any maha /k can advise mau up or maintain.

I read say can maintain but will effect sustainability wo...wtf do that mean. is this scam?

inb4 /k all kaya, no need insurance

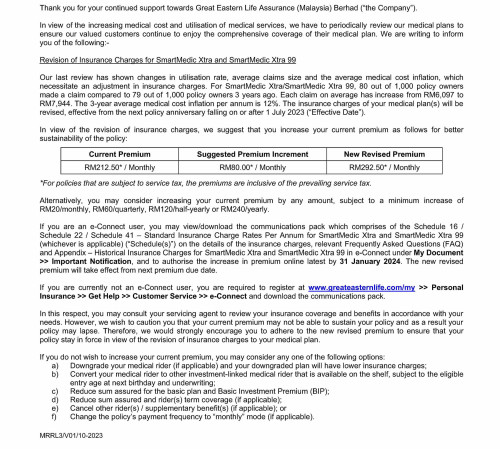

Insurance Premium Naik!

|

|

Jul 28 2023, 10:07 AM, updated 3y ago Jul 28 2023, 10:07 AM, updated 3y ago

Return to original view | Post

#1

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

|

|

|

Jul 28 2023, 10:14 AM Jul 28 2023, 10:14 AM

Return to original view | Post

#2

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(kelvinfixx @ Jul 28 2023, 10:13 AM) Why post in serious kopitam but you speak like in kopitiam, so just expecting us to be serious but not you? lol, ini kopitiam style talking. serious or not, the same. sudah makan ubat belum? djlake liked this post

|

|

|

Jul 28 2023, 10:34 AM Jul 28 2023, 10:34 AM

Return to original view | Post

#3

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(nihility @ Jul 28 2023, 10:27 AM) Call your servicing agent. Ask him how come last time explained the premium once locked / bought earlier, it will not change but now how come got revision & got extra , else will effect sustainability ? See how your service agent explain when he used that point to sell the plan years ago. problem is the agent no longer available anymore, Unker buy this like 20+ years ago. Last time got increase like 10 yrs ago. |

|

|

Jul 28 2023, 10:39 AM Jul 28 2023, 10:39 AM

Return to original view | Post

#4

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(-kytz- @ Jul 28 2023, 10:36 AM) Is yours an investment linked policy? Tq bro, yes my Insurance is investment link.If so, I'm sure you should be aware that the investment portion is actually used to "cover" for increasing cost of insurance. When the investment does not give back good returns, you need to top up, if not, the policy will sustain to let's say 60 years and not 70 years old as earlier estimated when u signed the policy. Even for standalone medical plans, you need to top up with increasing cost of insurance.... No such thing as "locked" premium.. Anyway, if you are serious about looking for answers, should post here: https://forum.lowyat.net/topic/5096196/+3700 |

|

|

Jul 28 2023, 10:56 AM Jul 28 2023, 10:56 AM

Return to original view | Post

#5

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 11:08 AM Jul 28 2023, 11:08 AM

Return to original view | Post

#6

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(prdkancil @ Jul 28 2023, 11:05 AM) The premium remain at RM3600 annually , wat i mean the medical card fees is increasing thn thy will auto readjust from RM3600. I see, tq for clarifying.Example from RM3600 , 1.6k go to pay medical card fees and 2k investment thn now auto adjust 2k on medical card then 1.6k for investment like that lur . The reason thy wana increase the premium because thy forecast in future investment not enuf to cover medical card fees because the medical fees is increasing . |

|

|

|

|

|

Jul 28 2023, 11:53 AM Jul 28 2023, 11:53 AM

Return to original view | Post

#7

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 12:05 PM Jul 28 2023, 12:05 PM

Return to original view | Post

#8

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 12:16 PM Jul 28 2023, 12:16 PM

Return to original view | Post

#9

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(Accord2018 @ Jul 28 2023, 12:12 PM) No such thing lock. Sure got clause you din notice similar to " we can revise the price from time to time reasonably" this is only 1 of my many policy. My medical is cap at 1Mil from GE.If the economy gets worse and higher inflation, then the premium will keep increasing. Recently a person had a stroke, 36 age only, medical cost hospital and Physiotherapy already more than 200k. And that person previously only pay 200++ per month like TS. I guess other policy will have the same issue comin. |

|

|

Jul 28 2023, 12:17 PM Jul 28 2023, 12:17 PM

Return to original view | Post

#10

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 12:18 PM Jul 28 2023, 12:18 PM

Return to original view | Post

#11

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 12:31 PM Jul 28 2023, 12:31 PM

Return to original view | Post

#12

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 28 2023, 12:33 PM Jul 28 2023, 12:33 PM

Return to original view | Post

#13

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(xpole @ Jul 28 2023, 12:32 PM) I'm on AIA medical insurance. I take pure medical insurance only. No investment link. Unker policy 20+ years jor, if not wrong got increase 1 time b4.Already 3 years I'm on this insurance and no increase. I hope can stay the same amount for a while since I have other commitments. |

|

|

|

|

|

Jul 31 2023, 02:24 PM Jul 31 2023, 02:24 PM

Return to original view | Post

#14

|

Junior Member

70 posts Joined: Aug 2014 |

|

|

|

Jul 31 2023, 03:48 PM Jul 31 2023, 03:48 PM

Return to original view | Post

#15

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(taurean @ Jul 31 2023, 03:38 PM) most likely this is investment linked policy and whenever they fail in their investment, they charged higher premium. mcm unker ade jasa sponsor their annual dinner?Or whenever they fail to achieve their investment ROI, they charged higher premium. Every year, they declare very high profit and annual dinner. |

|

|

Aug 1 2023, 12:02 PM Aug 1 2023, 12:02 PM

Return to original view | Post

#16

|

Junior Member

70 posts Joined: Aug 2014 |

QUOTE(hoonanoo @ Aug 1 2023, 11:16 AM) Did you recently had some health declaration that your insurance co found out? No unker had no health issue, from what Unker found out this is normal practice for all insurance company. maybe you went for a health screening and it reported to your insurance co? Perhaps you can adjust, say don't want increase premium but reduce your coverage or investment. |

| Change to: |  0.0209sec 0.0209sec

1.12 1.12

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 22nd December 2025 - 09:33 AM |