QUOTE(Natsukashii @ Jul 29 2023, 04:08 PM)

Maybe I'm not smart, but it is still not making sense to me. I got premium increase letter, and I spoke with my agent. My agent told me a lot of stuff, some examples.. "a lot of people claiming, and also medical cost gone up, with ringgit performing very bad."

I was there like .. "a lot of people claiming, and I never claimed but they want to increase mine also? why not just increase only those who have made claims?"

Medical cost gone up? I was like, "well, medical cost up or down, if I claim, I still will only get within my limit/plan which they've already allocated. In case ringgit starts doing well, will my coverage increase? no right?" "if my plan is 500k, then doesn't matter cost up or down, I should entitle for max 500k."

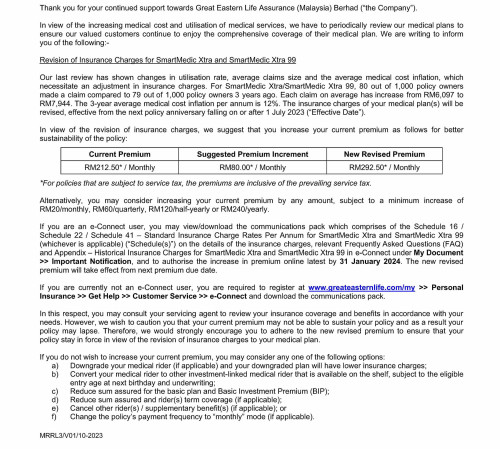

So this:

As long I pay the agreed price today, even 20 years from now.. they should be able to provide coverage for RM1m per year.

But after years paying, they say to continue providing the agreed coverage, they have to increase premium!

I'm not asking for RM1.5m coverage because of medical inflation right? So they shouldn't increase!

That's not how insurance work. Insurance works by collecting everyone money into a pool which is use to pay someone whenever claims are make.I was there like .. "a lot of people claiming, and I never claimed but they want to increase mine also? why not just increase only those who have made claims?"

Medical cost gone up? I was like, "well, medical cost up or down, if I claim, I still will only get within my limit/plan which they've already allocated. In case ringgit starts doing well, will my coverage increase? no right?" "if my plan is 500k, then doesn't matter cost up or down, I should entitle for max 500k."

So this:

As long I pay the agreed price today, even 20 years from now.. they should be able to provide coverage for RM1m per year.

But after years paying, they say to continue providing the agreed coverage, they have to increase premium!

I'm not asking for RM1.5m coverage because of medical inflation right? So they shouldn't increase!

Now if everyone don't claim then the pool remain constant. If people start claiming, it will come a time when there is not enough money for everyone. So because you are in the pool, you are also forced to pay up even though you never claim. Cause not everyone so good hearted don't want to claim.

Think of it as a reservoir. When reservoir no water, water rationing affects everyone.

Imagine you already pay so much for insurance, to get back some of the money back, you need to get yourself admitted or else money wasted right? So if one person think like that, you bet there will be others who also think like that.

Also the coverage amount is the same but the sustainability (means the insurance can last until xyz years) will decrease if you don't agree to increase the premium.

This is what my agent said not I said, standalone tends to follow the projected rate increase and yes there are some years which are exception while ILP won't follow the timetable. So some people get increase in price as early as 2 years.

That's why I didn't go with ILP. I was like I already pay so much and you want me to pay extra money every now and then when the insurance company request? Nope. Not going to happen.

This post has been edited by Ramjade: Jul 29 2023, 04:37 PM

Jul 29 2023, 04:36 PM

Jul 29 2023, 04:36 PM

Quote

Quote

0.0196sec

0.0196sec

0.54

0.54

5 queries

5 queries

GZIP Disabled

GZIP Disabled