doesn't have to be huge luminaryxi liked this post

|

|

|

|

|

|

Apr 16 2025, 05:12 PM Apr 16 2025, 05:12 PM

Return to original view | IPv6 | Post

#7

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(Ramjade @ Apr 16 2025, 04:17 PM) Correct for bolded part. For stuff like servicenow and MasterCard, I don't intend for them to get sold away. Cause they are fat cash cow giving me min USD600 for them.(USD500 for servicenow and USD100 for MasterCard) curious... how often you close it out early vs letting it expire?I always said first rule of options is do on stocks you want to hold Second rule don't be greedy. Be conservative. |

|

|

Apr 16 2025, 08:15 PM Apr 16 2025, 08:15 PM

Return to original view | IPv6 | Post

#8

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(jasontoh @ Apr 16 2025, 05:43 PM) ITM as in in the money? If in the money wouldn't that means that it will be exercised when expire or sometimes the buyer can exercise as well. Also 40% here meaning the strike price v current stock price? yes... In The Money... i wrote "low probability of success/ITM"... brokers will calculate and provide this info... so 40% here refers to this probability...as a seller you want the option to expire worthless/OTM... probability of OTM (per my example, 1-40%=60%)... but not all brokers will provide this info directly... |

|

|

Apr 16 2025, 08:21 PM Apr 16 2025, 08:21 PM

Return to original view | IPv6 | Post

#9

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Apr 16 2025, 08:32 PM Apr 16 2025, 08:32 PM

Return to original view | IPv6 | Post

#10

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(Hansel @ Apr 16 2025, 05:40 PM) Don't know if you guys can help me out here, Ramjade, DWRK, Jason,... do you know if there are any threads like this or any forums but on Daily Leveraged Certificates (DLCs) ? Forums like this are very useful for particular instruments,... Thank you,... no idea... they are similar to stocks/etfs... i.e., directional play... you bet up or down...problem with all these 3x 5x 7x stuff is they have decay from rebalancing... imho, good for intraday or 1-2 day swing only... might as well just buy calls and puts... Hansel liked this post

|

|

|

Apr 16 2025, 08:52 PM Apr 16 2025, 08:52 PM

Return to original view | IPv6 | Post

#11

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(Ramjade @ Apr 16 2025, 08:36 PM) There are options seller who purposely sells ITM options. Don't know how they are so confident that the options will become OTM. I don't dare. quite a lot are just trading them intraday or short term... they are not holding to expiry... also you only see 1 side of it... the person may have a 4 leg strat going...classic protection for stocks in a bear market is to buy ITM puts... so somebody is definitely selling ITM puts... |

|

|

Apr 16 2025, 09:01 PM Apr 16 2025, 09:01 PM

Return to original view | IPv6 | Post

#12

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Apr 22 2025, 08:32 PM Apr 22 2025, 08:32 PM

Return to original view | IPv6 | Post

#13

|

Senior Member

6,251 posts Joined: Jun 2006 |

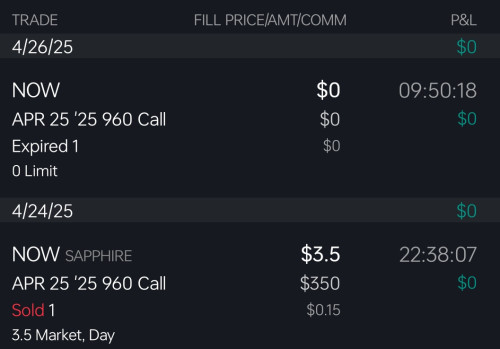

QUOTE(Ramjade @ Apr 21 2025, 11:18 PM) I won't share everything but I will share some 80-90% probabilities Servicenow | Strike 850 | Sold Call | Expiry 25/4 | Premium earned USD 400 Mastercard | Strike 530 | Sold Call | Expiry 25/4 | Premium earned USD 164 Linde | Strike 480 | Sold Call | Expiry 16/5 | Premium earned USD 230 IBKR | Strike 140 | Sold put | Expiry 16/5 | Premium earned USD 260 CNQ | Strike 30 | Sold call | Expiry 25/4 | Premium USD 10 |

|

|

|

|

|

Apr 22 2025, 08:55 PM Apr 22 2025, 08:55 PM

Return to original view | IPv6 | Post

#14

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(Ramjade @ Apr 22 2025, 08:38 PM) sop is quite standard... i know more or less what you are doing... just that bro Hansel dun believe you pick 80-90% and let it expires... i pick 60-70% and close early as required... with charting can pick more aggressively for higher premiums... different strokes for different folks... all the best mate Ramjade liked this post

|

|

|

Apr 25 2025, 09:33 PM Apr 25 2025, 09:33 PM

Return to original view | IPv6 | Post

#15

|

Senior Member

6,251 posts Joined: Jun 2006 |

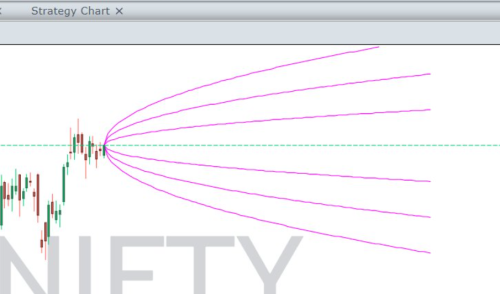

QUOTE(Hansel @ Apr 25 2025, 03:57 PM) Bro Hansel is lying on the bed now in an SG Hotel… waiting to go listen to a rally by a political party at Bkt Panjang tonight. It has been a good AGM Wk in SG - lots of good news…😂😂👍👍 is quite simple... Ramjade picks a strike price that gives him 90% probability of winning... he still has 10% probability of losing... these probabilities are calculated using black-scholes or binomial or other methods well known in the options world... given a large enough sample size or trades... he will eventually have 90% winning... this is just statistics at play... but i dun know how many trades are required to achieve parityI’ll study a new game here… if I don’t believe it… won’t ask for details. Appreciated input by Ramjade… Dividend-investing getting boring for me now….😂… perhaps I get bored quickly…😂 what he doesn't do is pick IV rank or IV percentile... these affects the options price/premium... and gives someone an extra edge... instead he picks stocks he wants to own long term... and supplements it with options trading... imho this is not ideal but i understand... if a normal "investor" is someone who just buys and sells a stock directly... i would call Ramjade "investor plus"... who buys and sells stocks indirectly using options... he is not doing anything dangerous afaik... so i never kacau him on options matter... to help you understand why market direction (bull/bear) is not so important to options...  each stock has its own "character"... the options pricing model captures these as the "options greeks" and plots the probability curves as above... let say the outer parabolic lines are 10% probabilities... if bullish, it has a 10% chance to reach the top lines... and same for bearish the bottom line... obviously news events will disrupt the normal behavior temporarily but eventually it reverts back to normal... all these are pretty standard for options... you can ask bro TOS... he probably spent a semester or two studying it... anyways, have fun in SG... |

|

|

Apr 27 2025, 10:16 PM Apr 27 2025, 10:16 PM

Return to original view | Post

#16

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(Hansel @ Apr 27 2025, 04:12 PM) I get the ideas here,.. thank you for explaining to me and for sharing your trades, bros,... I have performed Options previously but I have always gotten distracted by dividend shares,... and ended-up buying more shares with the dividend that kept dropping in. made an oopsie talking about Ramjade's winning...I'll study more when I have time,... now I don't. Tks again, gentlemen,... come rain or shine he will be selling either a weekly put or call... so it is in fact 100% in this regard... 90% probability would refers to the option expiring OTM in his favor... and the other 10% doesn't mean he is losing.... Ramjade liked this post

|

|

|

Apr 28 2025, 08:32 AM Apr 28 2025, 08:32 AM

Return to original view | IPv6 | Post

#17

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Apr 28 2025, 05:32 PM Apr 28 2025, 05:32 PM

Return to original view | IPv6 | Post

#18

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Apr 29 2025, 07:03 AM Apr 29 2025, 07:03 AM

Return to original view | Post

#19

|

Senior Member

6,251 posts Joined: Jun 2006 |

|

|

|

Apr 29 2025, 11:26 AM Apr 29 2025, 11:26 AM

Return to original view | Post

#20

|

Senior Member

6,251 posts Joined: Jun 2006 |

QUOTE(ChAOoz @ Apr 29 2025, 10:47 AM) If you take servicenow as an example to sell covered call for 500 weekly premium with a 10% chance of strike as of today closing you can go for 9/25/1025 call for around 5usd/call. no longer weekly So the total capital you need is 95k usd +/- which is 100 units of now as covered. Total return is 0.5% for 10 days duration. If no strike you pocket the money if strike then have to see how far it runs above. If 9/25 close at 1050 the potential “miss opportunity” would be 2.5k but nothing out of pocket since you are covered. |

| Change to: |  0.0228sec 0.0228sec

0.81 0.81

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 11:48 PM |

All Rights Reserved © 2002- 2025 Vijandren Ramadass (~unite against racism~)

Powered by Invision Power Board © 2025 IPS, Inc.

Quote

Quote