QUOTE(Ramjade @ Sep 5 2024, 05:16 PM)

Let me put it straight by giving you a very easy example.

Insurance increase regardless standalone or ILP for simplicity sake increase RM10/3 years.

ILP increase say RM5/2y for bad performance.

1y no increase

2y RM5 for ILP

3y RM15 total for ILP 10 for standalone

4y RM20 total for ILP

5y no increase

6y RM35 total for ILP 20 for standalone

Get my point?

So my point is why should I take on the extra RM5 incurred by the ILP for bad performance?

Another example

My friend borrow my car. He kena saman. I need to pay his saman. Why should I pay his saman? Just because he used my car?

I should be paying for my saman and not his saman. Same thing. If you like to pay for other people saman, be my guest. 😂

Who cares about voluntary top-up for standalone? You can choose to pay until what age you want. If you can't afford to pay premium for that year, it's gone. Bye bye. Simple.

Next year you know already roughly say, I need to pay around say 7k, need 1y to get 7k. Let's make it 10k. Budget the 10k ready.

Eg, you plan to cover until 70. At 60 years old you can't pay. Then bye bye.

As long as can pay you can continue paying until 99 years old.

ILP if you refuse to increase premium, your coverage duration decrease. Same thing. If you plan to cover until say 70 years old, insurance company keep increasing premium and you already on the lowest tier plan and can't downgrade anymore, like it or don't like it, your coverage ends at 60 (likely sooner) once the fund have no more cash value cause you need to pay to keep the investment part active. So at age 60, if you cannot do volunteer top-up, your insurance ends at 60 year old.

End of story.Thank you for the story.

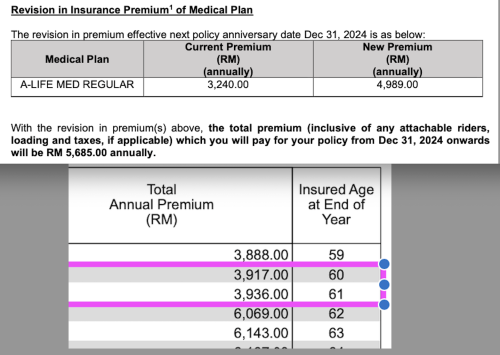

It would be more convincing and beneficial if, ...

you can made a comparison between ilp and not ilp (standalone) of a same or similar product.

Get the projection premium tables of each of them may hv better view.

those premium to be paid projection table usually come with the plan.

They are just a guide, but a guide is better that don't hv and based on just assumptions.

I hv some standalone medical plans for decades and realised that the premium will become unaffordable in future when my age catches up with it.

I experienced that standalone plans had large quantum of increases (much higher than the projected rate table) and was told by many that ilp product will not hv so nasty quantum of rate of increases

This post has been edited by MUM: Sep 5 2024, 06:49 PM

Jan 17 2024, 12:57 PM

Jan 17 2024, 12:57 PM

Quote

Quote

0.0150sec

0.0150sec

0.85

0.85

7 queries

7 queries

GZIP Disabled

GZIP Disabled